Summary:

- Both the Electric Vehicle industry and Tesla, Inc. have lost sales momentum.

- Tesla is situated well within the auto industry, but the company must successfully restructure.

- Tesla will pivot to high-volume, affordable cars and push its “Full Self Driving” subscription service.

- A great method of comparing peer valuations is using Enterprise Value.

- I created a DCF model as a “check” on Tesla stock valuation.

jetcityimage

Thesis

Magnificent 7 shares have run up sharply despite high interest rates. Concurrently, Tesla, Inc. (NASDAQ:TSLA) stock is suffering from a cacophony of bad publicity, an overvalued share price, and weakening industry fundamentals. I will explain how Tesla remains well positioned within the automobile industry despite its shortcomings.

Two disastrous back-to-back quarters have motivated CEO Elon Musk to restructure Tesla. I believe Musk will pivot from producing premium cars towards high-volume economical vehicles that utilize its FSD (“full self-driving”) subscription plan. I’ll show how Tesla could benefit from this new strategy using a financial model and discounted cash flow. Furthermore, I will also demonstrate ways of determining Tesla’s proper valuation, despite controversies over what kind of company it truly is.

Introduction

Tesla is often described as an automaker, and increasingly, as a clean-energy company that’s had its fair share of near-death experiences. Understanding Tesla is similar to understanding cryptocurrencies with its “second-order thinking.” Once you get past the Ponzi-scheme allegations and mercurial leader, you’ll see a broader vision of things to come. This article focuses on Tesla, the EV (Electric Vehicle) manufacturer, and its evolution to an FSD subscription model.

Tesla’s Position and Industry Structure

I rate Tesla “Above Average” using the Five-Forces Industry Analysis (after Harvard’s Michael Porter) and Innovation analysis (by Clayton Christensen). Tesla benefits from its strong business position, low-cost production, vertical integration, somewhat-low threats from existing ICE (Internal Combustion Engine) legacy makers (GM, Ford, Chrysler/Fiat), protection from competitive Chinese automakers, and weak credit profiles from other EV manufacturers (Faraday, Fisker, Lucid, Polestar, Rivian). Tesla’s greatest threat is Waymo, which may not be cost-competitive with Tesla, given Waymo’s use of complex autonomous subsystems. Legacy players announced plans to reduce their aggressive strategy to scale-up EV models due to inconsistent demand and production bottlenecks, and they must deal with high-cost unionized labor. Hence, Tesla remains in a strong “pole-position.”

EV Industry Weakness

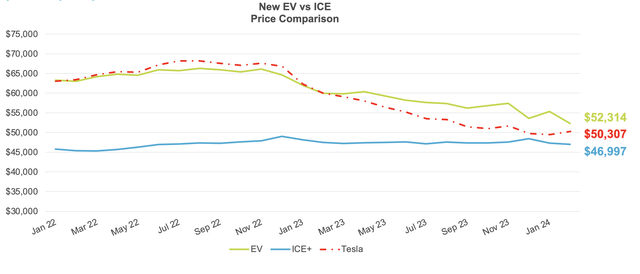

Since we’ve already hit a “tipping point” of EV unit sales, I expected a “J-Curve” of rapid adoption. Instead, several factors halted this transition. I believe the primary reason for the slowing EV sales was the “pull-forward” from the Biden Administration’s EV tax incentives. Bleeding-edge folks already adopted EVs and the mainstream consumer worries over “range anxiety.” EV’s share of total car sales has halted at 8% and EV prices need to decline below ICE prices ($46,997) to boost sales. Ark Invest expects 90% of EV market share once average selling prices fall to $20,000. EV versus internal combustion engine (“ICE”) prices are below.

Tesla’s Disaster

Dan Ives, one of the most outspoken analysts, called Tesla’s Q4 ’23 and 1Q ’24 earnings reports an “unmitigated disaster.” A laundry-list of well-telegraphed issues are bulleted below:

- Decelerating unit sales

- Weaker average selling prices due to pricing & mix

- Lack of new car models and dependence on the Model Y

- An arson attack in Gigafactory, Berlin

- Production issues related to Model 3 and Cybertruck ramp-ups

- Hesitant purchasers due to Elon Musk’s rants.

