Summary:

- Tesla, Inc. produces electric vehicles, solar panels and roof tiles, and battery storage systems.

- Tesla has already established itself as a premier EV producer and is well-positioned to achieve additional moats in its ancillary industries.

- They have a history of achieving attractive returns. I believe they will become a long-term compounder.

- After reviewing their present financials and valuation, I currently rate Tesla stock a Buy.

jetcityimage

Thesis

A few days ago, I was in a discussion with a friend about his recent Tesla, Inc. (NASDAQ:TSLA) stock acquisition and told him I thought he would likely be quite happy with his purchase a decade from now. When he asked me why, I gave him a brief on two high margin revenue streams that Tesla is in the process of developing. I am detailing the points I made to him in this article.

As much as I am quite bullish on their long-term prospects, when I wrote my last article on Tesla in April, I was hesitant to place a buy rating because of a combination of their margin contraction caused by price drops and our inverted yield curve. However, with the UAW strike providing significant problems for the Big Three, Tesla’s short and medium term prospects have improved significantly. After reviewing their financials and present valuation, I currently rate TSLA as a Buy.

Company Background

Tesla produces electric vehicles, solar panels and roof tiles, and battery storage systems. They are a leading developer of self-driving software, and have expanded into machine learning with the development of their own supercomputer called Dojo. They maintain operations in the United States, China, and internationally. The company was founded in 2003 and and is currently headquartered in Austin, Texas.

Tesla maintains an Automotive segment, and an Energy Generation and Storage segment. Their Automotive segment offers electric vehicles and ancillary products and services. This segment includes their network of Superchargers and service locations, in-app upgrades and mobile services, financing and leasing services, and warranties and extended service plans.

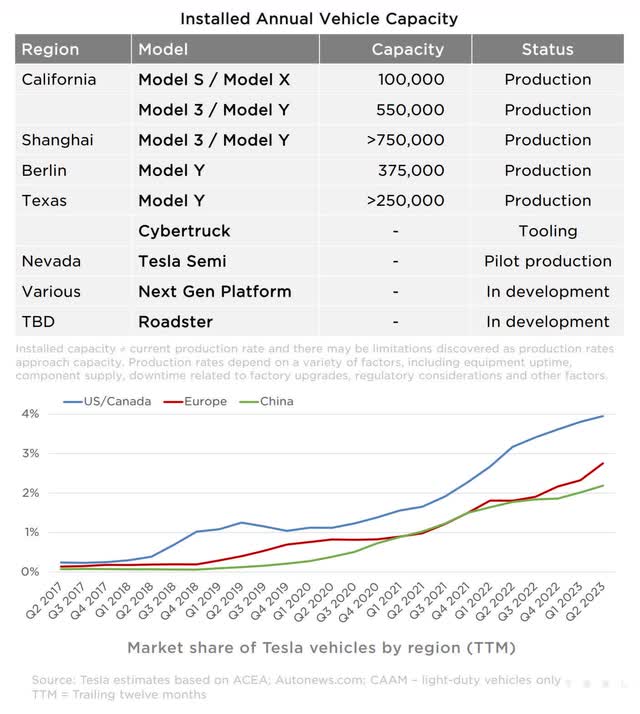

TSLA Automotive Market Share (Shareholder Deck, Q2 2023, page 9)

Their Energy Generation and Storage segment provides photovoltaic generation, storage products, and related services. It maintains a website as well as stores and galleries, and also reaches customers through a network of channel partners. They offer various financing options to their solar customers.

