Summary:

- Despite my dividend focus, Tesla’s technical breakout from a long period of narrowing volatility has captured my attention for potential short-to-intermediate term gains.

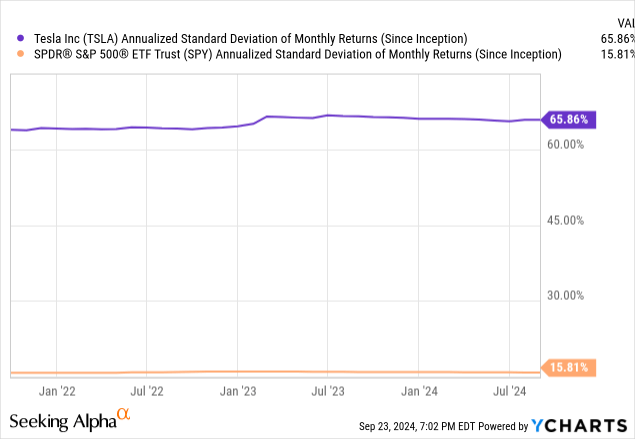

- Tesla’s high volatility, about 4x that of the S&P 500, presents a unique opportunity for outsized returns, but with significant risk. That risk can be controlled. I explain how.

- My approach involves a small initial position, closely monitored, with the potential for leveraging ETFs if the breakout proves successful.

- While TSLA doesn’t fit my typical dividend strategy, its potential for significant price movement warrants a speculative position in my trading account.

Richard Drury

Tesla, Inc. (NASDAQ:TSLA) is a company that…OK, if you are a Seeking Alpha reader or simply a human in the developed world, you know what Tesla is and what it does. You also know who founded the company, and you know where he stands politically. At least, lately. And you know what X, the former Twitter is, and that Mr. Elon Musk is well on the way to helping the United States re-start its space program. There’s nothing boring about TSLA and its CEO. That is unless you’re talking about The Boring Company, which he also founded, which is in the business of trying to solve traffic and logistics problems by building underground transportation tunnels.

TSLA is not the type of stock I typically write about, given my dividend focus and my Yield At a Reasonable Price (YARP™) stock selection process. So why, with so many excellent and varied fundamental takes landing on Seeking Alpha every day, am I writing about it now? Because I’m not just a dividend investor. I’m a technician. For 44 years, in fact, since my late father, a self-directed investor, taught me with graph paper and a pencil. In other words, the way Elon Musk probably contrived his first big idea, as a child no doubt.

I have a watch list of 75 stocks, and I aim to own 40 of them at any one time, rotating position weights between them. And I have been a skeptic of the “Magnificent 7”-inspired top-heavy stock market, which reminds me far too much of the dot-com bubble.

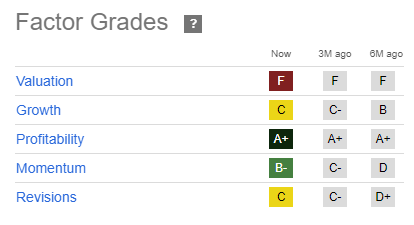

So why the sudden interest in TSLA? This is a company I have more often participated in via inverse ETFs like tickers TSLQ and TSLZ and even in put options to effectively short the stock. This is due to my belief that at some point, the long-term fundamental picture will not meet today’s expectations. As a non-fundamental type, I tend to lean on sources I’ve stress-tested like the Seeking Alpha factor grades and other “done for you” approaches to narrow down my stock selection. Then, I can apply technical/chart analysis and tactical position size rotation, my bread-and-butter style. So, while I like the A+ profitability grade here, the valuation is not surprisingly a “fail” and the growth grade is “meh” at best. And there’s no dividend to discuss here, so it doesn’t even allow me to apply my YARP dividend factor analysis.

Seeking Alpha

Yet, my headline references a rocket launch. Yeah, I’d be confused too if you read me regularly. But while I’m mostly dividend-focused, I’m not 100% about dividend stocks as an investor.