How Are Investors Valuing Tesla?

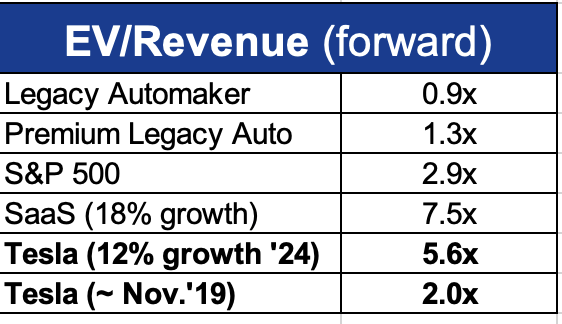

I agree with analysts that times are tough for Tesla, but I’m a long-term investor, so should I really care? My preferred valuation method is utilizing Enterprise Value/Forward Revenues, which can be used on any company, in any industry, regardless of earnings, and it adjusts for balance sheet cash.

I think we can all agree that Tesla is more than a car company and its valuation should reflect a blend between an Automaker and Tech company growing at 8-10% (or 18% for its LT growth). This would place Tesla’s EV/Revenues between 1.3x (Premium automaker) and 7.5x (SaaS Software) with a midpoint around 3x (similar to the S&P 500’s). Today’s EV/Revenue valuation of 5.6x remains expensive. This suggests Tesla’ price could decline 50% to approximately $90, though technically, there’s strong support in the $100 area. This 50% share-price cut assumes that investors think that half of the company is Tech (which may not be true). Also note that Tesla’s shares last bottomed at 2x EV/Revenues during 11/19.

Author’s Creation

Tesla’s Restructuring

It appears that Tesla’s in a “bad place” again. Could Tesla shift its strategy to reset itself ? As many are aware, Tesla has been aggressively restructuring. I believe Tesla could exit the other side by becoming more like an Apple iPhone (using a Razor Razor-blade strategy). Customers often say that the cars remind them of iPhones due to their glasslike paint, software updates, user-friendly interface, “iPad screen,” and minimalist design. The next step could be changing its business strategy to a subscription model.

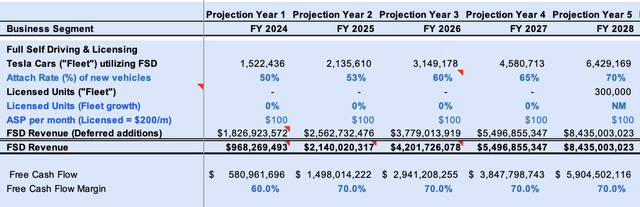

I created a Financial Model to incorporate this new strategy into 2038. I project that Tesla will substantially reduce its profit margins and free cash flow in its automobile business but boost cash flow from its subscription-based FSD business. I also expect Tesla to offer its own and third-party applications in its Tesla Mobile App; however, these are not included in my projections. Historically, the hugely profitable Apple App-store and Razor blade strategies have had strong moats, except for antitrust losses. Tesla wouldn’t be subject to these lawsuits, given the proprietary nature of FSD. My Tesla Financial Model includes “Tesla Core” and “New Tesla” which incorporates nearly one dozen models for each new business unit (e.g., Robotaxi, Optimus…). The segment data below is only for Tesla Core.

Auto Unit

I project that unit sales of all cars (Model S, 3, X, Y…) grow slightly in 2024 to 1.85MM cars. This growth is down sharply from 2023’s 38%. While Tesla’s Auto free cash flows (FCF) have been high over the last few years (~ $17Bn) I project 2024 will have a loss of nearly $2.8Bn. Tesla’s unique and vertically integrated operations have boosted historical FCF margins (i.e., FCF/Revenues) to well over 9%. One would expect that a much larger scaled operation and new production processes to continue boosting FCF margins. However, I believe Tesla will artificially suppress margins to no higher than 4% during the forecast period with the goal of increasing unit sales and market share.

Consequently, I expect unit sales to rebound in 2025 and grow at a CAGR of 29% from 2025 through 2029. Helping boost sales will be Tesla’s compact car (code-named “Redwood”) that will lower ASP (Average Selling Prices). Concurrently, global EV sales (including hybrids) are forecast to rise from 14.1MM units in 2023 to 37MM units by 2030 (Source: International Energy Agency). I expect Tesla’s EV market share to rise from 13% in 2023 to 18% by 2028 and 21% by 2030.

