Summary:

- Despite positive Q3 2024 results, Tesla, Inc.’s reliance on non-sustainable sources like regulatory credits and stock-based compensation makes its current valuation unjustifiable.

- Cash from operations was boosted by increased accounts payable and regulatory credits, which are not sustainable long-term.

- Tesla’s growth projects like robotaxis and Optimus lack concrete profitability, making its high valuation speculative and risky.

- A strong sell rating was maintained due to erratic cash flows, lack of buybacks, and stalling R&D spending despite substantial cash reserves.

Gustavo Muñoz Soriano

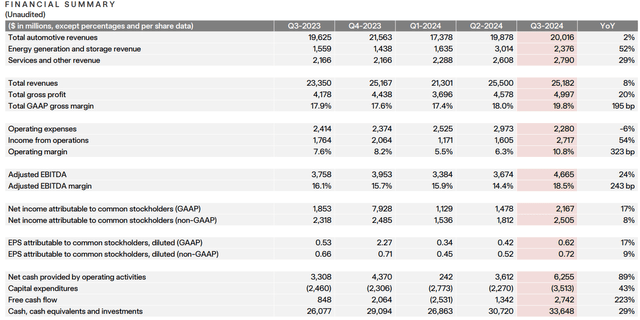

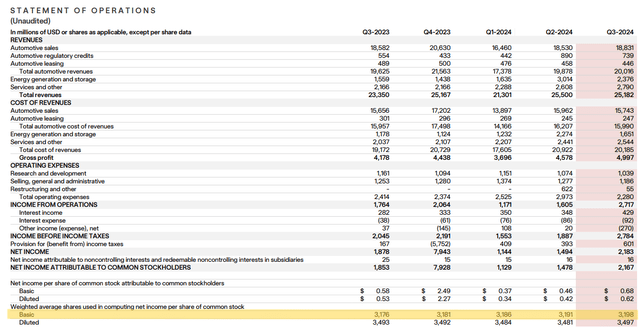

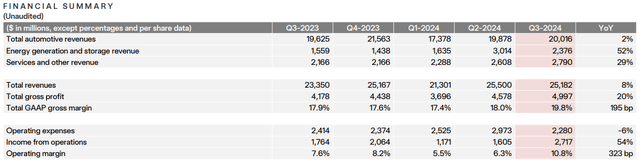

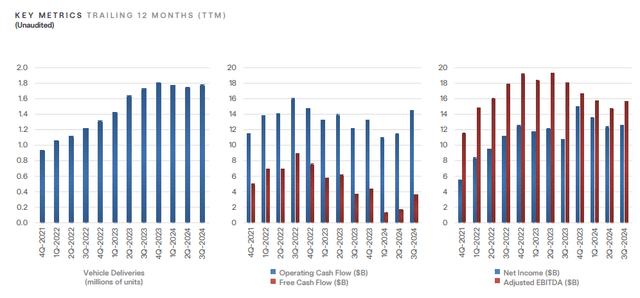

The market seems to have taken the Tesla, Inc. (NASDAQ:TSLA) Q3 2024 results very positively. In fact, the price per share is rising in double digits. The biggest concern was continuing to see declining profit margins, but there has been a nice recovery. In addition, YoY vehicle deliveries have improved and cash from operations is up 89% over Q3 2023.

Everything seems to be going right, but this quarterly still doesn’t convince me. I don’t think it was enough to change my strong sell rating.

Good but not great

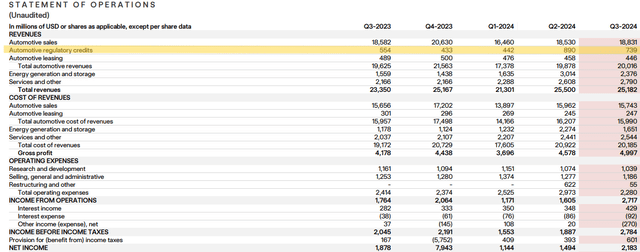

If we looked exclusively at this slide, we would probably think that this Q3 2024 was almost perfect:

- Cash from operations increased by 89% YoY, and free cash flow by 223%.

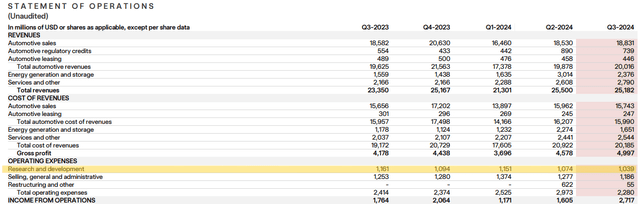

- Total revenues were up 8% but operating income was up 54%, a sign that margins are improving.

