Summary:

- Tesla, Inc. stock has experienced a 60% devaluation since reaching an all-time high in November 2021, even after the stock doubled in price in 2023.

- Downward revisions in earnings forecasts and concerns about EV adoption rates have contributed to the decline as have the rash of challenges in the EV space.

- After a boom year for Tesla stockholders in 2023, the equity is down by a third in 2024 and is the biggest loser in the S&P 500 year to date.

- Can the company and Tesla stock rebound? An analysis follows in the paragraphs below.

Getty Images/Getty Images News

The shareholders of Tesla, Inc. (NASDAQ:TSLA) had a banner year in 2023 in which the stock roughly doubled over the year. TSLA was a proud member of the “Magnificent Seven” that provided approximately two-thirds of the gains in the S&P 500 in 2023.

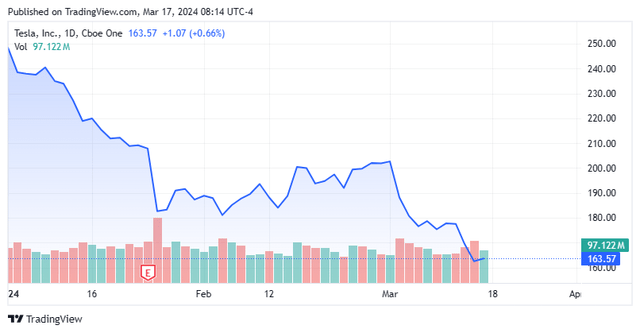

Unfortunately, for longer term stockholders, 2024 has been an entirely different story to date. The equity of this EV juggernaut is down by more than a third in the first 11 weeks of the year. Some of this is due to stock’s extreme valuations catching up to it as well as some profit taking after its huge gains in the prior year.

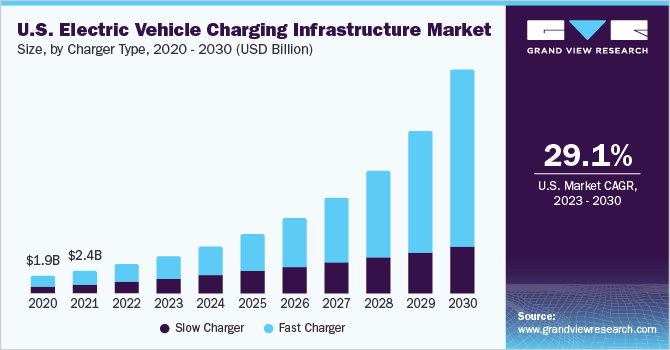

Grand View Research

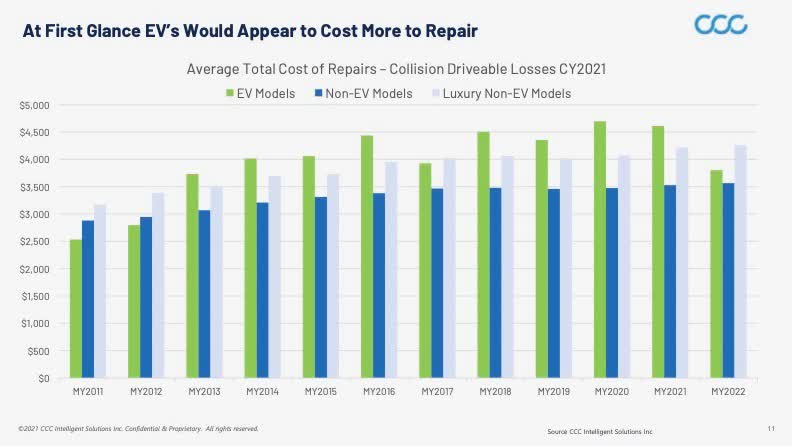

In addition, the luster of the EV space has waned considerably over the past several quarters and mass adoption rates are not quite as promising as hoped. Electric vehicles have several challenges to overcome to appeal better to a mass audience. There is the current limited charging infrastructure, range issues, charging times, the inability to operate effectively in freezing temperatures as well as higher repair bills than internal combustion engine {ICE} vehicles.

CCC Report

There has been a number of bankruptcies in the space including most recently Fisker (FSR). Major automakers like Ford (F) are curtailing their EV build outs after posted massive losses. EV inventories on lots have recently hit record highs as well. Then, we have Tesla’s company specific issues. So, has the stock dropped enough in 2024 for the stock to be in the “buy zone” yet? An analysis follows below.

Headquartered in Austin, Texas, Tesla, Inc. is the world’s largest manufacturer of fully battery electric vehicles (BEVs) in 2023, featuring five consumer models and a soon-to-be commercial semi-truck that offer self-driving technology and are supported by a global network of superchargers. The company also provides energy generation (solar) and storage products, which also act to augment its charging stations. The stock trades now for just under $165 a share, translating to an approximate market cap of $520.9 billion.

Share Price Performance

Since achieving an all-time high of $414.50 a share in November 2021 – translating to a then market cap of $1.25 trillion, Tesla’s stock has been besieged by a confluence of dynamics that has since resulted in a 61% devaluation of its share price. The ride has been volatile: after rebounding off a 2023 low of $101.81 (down 75% from its all-time high) to end the year at $248.48, its stock (as of its March 15, 2024) is the worst performing one in the S&P 500 2024YTD, down 34%.

