Summary:

- Tesla, Inc.’s share price is down over 30% YTD and its market capitalization is almost $500 billion.

- The company’s core car business is suffering, and it continues to highlight businesses that don’t exist.

- Tesla’s financial performance is weak, with declining revenue, profit, and earnings, and negative free cash flow.

Richard Drury

Tesla, Inc. (NASDAQ:TSLA) has continued to underperform YTD, with the company’s share price declining more than 30%. The company is down to an almost $500 billion market capitalization, and its core business as a car company continues to suffer. The company continues to highlight businesses that don’t exist, such as humanoid robots, or self-driving taxis, but its recent full self-driving (“FSD”) price cut highlights the weakness.

As we’ll see throughout this article, Tesla will continue to underperform, as its core business remains weak, and it fails to paint a realistic picture for earnings from alternative businesses, as segments like self-driving remain years behind targets.

Tesla Highlights

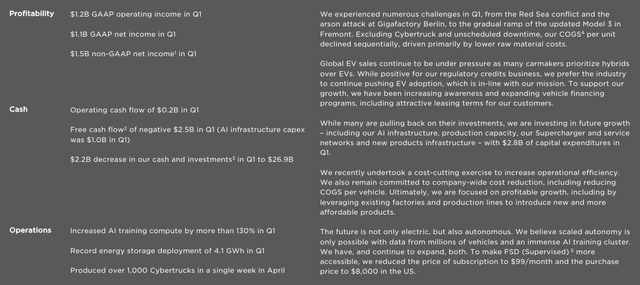

Tesla had an incredibly tough quarter as demand for its vehicles remains weak, combined with other continued challenges.

The company’s profitability petered out with just over $1 billion in GAAP net income. That gives the company a P/E of more than 100. The company had an operating cash flow of more than $0.2 billion, with free cash flow (“FCF”) at a massive $2.5 billion. AI infrastructure capex was $1 billion, meaning even after the growth the company was chasing, it had massively negative FCF.

That hurt the company’s cash and investments significantly. The company is continuing to chase growth, but there’s no guarantee that chasing that works out. If it doesn’t, the company will have spent billions of dollars of capital for nothing.

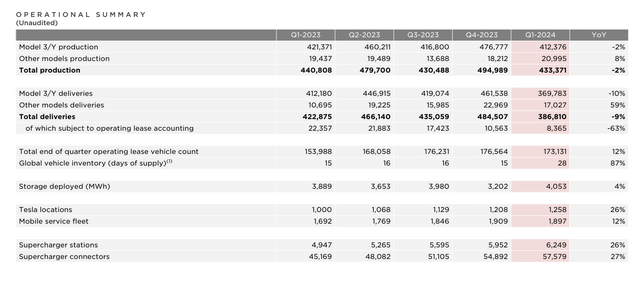

The company talks about billions spent to acquire AI GPUs, the hot topic of the year. However, it fails to paint a picture of what it can accomplish with those versus competitors that have $10s of billions more to spend on capital, such as Meta Platforms, Inc. (META), which is spending almost $40 billion on capex. The company’s core business continues to drive the vast majority of its revenue and had a tough quarter.

Tesla Financial Performance

Tesla has continued to struggle financially, as the company has seen weak demand for what is the majority of its business, vehicles.

The company saw total automotive revenues of $17.4 billion down 13% YoY with even additional QoQ weakness. The company’s Q4-2023 revenue was more than $21.5 billion, which is a hefty weakness. The company’s energy generation and storage revenue remains strong, with 7% YoY growth, but it remains less than 10% of the company’s revenue.

Services etc. also continue to perform well off the company’s vehicle count. However, nothing can make up for vehicles, with the company’s revenue decreasing substantially. The company’s gross profit dropped a massive 18% YoY as its margins continue to decline and gross profit is now at less than $3.7 billion for the quarter.

Versus a market capitalization of more than $500 billion, the company is trading at a P/E of approximately 40. Not a great look for a company with declining earnings. Net income dropped more than 50% YoY and the company’s annualized P/E is now more than 100. FCF was a massive negative $2.5 billion and the company’s cash has declined.

Given continued weakness, we see no path for the company to turn things around and justify its valuation.

Tesla Operational Performance

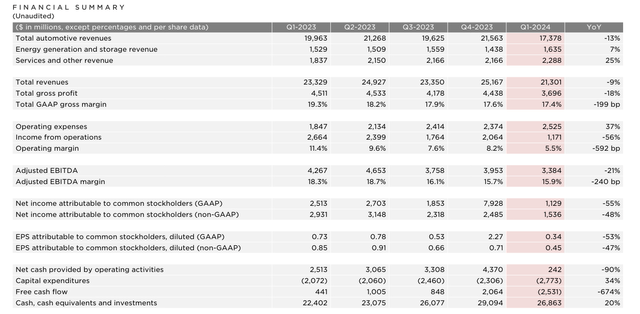

The company’s operational performance was impacted by shipping and other impacts, but it was also impacted by weak demand.

The company’s total production for the quarter was just over 430k down both YoY and QoQ. The company’s production has remained volatile, as it originally zoomed past 1 million vehicles/year but has struggled to pass 2. The company also saw some of the weakest performance in deliveries, in terms of the ratio of vehicles produced versus delivered.

That has pushed the company’s inventory to almost double to 28. Storage and businesses remain strong, but it’s clear that demand for the company’s vehicles remains incredibly weak.

