Summary:

- We investors are waiting for the “We robot” event Tesla is setting up.

- Robotaxis are expected to be a new strong business for Tesla.

- If we look closely at Tesla’s fundamentals and operations, there are reasons to take gains now and wait for further drops.

BING-JHEN HONG/iStock Editorial via Getty Images

Tesla: Catalysts and Macroeconomic Trends

Tesla (NASDAQ:TSLA), just the name evokes and provokes various thoughts and reactions rarely seen elsewhere. This is why I seldom write on Tesla stock, to prevent stirring the beehive of its fans that can be found among its investors. Right now, much excitement is mounting as we get ready for the event “We, robot”, which, according to Elon Musk, will be “one for the history books”. There are reasons to believe Musk is bored by the car business and wants to move toward the brighter and more intriguing future of self-driving and robotaxis, where Tesla’s auto business will be but a small portion of a much larger company. At the same time, experts have doubts that self-driving taxis will be able to generate profits soon. So, once again, the clash between the faithful and the unfaithful goes on.

Of course, for over ten years we have heard him say that this future was going to be just a year away, but the deadline kept on being postponed. However, investors are patient and long-term oriented. As a result, no one (or very few) cared about a delay that, once FSD was released, would seem but a little hurdle on a glorious ride. When something once thought impossible will become possible, there will be profits for everyone.

This context is enough to scare me away and keep clear of this debate. After all, I am an investor and, as such, I try to detach my emotions from the rationale of a bullish or bearish thesis. But as I am going through many reports and transcripts of the most important automakers, I am gathering more and more data that is relevant to Tesla, at least as it currently stands and operates.

In early September, as soon as Volkswagen (OTCPK:VWAGY) issued a profit warning and revised its FY2024 guidance downward, I started covering the whole auto industry to understand and explain what was happening and re-rate its most renowned stocks. In particular, I shared what I think the way to come out of the crisis for Volkswagen could be. We then discussed the future of BMW (OTCPK:BMWYY) and the outlook for Stellantis, after an unexpected thunderstorm of bad news started whirling around the company and its once-popular CEO Carlos Tavares.

In short, the industry suffers under the pressure of two main causes: softening demand for new cars and EVs in particular (both because of high interest rates and high car prices) and new competition in and from China.

What does this have to do with Tesla? Let me walk you through my reasoning.

Robotaxis: Buy The Rumor, Sell The News

Tesla has been prompting its “We, robot” day. But currently, although the possibility of a big event remains, the likelihood that we will see Tesla unveil its system and release it to the market remains low. Experts are expecting the vehicle unveiled, probably with no steering wheel and pedal, but we also know Elon Musk said that Tesla could not start offering rides until FSD can be used unsupervised. Doubts on this topic cluster and clobber my thoughts and those of many investors. But, let’s admit, Musk will say Tesla has reached this milestone and that the robotaxis are ready to be produced and used.

We would still need to know more about the infrastructure needed to run these fleets. In particular, we need to know how the issue of self-charging is solved. The connectivity of the fleet is another. These are not major issues, at least, not as big as developing FSD. But they all require one common resource: time. And time means money. I say this to explain why, even in the best-case scenario, Tesla will take years before it will get any profit from this huge (and useful) endeavor. Last, but not least, it still needs to be proven that robotaxis may be cheaper than human-driven taxis. We rarely talk about the economics of this business, but if it is going to succeed, it will need to make profits while being more convenient than the cost of a taxi ride. Anyway, if this business is going to truly start, estimates see its market size growing from around $1.7B in 2022 to $118.6B by 2031, with the Asia Pacific region becoming the largest market.

Moreover, we should not look at Tesla as being the undisputed leader in the industry. The Google-owned Waymo, for example, has been working on autonomous driving technology for over a decade and is becoming increasingly popular in San Francisco. Waymo, by the way, has offered its driverless services in Phoenix since 2017. This year, the company started in Los Angeles and should soon add Austin, Texas. Zoox – owned by Amazon – has started carrying passengers as well and is preparing for its commercial launch after testing it in Las Vegas. GM has a self-driving unit called Cruise, and it recently partnered with Uber to offer robotaxis on the platform next year. So, even though Tesla is a highly technological company, it is going to compete against very big names that have plenty of billions to spend and already seem, in some cases, to have taken the lead in the race.

