Summary:

- Tesla, Inc. recently announced that it had broken ground on a lithium refinery in Texas, with initial production expected by the end of the year.

- The company claims that this will allow them to avoid high lithium prices, as lithium supply is more refinery-limited than it is mining-limited.

- An examination of available data suggests that this is largely mistaken, with lithium concentrates appearing to be far more limited.

- Regardless of the apparent factual miscommunication, a lithium refinery is a great investment for Tesla as it will allow the company to secure its supply chain and qualify for EV tax credits.

Bjorn Bakstad

At the recent Tesla, Inc. (NASDAQ:TSLA) Investor Day event, the company announced that it had broken ground on a lithium refinery to supply its North American operations with battery-grade lithium compounds. While I think this is good news for the company and its investors, I disagree with much of the messaging surrounding what the limiting factor for lithium may be. In this article, I look at some of Tesla’s comments about lithium and discuss some of my thoughts on the lithium shortage.

In a previous article, I discussed how a more affordable Tesla electric vehicle (“EV”) could impact the company’s competitors. While Tesla did not unveil that vehicle at its Investor Day event, as I had predicted, this refinery may enable them to get closer to unveiling it. As I will discuss in this article, it may also allow the company to make its existing vehicles more affordable.

Tesla’s Lithium Comments

Elon Musk has continuously downplayed the lithium shortage, largely beginning at Tesla’s 2020 Battery Day event. At the 2:22:00 mark, Musk says that lithium is like oil, in that it’s not particularly rare and that it can be found pretty much everywhere. This statement, while true, ignores a number of issues with extracting lithium.

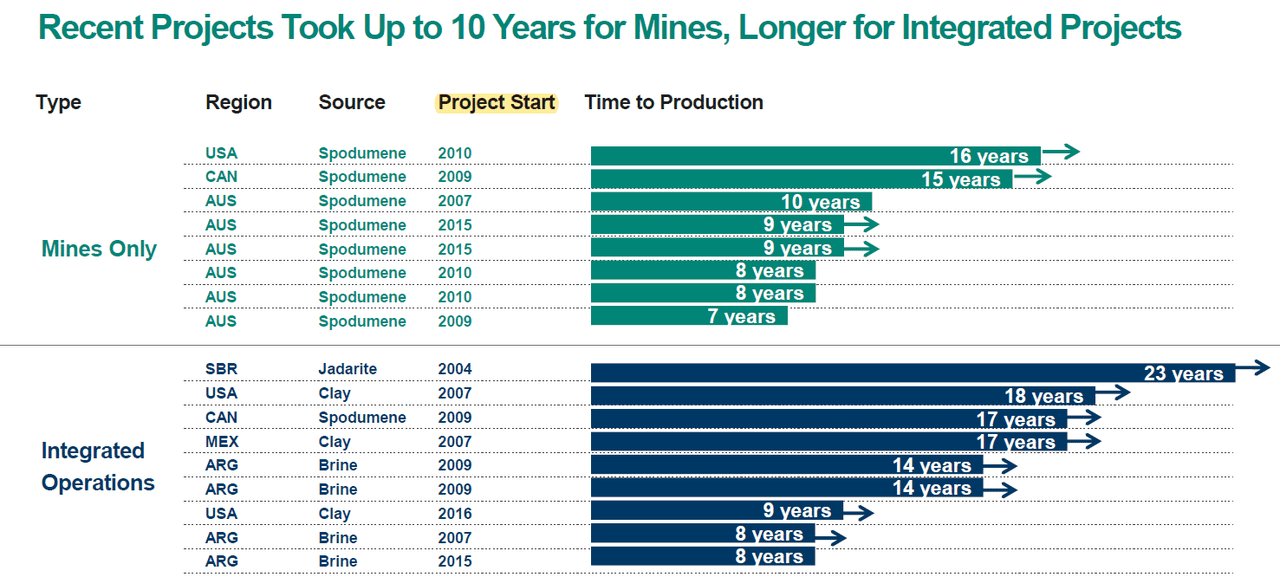

First of all, it takes a long time to bring a mine into production from initial discovery. As demonstrated by the image below, it often takes at least seven years to bring a lithium project into production. So, just because we found it, doesn’t mean we’ll be extracting it within the next several years.

Albemarle

McKinsey estimates that 60% of lithium demand today is for battery applications, which it expects to reach 95% by 2030. This means that the lithium market, unlike nickel, is dominated by demand from electric vehicles. Considering that the Model 3 didn’t start production until the second half of 2017, less than six years ago, the industry has hardly had any time to react to this massive growth.

In other words, if a mining company began developing a lithium project just as the first Model 3s were coming off the assembly line, it still wouldn’t be in production today.

