Summary:

- The Federal Reserve raised interest rates by 25 basis points, but Tesla investors remained relatively unaffected as the stock held steady this week.

- Despite Tesla stock being slightly overvalued, the company is expected to continue showing progress on medium and long-term margin goals, potentially stabilizing its profitability margin.

- Tesla continues to befuddle bearish investors who profited from its downfall last year, but got hammered this year as it surged.

- With macroeconomic conditions improving and the Fed nearing the end of its rate hikes, Tesla’s profitability fears could dissipate through 2024.

- Stay invested and ignore the naysayers.

Dimitrios Kambouris

The Fed raised interest rates by another 25 bps yesterday (July 26) to a range of 5.25% to 5.5%, “reaching the highest levels in 22 years.” Yet, Tesla, Inc. (NASDAQ:TSLA) investors remain relatively “nonchalant” as TSLA held in the $250 zone. TSLA is moving closer to the increasing analysts’ price targets, or PTs, after falling through with a steep selloff last week.

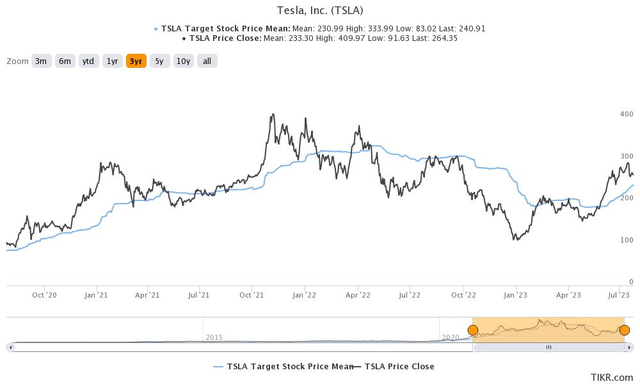

TSLA analysts’ price targets (TIKR)

As seen above, TSLA has had a tendency to mean-revert to the average PTs over the past three years, including the excessive surge in late 2021. The over-pessimistic selloff through its early January lows also saw buyers returning aggressively, as TSLA fell markedly below the analysts’ PTs then.

Based on the current expectations, TSLA remains about 10% above the consensus PT trend of $241, suggesting slight overvaluation. My price action analysis (discussed subsequently) also indicates caution after a sharp surge from its April lows heading into its second quarter, or FQ2, earnings release.

However, while a partial rotation away from TSLA (either to cash or other less expensive but fundamentally strong stocks) is sensible, I didn’t glean a necessity to cut entirely, which I did back in late 2021, as I also informed members of my service then.

Keeping a meaningful TSLA exposure to hedge potential upside risks is worthwhile, as CEO Elon Musk & team continue to wield significant leverage against its competitors.

Keen investors should recall that Tesla’s price cuts and sub-scale production in Austin and Berlin have hampered its industry-leading profitability margins. Q2’s adjusted gross margin of 18.2% (Vs. Q1’s 19.3% metric) likely led to last week’s downside volatility. Based on TSLA’s price action, the pullback has the potential for further downside and could compel some late buyers to exit. However, TSLA’s remarkable surge from its April lows is a timely reminder that it’s immensely challenging to time an exact exit out of TSLA.

Furthermore, TSLA isn’t as excessively valued at the current levels compared to the lofty highs at the end of 2021. In other words, TSLA’s upward bias could have legs if Musk & his team continue to progress on their medium- and long-term margin goals and optionalities (such as autonomy, Optimus, and energy storage).

Moreover, the consensus estimates suggest that Tesla’s adjusted gross margin could have bottomed out in Q2, with an inflection back up to the 19%+ zone from early 2024.

Does it make sense? Possibly. Management highlighted that Tesla’s dynamic pricing strategy depends on its assessment of prevailing macroeconomic conditions. As such, if the macro outlooks seem adverse, Tesla is ready to lower prices, maintain demand and aim to “maximize volume.” Management alluded to interest rates in its earnings commentary several times, providing clues into how Tesla assesses its pricing strategies.

However, I think it’s reasonable to assess that the Fed is inching closer to its peak rate hikes after yesterday’s 25 bps raise. Fed Chair Jerome Powell gave no clear indication about September’s decision, highlighting a decision will depend on incoming data. With the U.S. economy resilient, it does open up some uncertainties about the possibility of the Fed’s next move.

Despite that, the market is forward-looking. Considering how TSLA has surged well above its January 2023 lows, despite ongoing rate increases, I believe it’s clear that the market is looking past these headwinds.

Therefore, with macroeconomic conditions improving and the Fed getting closer and closer to the end of its hikes, it should provide more stable conditions to Tesla and its auto peers. Coupled with its increasing ramp and potentially lower cost of goods sold trajectory through Q3, it could stabilize Tesla’s profitability margin, helping it bottom out decisively, as projected by analysts.

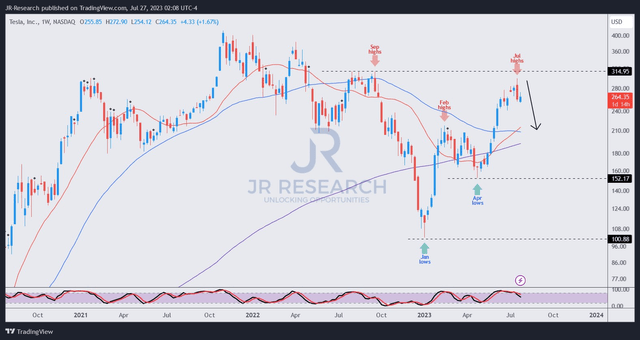

TSLA price chart (weekly) (TradingView)

With Tesla, Inc. stock still slightly overvalued and remaining well above its critical moving averages, or MA, I remain cautious about adding more here.

However, I will carefully assess the buying support if TSLA pulls back nearer to the low $200s zone, which should markedly improve its risk/reward for another opportunity to add.

For now, I urge investors to remain cautious about adding exposure but stay invested if they already have holdings in Tesla, Inc. stock.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.