Summary:

- We have concerns regarding the sustainability of the company’s valuation due to the capital intensity of Tesla’s business model, increasing competition in the market for EVs, and regulatory risks.

- Delays and uncertainty surrounding new products and technologies, like robotaxis, further complicate Tesla’s growth outlook.

- Despite Tesla’s historical success, we think the market may be overestimating the company’s future growth potential, leading to our Sell rating on the stock.

baileystock

This write-up is not meant to discount the huge amount of success Tesla, Inc. (NASDAQ:TSLA) has seen with CEO Elon Musk at the helm over the last 20 or so years.

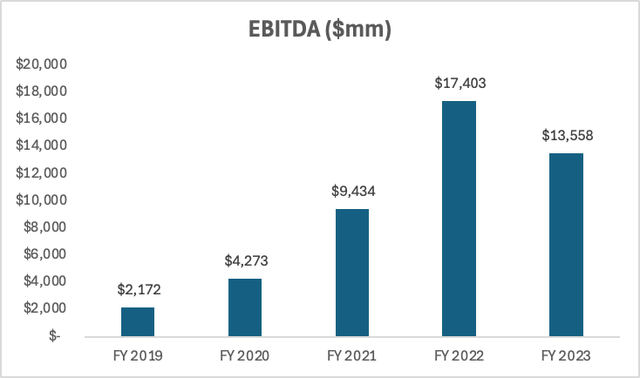

Tesla’s growth has been astronomical. In the last 10 years alone, the company has increased revenues by more than 29x (a 41% CAGR) and EBITDA by almost 300x (77% CAGR)! And shareholders have been rewarded – over the same period TSLA stock has appreciated by more than +1,500%, while the S&P 500 (SP500) returned just over +230%.

TSLA Historical Fundamentals & Performance vs. SPY (L10Y) (Koyfin)

It’s difficult to argue with this level of success. And that’s not what we’re trying to do here.

I’ve always believed that nothing was worth an infinite price.

– Charlie Munger.

Our issue is more about the level of future success we think the market is currently pricing in.

In light of Tesla’s capital-intensive business model, intensifying competition in the market for electric vehicles, or EVs, and an evolving and inherently unpredictable regulatory environment, we find it challenging to justify Tesla’s current valuation.

Couple this with the fact that Tesla’s historical guidance on its product pipeline and the rollout of new technologies hasn’t always been accurate, making it difficult to predict when these initiatives might actually start driving growth in sales and earnings.

As such, we’re initiating coverage on TSLA with a Sell rating.

If we haven’t lost all the Tesla bulls yet, humor us as we attempt to justify our views on the stock.

Capital Intensity

Tesla is a capital-intensive business. Building new facilities, increasing battery production, expanding its charger network, and delivering more and more cars, are all key to Tesla’s growth and require significant capital investment.

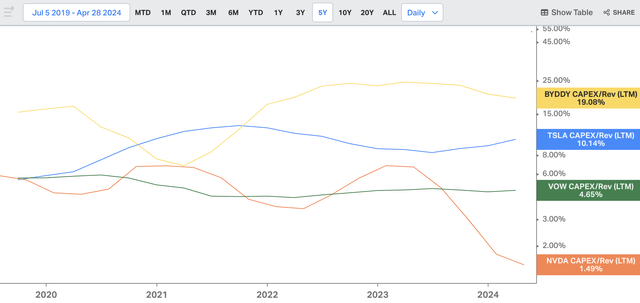

To put Tesla’s capital requirements into perspective, let’s compare its capital intensity to a few other businesses:

- BYD Company (OTCPK:BYDDY): Chinese competitor in the BEV space.

- Nvidia (NVDA): A high-growth tech company benefiting from similar AI-related tailwinds.

- Volkswagen (OTCPK:VWAGY): A mature automaker with the second-largest global EV market share.