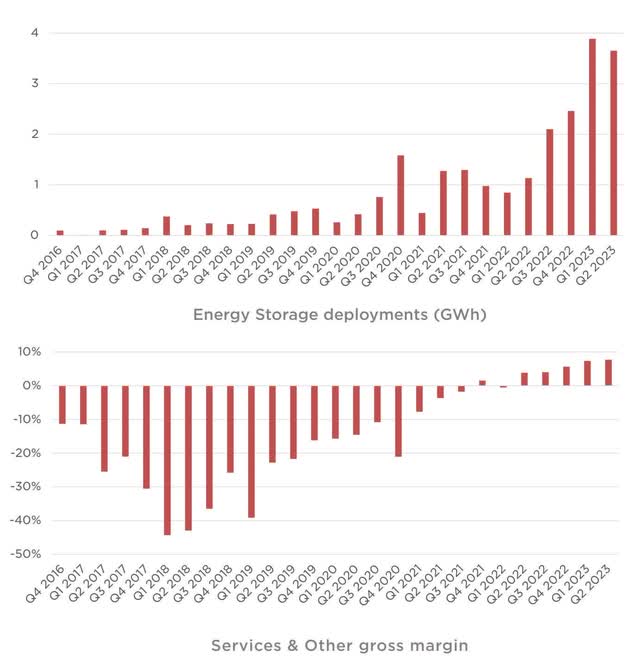

TSLA Energy Storage And Services (Shareholder Deck, Q2 2023, page 8)

Long-Term Trends

The global electric vehicle (“EV”) market is projected to have a CAGR of 22.1% until 2030. The global autonomous vehicle market is projected to have a CAGR of 35% through 2032. The global electric vehicle charging station market is projected to have a CAGR of 37.7% until 2033. The energy storage market is projected to have a CAGR of 14.31% through 2028. The global photovoltaic market is projected have a CAGR of 10.1% during the forecast period.

The Future Of Self-Driving

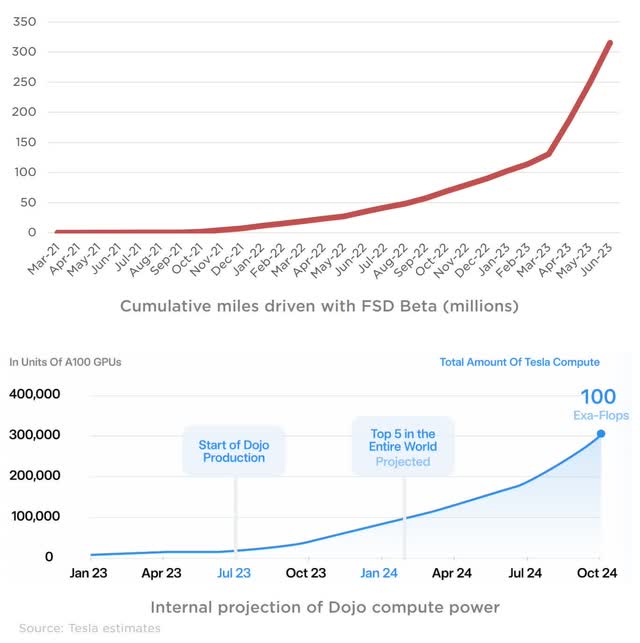

Tesla is in the process of improving its capabilities on multiple fronts. They have been working toward full self-driving (“FSD”) for many years. As part of this effort, they announced Dojo at their AI Day event on August 19, 2021.

TSLA Dojo Projections (Shareholder Deck, Q2 2023, page 8)

As progress continues on establishing superior reliability and safety capabilities, it will eventually become clear that autonomous vehicles are safer than human drivers. Once a certain statistical threshold has been met, insurance companies are going to be willing to offer lower rates to drivers who use proven autonomous driving software.

What I believe frequently gets overlooked is the pressure this will place on entities who operate large fleets of vehicles. They will be financially incentivized to transition to autonomous capable vehicles. While most of the auto industry has been working toward their own versions of autonomous driving, Tesla has a capability lead on most of them. If insurance companies are willing to offer users of Tesla’s software better rates, this will incentivize Tesla’s competition to manufacture vehicles which are capable of running a variety of software packages.

Their Autopilot has access to more raw data than any of their competitors. This gives them a significant lead on reaching full capability more quickly than any other autonomous driving software provider.

