Summary:

- I missed an opportunity for alpha in Tesla, Inc. stock, as I had a neutral/hold rating on the stock earlier.

- But now, whilst some investors have concerns about Tesla’s margins and profitability, I am becoming more confident of buys.

- Pricing reductions have masked genuine margin tailwinds in COGs that will become more visible.

- Investments such as humanoid robot Optimus and full-self-driving have great multiplier potential for the stock.

- Valuations are attractive, as Tesla trades at a 35% discount to the average PE since 2020.

Woman waiting for electric car to charge and solar panels in background SimonSkafar/iStock via Getty Images

Introduction

I’ve had a “neutral/hold” rating on Tesla, Inc. (NASDAQ:TSLA) since my last update in May 2023, although I recognized the chance of a re-rating. This has been a missed alpha opportunity, as Tesla has delivered a return of +54.42% since then vs the S&P 500’s (SP500) +10.38%, corresponding to an alpha of 44.04%.

Now, after reviewing the company’s Q2 FY23 results, I am changing my stance to a “buy.” Amongst Seeking Alpha analysts, this seems to be an unpopular view since there have been only 3 “buy” ratings, 7 “sell” ratings, and 10 “hold” ratings after the recent earnings release. Here are my reasons for the contrarian stance:

Thesis

I am bullish Tesla due to 3 key reasons:

- Pricing resets have masked genuine margin tailwinds

- Investments have great multiplier potential

- Valuations are attractive.

Pricing resets have masked genuine margin tailwinds

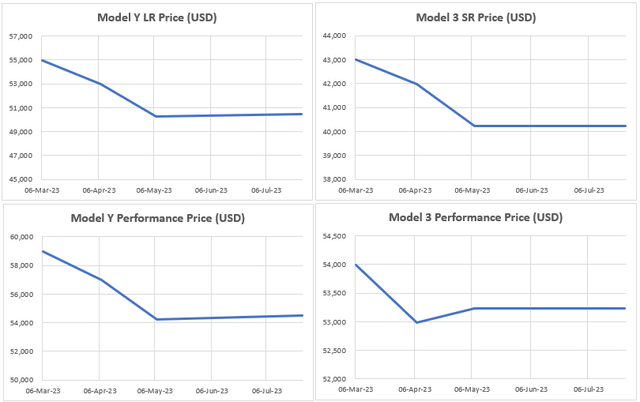

During Q2 FY23, Tesla continued to implement broad-based price cuts in the mid-high single digits range. Here is a graphical summary of the pricing changes for Model 3 and Model Y, which together make up almost 96% of total deliveries:

Model 3 and Model Y Prices vs Time (Tesla Website, Author’s Analysis)

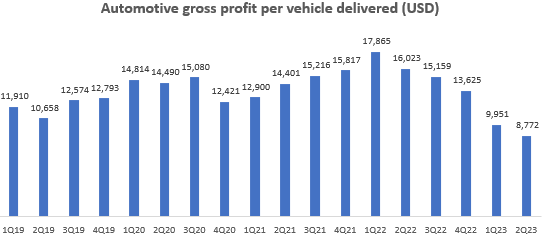

These pricing cuts have led to a sharp 45% YoY deterioration in the gross margin per vehicle sold, from the mid-teen thousands of dollars to $8.7k:

Automotive gross profit per vehicle delivered (Company Filings, Author’s Analysis)

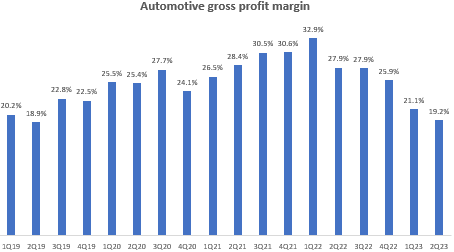

Tesla bears highlight the deteriorating automotive margins as one of their key thesis points:

Automotive gross profit margins (Company Filings, Author’s Analysis)

In my last article on Tesla, one of my arguments was that “Management’s [20% automotive gross margin] outlook is unreliable.” Q2 FY23’s results seem to have played out as per expectation.