Even though in these past few days Tesla’s stock has been moving down, the share price surged close to its 52-week-high following a pattern that seems to me a “buy the rumor, sell the news”, which is now materializing as we approach the event that has first excited many and is now becoming a bit concerning as more and more analysis represent it as a non-event. After all, expecting new inflows of revenues and earnings from FSD and robotaxis soon appears erroneous.

True, there is another ace up Tesla’s sleeve: the humanoid robot Optimus, which is already being used in some of Tesla’s factories. In the Q2 earnings call, Mr. Musk said he expects long-term demand for this product to exceed 20B units. This mind-blowing number glitters and suggests billions in earnings down the road. But, once again, there is little short and midterm visibility to fully assess the fundamentals of this new line of business.

So, with numbers at hand, let’s look at Tesla right now and understand why, even though the robotaxi event may be a catalyst, several factors currently undermine Tesla’s upcoming profits.

Tesla Is (Still) An Auto Company

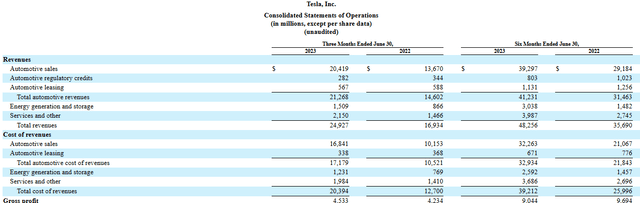

No matter how we look at it, Tesla’s income statement shows a company that relies greatly on car sales. We can see below, in fact, how Tesla’s automotive sales totaled $39.3B in 1H24, with another $803M coming from regulatory credits and $1.1B coming from automotive leasing. The sum is $41.2B out of the $48.3B reported as total revenues. This represents 85.4% of Tesla’s revenues. True, while automotive sales increased by 34.7% YoY, we see energy generation and storage increasing by 105% YoY. Yes, this is a fast-growing stream of revenues, but before it reaches the size of the automotive business, we would need to wait at least five years under the assumption that it doubles every year while automotive sales remain more or less flat over the same period. As far as I see it, it is unlikely to see energy generation and storage become so massive in such a short period of time because infrastructure and factories are needed to support such rapid growth. Once again, Tesla might have the technology, but it needs time to build the facilities it needs to widen its scale.

TSLA Q2 Report

Moreover, Tesla’s income statement resembles more and more those of other automakers.

In fact, its margins are compressing: in 2Q22 we saw 25%, in 2Q24 we saw 18%. Operating margins are even lower and dipped in just two years from 14.6% to 6.3%, which is worse than other automakers even after the recent guidance slashes. With this ongoing trend, while we see Tesla’s revenues growing, we see its EPS reduced: in 2Q24 we saw a big drop of -46% YoY. Free cash flow is still below $2B for the TTM, even though in recent years it was around $4-$5B.

Well, given the structure of Tesla’s income statement and the reasons why I believe we won’t see a big shift soon in its revenue streams, I think Tesla’s shareholders should pay close attention not only to the robotaxi event but also to the macroeconomic environment that is currently causing concerns and strains among automakers.

As recalled earlier in this article, competition is fiercer than ever. Tesla was among the first ones to announce price cuts and even during the last earnings call, Tesla’s CFO Mr. Taneja, almost promoted the offerings for the customers:

On the auto business front, affordability remains a top of mind for customers, and in response in Q2, we offered attractive financing options to offset sustained high interest rates. These programs had an impact on revenue per unit in the quarter. These impacts will persist into Q3 as we have already launched similar programs. We are now offering extremely competitive financing rates in most parts of the world. This is the best time to buy a Tesla, I mean, if you are waiting on the sidelines, come out and get your car.

