Summary:

- Tesla, Inc. is caught between two growth cycles, and Robotaxi should be the next key driver.

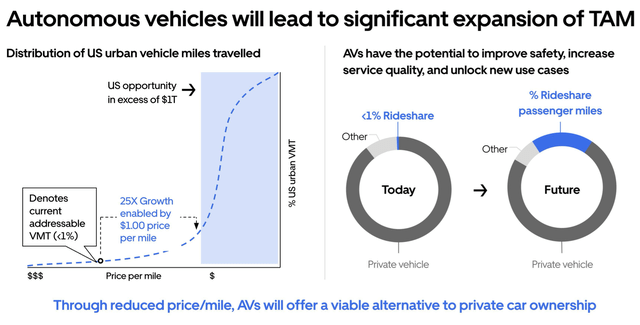

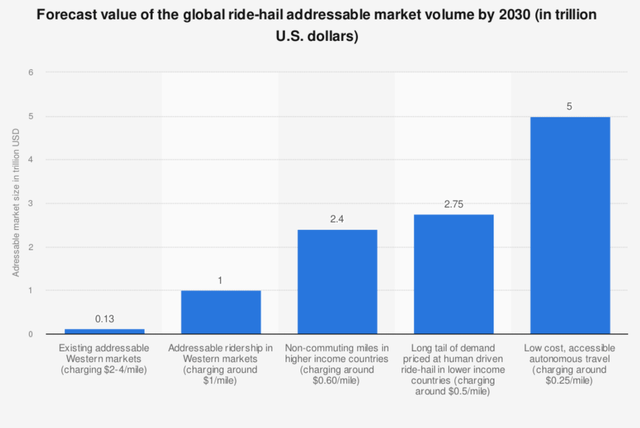

- The Total Addressable Market for autonomous ride-hailing is expected to be in the trillions of dollars.

- Tesla’s business position and domain experience sets it up for success in Robotaxi.

- Tesla’s latest version of autonomous technology, that utilizes AI, could be its “holy grail.”.

- I created a financial model for Robotaxi as well as a discounted cash flow model for Tesla including Robotaxi.

baileystock

Thesis

Since my first Tesla, Inc. (NASDAQ:TSLA) article (Tesla’s iPhone Moment) shares have rallied sharply. However, it’ll be difficult for shares to rally further until the company moves into its next growth-phase. A key driver could be Tesla’s transition to entry-level vehicles utilizing FSD (“Full Self Driving”) and the launch of Robotaxi. I will show how Tesla is uniquely positioned to benefit from Robotaxi based on its business position and domain experience. I will also present a financial model and discounted cash flow. Lastly, I’ll compare what Robotaxi’s worth to Tesla and how it compares to ARK Invest’s (ARKK) valuation.

Introduction

You need to be somewhat of a futurist to “get” Tesla. This includes Elon Musk, who is simultaneously a Bad Human and Humanist. Tesla’s a mirror of Elon – it’s both a highly rated ESG company for saving the environment and a terrible ESG organization for its governance practices and reported employee relations. If you’re a believer, please read on, if you’re a skeptic, challenge my assumptions.

Tesla’s Business Position and Industry Structure

In my previous article, I rated Tesla “Above-Average” for its position within the auto industry, using the Five-Forces Industry Analysis framework. There are four important areas we should focus on in relation to Tesla Robotaxi. They are:

Low-cost EV production Vertical integration Low-cost autonomous Legacy automaker “start-stop” EV initiatives

I typically frown-upon Vertical Integration, since it’s a “Jack of all trades” approach that is complex and inflexible. But there’s an exception — when there’s a new industry that requires an organization to invent the tools and infrastructure that don’t exist. And so here we are with Tesla — this new space requires integration. This gives Tesla a competitive advantage, especially when electronic systems (e.g., mapping, autonomous, software upgrades, charging) are melded into the hardware. This is why I say Teslas are “iPhones on wheels.”

Adding Robotaxis to the mix will further improve Tesla’s advantage. Why? Well, first, its cars are cheaper. If Uber (UBER) or Waymo (GOOG) (GOOGL), scales the business, costs will skyrocket as they have to purchase their car fleet from outside sources and install pricey autonomous-gear. Waymo cars, for example, cost over $100,000 compared to Teslas that cost under $40,000 to manufacture. Tesla’s (now delayed) “unboxed” Model 2 (codenamed “Redwood”) will lower prices further. Outside of Chinese manufacturers, I believe Tesla is the world’s lowest-cost carmaker.