Tesla’s Market Share Growth Slows Down

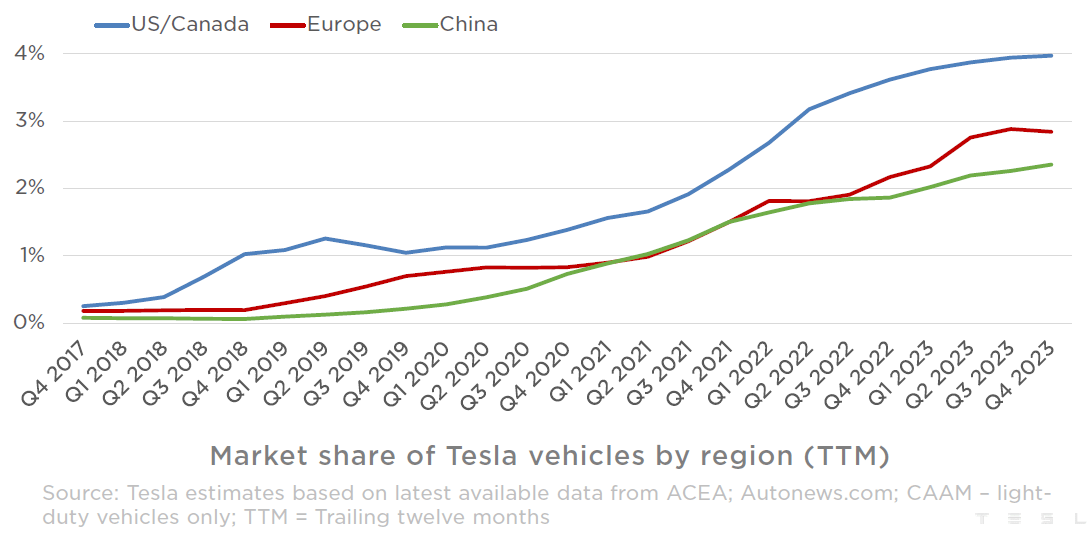

The weak demand is visualized through the image above, which highlights the market share of Tesla by region. It initially looks promising, with a Q4 2022 market share of approximately 3.5% in the U.S. / Canada, 2% in Europe, and 2% in China. By year-end 2023, the company’s market share was 4% U.S./Canada, and roughly 2.5% Europe, and 2.5% China.

However, from year-end 2022 to year-end 2023, BEVs market share grew from 9% to 11%. So while the market share by BEV grew by 2%, the company only gained 1.5% in its core markets, showing it’s not growing as fast as the BEV markets. That shows the company’s market share is declining. We see this with increased low-cost competition, where the company has been dethroned in markets such as China.

Tesla Alternative Businesses

The company has a number of alternative businesses; however, we expect none of them to be competitive.

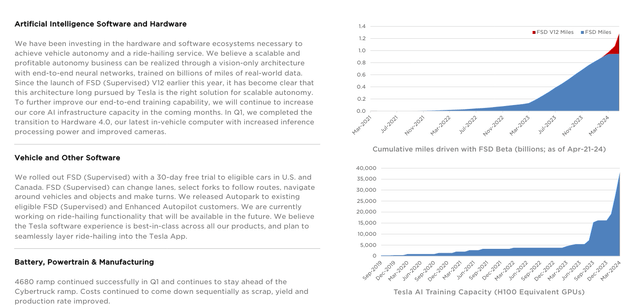

The company has been forced to qualify all of its FSD as “Supervised” due to lawsuits, and it’s cut its cost for a subscription by 50%. The CEO originally promised to have more than 1 million robotaxis on the road several years ago, but that segment continues to struggle, when competitors such as Waymo are already actively earning revenue from their robotaxis.

The company is building up a massive portfolio of artificial intelligence GPUs and has more than 35k H100 equivalent GPUs worth almost $1 billion. What is it using these GPUs for? Plenty of things. What is it using these GPUs for that are making money? Nothing. The company is chasing numerous alternative businesses while its core business continues to suffer.

There are some related alternative businesses such as its battery cell manufacturing that will help reduce costs, but its alternative businesses like humanoid robots are side quests it has no expertise in.

Our View

Tesla is chasing growth, but it needs the ability to justify its valuation, with $10s of billions of profit needed to justify its valuation.

The company argues it is between two major growth waves, with the second expected to be initiated by advances in autonomy and new products, including a new generation vehicle platform. What does that read to us? The company admits it peaked with its current business, despite its prior discussions of ~40% annualized growth.

The company is expecting vehicle volume growth rate to be weak in 2024. The new products it expects to drive the next wave don’t exist. A new vehicle program could help the company out, but China is currently outcompeting at a cheap platform. In the U.S., the company could outperform, with protections, but outside that we expect China to outcompete.

The company announces it’s entering a field, such as humanoid robots, which are effectively completely independent of its core strength. The company has said it’ll start selling useful robots in the next year, but it’s 4 years and counting after its robotaxis estimate.

The company has been unable to convince us why it will hit its lofty technological ambitions this time around, given that after years of promises, it’s failed to build a significant business outside its core vehicle business.

Thesis Risk

The largest risk to our thesis is Tesla’s continued focus on manufacturing dominance and the company’s ability to innovate. While the company has yet to have successes that justify its valuation, a breakthrough with FSD or something else, could turn that around. The company is a poor investment in our view, but a “golden goose” event could always turn things around.

Conclusion

Tesla has managed to build an incredibly impressive business. There’s no denying that the company has had some impressive accomplishments in the midst of building the largest publicly traded car company in the world. There’s also no denying that the company’s EV business remains strong and unparalleled in its target market.

However, when you have a market capitalization of more than $500 billion, a lot more matters than that. Tesla, Inc. needs a path to $10s of billions in annual profits, and right now, we’re not seeing that. The company is listing hypothetical businesses, but we don’t see a path to developing them. Overall, that makes the company a poor investment.

Please let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.