Summary:

- Tesla, Inc. production capacity has increased, but delivery numbers have not kept pace, raising questions about demand for its vehicles.

- Tesla has cut prices and could benefit from advertising, but growing competition and lower gas prices may also impact sales.

- Tesla’s Cybertruck could be a major catalyst, but it won’t be a material item until at least next year.

Bill Pugliano

For much of the past decade, the narrative surrounding Tesla, Inc. (NASDAQ:TSLA) was that the company sold every car it built. The bull camp continued to argue that the only thing holding back the electric vehicle (“EV”) maker from selling more vehicles was its production limits. In the past couple of quarters, however, production has meaningfully outpaced delivery figures, despite numerous major tailwinds. As we get ready to finish the second quarter of 2023, I’d like to look at where Tesla’s growth potential stands for the back half of the year.

In Q4 2022, Tesla produced just under 440,000 vehicles. Since that time, production ramps at both the Austin and Berlin factories have continued, with their quarterly installed capacity stated by Tesla to be over 150,000 units at the Q1 earnings report. Shanghai can easily produce about 80,000 vehicles a month, and Fremont should be able to do around 140,000 a quarter. That means that Tesla shouldn’t really have any problems producing around half a million vehicles per quarter currently, if not more.

In the past three quarters, Tesla’s total production has outpaced deliveries by just under 75,000 vehicles. When adding in the above production potential I’ve detailed, you would think the company should be selling at least half a million units per quarter now, or perhaps even more if you think inventory could come down a bit sequentially. However, as noted Twitter user Troy Teslike recently stated, Wall Street analysts at the beginning of this month were calling for just 447,000 deliveries in Q2 and he was calling for even less. Troy’s estimates don’t have Tesla showing that much sequential unit growth in Q3 or Q4 either. It seems that the company has put a major dent into its delivery wave with the majority of deliveries no longer happening in the final month of the quarter, so that should reduce the percentage of in-transit vehicles at the end of the fiscal period.

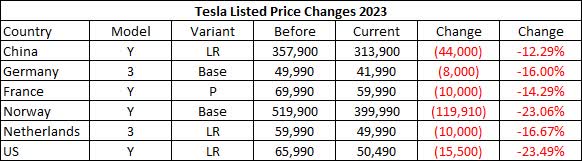

The delivery numbers are even more curious when you consider some of the tailwinds we’ve seen recently. Tesla announced major price cuts just after 2023 started, and it followed that up in early Q2 with more price reductions. Year to date changes in select markets can be seen below in local currencies, and these numbers exclude any potential incentives. The company is further discounting inventory units it has on hand, even on the Long Range Model 3 that just resurfaced in the U.S. as well as the Model Y.

While a refreshed version of the Model 3 is reportedly coming at any time now, I don’t think that’s holding back a major amount of demand. Don’t forget that Tesla’s two mass market vehicles in the U.S. have the potential for consumers to get up to a $7,500 tax credit, lowering the price even further.

2023 Price Changes (Tesla Website)

The bear camp will argue that competition is really starting to eat at Tesla’s lunch. That may be more true in China where local brands are starting to get their acts together and are taking part in a major price war. In the United States, however, auto giants like Ford Motor Company (F) and General Motors (GM) are still well behind in their EV efforts, while other automakers like Volkswagen and Hyundai are making progress but not exactly at warp speed. There are conflicting thoughts on Tesla opening up its charging network as well. On one hand, it brings in more services revenue to Tesla, but the move also makes the competition stronger as charging fears are eased. Of course, the decision for Tesla to start advertising could be beneficial for demand, but Elon Musk has been hesitant to do that in a major way so far.

One thing that might hurt the whole EV space later this year is that the current RBOB futures curve implies the national average for regular gasoline could get below $3 sometime after Labor Day. That would be more than 40% off the peak seen after Russia invaded Ukraine. A 2 handle on the national average could be a major headwind to EV conversion as compared to when gas prices were soaring and were one of the top news stories being reported every day.