Author’s creation, IHS Industry projections

“Full Self-Driving”

Tesla sells Level 2 ADAS (Advanced Driver Assistance Systems) to its customers using what it calls “Full Self Driving Capability.” Having seen Tesla’s FSD in action, it’s clear that it’s at least at Level 3; however, one could assume it is fully autonomous (Level 6) given its nomenclature (hence the lawsuits).

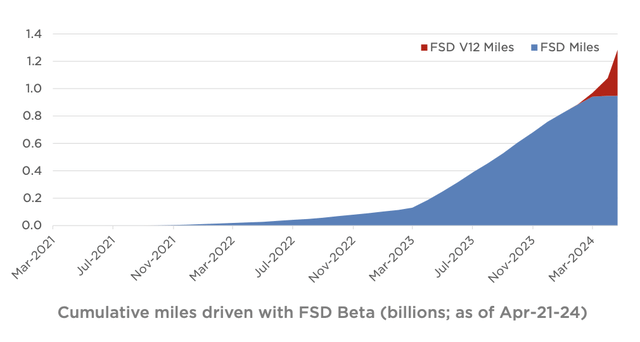

Last year, Tesla rolled out FSD version 12. New Tesla investors may not realize it, but FSD 12 isn’t just the 12th iteration of FSD, but the first version of a whole new way of autonomous driving. Instead of having every single driving situation hard-coded, V12 uses an AI trained Neural Network. Despite coming from a high-base, Miles-Driven with FSD rose from 56% growth in 4Q ’23 to 73%, to 1.3Bn miles, as of 1Q ’24.

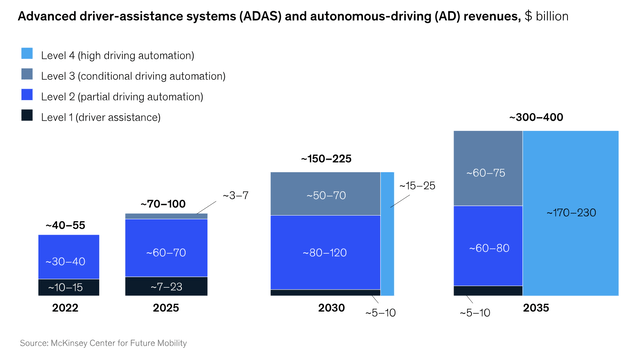

While I expect Tesla’s auto sales to have low FCF margins, its FSD segment will likely maintain high margins due to mostly “sunk-costs.” At first glance, this goes against the grain of Tesla’s recent 50% price cut to $100/month for FSD (or $8,000 one-time payment) but I think we can all agree that the “attach rate” would be hindered at high prices. I project a 50% “attach rate” of Tesla’s fleet using FSD, rising to 70% by 2028. Tesla’s FSD revenue growth is supported by forecasts from McKinsey (see below).

I also expect Tesla to license its FSD to legacy carmakers beginning in 2028 at $200/month. If Tesla follows through with its Robotaxi by 2028 (Musk has said it could launch as soon as this year under human-supervision) that could add substantial licensing dollars not included in this model.

Tesla Truck Unit:

My Tesla “Truck” projections, meaning Class 8 Semis, are conservative as Ryder Systems recently published a study showing that EV trucks are not economical and too expensive to maintain. By 2028, I project 81k unit sales at $207k/unit, with ASP declining 3% per year. For perspective, Paccar forecasts 788k global unit sales by 2028 (see Industry Class 8 sales below). On 5/24, Tesla announced it will finally start producing trucks in 2025 (over eight years late if we exclude the pilot production for PepsiCo).

Author’s creation, Paccar industry forecast

Insurance & Charging

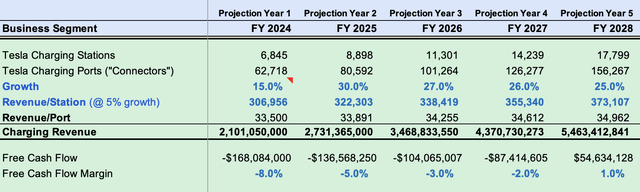

Tesla’s Insurance business is small and conducted more as a “service” to customers that cannot find affordable coverage. I forecast Tesla charges $3,300/car based on blended auto insurance rates for those states Tesla sells into, according to data supplied by Insurance.com.