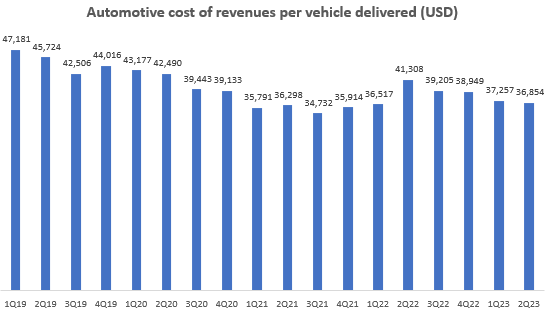

However, I am now more optimistic on the company’s margins because underneath the pricing resets, the numbers show that genuine structural margin improvements are in motion. This is evident when we look at the continued reductions in COGS per automotive vehicle delivered:

Automotive cost of revenues per vehicle delivered (Company Filings, Author’s Analysis)

Management attributes these reductions to a multitude of factors:

…we realized per unit cost improvements in nearly every category, including material cost and commodities, manufacturing costs and logistics…

– CFO Zachary Kirkhorn in the Q2 FY23 earnings call.

I believe the cost reduction improvements will continue driven by further commodity cost improvements via the new lithium refinery and long-term sourcing of lithium contracts, as well as robots and automation:

…we’ll be able to have it [Optimus] do something useful in our factories sometime next year… I’m pretty confident of that

– CEO Elon Musk on the applicability of humanoid robot Optimus in Tesla’s factories in the Q2 FY23 earnings call.

On the pricing side, it seems like the microeconomic pricing reset is done. Management noted that as macroeconomic conditions stabilize, prices would too. Hence, my base case anticipation is that Tesla will print a margin rebound from Q3 FY23 onwards. So looking forward, I see more margin tailwinds rather than headwinds.

Investments have great multiplier potential

I am very excited about Tesla’s humanoid robot Optimus. The addressable market size is huge; Elon Musk has remarked that 10 billion units over the long term is a very feasible target. Indeed, he confidently expects Optimus to contribute the majority of Tesla’s overall value as commercialization begins and expands.

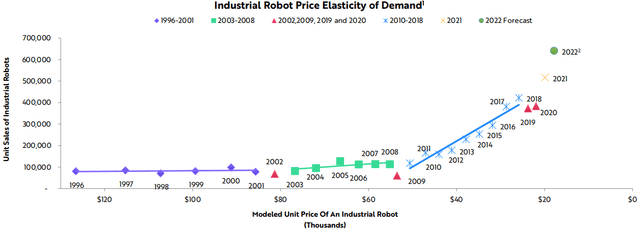

Rising Adoption of Industrial Robots (Slide 13 in Ark Invest’s Note on Autonomous Technology)

Research from ARK Autonomous Technology & Robotics ETF (ARKQ) supports this view, as it illustrates the rising adoption of industrial robots. Note that Optimus is designed to be suited for both industrial and residential purposes.

Tesla is also spending more than $1bn over the next year into Dojo for AI-based video training data. This would help make the full self-driving (FSD) dream a reality.

But wait – isn’t this the same thing that has been promised for more than 5 years now? Yes it is, and even CEO Elon Musk has acknowledged that but he is once again re-affirming his confidence in major progress toward the end of this year (emphasis added):

Now I know I’m the boy who cried FSD, but man, I think we’ll be better than human by the end of this year.

– Elon Musk on FSD’s progress in the Q2 FY23 earnings call.

With the increased investments in AI, I believe this is a catalyst that can make leapfrog improvements into the FSD ambitions. So yes, this time, I am willing to give the benefit of the doubt.