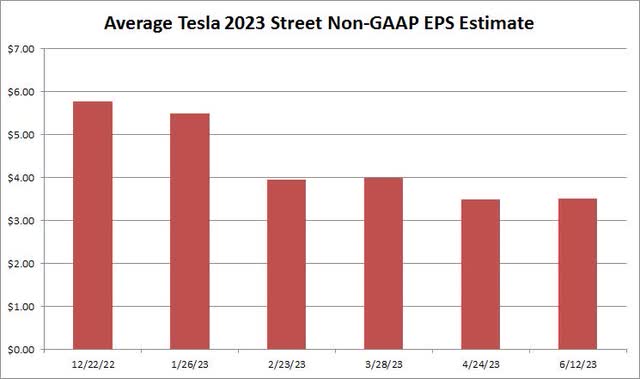

One of the possible reasons for Tesla’s surge in share price recently is that the price cuts are behind us and analysts will be raising estimates soon. As the chart below shows, this year’s EPS average has bottomed for now, and has actually increased two cents since late April. Of course, if Tesla comes out in early to mid July and cuts prices across the board again, analysts will likely be tripping over themselves to cut their gross margin and earnings expectations.

2023 Average Non-GAAP EPS Estimate (Seeking Alpha)

The next major demand catalyst for the overall company is the Cybertruck, which is expected to start production in the coming months. Recent rumors suggest that Tesla plans for annual production of 375,000 units, but that hasn’t been confirmed by the company and a timeline to getting to that number is unclear. The Cybertruck isn’t expected to be material to Tesla’s results this year, with mass production really planned for 2024, and of course new vehicle platform launches are always tricky. Some bulls may argue that Cybertrucks on the road will essentially be an advertising campaign for Tesla, but bears could also argue that some Tesla fan purchases of the pickup as a novelty item could take away some sales from the current lineup.

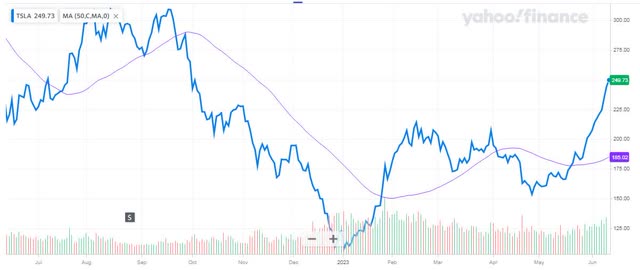

As for Tesla shares, anyone following the name knows that the stock has been on a tremendous run lately. As the chart below shows, shares are above their 50-day moving average (purple line) by more than they have been in the past year. Most other technical indicators show that shares are overextended quite a bit in the near term. The stock is also more than $50 above the average price target on the street, something we haven’t seen in more than a year.

Tesla Last 12 Months (Yahoo! Finance)

At the moment, I would be a little hesitant to buy Tesla given the tremendous rally. We have a Fed meeting this week, and if the dot plot update shows that interest rates will remain higher for longer than the market expects, the growth stock rally could fizzle out here. The U.S. economy could fall into recession territory later this year, and the restart of student loan payments could hurt consumer spending. If I were looking to buy Tesla in the coming weeks, I would prefer to wait until some of these technical indicators improved a bit. Should the stock get back to, say, $25 above the 50-day moving average, I would then look at the demand situation again and reconsider whether it is time to buy.

In the end, Tesla is looking at ways to overcome its demand issues as we approach the second half of 2023. While the company seemingly has the ability to produce around or over half a million vehicles per quarter, demand remains quite a bit below that amount currently. While we still are likely to see quarterly records for deliveries, many would have expected that large price cuts and U.S. EV subsidies would have driven a lot more sales. For now, Tesla stock is on a massive run, so it will be interesting to see if we see major advertising efforts soon or more price cuts to get demand to the next level.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.