Summary:

- Tesla, Inc. missed estimates on both earnings and revenue, which is the first time this has happened since Q2 2019.

- Tesla is improving the revenue share of higher-margin services and investing heavily in AI, which should give better returns in the long term.

- Tesla’s focus on new services like full self-drive and its Dojo tech, as well as building a vertically integrated platform, could drive future growth and improve margins.

- Investors should look beyond Tesla’s quarterly swings in order to gauge the potential of Tesla stock and its ability to deliver revenue growth at good margins.

jetcityimage

Tesla, Inc.’s (NASDAQ:TSLA) market cap is more than $650 billion despite the recent correction. The company missed estimates on both earnings and revenue for the first time since Q2 2019. Wall Street has been focused on the pricing challenges and headwinds faced by Cybertruck. However, there were some silver linings in the recent Q3 earnings call.

In the last ten years, Tesla’s revenue has increased from $1.7 billion to $94 billion, which equals close to a 50% compound annual growth rate. The management has also forecasted that they would deliver 50% CAGR till 2030, with a few ups and downs depending on quarterly performance. Even with a more modest 25% CAGR, Tesla’s revenue should touch $500 billion, which would likely make it a leader in auto revenue. The key to Tesla’s stock lies in its ability to show revenue growth in higher-margin service businesses.

In the earnings call, more than 80% of the time was spent by the management in discussing new services like FSD and Dojo. We can already see a greater focus of the management in building profitable services business which can fuel growth in the auto business.

Big Tech companies like Amazon (AMZN) and Apple (AAPL) have delivered massive revenue growth in high-margin segments that were not part of their core business. Amazon showed growth in its Amazon Web Services, or AWS, and advertising, while Apple has reported growth in licensing and App Store revenue. The current trillion-dollar-plus market cap of both these companies is largely due to these “other” businesses. Tesla is trying to monetize its autonomous full self-driving (“FSD”) feature.

But Tesla would need to create more revenue streams that have healthy margins. There is a clash between possible and potential when it comes to Tesla’s future growth. It is still likely that Tesla will exceed the average expectations and deliver better margins as its market share improves, making the stock a Buy.

Beyond quarterly ups and downs

Modest estimates show that Tesla will have tens of millions of vehicles on the road by 2030. All of them will have some support for semi or full-autonomous driving depending on how soon the regulators give the approval. It is likely that Tesla would try to build an ecosystem that will rival Apple’s CarPlay and Android Auto. There is a massive monetization potential in owning a vertically integrated platform. Apple has shown this with its licensing and App Store revenue.

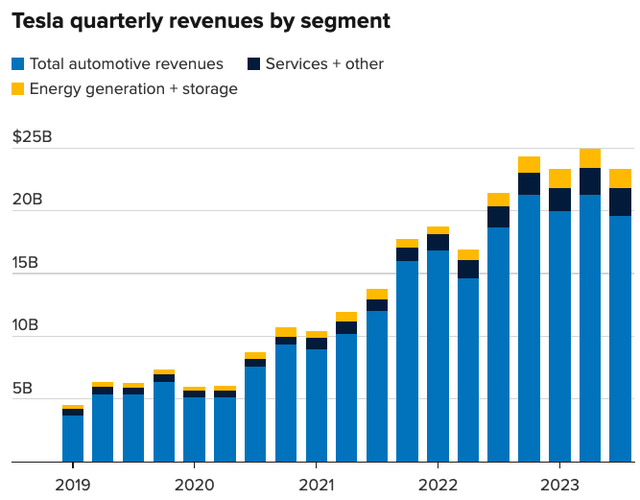

Apple gets more than $10 billion from Google (GOOG) through its licensing agreement. Most of this is pure profit for Apple. In return, Google gets massive traffic by being the default search engine on all Apple devices. Apple’s net income is $94 billion in the trailing twelve months. Hence, the licensing revenue alone contributes over 10% of the bottom line for Apple. The App Store is another revenue stream for Apple which contributes massively to the bottom line. Below are Tesla’s revenues by segment.

Tesla’s Services revenue is growing at a steady pace, and it is likely that the overall revenue share of this segment will increase in the future. This should help the company improve its margins as it faces pricing pressure.

Tesla’s revenue base is likely to exceed Apple’s by 2030 as the production capacity increases and new models are launched. Even at a modest 25% CAGR, Tesla’s revenue base should exceed $500 billion by 2030. It should be noted that Tesla’s management has forecasted close to 50% CAGR till 2030. We should see a consolidation within the auto industry as fewer companies might be able to transition to the EV industry. This should eventually improve margins for Tesla. However, the bigger tailwind for Tesla would be to build a device platform that can be monetized similar to Apple devices.

Leader in the AI race

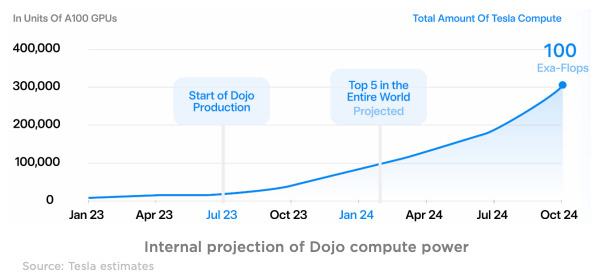

Tesla’s margin has dipped in recent quarters. One of the key growth segments in the future will be its AI capabilities in which the company is investing heavily. The FSD system requires a massive amount of computing power for training. Tesla’s Dojo platform will be among the top systems in terms of computing power by the end of next year. We could see Tesla use the excess computing power to deliver new services to third parties. This is very similar to the approach used by Amazon in building its own AWS system and then selling extra computing power to other clients.