In July ’24, General Motors (GM) announced it would pause production of its Origin, Robotaxi, with high-costs cited as a key factor. On Feb ’24, Apple (AAPL) canceled its Apple Car project and ceased working on autonomous software. On the autonomous front, Tesla has made the highly controversial move to only using vision for its FSD (Full Self-Driving) ADAS level 2. Tesla removed Radar and Ultrasonic Sensors from its cars beginning in 2021. Musk has said that LIDAR is an expensive “fool’s errand” like having “several appendixes in a body.”

Last year, Tesla rolled out FSD version 12. FSD 12 isn’t just the 12th iteration of FSD, but the first version of a whole new way of autonomous driving. Instead of having every single driving situation hard-coded, V12 uses an AI trained Neural Network. Given that this is a new way of autonomous, I believe there are a few issues that need to be worked-through before introducing it in the now delayed Robotaxi Event. My previous article spurred several comments from SA readers noting Tesla’s broken promises for autonomous. I kept this top of mind in my updated financial model and delayed both full FSD and full-scale Robotaxi.

Robotaxi

We all know what the Robotaxi is; the big questions are, What business model will it use? What’s the total addressable market, or TAM? Will it be human-supervised? Is it even possible? I think the question should be “When” not “If” as the Robotaxi likely will be economically possible on as large-scale as soon as FSD becomes Level 4 (like Waymo). You’re probably thinking, Waymo’s there already – well, not so fast. Waymo cars are expensive and operate within a geofence. I recently rode in a Waymo (San Francisco) and it was significantly pricier than an Uber, yet the company is bleeding cash.

It’s difficult to forecast Robotaxi’s TAM, as the addressable market is long-dated and exponential. According to several sources, the Robotaxi TAM will be huge once its cost to consumers (i.e., Price/Mile) falls towards $1. Uber believes the TAM could be as high as $1 trillion in the U.S. alone (chart below). Ark Invest believes that $1/mile could also get Western markets to $1 trillion, but thinks it can get to $5 trillion at $0.25/mile.

Robotaxi Business Model

There are multiple business models Tesla can utilize:

- Tesla-only cars

- Customer-only cars

- Fleet/Platform (Uber)

- Joint Venture (JV).

Theoretically, the best method would be “outsourcing” to a fleet operator or a JV, as Wall Street bankers are fond of forming SPVs (Special Purpose Vehicles) and then marketing securitized debt instruments. Since embedding Tesla cars with FSD hardware in 2016, Musk said that he would like Tesla customers to share their cars and make additional earnings and that Tesla would only supply cars to fill in empty service areas. However, necessity is destiny, meaning since Tesla’s FSD is not ADAS 4 and hasn’t been approved at the state level. For now, Tesla will have no choice but to offer localized human-supervised ride-sharing.

Tesla’s October 2024 Event

As for the timing of Robotaxi, I think the 90/90 Rule applies here: “We are 90% of the way to the finish line, with another 90% left to go.” Hence, I expect the Hollywood event will highlight a prototype Robotaxi vehicle along with a mobile app. I’m not forecasting mass adoption until late 2027. This will be over a decade after Tesla included FSD hardware in all of its cars. Again, it’s difficult to model precisely with all the balls in the air: technical, legal, regulatory, political and ethical factors. Further, Tesla may be prohibited from rolling-out Robotaxi in sanctioned countries, as autonomous technology can be repurposed for the military.

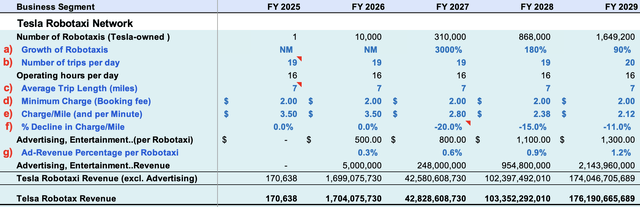

My Robotaxi model:

The projections below can be considered a somewhat Bullish-Case. FY 2025 has just one Robotaxi for illustrative purposes. I’ve chosen the Tesla-owned operating model below; however, the company will likely use a blend of business models once FSD becomes fully autonomous.

a) Robotaxi production will likely ramp up in 2027 depending on the ADAS level of autonomous and state approvals.