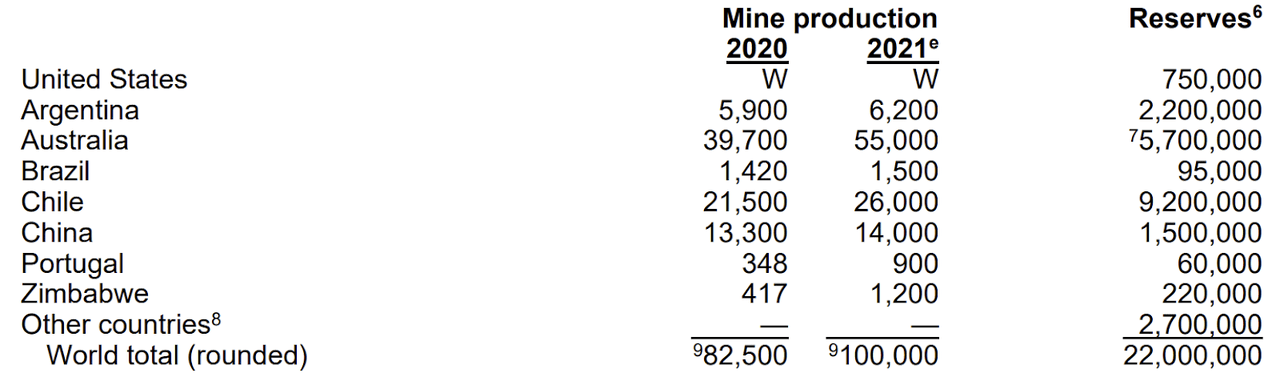

Musk goes on to say that there is enough lithium in the United States alone to power 300 million EVs. And while this, too, is technically true, it is a bit misleading.

As of 2022, the United States had 750,000 tonnes of lithium in reserves (3.992 million tonnes LCE). This means that the economically-extractable amount of lithium in the United States is really only enough to power ~100 million EVs. And that assumes that 100% of it is actually mined, even though most lithium projects only extract ~80% of the reserve amount. It’s also worth noting that, when this was said, the United States’ lithium reserves would have been enough to power only ~84 million EVs.

To get to his 300 million EV figure, Elon Musk used the country’s lithium resources. Unlike reserves, resources include ore that would be financially damaging to extract. This difference between resources and reserves is critical to understand because it also goes back to Musk’s earlier point about how common lithium is.

Yes, lithium is common, but it is not commonly found in concentrations that are economically feasible to extract. A large resource does not guarantee a large reserve. Most lithium projects will have a reserve that is ~22% the size of the resource, but this can vary significantly from project to project.

But one issue that Musk has continuously brought up, is that the lithium industry is currently limited by refining capacity. In Tesla’s Q2 2022 earnings call, Musk said:

“I would like to once again urge entrepreneurs to enter the lithium refining business. The mining is relatively easy. The refining is much harder. So, the lithium is actually a very common – sort of very – like lithium pretty much everywhere. But you have to refine the lithium into battery-grade lithium carbonate and lithium hydroxide, which has to be extremely high purity. So, it is basically like minting money right now. There is like software margins in lithium processing right now. So, I would really like to encourage, once again, entrepreneurs to enter the lithium refining business. You can’t lose. It’s licensed to print money.”

During the recent Investor Day, Musk once again brought this up. After once again going through his spiel about the United States having enough lithium to electrify the world (55 minutes in), he said that “the limiting factor is the refining of lithium into battery grade hydroxide or carbonate.” He reiterated this at around the three-and-a-half-hour mark, stating that refining is the “choke point” for lithium.

The Reality

Market dynamics do not support this claim that lithium is refinery-limited. The easiest way to see this is by looking at the market pricing of 6% spodumene concentrate, which is a precursor material for battery-grade lithium compounds. Pilbara Minerals (OTCPK:PILBF), specifically, offers good examples of this.

In its last spodumene auction, Pilbara Minerals sold its spodumene concentrate for an equivalent of $8,299 per tonne of 6% spodumene concentrate. While this represents the spot market pricing, which is always a fair bit above contract pricing, the company later announced that its major customers will be paying $6,300 per tonne from December onward

$6,300 per tonne for contract pricing is pretty significant but, even more recently, the company introduced a new spodumene pricing method. The pricing mechanism, which it calls lithium hydroxide tolling, is a first-of-its-kind arrangement in the lithium industry that will see Pilbara receive the value of the lithium hydroxide sold by its customer, less an agreed amount for conversion and other costs.

I struggle to find an alternative way to interpret this, other than that this heavily implies that ore production is far more valuable than ore refining in the lithium industry.

