Summary:

- Tesla, Inc. stock has significantly outperformed this year, although the last month has jolted the stock a little.

- All stock-fundamental factors I evaluated have gotten worse since my last review.

- Market share, as a percentage, will inevitably be under pressure due to expanding market size and competitors.

- Despite short-term overvaluation concerns, I am staying with the stock as I believe Tesla is batting early in its innings.

bruev/iStock Editorial via Getty Images

In my last review of Tesla, Inc. (NASDAQ:TSLA) three months ago, I had rated the stock a “Hold” while evaluating the stock on 13 different parameters. Since then, the stock has gained more than 50% compared to the market’s 8% run. Does that change my rating on the stock? How have these 13 factors changed meanwhile? Let us find out below while I also assign a quantitative rating to each of these 13 factors based on whether they’ve gotten better or gotten worse or stayed the same.

Four Business Reasons

- Margin Erosion: Tesla’s operating and gross margins continue to be under pressure due to a slew of price cuts. Operating margin went down to 9.60% in Q2 while gross margin decreased 25% YoY to reach 18.20%. Analysts very familiar with Tesla believe margin compression will continue through the next few quarters. Hence, I am rating this as “stayed the same” (Stayed Same: #1)

- Demand Erosion: Demand has gotten better as customers have responded positively to price cuts and tax credits. It is a welcome move that the company is implementing demand based pricing. This means that States with the highest demand, like California and Florida, are likely to receive lesser incentives and credits than states where the demand is not as high. Since Tesla does not have independent dealers, I consider demand-based pricing a no-brainer as the company can independently assess the national and State-wise demand to adjust pricing accordingly. I am rating demand as “gotten better.” (Gotten Better: #1)

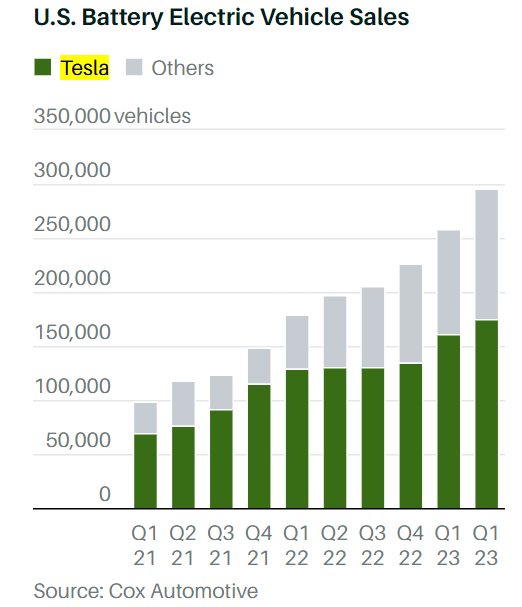

- Market Share: Tesla’s market-share in Q2 slipped to 59% from the 62% share it had in Q1. This may sound perplexing as price-cuts did indeed help the company sell more cars. But it does not sound perplexing when you factor in that U.S EV sales jumped 50% YoY in Q2. That is, the playing field is getting larger while Tesla’s share as a percentage is getting smaller. Tesla’s first-mover advantage is still intact, although market-share as a percentage is likely past its peak. I rate this as “gotten better,” especially given the aggressive target set by the administration for EVs to have a 50% overall share by 2030. (Gotten Better: #2).

US EV Sales (barrons.com)

- The Elon Musk Problem: Although Twitter now has a new CEO (and a new name, or a new alphabet to be precise), I am not as optimistic now as I was in the May review that Musk’s involvement/distraction with Twitter would reduce. Musk’s recent move to rebrand Twitter as “X” highlights the extent of his involvement with the social networking platform. Musk’s unpredictability scale is likely not coming down any time soon and hence this risk remains the same. (Stayed Same #2)

Four Stock Fundamental Reasons

- Forward Multiple: Almost directly as a result of the stock’s 50% since my last review, Tesla stock’s forward multiple has almost reached 75. This belongs to the “gotten worse” category. (Gotten Worse #1)

- PEG: Growth at Reasonable Price (“GARP”) investors like myself tend to look at the Price-Earnings/Growth (“PEG”) multiple as it tells us how fairly valued a stock is relative to its growth prospects. Tesla stock has gotten considerably worse on this metric since my last review, as the current estimated growth rate of 10%/yr gives the stock a forward PEG of nearly 7.5, while it was 5 during my May review. This too belongs to the “gotten worse” category. (Gotten Worse #2)

- Price Target: At the current price per share of $254, the stock is just a 7% away from its median price target. This too belongs to the “gotten worse” category as the stock was 10% away from the median price target during my May review. (Gotten Worse #3)

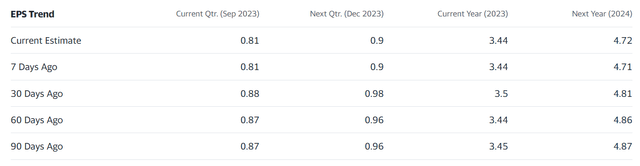

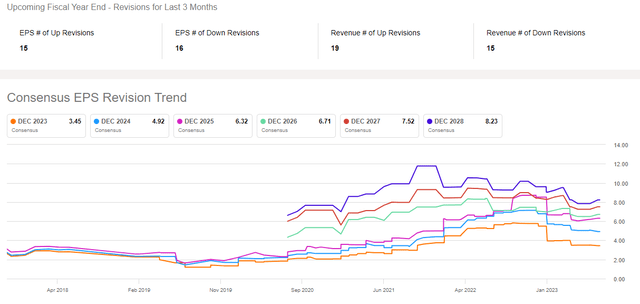

- Estimates: Now that 2023 is at the half-way mark, estimates for the year have more or less remained the same. 2024’s estimates have fallen from $4.88 during my last review to $4.72 now, a 3.50% reduction. So, this has gotten slightly worse. (Gotten Worse #4)