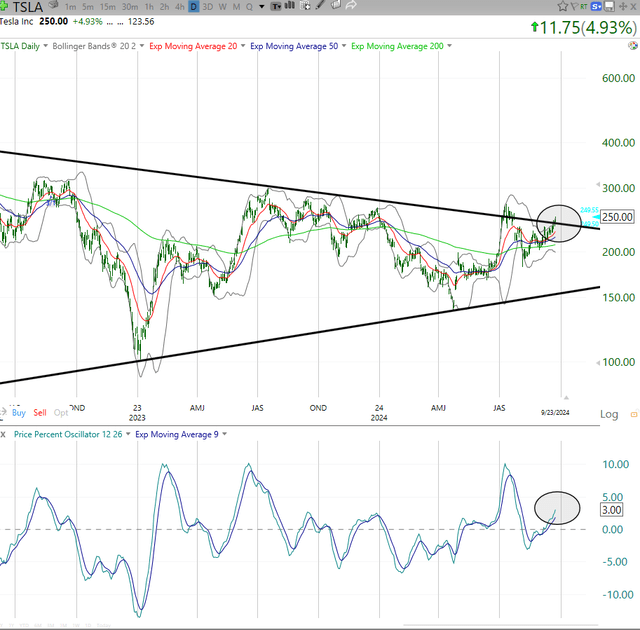

When I see 3 charts like these below, the technician in me stops…cold. Even when it is TSLA

I’ve watched the stock casually for years, like everyone else, I suspect. And I’ve traded around it here and there, never paying much more than a fleeting bit of attention to it. Its features and my base investing style don’t overlap much. But as strange as it seems (to me, at least), they certainly do now!

That’s because TSLA is threatening to break out from a long period of narrowing volatility. Not to get too “technical” here, but stocks are cyclical. All of them are. They go from high volatility to low volatility and back again, over and over. The magnitude is different in the case of each stock, of course. But this is akin to a “law of the jungle” in the stock market, as I have witnessed for decades.

There are NO guarantees here, only a reward/risk tradeoff. In other words, I see higher than normal potential for TSLA to take off…like a SpaceX (SPACE) rocket does…and climb well into the atmosphere. The key is to exit the “Earth’s atmosphere” as marked in the top section of this daily price chart.

But I’ll quickly point out that we’ve been here before, not long ago, back in July, which led almost immediately to a 25% dip, that was firmly bought, to bring us back to where it is now. But this is yet another try, and I like the chances here.

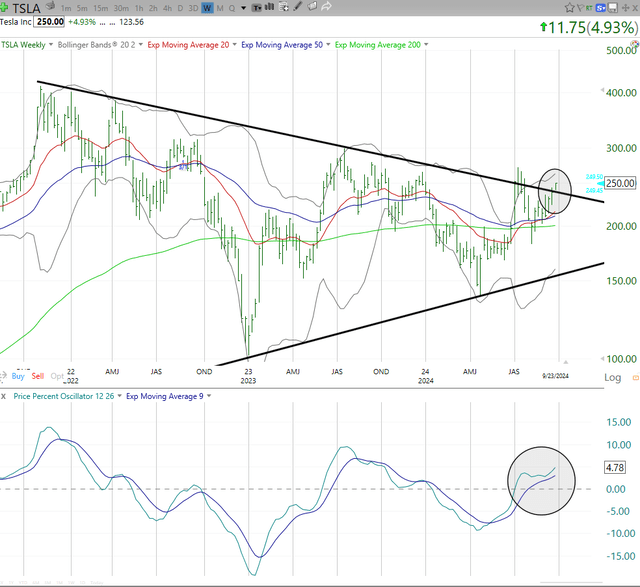

My interest in the stock as at least a short-to-intermediate term situation is compounded by what I see here in the weekly price chart (versus the daily chart above). I see the same breakout from that narrowing volatility period. However, my focus is on the lower part of the chart. I’ve put a big circle around what my son and I (he’s a 3rd generation Isbitts chartist, you might say) affectionately call a “dolphin’s mouth.” Because that’s what it looks like to us.