TSLA’s Capital Intensity (Koyfin)

At the beginning of the year, Musk mentioned that he expects CapEx to exceed $10bn in 2024 and to range from $8-10bn for each of the next two fiscal years. This amounts to a 5.5-7x increase versus 5 years ago.

While high-growth businesses command higher valuations, we think the market might be overlooking Tesla’s capital intensity. Businesses with greater capital intensity tend to trade at lower multiples since they have to commit a greater percentage of capital to investments in fixed assets, limiting their financial flexibility.

Tesla’s growth costs a lot of money to fund. And while the company should benefit from economies of scale as it grows, we think it will become increasingly difficult to achieve the kind of growth they’ve experienced in the past.

As competition in the EV market heats up, and demand for EVs cools off, where does that leave Tesla? Musk has been slashing prices, and margins are under pressure as a result.

In the last year and a half, Tesla’s operating margin has declined from 17.2% to 5.5%.

Intensifying Competition

As the EV market matures, Tesla faces an increasingly crowded and competitive landscape, challenging Tesla’s market dominance and future growth prospects.

The EV market is becoming saturated with established automakers like Ford (F), General Motors (GM), Volkswagen, and Hyundai (OTCPK:HYMTF), all of which are investing heavily in EV development and either currently offer or plan to offer EVs at comparable or more competitive price points relative to Tesla.

But in the US, Tesla remains king. With more than 140k cars sold in 1Q24, Tesla far outsold the #2 selling EV maker in the US during the quarter, with Hyundai selling just under 23k EVs.

However, Chinese EV manufacturers like BYD, NIO (NIO), XPeng (XPEV), and Li Auto (LI) are rapidly expanding their global reach, offering competitive models with advanced technology, long-range capabilities, and attractive price points.

- BYD: As the leading EV manufacturer in China with more than 300k EVs sold in 1Q24, BYD boasts a diverse product portfolio, including the Seal sedan, which rivals Tesla’s Model 3 in terms of performance and features, but at a slightly lower price point (in Australia where new tariffs aren’t a factor, BYD’s 2024 Seal Premium retails at $58,798 vs. $61,900 for the 2024 Tesla Model 3).

- NIO: Known for its premium electric SUVs, the company recently unveiled its new lower-priced brand Onvo, which directly competes with Tesla’s Model Y. In China, prices for NIO’s new Onvo L60 SUV will start at 219,900 yuan, roughly 12% lower than Tesla’s Model Y (which starts at 249,900 yuan). NIO’s unique battery-swapping technology further differentiates the company’s offering, though it isn’t mainstream yet.

- XPeng: With its emphasis on technology and autonomous driving capabilities, XPeng has gained traction with models like the P7 sedan and G3 SUV, as the company delivered 21,821 vehicles in 1Q24. The company’s advanced driver-assistance systems and innovative features like in-car voice control and smart parking assist aim to rival Tesla on tech.

- Li Auto: Focusing on extended-range electric vehicles (EREVs), Li Auto’s Li ONE model offers a solution for range anxiety concerns in regions with limited charging infrastructure. Li Auto boasts strong unit economics, a solid financial position, and significant growth potential in the expanding Chinese EV market, particularly in the increasingly popular EREV segment.

The success of these companies in China, the world’s largest EV market, demonstrates their potential to disrupt the global EV landscape (we’ll touch on tariffs later). In 2023, China accounted for nearly 60% of global EV sales, with Chinese brands capturing 81% of domestic EV sales.

But can anyone compete with Tesla’s Robotaxi/Cybercab? And will its rollout result in another step function change in Tesla’s growth trajectory?

Product Pipeline & Timing Uncertainty

In our view, Tesla’s ambitious product pipeline, a driving force behind its growth narrative, is called into question by the company’s less-than-stellar history of overpromising and underdelivering.

While Musk’s vision has been instrumental in pushing the boundaries of innovation, the gap between ambition and reality can be pretty wide.