I forecast Tesla’s EV charging business will grow sharply but operate at a FCF loss for several years (as per a McKinsey White paper and Wedbush’s Dan Ives) which now explains recent mass layoffs in this unit. Revenue/Port is expected to rise now that Tesla’s charging model has become the standard for most automakers.

Energy Generation & Storage

I believe that Tesla’s Energy Storage segment offers the most promise. The company aggregates residential and commercial storage together, which doesn’t do justice to the FCF powerhouse in selling commercial Megapacks. It’s basically a giant battery used in power stations to help manage the flow of electricity on the grid. A Megapack (~ $1.5MM each excl. installation costs) holds a huge 3.9 MWh which can power 3,600 homes for one hour. I forecast the Energy Storage unit will grow much faster than Generation (which sells cheap residential solar panels and pricier solar-roofs). In contrast, the Megapack business has a two-year backlog and just received approval for a Chinese factory that will start producing 10,000 units by 2025. For perspective, the Chinese fab will be able to annually produce over twice the revenues of the combined Energy Generation and Storage Unit’s 2023’s revenues.

Given the strong backlog, I forecast rapid revenue and FCF growth during the forecast period. This aligns with industry projections for “Energy Battery US Storage Revenue” provided by Grand-View Research below and anecdotal commentaries.

Author’s creation, Grand-view Research projections

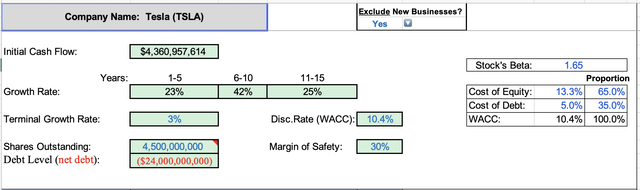

DCF Model

The DCF Model projects each unit going out to 2038 – thereafter, I project a conservative 3% growth rate in FCF. I calculated a conservative (i.e., high) WACC of 10.4% using a Beta of 1.65 and a 5% cost of debt, blended at 65% Equity and 35% Debt proportions. I use a high Shares Outstanding of 4.5Bn (vs. today’s 3.5Bn) to account for Elon’s hefty share compensation; however, I don’t foresee future capital raises.

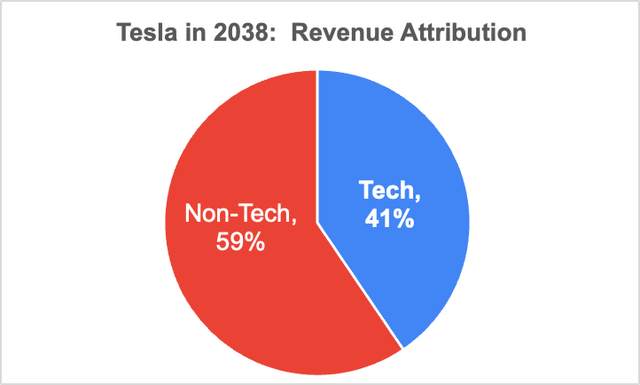

The Model’s calculated value is 20% above the present-day’s stock price. More aggressive assumptions yield calculated values 50% higher than today’s stock price. Still, given the sensitivity to assumptions and execution risk, I don’t think this is enough margin to support the shares. Hence, I still think Tesla’s shares could decline another 40-45% until investors feel comfortable with the risk and until its revenues are mostly Tech-based (see pie chart). Remember…investors are focused solely on the EV business.

Explaining My Buy Rating

Despite my above near-term bearishness, I rate Tesla a “Buy” as Seeking Alpha doesn’t have a short-term rating. Further, my “New Tesla” DCF model reflects another half-dozen new businesses that, I believe, will evolve Tesla into an AI and robotics powerhouse.

Conclusion:

I’ve never seen such a large company with a “Do or Die” plan. Tesla has the chance to become the most consequential company in history. Readers interested in knowing more about Tesla’s moonshots are encouraged to read its Master Plan. Shh, it’s a “secret.”

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.