What’s Happened?

What are those dynamics, will they change – or more importantly, is there a perception that they may change?

First and foremost, Tesla was priced for perfection in November 2021. For the avoidance of doubt, there was cause for optimism, with the company having just posted 3Q21 non-GAAP earnings of $0.62 a share (adjusting for the 3-for-1 split in 2022) – beating Street estimates by $0.08 – on revenue of $13.8 billion, which was up 57% year-over-year. It also had (and still has) an extremely ambitious stated production goal of 50% CAGR.

Since normal metrics didn’t apply to Tesla because it was all about the paradigm shift taking place, a better view of the priced-for-perfection statement could be seen in out-year consensus top- and bottom-line Street forecasts at that time. For FY26, Tesla was expected to earn $7.49 a share (again, split adjusted) on revenue of $225.9 billion, meaning it was trading at a PE of 55.3 on those earnings and 5.5 times estimated sales – again, five years into the future. Those forecasts are failing to materialize as current FY26 Street consensus calls for $5.09 a share on revenue of $152.2 billion, representing declines of 32% and 33%, respectively.

These downward revisions reveal not only the effects of inflation-driven higher interest rates, which have acted as a drag on the entire automobile industry, but also a perception that the widely forecasted 30% domestic EV adoption rate by 2030 is far too ambitious, due to plethora of factors, as discussed in the opening of this article. This resistance to ownership also stems from relatively cheap gasoline prices and to a small extent the shift in opinion about how ‘environmentally friendly’ EVs are versus internal combustion engine vehicles when lithium mining is factored into the algebra. Many of these undercurrents have been egged on by surprisingly less enthusiastic media.

That said, according to Cox Automotive, BEVs as a percentage of total domestic automobile sales reached an all-time high of 8.1% in 4Q23, up from 6.5% in 4Q22. However, Tesla’s market share continued to slip, down to 51% from 58% in the prior year period – and 79% for all of 2020. Its rapid drop from a near-monopoly position has implications for its network of superchargers that (currently) only “fill” Teslas. By contrast, nearly all non-Tesla chargers have universal ports, meaning they can charge every EV on the highway, which diminishes the utility and value of the company’s network. Tesla was able to turn that deficit into a positive, announcing in mid-2023 that it will retrofit its chargers with ports amenable to General Motors (GM) and Ford vehicles, allowing them to utilize its network, which should result – according to analysis conducted by Piper Sandler & Co. – in a high-margin $3 billion annual revenue stream by 2030 – arguably the best recent news for the company.

However, viewed by Street analysts and the market, Tesla’s outlook keeps declining, due both to self-inflicted wounds, like the delayed launch of its Cybertruck, and ones that are beyond its control, such as the growing sentiment that domestic EV adoption is not going to be as broad as initially anticipated. They are also a function of waning market share as new competitors enter the EV space. Competition in China – the world’s largest EV market – is especially intense, where due to dwindling overall demand, Tesla has been forced into a price war with rival and market leader BYD (OTCPK:BYDDF) (OTCPK:BYDDY) (amongst others), slashing prices twice already in 2024. Although additional competition was obviously anticipated, its impact on the company’s gross margin in FY23 was clearly underestimated, falling from 25.6% in FY22 to 18.2%. That squeeze helped lower operating margins to a pedestrian 9.2% in FY23 from 16.8% in FY22.

As such, despite the precipitous 61% drop, the company’s stock, viewed as an automobile concern, is still significantly overvalued when considering that it is only expected to earn $3.00 a share (non-GAAP) in FY24, essentially down slightly versus the $3.12 a share (non-GAAP) it delivered in FY23. In addition to shrinking per unit profitability, a deceleration in its volume growth (less than its stated 50% CAGR goal) is expected in FY24 as it focuses on developing a next generation vehicle platform. Furthermore, the FY23 and FY24 figures are down from its peak earnings of $4.07 a share (non-GAAP) in FY22. As an automobile company, does that kind of earnings performance merit a PE on FY24E EPS of 51.8, or a PE of 37.6 on FY25E EPS? Or an EV/TTM Adj. EBITDA of 30.1? Two-thirds of the 45 Street analysts who cover Tesla don’t think so, featuring 15 buy and outperform ratings against 22 holds, three underperforms, and five sells.

Conclusion:

For Tesla bulls who believe that its $12,000 vehicle autonomy package – which is currently level 2 (limited hands-free, requiring driver attention at all times) on a scale of 0 (fully manual) to 5 (fully automated) according to the Society of Automotive Engineers – and its robotic humanoid Optimus make it a paradigm-changing AI robotics company: based on the still gaudy valuation metrics, that conviction is already baked into its share price. As management has stated with Optimus, the challenge “is getting to do something useful.” Until perceptions concerning EV adoption rates flip from pessimistic to optimistic or if Tesla can demonstrate that its AI robotics technology is worthy of non-automobile valuations, the risk/reward remains asymmetrical to the downside.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author’s note: I present an update my best small and mid-cap stock ideas that insiders are buying only to subscribers of my exclusive marketplace, The Insiders Forum. Our model portfolio has more than doubled the return of its benchmark, the Russell 2000, since its launch. To join our community and gain access to our market beating returns, just click on our logo below.