A few noteworthy examples:

- Battery Range: In 2015, Tesla claimed it would achieve a 1,000 km (621 miles) battery range within a few years. Currently, the longest range achieved by a Tesla is about 560 miles. While battery technology continues to improve, the discrepancy between the initial projection and current reality highlights the challenges of achieving such breakthroughs. While Tesla continues to iterate on battery technology, competitors like Lucid, Chevrolet, and Mercedes have been catching up.

- Full Self-Driving (“FSD”): Tesla’s 2016 prediction of coast-to-coast fully autonomous driving by 2018 remains unfulfilled. Tesla’s progress in FSD has been slower than anticipated, and rival Mercedes recently became the first automaker to bring Level 3 autonomous vehicles to the US with its EQS. But it seems like Tesla is making some progress on this front. In April, Baidu (BIDU) announced an agreement with Tesla to upgrade the EV’s mapping software in the China – a key step toward rolling out FSD in the country. And while other of Tesla’s competitors have been testing their own fully autonomous driving solutions, progress has been mixed. GM’s Cruise has faced setbacks, while Waymo is beginning to test its driverless cars in new markets.

- Robotaxis: First mentioned in 2019, with Tesla predicting a 2020 launch, the company’s robotaxi concept is still in its infancy. While a prototype unveiling is planned for next month, concrete details about the vehicle’s capabilities, regulatory approval process, and deployment timeline are scarce.

Musk’s bold vision has undoubtedly propelled Tesla forward, but we’ve seen how long it can take to achieve some of his goals.

As such, we think the company’s valuation should reflect a longer, more realistic timeline to execute on these key growth initiatives.

Regulatory Risks

In addition to the increasing level of spending required to achieve Musk’s lofty goals, intensifying competition in EVs, and the company’s history of overpromising and underdelivering, Tesla also faces a number of regulatory risks.

Countries are implementing stricter emission standards and offering incentives to promote EV adoption. While these policies generally benefit Tesla, changes in these regulations could disrupt Tesla’s production plans and sales growth.

For example, the phase-out of EV tax credits would likely negatively impact demand for EVs. Research by the National Bureau of Economic Research found that for every $1,000 decrease in EV tax credits, there is a 2.6% decrease in sales, illustrating the direct relationship between incentives and consumer behavior.

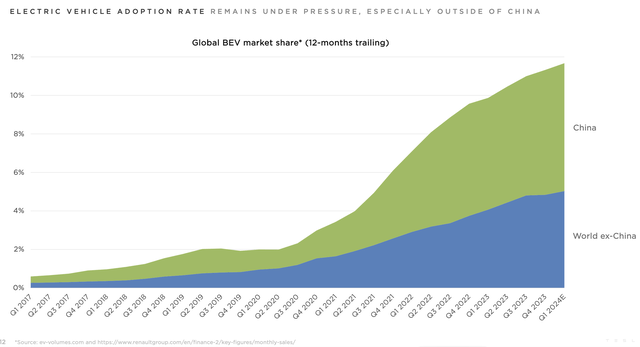

And while US and EU tariffs on Chinese-made EVs might help Tesla remain competitive outside of China, China is the largest EV market in the world by far, so Tesla needs to be competitive there too.

Global BEV Market Share (Tesla’s 1Q24 Share Holder Deck)

According to research from Counterpoint, China is expected to hold more than 50% market share of global BEV sales until 2027 and Chinese BEV sales are projected to exceed the combined sales of North America and Europe by 2030.