Valuations are attractive

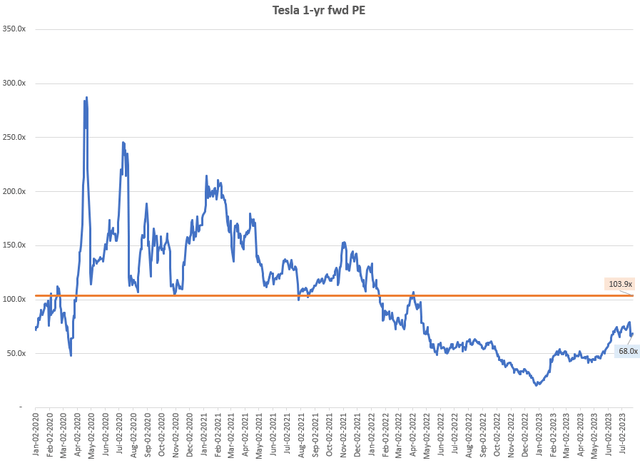

Tesla 1-yr fwd PE (Capital IQ, Author’s Analysis)

Tesla today trades at a P/E of 68.0x, which corresponds to a 35% discount to the average P/E since 2020 of 103.9x. I deem this to be attractive.

Tesla’s valuation lies in the optionality of its investments. The current market capitalization is $854 billion. New growth avenues enabled by Optimus and FSD are likely to have a multiplier effect on this number. Elon Musk has proven his ability to consistently scale new heights… eventually. Indeed, even he estimates that Tesla may be worth 5x what it is today from FSD roll-out alone (emphasis added):

you can think of every car that we sell or produce that has full autonomy capability as actually something that, in the future, may be worth as much as 5x what it is today.

– Elon Musk in the Q2 FY23 earnings call, author’s highlight

Hence, I am long-term bullish Tesla and believe there are strong growth prospects ahead. I believe the valuation discount relative to 2021 levels, when the stock underwent a ~75% correction from its peak, gives some additional cushion and margin of safety.

The Main Risk

My thesis assumes no further microeconomic-related pricing cuts for Tesla.

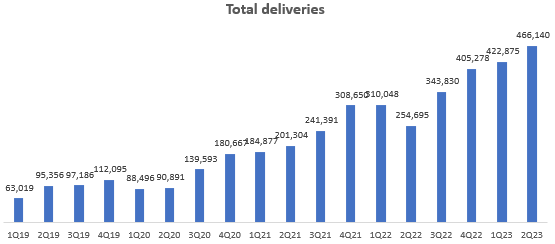

Total Deliveries (Company Filings, Author’s Analysis)

I think the fact that Tesla has had an acceleration in deliveries – from 423k in Q1 FY23 to 466k in Q2 FY23 – is proof that its pricing cuts have been better optimized to capture more producer surplus. However, for my margin improvement expectations in future quarters to play out, further cuts in sale prices should not occur. Hence, I will be keeping a close eye on the model prices and tracking the changes periodically.

Takeaway

My last thesis on Tesla expressed skepticism about margin improvements in Tesla. Primarily due to this doubt, I refrained from issuing a “buy” rating on the stock. The good news is the fundamental view has played out; Tesla disappointed in margins in Q2 FY23 by posting continued gross margin declines. The bad news is, the stock still rallied strongly, and I missed a chance for a 44% alpha move.

But now, after Q2 FY23’s results, I am more optimistic on the margins story than most. I believe the sale price cuts are over and we can expect to see meaningful margin improvements to play out over the subsequent quarters driven by lower commodity costs, continued operational efficiencies, and the productivity boosts enabled by AI and the humanoid robot Optimus in the long run.

This provides me with the shorter-medium term trigger to pull the buy. If I am wrong on the timing, I think I can take comfort in the fact that there is strong multiplier potential to Tesla’s value in the long term.

Rating: ‘Buy’

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in TSLA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I have a beneficial Long position in the shares of VOO either through stock ownership, options or other derivatives.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.