But even looking at the company’s $6,300 per tonne sales price, we can start to build a picture of the margins involved here. Pilbara reported an all-inclusive sales cost operating cost of $1,136 per tonne for the second half of the year, with royalties contributing to a large portion of that. Operating costs at the plant level, before royalties and shipping costs, were $595 per tonne.

Pilbara’s average realized sales price for the second half of the year was $4,493 per tonne, which implies an EBITDA margin of 77.3% and a mine-level profit margin of 88.1%. To get an idea of what the profit margin for a pure lithium refiner might be, let’s look at some data from Allkem (OTCPK:OROCF).

Allkem did a much better job than most of its peers in extracting the maximum value from its lithium production, selling its lithium carbonate for an average price of $48,125 per tonne in the second half of 2022 (September Quarter, December Quarter). Applying a $1,500 premium to that for hydroxide, we can infer that a similarly successful company would be able to sell its lithium hydroxide for $49,625 per tonne. Note that this is contract pricing.

To produce one tonne of lithium hydroxide, a refiner needs ~7.5 tonnes of spodumene concentrate. Pilbara’s pricing ($4,993/tonne), therefore, implies a raw material cost of $37,448. Refining spodumene into hydroxide costs an additional $2,500 per tonne, bringing the final production cost to ~$40,000 per tonne.

Thus, the final margin is 19.4%. That’s certainly not terrible, but not exactly the “software margins” that Elon Musk likes to talk about. More importantly though, if the industry were truly refining limited, it would stand to reason that refineries would have a much higher margin than ore producers. Yet, the opposite is true.

Benefit to Tesla

Look, this doesn’t mean that Elon Musk, and Tesla by extension, are incorrect in identifying a need to develop lithium refining capacity. China currently dominates spodumene refining, with the first facilities outside of China currently struggling to ramp production in Australia. The Kwinana lithium refinery, for example, finished construction in 2019, but has yet to reach scaled production of lithium hydroxide.

By adding refining capacity to North America, Tesla could sidestep the massive geopolitical risk posed by China, securing a stable supply of lithium for its vehicles. Though, this isn’t the only benefit of providing Australian spodumene producers with an alternative to China.

Under the new guidelines set by the Inflation Reduction Act, at least 40% of the critical materials in an EV’s battery need to be sourced from the United States, or countries that it has a free trade agreement with, in order to be eligible for the first half of the $7,500 tax credit. This 40% threshold will rise to 50% in 2024; 60% in 2025; 70% in 2026; and 80% in 2027 and beyond.

While Australia does have a free trade agreement with the United States, China does not. Because all of Australia’s lithium is currently refined in China, this automatically eliminates ~55% of the world’s lithium supply from qualifying for these tax credits, despite the country of origin having a free trade agreement in place. So, setting up a refinery in the United States opens Australian lithium to qualify for the federal tax credits, allowing Tesla to effectively reduce the price of its vehicle without actually changing its sales price.

United States Geological Survey

Furthermore, while it’s not quite the 77% margin that miners are able to achieve, a 19% margin isn’t insignificant. By sidestepping that refiner premium, Tesla can boost its efforts in the EV price war and continue to undercut competitors.

As I discussed in my previous article on Tesla, a cheaper EV from the brand is coming. By taking even greater control of its supply chain, Tesla will have even more control of its production costs, making it easier to produce a cheaper EV. So I do think this is a very good strategic move for the company, I just disagree with the company’s messaging.

Investor Takeaway

The numbers don’t lie. Again, I agree that it is critical to invest in lithium refining capacity outside of China, but talking down the necessity of mining expansions limits the public investments being made into lithium miners.

Lithium companies were broadly down after Tesla’s Investor Day, some by over 5%, but most between 1.5% and 5%. Without investment today, the future lithium supply is jeopardized due to the long lead times for projects to reach commercial production. As such, I feel that Tesla should be encouraging these mining efforts, rather than discourage them.

All this being said, Tesla’s lithium refinery is great news for shareholders that should be celebrated. This will allow the company to secure its supply, improve profitability, and ensure it meets the standards to receive tax credits for its domestic vehicle production. As it continues to wage its EV price war, this will only extend the company’s existing advantage.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Electric vehicles are on the rise, and those leading the change are often seen to be the automakers. I disagree. While I like GM, the suppliers behind the automakers have the most to gain. But that’s just one component of the green transition. In 2017, I created a portfolio centered on decarbonization that his since grown over 400%; I want to share that experience with you. With a regularly updated portfolio, exclusive research, and direct access to myself, there’s no reason that you too can’t take part in the exciting market. Start your free trial to Green Growth Giants now!