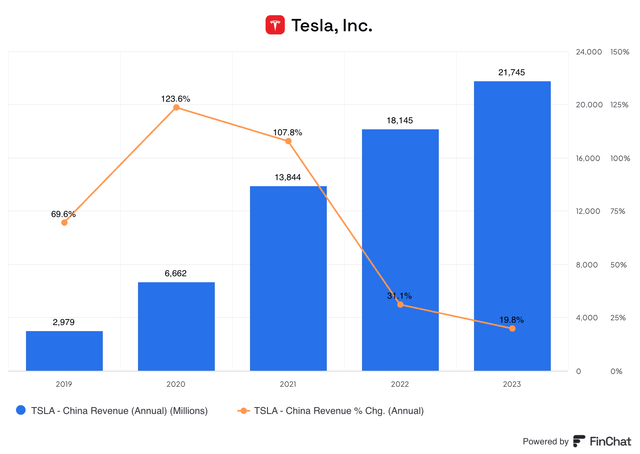

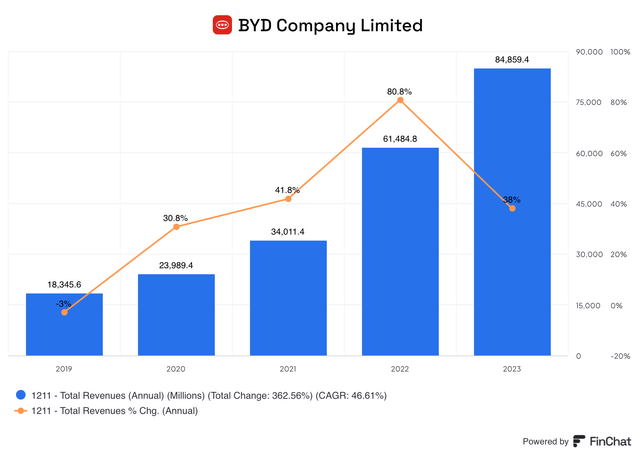

Over the last 5 years, Tesla’s revenue from China has grown at a clip of nearly 50%. But last year that growth slowed to 20%. BYD reported sales growth of more than 40% in 2023.

TSLA China Revenue (FinChat.io) BYD Total Revenue Growth (FinChat.io)

EVs also face evolving safety regulations. Tesla’s advanced driver-assistance systems (ADAS) and autonomous driving technology are under intense scrutiny. The NHTSA has opened several investigations into Tesla crashes involving Autopilot.

In 2021, the DOJ launched a criminal investigation into Tesla’s claims about its self-driving capabilities. According to Reuters, the investigation is ongoing and focused on whether Tesla committed securities or wire fraud by misleading investors and consumers about its electric vehicles’ self-driving capabilities.

Additionally, Tesla’s energy generation and storage businesses are subject to evolving environmental regulations regarding the sourcing of raw materials, manufacturing processes, and waste disposal. Compliance with these regulations can be costly, and any violations can result in fines, penalties, or reputational damage.

Valuation

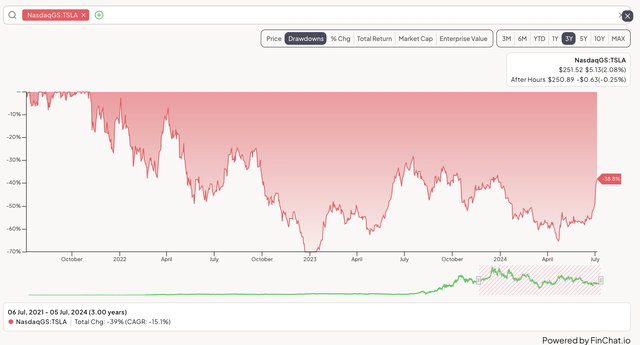

Tesla stock closed at a split-adjusted all-time high of about $410 on November 4th, 2021. Since then, the stock is down about -40%, currently trading around $250.

TSLA 3-Year Drawdown (FinChat.io)

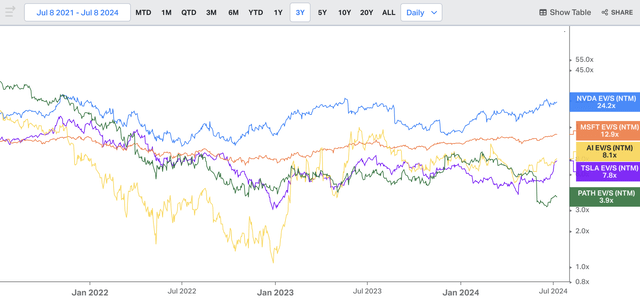

Despite this drawdown, according to Wall Street consensus estimates, Tesla still trades at about 43x NTM EV/EBITDA or 8x NTM EV/S, which in all fairness is right around the 5-year average for the stock.