- Diluted EPS improved 17% YoY and cash and equivalents reached $33.64 billion.

This is what any investor would think based on this slide alone, but digging deeper there are factors that could turn the situation upside down.

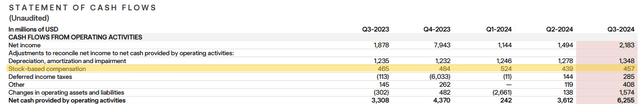

First, let’s take a detailed look at cash from operations and try to understand the determinants that triggered such an improvement since it was the highest ever recorded by the company in the third quarter.

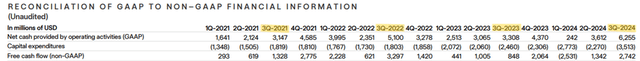

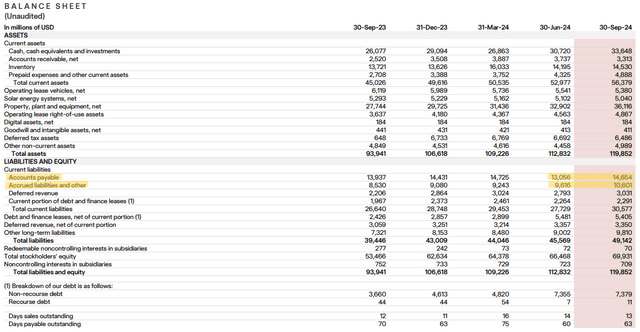

This figure considers everything that generated cash flow in operations; what comes in is considered positive, and what goes out as negative, regardless of its nature. If you do not pay a supplier, for cash flow from operations, this is a positive thing because you have not disbursed money externally. To understand Tesla’s relationship with its suppliers, we need to look at accounts payable and accrued liabilities, which is the money a company owes to its suppliers.

As you can see, both accounts payable and accrued liabilities increased considerably compared to the previous quarter, and this is good for cash from operations. Overall, the increase in both from the previous quarter amounts to $2.58 billion, the highest recorded in the last year.

This obviously does not mean that Tesla is not paying its suppliers, but that it will probably do so in the short term. Be that as it may, just as now this change has been positive for cash from operations, in the future it may become a boomerang since Tesla will have to pay its suppliers eventually.

Another factor “pumping” cash from operations is stock-based compensation, or SBC, as it is a way to get a performance without spilling cash.

This is nothing new for Tesla. In fact, even in the past, this item had an important weight on cash flow from operations; today it is 7% of it. In general, there is nothing wrong with stock-based compensation, but one must be aware of the risks related to it. They are not a way to get something without spending anything; there is always something to pay, in this case, dilution risk.

For a company worth more than $700 billion, I would expect it to do buybacks rather than diluting its shareholders, but for Tesla, it appears that anything conventional is not valid.

Finally, another aspect that affected the high cash from operations was regulatory credits. More specifically, they have impacted sales, and consequently cash flows.

In this quarter, they were $739 million; only last quarter were they higher over the past 12 months. The problem with automotive regulatory credits lies in their non-sustainability over the long term, being government incentives that will not last forever. Tesla obviously is right to take advantage of them as long as it can, but it is still too dependent on them.

These credits are free and technically have a 100% profit margin, so they impact the entire financial statements. They currently account for 39% of profits, and without them, diluted EPS would only be $0.41 vs. the current $0.62.

I often hear about how Tesla is focused on the future, its tech company characteristics, etc. However, objectively, it is still primarily an automotive company dependent on government credits. I hope that in the future it will be able to achieve its most innovative goals, such as the use of Optimus in daily life and the global deployment of robotaxis. Currently, though, these remain only hopes without tangible numbers.

Overall, cash flow from operations net of increased accounts payable ($2.58 billion), stock-based compensation ($457 million), and regulatory credits ($739 million) would be only $2.47 billion vs. the current $6.25 billion. A company that wants to achieve capitalization in the trillion-dollar range cannot rely so heavily on these sources because they are not sustainable over the long term. Government credits will eventually run out and shareholders will get tired of being diluted.

We certainly cannot completely overlook how well it is doing in energy & storage and services, but it is not enough to justify the current valuation. The P/E is almost in triple digits, yet the overall growth is not exciting.

Q3 2024 was not negative, but contextualized within a broader time horizon it takes on a different connotation.