TSLA Estimates (Yahoo Finance) TSLA Estimates (Seekingalpha.com)

Three Macro Reasons

- Market Complacency: Since my review in May, the market has gone up a further 8%, basically doubling the YTD returns to about 16.60%. While last week was a little shaky, overall, I am of the opinion that the market complacency has gotten worse as “risk-on” names are still having a huge demand. While AI may justify some gains for some stocks, it does not justify all the gains for all the stocks. Tesla’s stock in undoubtedly one of the biggest winners in the “risk on” mode 2023 has been so far, as the stock is up 134% YTD and at one point was up 200% from its 52-week lows. (Gotten Worse:#5)

- Recession or Fears of One:

“One day it seems like the world economy is falling apart, next day it’s fine. I don’t know what the hell is going on.” – Elon Musk.

That statement from a man who usually has a firm opinion about almost everything tells us all we need to know about the economy right now. One day inflation numbers appear worse than expected in one category while the very next day a different metric suggests the sky is all clear. Overall, there is no consensus yet and that makes the market more interesting in my opinion. (Stayed Same #3)

- China: If you thought making up our minds about a recession was hard, try this:

- Tesla’s EV Sales in China Fell more than 30% in July 2023.

- Tesla’s China-Made EV Wholesale Sales doubled in July 2023.

- Tesla China sales fall to lowest level in July 2023.

- Tesla, BYD’s China deliveries hit record high in Q2.

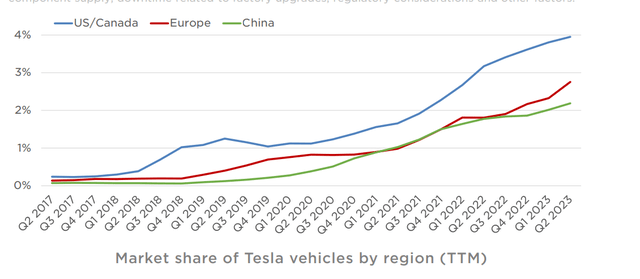

Not confused yet? I don’t want to try you further then. The point is, it just depends on who you ask and what you read. While Tesla’s overall market share in China has crossed 2% (not just EVs, but overall), there will be plenty of road-blocks on the way including regulators and plenty of local competitors. (Stayed Same #4).

TSLA China MarketShare (digitalassets.tesla.com)

Two Technical Reasons

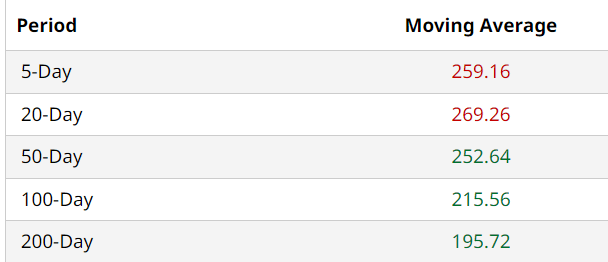

- Moving Average: Tesla’s 200-Day moving average has fallen to $195 from $205 in May. This is not necessarily bad news because right now, the stock is way above (30%) the 200-Day moving average while in May, the stock was almost 20% below the 200-Day moving average. In case the market worsens and Tesla’s stock runs into fundamental issues, I expect strong support around the $200 area. Overall, I’d say this section gets the same grade as before. (Stayed Same: #5)

TSLA Moving Avgs (barchart.com)

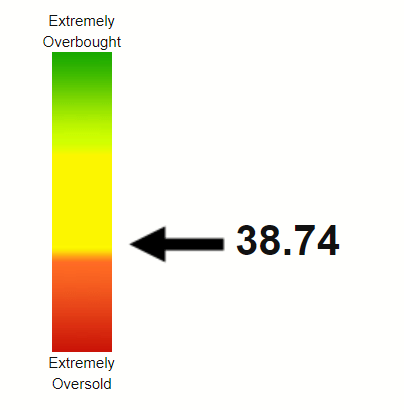

- RSI: Tesla stock’s Relative Strength Index (“RSI”) of 38.74 right now appears a quite a bit lower than the 58 during May’s review. This is not a surprise given the stock’s weakness over the last month where it has lost about 10%. From a pure technical basis, this falls under the “gotten worse” category as weakened stocks don’t suddenly stop and turnaround. (Gotten Worse: #6).

TSLA RSI (stockrsi.com)

Conclusion

Okay, that was a little tricky to ensure I did not miss rating any section and that the total gets to 13. For those curious about scores, this is how we look:

- Stayed Same: 5

- Gotten Better: 2

- Gotten Worse: 6.

More important than the numbers in each category, the fact that the entire fundamental section fell into the “Gotten Worse” category tells us the main story. The stock’s strong run up in price has made it much less attractive than it was 3 months ago. I urge investors to pay more attention to margin than to market share as due to the combination of expanding market size and number of players, it is inevitable that the company’s market share (as percentage) will be under threat.

Despite most of the 13 factors getting worse or staying the same, given my opinion that Tesla is still batting in the early innings of a very long game, I am still rating the stock a “Hold.” But a weak hold at that.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.