b) Number of Trips: I’ve chosen 19 trips/day, which equates to under 49k miles/year per car. ARK Invest estimates over twice that amount. The number of trips is limited by several factors: Miles/Trip, Speed, Passenger Wait Time, Loading Time, Order Wait-time, Driving to the customer, Charging, Servicing and Cleaning cars.

c) Average Trip Length: I selected 7 miles as a blend between city and suburban fares. Trip length may rise as Robotaxi enters less-dense cities and suburbs over time.

d) Minimum Charge: There is usually a “flat fee” charged just for booking a ride, regardless of the distance travelled.

e) Charge/Mile: My $3.5/M charge is higher than others due to startup-costs and the need for expensive human-supervised drivers. It also accounts for a Charge/Minute to compensate drivers stuck in traffic and customer wait time. Surge-pricing was not included in my projections.

f) % Decline in Charge/Mile: I expect a rapid decline in pricing when humans are no longer needed to supervise driving. I also expect up to a 50% decline in Production Prices/car, which will feed into the pricing.

g) Ad Revenues: I expect several ancillary revenues such as advertising, entertainment and curated sightseeing trips, etc. to comprise a small proportion of revenues.

Tesla Robotaxi Revenue and Free Cash Flow

I expect revenues to grow rapidly to $176Bn by FY 2029 and $923Bn by FY 2038 (Projection Year 15). The $923Bn compares with ARK Invest’s $2.1 trillion (using a CAGR of 10%) for Western Markets.

ARK Invest and independent analysts expect Robotaxi to be hugely profitable, with Net Income margins as high as 50%. I think this is a mistake: we don’t know the competitive landscape and startup (e.g., infrastructure) costs are high. I’m forecasting years of net losses and a cumulative free cash flow loss of $7Bn.

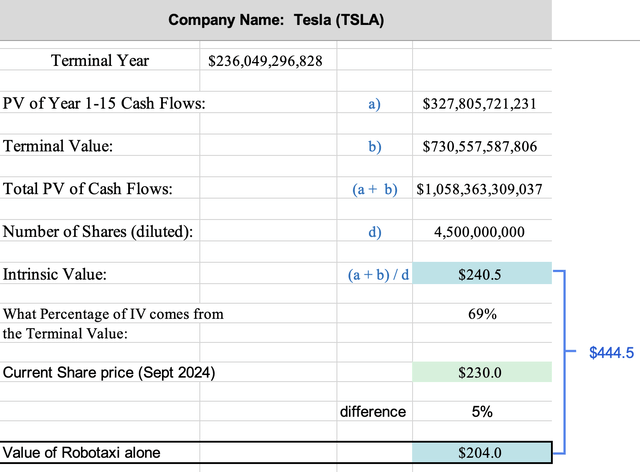

DCF Model assumptions

The discounted cash flow (“DCF”) Model projects each business unit going out to 2038 – thereafter, I project a conservative 3% growth rate in FCF. I calculated a conservative (i.e., high) WACC of 10.4% using a Beta of 1.65 and a 5% cost of debt, blended at 65% Equity and 35% Debt proportions. I use a high Shares Outstanding of 4.5Bn (vs. today’s 3.5Bn); however, I don’t foresee future capital raises.

DCF Results

Below presented are Tesla’s DCFs for its core business units as they exist today. Today’s stock price of about $230/share is 5% lower than the calculated value of $241. This isn’t enough to satisfy a margin of error. However, if we include the Robotaxi unit, the shares would be worth another $204 (or $444.5 altogether).

My model compared to ARK Invest’s

ARK Invest uses 45 independent inputs to calculate a range of potential outcomes using what’s called Monte Carlo simulation. The expected value is a startling $2,600/share (for 2029) and $2,000 in a bear-case if you can believe that! I found numerous errors in the model; broadly speaking, the upper-limit parameters fed into the black-box are nonsensical. For example, the maximum gross profit margin is 40% when historically, Tesla’s GPM was never higher than 28% and going forward, I expect auto GPM to continue compressing as EVs become a “loss-leader.”

Conclusion:

As I’ve said numerous times, my Buy rating on Tesla is a long-term one. Given that I expect a recession in 2025, I expect Tesla’s shares to decline as investors convince themselves that “Tesla is just a car company.” Tesla’s EV/Revenue is 7x, versus sub-1x for the average automaker. Finally, while I believe ARK’s Monte Carlo simulation is flawed, I do agree that Robotaxi will comprise a substantial portion of its enterprise value. Good luck out there!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.