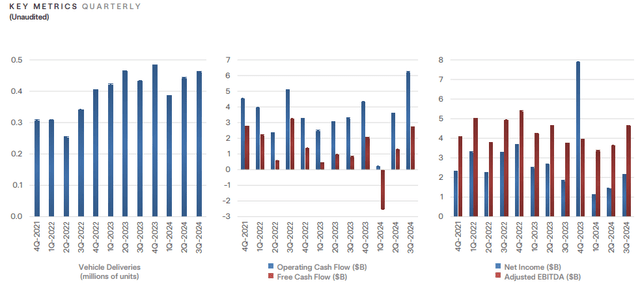

Graphically it is obvious that the company is going nowhere and there is no clear bullish trend in cash from operations, free cash flow, and net income. Yet, I should be paying 90x earnings.

Considering the TTM key metrics is even more obvious: why should I pay this company so much? In my view, Tesla’s valuation is based on the almost certain success of its projects, but as of today, the likelihood of realization is much lower than the narrative believes. Its cash flows are extremely volatile (still being a car company) and investing in it for Optimus and robotaxis is like investing in Meta Platforms, Inc. (META) hoping that the metaverse will change the world: it may not.

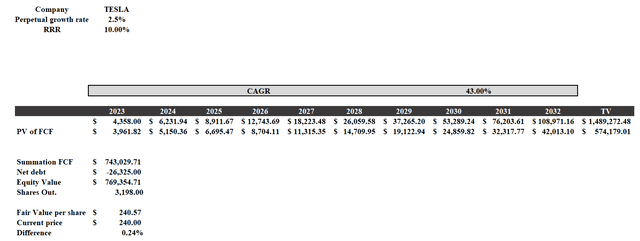

Calculating Tesla’s fair value is a hard task because it does not have stable profitability and everyone thinks differently about what it will be in the future. In this case, it is probably best to perform the reverse process, which is to figure out how much Tesla needs to grow each year to justify the current price.

I created a discounted cash flow (“DCF”) with an RRR of 10% (in line with the long-term average return of the S&P 500) and entered the growth rate that justifies the current price starting with free cash flow in 2023.

The result is this, i.e., a growth rate of 43% per year for the next 10 years to achieve a return that is not even too high. Anything is possible, but this scenario seems to me highly unrealistic. Personally, I would be surprised if the growth rate were 15% per year, let alone 43%.

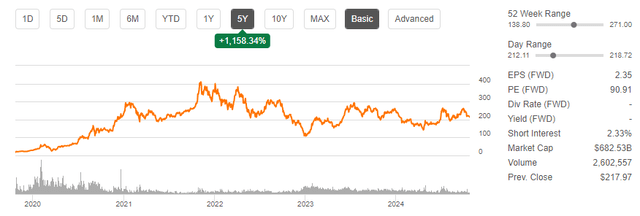

Even if my expectations are negative for Tesla, I will never short it, since the irrationality of the market can exceed all limits. After such a quarter, I never expected a gap-up, yet there was one.

Over the long term, we will see what Tesla is really worth, but we can already notice something today.

Over 5 years, Tesla’s performance has been outstanding, +1.158%, but the current price ($240) is the same as in December 2020. For a growth company that does not issue dividends, this is not the best, especially when the S&P 500 is making new all-time highs. Tesla alternates positive phases with negative phases, but overall the price per share remains stalled.

Conclusion

Tesla is a great company, perhaps the best in its industry, but that does not justify a valuation not based on fundamentals. Its cash flows are erratic and fragile, being based on business cycle trends, government credits, and stock-based compensation. In addition, cash from operations this quarter was boosted by an increase in accounts payable, something that will spill over into the coming quarters.

As exciting as all the robotics and robotaxi-related projects may be, there is nothing concrete to build on: I need numbers, not events. In the best-case scenario, Tesla will succeed in creating its robotaxi fleet and integrating Optimus into society, but we do not know how profitable these businesses will be. At the same time, the profitability of Cybertruck and the growth of secondary segments are certainly positive news, but by themselves, they cannot compensate for all the weaknesses. What will Tesla be worth once the government credits are gone, and it stops diluting shareholders?

Another question shareholders’ should ask is why Tesla does not do buybacks. Elon Musk is a big believer in the company’s potential, its price per share has stalled for four years, but there is no shadow of a buyback. For a company that has negative net debt and cash & equivalents + short-term investments of $33.65 billion, this is quite strange. If Tesla is so undervalued as to be worth several trillion dollars in the future, buying its shares should be one of the best ways to allocate capital.

Although the current quarterly report was more positive overall than the previous one, my rating remains a strong sell. The market is discounting successes that the company has not yet achieved (and may not achieve), and gradually the price will converge toward its fair value.

Finally, I conclude this article with one last observation.

From a company that wants to turn the world upside down and has $33 billion at its disposal, I expect it to increase its R&D spending on its projects, yet it is precisely the opposite: the more quarters go by, the more it shrinks. Am I missing something?

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.