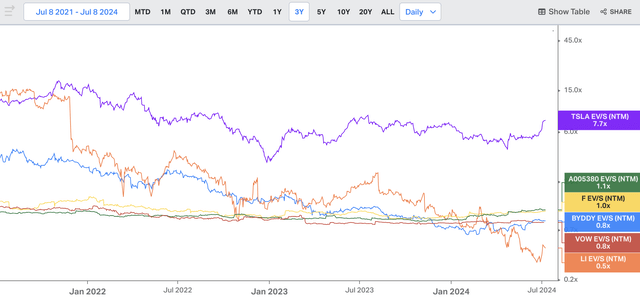

Let’s see how Tesla’s multiple stacks up with competitors.

TSLA EV/Sales (NTM) vs. Peers (Koyfin)

Somewhat unsurprisingly, TSLA trades at a significant premium to other domestic and international EV makers.

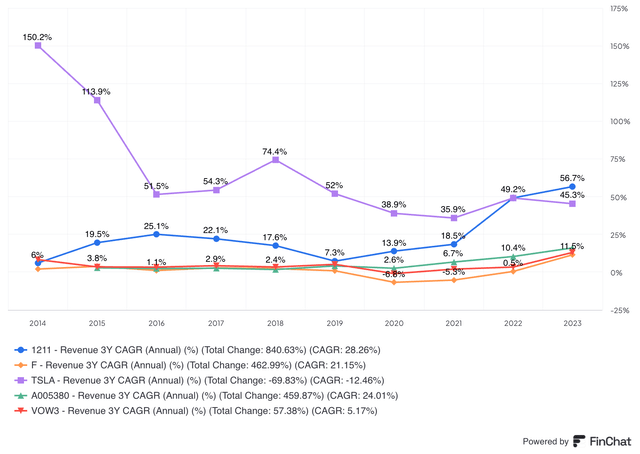

However, it’s important to look at valuation multiples alongside growth to help contextualize these figures.

TSLA Rolling 3-Year Revenue CAGR vs. Peers (FinChat.io)

As we mentioned earlier, Tesla’s growth has been astronomical, leading to the company’s optically high valuation. However, on a 3-year revenue CAGR basis, BYD’s growth surpassed Tesla’s in FY 2023, yet BYD trades at less than 1x EV/NTM Sales while Tesla trades at almost 8x.

But on TSLA’s last earnings call, Musk said:

But I think Cathy Wood said it best, like really, we should be thought of as an AI or robotics company. If you value Tesla as just like an auto company, you just have to – fundamentally, it’s just the wrong framework and it will come to be.

So let’s look at TSLA’s valuation relative to a few AI and robotics companies (including companies like Nvidia, which are direct beneficiaries of the growth tailwinds in AI).

TSLA Valuation vs. AI and Robotics Companies (Koyfin)

TSLA’s valuation looks relatively less expensive compared to these types of businesses.

And for a company that’s achieved Tesla’s level of historical growth, its current multiple might not seem excessive at first glance.

However, the critical question is whether Tesla can maintain a similar growth trajectory going forward. How much needs to go right for Tesla’s current valuation to make sense? And is there any real margin of safety for investors at these levels?

