Summary:

- Tesla and cheap are two words that you don’t typically see together.

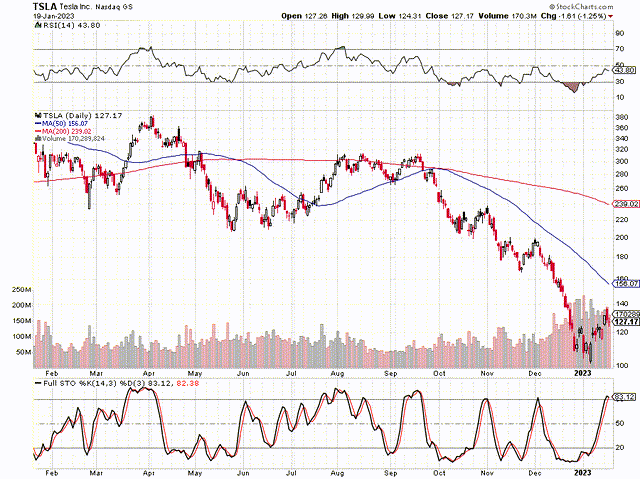

- However, with the stock crashing by 75% from peak to trough, Tesla’s stock looks relatively inexpensive.

- Tesla’s stock only trades at 12-15 times higher end forward (2024) earnings estimates.

- Tesla is not a value company, and as sentiment improves, Tesla’s stock should move much higher in the coming years.

Spencer Platt

Tesla, Inc. (NASDAQ:TSLA) has been on a wild rollercoaster ride in recent years. I was long the company’s stock throughout most of the time from October 2013 to early November 2021. However, I called out the company’s stock for being significantly overbought during the height of the tech bubble in November 2021. I released my position at about $395 (split adjusted). The Tesla top materialized at about $420, and the stock recently hit a low of just $100, illustrating a spectacular 75% peak-to-trough decline during this bear market phase.

Tesla 1-Year Chart

Tesla’s epic decline may have culminated in a bottom around the $100 level. Even if Tesla’s stock were to travel lower, the downside is likely limited, and with Tesla’s stock price at $100 or lower, the shares are essentially a gift. Tesla is trading at around 20 times projected EPS estimates (consensus). However, the stock may sell at 12-15 times forward EPS estimates if the company can achieve higher-end EPS results. Also, Tesla is far from a value stock and could continue delivering 30-20% revenue growth for most of the decade. Therefore, Tesla’s stock price is oversold and undervalued and is a strong buy intermediate and long term.

China: The Key Component to Tesla’s Success

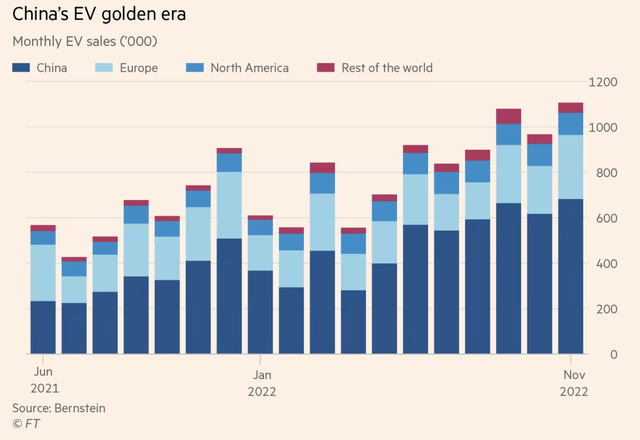

China is a critical market for Tesla. Fortunately, Tesla has the necessary ingredients to do great things in China. Firstly, China remains the crucial and most lucrative electric vehicle (“EV”) market globally. China’s population is more than four times that of the U.S., with more than 500 million drivers. Moreover, China is exceptionally EV-friendly and has the most dynamic EV market globally. China sold 5.67 million EVs and plug-ins in 2022. More than four million vehicles were 100% EVs, more than five times the number of all-electric vehicles sold in the U.S. last year.

China EV Sales – Up Almost 200% Over 18 Months

During this challenging slowdown, most of the global EV growth has come from China. While Europe and North American sales have increased modestly, China’s EV sales have skyrocketed, nearly tripling in the last 18 months. Also, global EV sales should rebound in crucial markets that have lagged recently. Therefore, Tesla and other EV sales will likely boom in critical markets like China, North America, Europe, and others as the company advances in the coming years.

Tesla’s Price-Cut Advantage

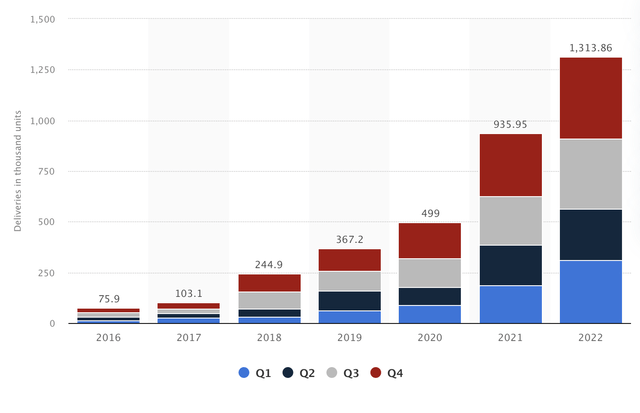

Tesla is well-positioned to capitalize on China’s booming EV transition. The company’s registrations surged last month. Tesla delivered more than 710,000 vehicles from its Shanghai factory in 2022. Tesla’s sales surged after the company dropped prices in China, illustrating another advantage due to Tesla’s economies of scale and remarkably high profitability. Tesla can lower prices in other areas globally to spur sales and improve demand while the slowdown persists. The company can scale prices back up as the next recovery materializes.