Right away, we see why demand has softened: financing conditions are harsh. True, with an easing cycle apparently starting, we could assume that many consumers who would like to buy a car are simply postponing their purchase by a few months because they are waiting for a few interest rate cuts. So, we could think that 1H25 could be the time for recovery and order increase. But, in any case, Tesla is already pouring a lot of effort into making its cars affordable. This is not a path that will bump margins up. It actually paves the road for an increasing need for volume, making Tesla need to reach 2.5-3M units sold per year to preserve its profitability.

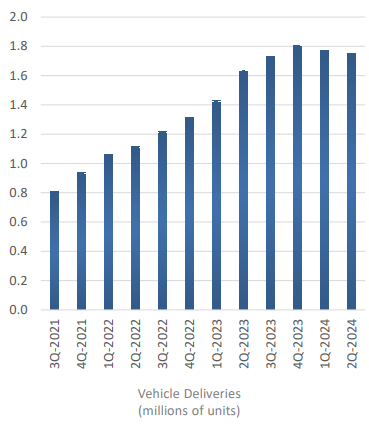

Now, low-interest financing and good lease deals, coupled with price reductions and free charging, all helped Tesla report its first quarterly increase in deliveries just a few days ago. While in 3Q23 Tesla produced 430k vehicles and delivered 435k units, in 3Q24 Tesla reported 470k units produced and 463k deliveries. This is positive because the TTM deliveries since 4Q23 have been declining. In an environment where volume becomes crucial, this was no positive trend.

TSLA 2Q 2024 Earnings Presentation

However, Tesla also needs to keep its inventory under control ($5.77B at the end of FY21, $14.2B at the end of 2Q24. As its inventory piled up, Tesla was quick to launch deep discounts. This is particularly strategic for Tesla because the company expects to have low volume growth in 2024 because it is working on the next-generation vehicles to be launched in 2025. By then, inventories will have to be cleared if Tesla doesn’t want to take a massive profit hit. So, if Tesla’s production is increasing, but its sales don’t keep up at the same pace, we may have an issue in 4Q24 or even 1Q25.

Let me state it clearly, when Tesla releases its 3Q24 report, I would look right away at its inventory. That will help us feel the pulse of what is going to happen down the road. After all, with a margin compression like the one we have seen, Tesla has just enough room for another massive discount campaign before putting its profitability at stake. An operating margin just above 6%, in fact, leaves room for a 4-5% discount, if no other cost-cutting measures are put into action.

Valuation

Surely, with these words I am attracting the wrath and the indignation of many. But I am learning that the harsh reality of numbers, especially when dealing with big industrial companies, matters, if not only for the long time it takes for these companies to transition and shift towards new businesses.

Let’s take a look at Tesla with the numbers we have seen. We are talking about a company projected to reach $100B in revenues this year (+3.4% YoY), but with lower profitability (EPS consensus is $2.29, a 26.7% drop YoY). Tesla’s market cap is close to $800B. This means we have a P/S around 8. Automakers trade at 0.2, reflecting the instability and the poor quality of these cyclical revenues, where it is hard to see that an additional dollar in revenue increases more than proportionally the company’s earnings. Of course, Tesla is no ordinary automaker, but its financials suggest it is closer to this industry than to others.

Based on its earnings, Tesla trades at a fwd PE of 105, which should then become 75.5 in 2025 and 57.8 in 2026 (assuming two consecutive years of 30+% EPS growth).

In its best years, Tesla did $5B in FCF. This means that we can expect a P/FCF above 160.

These metrics don’t make sense. Even if Tesla were to start a new and incredible growth cycle for the next five years, we would have to wait until 2028 or 2029 to speak about a P/S multiple around 1 or a P/E ratio in the 30s. In the meantime, the economy is deteriorating and many governments around the world are pondering what to do to prevent a recession from happening in 2025.

No, the outlook isn’t rosy. Good companies can survive hardships and come out of it even better. But investing is different, and the price we pay matters. Currently, Tesla trades at sky-high valuations due to rumors and news, but its fundamentals don’t lie and, sooner or later, will lead to a reversion to the mean. If I were invested in Tesla right now, I would profit from the recent surge in price before the robotaxi event and redeploy my gains elsewhere.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.