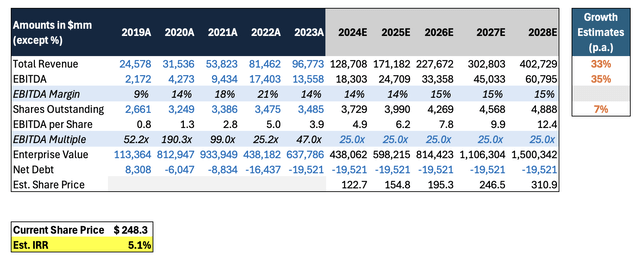

To answer these questions, we need to make some assumptions about Tesla’s future performance:

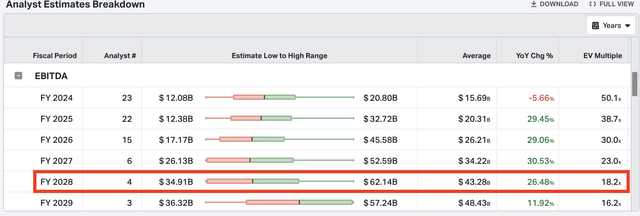

1) Exit Multiple: While Tesla currently trades at an EBITDA multiple in the 40s, we’ll use a more conservative exit multiple of 25x for our 5-year forward estimate. This is higher than the 18x multiple projected by the few analysts with 2028 estimates, but still provides room for Tesla to outperform expectations.

TSLA Analyst Estimates (Koyfin)

2) Growth Rate: Tesla has compounded EBITDA at a CAGR of 44% over the past 5 years. To be conservative, we’ll assume a 35% EBITDA CAGR through FY 2028, which is still well above the consensus estimate of ~20%.

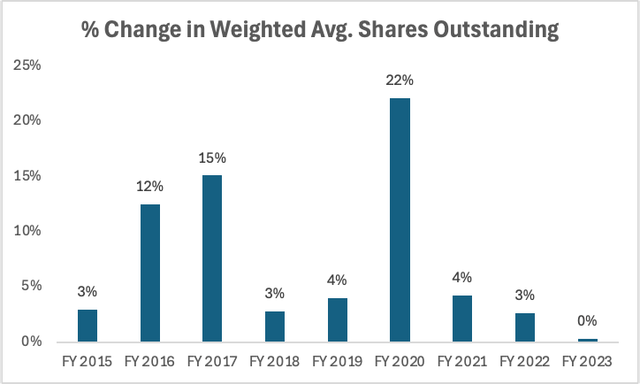

3) Capital Structure: We’ll assume net debt remains flat from current levels and factor in ~7% annual dilution, in line with Tesla’s historical average.

TSLA % Change in Weighted Avg. Shares Outstanding (Koyfin)

Using these optimistic assumptions, our model suggests that TSLA currently trades at a ~5% 5-year forward IRR.

TSLA IRR Model (Koyfin; FV Capital Analysis)

We believe these assumptions may prove overly optimistic given the challenges we’ve discussed throughout this analysis. But even if we’re directionally correct, Tesla’s stock doesn’t appear to offer an attractive risk-adjusted return at current levels, in our view.

Upside Risks

Despite the challenges we see Tesla facing, there are several potential upside risks that could impact our thesis for the stock:

-

Successful execution of the robotaxi initiative: If Tesla can successfully develop and deploy its robotaxi fleet, it could be a major game-changer for the company. Robotaxis could generate transformation growth for Tesla. But when? That’s the big question.

-

Continued growth in the EV market: The EV market is expected to grow rapidly in the coming years, and Tesla is well-positioned to benefit from this growth. The company has a strong brand, a loyal customer base, and a growing product portfolio.

-

Regulatory changes: Government policies are becoming increasingly supportive of EVs. This could support sustained long-term demand for Tesla’s products.

Shorter-term risks to our thesis include Tesla’s Robotaxi Day in August, as well as its upcoming earnings release on July 23rd. Earnings could surprise to the upside, as the company recently reported better than expected deliveries for the second quarter.

Key Takeaways

Tesla’s impressive track record of growth and innovation are nothing short of remarkable.

But even so, we think the company’s current valuation is unsustainable.

In our view, Tesla faces a number of challenges: significant capital investment required to fund future growth, intensifying competition, product pipeline uncertainty, and a rapidly evolving regulatory environment.

While continued growth is certainly possible, we think TSLA shares have priced in much of this potential.

As such, we initiate coverage on Tesla, Inc. with a Sell rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.