Summary:

- Tesla struck a solid deal with General Motors Company that should benefit both firms, but in different ways.

- This move is a great one for Tesla in the long run, as was a similar deal with Ford Motor Company.

- But this doesn’t change the fact that Tesla shares are very expensive at this time and investors should tread cautiously.

jetcityimage

Due to a number of factors, some political and social, some economic, and some technological, one of the most controversial and debated investments on the market today is electric vehicle manufacturer Tesla, Inc. (NASDAQ:TSLA). Much of the discussion that goes on regarding the company involves how much upside potential it might have.

In this article, I touch on the topic of valuation. But more interesting to me at the moment is a rather interesting development that came out a bit earlier this month. Not long after Ford Motor Company (F) announced a partnership with Tesla whereby Ford’s electric vehicle (“EV”) customers will gain access to 12,000 Tesla superchargers next year and will begin using Tesla’s NACS (North American Charging Standard) connectors as the built-in charging apparatus on all models starting in 2025, rival General Motors Company (GM) announced a similar deal.

Some analysts have made the case that this is a rather bearish move for Tesla. One even went so far as to claim that, by making this partnership, Tesla “surrendered its key competitive advantage” in the space. However, I would take the opposite stance. While I personally would not buy shares in the company because of how pricey TSLA stock is and because I see it losing market share moving forward, I do believe that this particular maneuver was a great one.

I will talk not only about the nature of this partnership, and what I believe it means for the company and the industry, but I will do so by drawing on some historical precedents that indicate why this is a good business decision by Tesla.

A look at this development

On May 25th of this year, Ford announced that, starting next year, its EV customers will have access to over 12,000 Tesla superchargers across both the U.S. and Canada. This is on top of the more than 10,000 DC fast-chargers that are already a part of the BlueOval Charge Network. This would be made possible in 2024 thanks to an adapter and software integration that Ford will offer its customers. And starting in 2025, the company will begin putting the NACS connector built into its EVs so as to eliminate the need for an adapter moving forward.

This is an obvious win for Ford in two ways. For starters, it increases the ability of its customers to charge almost wherever they find themselves. And second, it should allow the company to spend less on building out its own charging network.

This news was followed up on June 8th by more news that General Motors had struck essentially the same kind of agreement with Tesla. The CEO of General Motors, Mary Barra, even went so far as to say, in an interview, that partnering up with Tesla will allow the company to save around $400 million of the $750 million it announced it was going to spend starting in 2021 on its own EV charging infrastructure across the U.S. and Canada.

The way I see it, there are some big advantages to these companies working together on this initiative. Nobody would deny that EVs are still very much in their infancy. In fact, according to the data I’ve seen, EVs currently account for only about 7.2% of the vehicle fleet market share in the U.S. That is destined to change. Analysts at Bank of America (BAC), for instance, mentioned that, for the first time ever, EVs should count for the largest share of new model launches this year, with 46% of all such launches being EV models compared to 36% that should still be internal combustion engines (“ICE”).

During the early days of adoption for new technologies, standardization must occur. This can either be ordered or messy. And up until this point, the picture has been quite messy. The U.S. Department of Energy, for instance, has said that there are about 5,300 CCS fast chargers across the U.S. Earlier this year, the Biden Administration reiterated its goal of building out a national network of 500,000 EV chargers across the country in a push to encourage further EV adoption and get at least 50% of new car sales to be EV in nature by 2030. $7.5 billion has been allocated specifically for EV charging activities, with another $17 billion split between clean transportation and EV battery components, critical minerals, and materials.

In order to tap into some of this money, the government has maintained that the CCS connection needs to be championed. One day after the news broke regarding the relationship between General Motors and Tesla, the Biden Administration stated that Tesla would be eligible for these subsidies if they included CCS technology as well. It remains to be seen whether this will ultimately occur or not. But the significance of this is to point out that there is a fight going on between which model will ultimately become the standard across the industry.

By continuing to go it alone and not partner up with the other major car manufacturers, Tesla risked losing out on this battle. As of the most recent quarter, the company had 45,169 supercharger connectors installed globally at 4,947 supercharger stations. But there is no public data on how many of these are spread across the U.S. alone. Losing out on this battle could mean a tremendous amount of capital lost. We don’t know exactly how much has been spent by Tesla on its charging network. But we do have some numbers that can give us a rough approximation.

According to one source from April of last year, Tesla had applied for some grants in Texas that would allow it to build the first superchargers in the country that could accept all electric vehicles, not just its own. While Tesla did not get any of the funding, the documents filed by the company implied that the superchargers cost around $43,000 or less apiece. If this is an appropriate price across all the regions in which the company has its superchargers installed, it would imply around $2 billion spent on the network so far, which would include any outside funds the company might have received as part of this initiative.