Tesla Filings

The AI race would require better software and neural networks along with raw computing power. Tesla’s FSD has required immense computing power and has built a strong software model to analyze the massive data. It is likely that new services will be built using this system in warehousing, transport, and other sectors. There are various projections for the future growth trajectory of AI services. However, if Tesla is within the top five players, it will build a strong revenue stream with good margins.

Possible vs potential

Investment in Tesla stock is always a battle between what is possible and what is the potential. Ford Motor Company (F) and General Motors (GM) have a market cap of less than 10% of Tesla while selling many times more cars. Looking at the current product pipeline and manufacturing expansion, it seems likely that Tesla could deliver 20%-25% CAGR growth over the next few years. This will take the revenue base of the company to over $500 billion by 2030 and also make it a market leader. Even with a 10% operating margin, Tesla’s operating income could be over $50 billion by 2030. Under this growth projection, the current stock price seems reasonable and there is a lot of upside.

However, for future bullish momentum, Tesla would need to deliver on its potential in different services. As mentioned above, most of the tech companies have built high-margin services that are not part of the core business. Tesla is also trying to enter new services like FSD, AI, and is building a vertically integrated platform with higher monetization options in the future. Any bullish bet on Tesla will need to take this into account.

Future Tesla stock trajectory

Wall Street has always given higher multiple to companies that deliver strong revenue growth. High revenue growth shows that there is a good demand for the products of a company and it also indicates that the company could improve margins in the future by using price leverage. Tesla has shown a 50% CAGR in the last ten years within the auto industry which is generally considered to be a mature sector with very low growth potential. In the next few years, we could see a transformation and consolidation within the auto industry. Tesla will likely be a winner with a big chunk of the market share. This alone should give the company enough pricing power to deliver reasonable margins.

However, the main factor behind future bullish momentum in Tesla stock will have to be its services. It would be very important to gauge the revenue and margin potential of different services launched by Tesla. Even a single service like AWS, or App Store can completely transform the bottom line of Tesla. Profitable services will also have a virtuous cycle for Tesla by giving extra resources to build more manufacturing units that allow the company to grab a higher market share in the auto industry. We have seen a similar trend in Amazon as AWS profits are invested in logistics to build a more robust e-commerce platform.

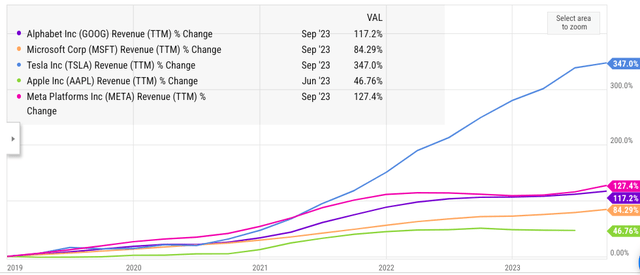

Over the last five years, Tesla has reported a significantly higher revenue growth compared to other Big Tech companies. Tesla had the benefit of a lower base effect, but it also shows the strong demand for the products and services offered by the company.

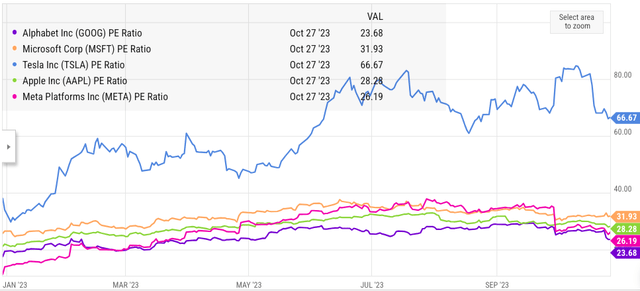

Tesla’s P/E is obviously a lot higher than major automakers. However, it is also higher than big tech companies like Apple, Alphabet (GOOG), Meta Platforms (META), and Microsoft (MSFT). If Tesla maintains the current revenue growth rate and margins, the PE multiple should become a lot more reasonable by 2025. At the same time, all the focus is on future services launched by Tesla that can improve the overall margins.

Most of the big tech companies have projected single-digit or low double-digit growth in the next few years. Only Tesla is forecasting a 50% CAGR till 2030. Recent quarterly earnings show that there can be setbacks, but the future product pipeline of Tesla is still quite strong, and can deliver robust growth. Tesla’s revenue base could soon overtake most of the tech companies in the next few years. However, the most important question is if Tesla could launch a high-margin service that moves its bottom line.

In the worst-case scenario, if Tesla does not gain a big lift from services, it will still retain a good sentiment due to rapid market share and revenue growth. In an ideal case, Tesla’s profitable services could change the bottom line and build a long-term bullish momentum for the stock. This makes the stock a Buy despite a higher P/E ratio than other tech and auto companies.

Investor Takeaway

Tesla’s management is focusing more on building services and a vertically integrated platform that can be monetized in the future. Tesla is already competing against Apple’s CarPlay and Android Auto. It is also looking to increase its presence in the AI business with its Dojo platform which should have one of the highest computing power by the end of next year.

Currently, we can reliably forecast that Tesla should deliver at least 20%-25% CAGR in revenue over the next few years which will take the revenue base to $500 billion by 2030. This alone will make the company a market leader in the auto industry by 2030. Additional services can further boost the margins and help Tesla improve its valuation multiple. Tesla’s revenue growth projection is a lot higher than other auto and big tech companies. Good market share growth with better margin potential should give the company a better bullish sentiment, making Tesla stock a Buy at the current price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.