Tesla remains the leader in innovation and technology in the EV segment and is akin to the iPhone of electric cars. Therefore, Tesla vehicles should continue garnering substantial demand in China and globally. China EV sales surged by 71% in November, with Tesla delivering a record 100,291 Chinese-made cars. Tesla’s Model 3 and Y vehicles remain wildly popular in China and many parts of the world. Tesla should continue growing revenues substantially as its China, Asia, Europe, and other business segments continue expanding in future years.

Tesla’s Outstanding Deliveries Data

Tesla closed out 2022 with more than 1.3 million vehicle deliveries. The surge represents a unit sales increase of 40% over last year. In Q4, Tesla reported deliveries of roughly 405K cars and production of about 440K vehicles. The lag in deliveries (relative to production) could be due to year-end orders that should transfer over to Q1 deliveries. Regardless, Tesla continues showing remarkable production capacity and significant growth momentum that should continue for years.

Q4 – Strong Deliveries Translate to Significant Revenue

Tesla delivered 17,147 Models S/X vehicles, 9% of which were subject to leasing. Therefore, Tesla sold approximately 15,604 Model S/X vehicles last quarter. Using an ASP of $120,000 for Tesla’s premium models, the company likely made $1.9 billion in revenues from Model S/X sales in Q4.

Tesla’s Model 3/Y segment delivered 388,131 vehicles last quarter, 4% of which were subject to lease accounting. Therefore, Tesla sold approximately 372,606 Model 3/Y vehicles in the fourth quarter. Even with the recent price cuts, I suspect the ASP came in around $50,000. Thus, Tesla’s Model 3/Y segment may have delivered around $18.7 billion in Q4.

Tesla’s leasing, energy generation and storage, and services segments may have provided around $3.8 billion in revenues in the fourth quarter. Therefore, Tesla’s revenues should be around $24.5 billion for the fourth quarter, roughly a 38% YoY revenue increase.

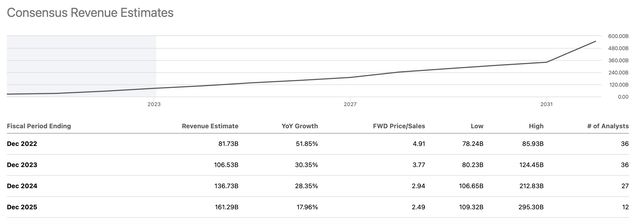

Revenue Estimates

Revenue Estimates (seekingalpha.com)

2022’s revenues should come in at about $82 billion (52% YoY growth), and we should continue seeing significant revenue growth in the coming years. We could see 20-30% YoY revenue growth for most of this decade. Provided the consensus estimates, Tesla is trading at less than three times next year’s (2024) projected sales. Additionally, Tesla is becoming increasingly cheap on a P/E basis.

Is Tesla a Value Company Now?

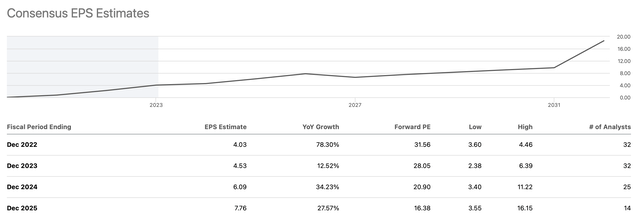

EPS Estimates

EPS Estimates (seekingalpha.com)

While Tesla’s 2022 EPS should come in at approximately $4, the company should earn more than $6 in 2024. Therefore, Tesla is trading at just 20 times the forward consensus EPS estimate. Additionally, EPS estimates have been lowered due to the transitory economic slowdown. There is a strong probability that Tesla could outperform in 2024, delivering $8-10 in EPS instead of the projected $6.10 consensus estimate figure. If Tesla achieves my $8-10 EPS estimate in 2024, the company will be trading at just 12-15 times forward earnings now. This valuation is remarkably cheap for a dominant market-leading growth company in Tesla’s position. Therefore, as the slowdown moderates and market sentiment improves, Tesla’s stock price should travel significantly higher.

What Wall St. Thinks

Price Targets (seekingalpha.com)

While the lowest price target remains incredibly depressed below $100, the average analyst on Wall St. expects the company’s stock to appreciate by about 56% by the end of the year. Some very bullish estimates project a stock price of around $350. However, I am more modest and believe Tesla’s stock could reach approximately $250 by year-end, doubling from current levels. Moreover, Tesla’s stock price could increase several-fold over the next few years.

Here’s Where Tesla’s Stock Could Be By 2030

| Year | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $124 | $178 | $235 | $315 | $400 | $510 | $640 | $770 |

| Revenue growth | 51% | 44% | 32% | 34% | 27% | 27% | 25% | 20% |

| EPS | $7 | $10 | $14 | $19 | $25 | $32 | $38 | $45 |

| EPS growth | 70% | 43% | 40% | 38% | 32% | 28% | 19% | 18% |

| Forward P/E | 12 | 15 | 18 | 21 | 22 | 21 | 20 | 19 |

| Stock price | $120 | $210 | $342 | $525 | $704 | $798 | $900 | $1,007 |

Source: The Financial Prophet

Risks to Tesla

There are risks – The company may miss earnings and revenue estimates. Furthermore, a slowdown in demand, increased competition, supply issues, decreased growth, issues with regulators and foreign governments, and other variables are all risks we should consider before betting on Tesla to move higher. Serious concerns could cause Tesla’s valuation to lose altitude, and the company’s share price could even head in reverse if any serious issues should arise. Therefore, one should consider these and other risks before committing any capital to a Tesla investment.

Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long a diversified portfolio with hedges.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2022 17% return), and achieve optimal results in any market.

- Our Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement our Covered Call Dividend Plan and earn an extra 40-60% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Own Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now, and start beating the market for less than $1 a day!