Now, instead of facing either a scenario of defeat or one where there are two separate major networks in the country, the company has increased the probability that the standard will move in its direction. Of course, this is still not a guarantee. Based on my estimates, as well as third-party sources here and here, Tesla, Ford, and General Motors have a combined market share of all vehicles in the U.S. of 35.6%. But when it comes to EVs, Tesla alone currently dominates the space. Its market share as of the end of the most recent quarter was 62.4%.

This is a good approach to take

Those who believe that Tesla is making a mistake have a couple of good points that they can make. For starters, they can argue that, by partnering up with firms that have a much smaller market share than it does in the EV space, that the company is sparing those other firms the significant amount of capital they would have to spend on their own networks had the partnerships not been entered into. In addition, opening up its charging network to its competitors makes it more appealing for consumers to view EVs in more commoditized terms as opposed to weighing the pros and cons that each manufacturer brings to the table. One of the pros that Tesla brought was its extensive charging network that made driving anywhere by Tesla a safer bet.

As I stated earlier in this article, however, standardization almost always occurs and, in the long run, it is beneficial to all parties involved. I would like to point to a couple of historical examples in this regard. One of these involves the shipping container. Throughout the 1950s, containerized shipping grew in popularity. But it was still very much in its infancy. One survey, conducted in 1959, said that there were about 58,000 privately owned shipping containers in the U.S. 43,000 of these were eight feet square or less at the base. The other 15,000, which were largely owned by Sea-Land and Matson, were over 8 feet in length.

This created significant problems for both ships and railcars that sought to transport shipping containers. Exporters would be stuck trying to figure out which sized container they would need to place their goods in, since in many cases the loaded box could only make it onto the vessels of one or two different carriers. This proved to be a problem not only for companies but also for the U.S. government. Two different agencies within the government, Marad, and the Federal Maritime Board, were, at that time, allocating subsidies to build ships and focused on administering laws that determined how government freight should travel in U.S. flag vessels. Marad set up two committees in 1958, one that was designed to recommend standards for container sizes and the other set up to study container construction.

Standardization spread to all aspects of the containerized shipping industry. And debates over it extended well throughout much of the 1960s. In 1967, for instance, Sea-Land Was forced to spend about $35 million on altering all of its ships and cranes in order to comply with solidified Standards, while Matson incurred about $9 million in costs. But this is not where the debates ended. In truth, an entire book could probably be written on just the shipping container space itself. Another example requires us to move a bit back in time to 1962. By that time, the industry knew full well the downsides of losing when it came to standardization. Then, as it is now, the end result would often be obsolescence and the pain of missing out on government subsidies.

In an attempt to mitigate this, Sea-Land developed a special twist lock to be used on its containers. At that time, small shipping containers were very popular throughout both North America and Europe. However, in North America, larger shipping containers were also becoming rather popular. In order to handle the weight of additional cargo, the larger containers had steel fittings at each corner that were welded to a corner post, to a top or bottom rail that ran the length of the container, and to cross members that ran across the front or back ends. These corner fittings had holes in them through which the containers could be lifted, locked to a chassis, or even connected to another container. Different companies have their own devices that were used because there was no standard at that time.

The problem with this is that the size and shapes of these differing lifting and locking devices made it impossible for one company to lift the containers of another or for one company to have its containers put on the chassis of another. Railroads were also hindered by this because they would need a complicated system of chains and locks in order to secure all different types of containers. Regulators worked to tackle this. But so far, no standard had been implemented. At that time, Sea-Land’s corner fitting was compatible with the world’s largest fleet of containers. So in an attempt to solve this problem, the company, in early 1963, released the patents that it had on the twist lock so that any company could you use it. After significant debate and some minor modifications, this particular fitting was eventually adopted not only as the national standard here at home but also on the international market. Without this kind of standardization, the containerized shipping market would have struggled to grow into the behemoth that it is today.

Shares are still not attractive

The way I see it, there are far more good reasons for Tesla to have made the decision that it did than bad reasons. By moving in the direction that it chose, it’s increasing the probability that its standard will ultimately prevail and, as General Motors and Ford start making their newer vehicles compatible in 2025, it’s almost certain that new charging stations that are not part of its network will also utilize this compatibility. And as the leader in terms of market share in the U.S., I believe that no other party will benefit from this maneuver more than Tesla well.