More importantly, while nothing in the stock market is a sure thing, that action on a weekly basis in the “PPO” (Price Percent Oscillator) indicator I use as a staple in my work, is very encouraging.

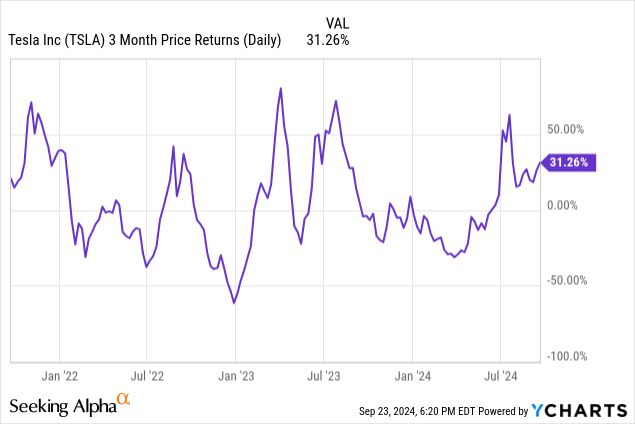

The question is, for how long? This is the third of the three charts I alluded to above. It shows TSLA’s “rolling” 3-month returns at every daily marking period over the past 3 years. As I write this on Monday after the close, TSLA closed right on the nose at $250.00. Where was it 3 years ago? Around $258. So, flat for 3 years, just like many stocks have been.

But “flat” hardly describes the constant whipsaw because of TSLA’s newsworthiness, deep debate and controversy within the analyst community about the company’s future potential, and even the “political football” surrounding the upcoming US Presidential Election. If Trump wins, will his newfound kinship with Musk and possible appointment of the TLSA founder to a government post make TSLA a favored son “buy to the sky?” And if Harris wins, will TSLA’s leading-edge position in clean transportation make it a market darling for entirely different reasons?

I don’t care about any of that. I just see a possible breakout in TSLA stock

And, I see that it has a habit of rewarding those willing to embrace it as follows: monitor it long-term, understand that in a given 3-month period, it can move 30%-50% in either direction (or even both in that time!) and proceed according to one’s risk appetite.

How I consider using (non-dividend) stocks like TSLA

As I said, TSLA is not a buy-and-hold for me, as no stock truly is. In my main stock portfolio, I own 40 dividend names. They have 1%-5% weightings, but those weights fluctuate based on the process I developed and honed during 30 years as an investment advisor, mutual fund manager, researcher, and since selling my advisory business in 2020, as a self-directed (and experienced in the trenches) investor.

TSLA won’t ever be a stock I risk a lot of capital with. But with that type of volatility, I don’t feel I have to

Some quick math: this chart shows that TSLA has consistently been about 4 times as volatile as the S&P 500 Index (SPY). This is in the past and not an exact science, but standard deviation measures the variability of returns, a range that occurs about 2/3 of the time.

So to me, that translates to every 1% in TSLA stock potentially providing 4 times the price fluctuation of a typical stock. Back of the envelope stuff.

How I’m acting on my analysis of TSLA

So to me, that means taking a shot at outsized returns on a breakout, but also being prepared to think the opposite if it fails. And also understanding that within any 3-month period, we could see some of both.

That’s nothing like the dividend stock work I do primarily, but it fits quite nicely in my trading account. So in it goes, in small size, to be added to once more “evidence” shows up in the chart. Currently, this is a “watch very closely” situation, and so I’ll put a buy rating on it.

But I’ll include my usual caveat that “ratings” don’t mean much to me, since I see every stock not as “should I own it or not?” (a binary choice) but instead as “how much should I own?” Like I said, I track 75 dividend stocks, and at any time, 35 of them are 0% of my portfolio, while the other 40 are between 1% and 5% weightings in the YARP portfolio.

As for TSLA, I’ll start with a small stock position, on a tight leash, and looking at some levered ETFs if that rocket launch is successful. And as a dividend investor, I’ll start checking out the covered call ETFs that might allow me to squeeze it into the portfolio, alongside a few high-yield ETFs I use along the edges.

Tesla? Me? Never say never!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.