There are, of course, other ways that the company might benefit from this. As one analyst pointed out, the deals that Tesla made with General Motors and Ford could go on to add another $3 billion to annual EV charging revenue for the company over the next few years.

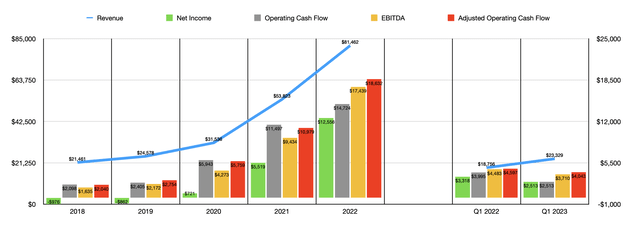

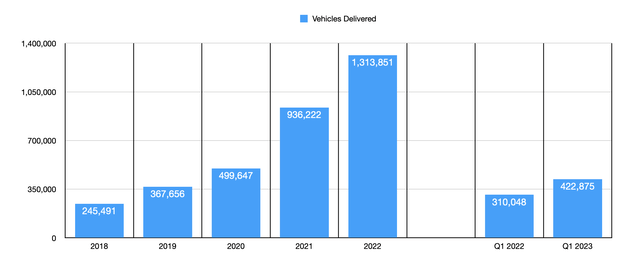

Although I am bullish on this move, I do believe that shares of the company are not logical purchases at this time. As you can see in the chart above, the financial trajectory of the business has been really impressive. Management is trying to grow the number of units that it sells by about 50% per annum. Obviously, this will hit a point of resistance eventually. But over the past several years, revenue growth has been impressive and the company has started generating significant positive cash flows. Last year alone, it delivered 1.31 million vehicles. That was up from the 936,222 reported for 2021. And so far this year, for the first quarter at least, the 422,875 units shipped translated to a 36.4% increase over the 310,048 units that were sold in the first quarter of 2022.

As I mentioned earlier in the article, Tesla has a massive market share in the U.S. That number comes out to about 62.4% of EVs. However, that’s down from the 79% market share that it boasted back in 2020. This downward trend is certain to continue as additional EV models are made available to the public. According to Bank of America, for instance, the company’s market share in the U.S. should decline to about 18% by 2026. It is worth noting that the business does have significant operations elsewhere. In China, which is the world’s largest market for EVs, adoption of the technology has spread to 34% compared to the 7.2% here at home. But Tesla owns only a 13.6% of the market share there.

When it comes to the domestic market, the company is already dealing with significant challenges. In the luxury EV market, for instance, the Model 3 was ranked at #5 in terms of overall quality with a rating of 8.6. The Model S, which is most certainly a more premium model, was ranked at #10. It had a rating of only 8. When it comes to just regular EVs, the company fares worse. The Model Y ranked #12 on the list with a score of 7.9, while the Model X was #16 with a score of 7.6.

Of course, this doesn’t mean that the company is going to stop growing. But in the next few years, Tesla investors should expect the company to be viewed in a more commoditized way like traditional car manufacturers have been forever. And the fact of the matter is that shares of the company look very pricey for a business that will find it more difficult to further distinguish itself from the competition. As an example, using data from 2022, the company is trading at a price to earnings multiple of 63.1. The price to adjusted operating cash flow multiple is 42.5, while the EV to EBITDA multiple comes in at 44.3. Even if we assume that these bottom line metrics grow at a rate of 30% per annum for the next five years, and if the share price of the company remains unchanged during this time, these multiples would come out at 17, 11.4, and 11.9, respectively, by the end of the five-year window.

As you can see below, Ford is cheaper than this future hypothetical version of Tesla using two of the three metrics, while General Motors is cheaper than Tesla using all three.

| Company | Price/Earnings | Price/Operating Cash Flow | EV/EBITDA |

| Tesla Today | 63.1 | 42.5 | 44.3 |

| Tesla in 5 Years (Hypothetical at 30% Growth/Annum) | 17.0 | 11.4 | 11.9 |

| Ford | 19.6 | 5.3 | 11.7 |

| General Motors | 5.8 | 3.1 | 8.4 |

Takeaway

The way I see it, Tesla has made a bold and promising move that helps not only its rivals but also itself. Down the road, investors will likely be happy that this decision was made.

But this should not be construed as a reason to buy Tesla stock. While I fully suspect that the company will benefit monetarily from this decision in multiple ways, I do think the business is very expensive at this time. I would definitely go so far as to say that the stock looks overvalued and that one of its rivals like Ford or General Motors would make for a more appealing prospect at this moment. Because of this and in spite of the wise move that management made, I cannot in good conscience rate the business and Tesla stock any higher than a “sell” at this time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!