TSLA Guidance Autopilot (Earnings Call Transcript, Q2 2023)

We could witness an era where it’s common for people to buy a new Ford (F), General Motors (GM), or Stellantis (STLA) vehicle equipped with Tesla’s autonomous driving software. This may also produce an industry of third party entities which convert vehicles to be capable of using Tesla’s software. Eventually, any capability gap should close for those of their competitors who continue developing their own software packages, so this period may only last a few years. However, the trend of vehicles being manufactured with multi-software capability may continue even after the gap closes. Being able to purchase a vehicle capable of using a variety of self-driving software packages may eventually become standard.

While I am not clear as to when this threshold will be crossed. The idea that Tesla might find themselves with a much larger market for their software than their own vehicles is extremely appealing. The pressure would have to be significant for the other auto manufacturers to make the switch. If the discounts the insurance companies are handing out are not deep enough, we may not see an adoption or we may only experience a partial adoption.

The Future Of Energy Storage

Tesla is well positioned to benefit from ongoing changes in our energy grid. The Levelized Cost of Electricity is the most dominant factor at play when examining long-term energy infrastructure trends.

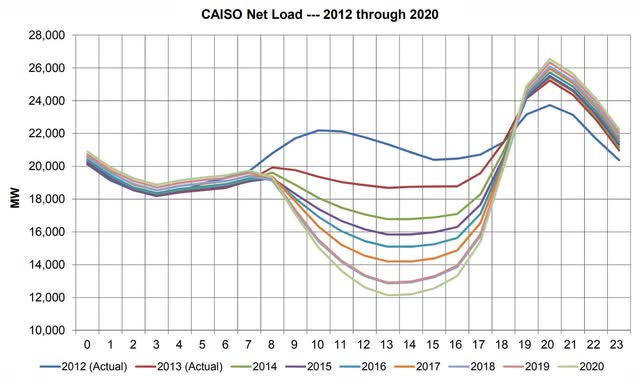

When photovoltaics reached the status of our cheapest source of electricity several years ago, additional renewable capacity seems inevitable. However, the adoption of intermittent sources warps the daily supply and demand curve for wholesale electricity. This supply and demand imbalance produced by solar is known as the Duck Curve. Excessive overproduction from solar will damage portions of the grid. This problem is severe enough that it is already common to disconnect portions of commercial scale capacity during the middle of the day. I went into further detail about how this is affecting long-term trends related to our grid in my recent article about Fluence Energy.

The Duck Curve (Brad Bouillon; Stanford University)

Tesla sits in a unique situation where they are involved in both grid scale storage as well as machine learning and artificial intelligence. In places where a portion of the grid is supplied by photovoltaics, storage providers are able to collect free or almost-free electricity in the middle of the day while the grid is overproducing. This electricity can later be sold back into the market in the evening when they are at their highest.

Wholesale California Electricity Prices Over 24 Hrs. On A Spring Day (Charles W. Forsberg; ResearchGate, May 2020)

With the electricity collected at no cost, or almost no cost, the margins for such an operation are a function of the sheer volume one can manage divided by the maintenance costs for the batteries. This means that storage providers are incentivized to gain access to as much overproduction as possible. Over the next several decades, I believe the electricity arbitrage industry has the potential to scale with the mass adoption of solar and will become incredibly lucrative. Although it’s still far too early to tell how this situation will develop, Tesla is currently well positioned to become a major player in this emerging industry.

Their Autobidder continues to find opportunities in Australia, Texas, California, and the UK. The company cites the clear advantages of growing their footprint, as each facility they build is expected to produce revenue for about 20 years.

TSLA Autobidder Guidance (Earnings Call Transcript, Q2 2023)

In 2022, their energy generation and storage segment reached 5.4% of total revenues, representing a 90% YoY increase to $1.310 billion, while the cost of revenues stands at $1.151 billion. This gives it a gross margin of 9.26%. According to a September 2023 article, Autobidder has made over $330 million in trading revenues since inception.

Guidance

Tesla’s most recent earnings call spoke of several long-term projects they have in the works. They covered developments with the Cybertruck, which they plan to launch later this year, and also mentioned continued efforts toward developing a robotaxi. They are pleased about the adoption of the North American Charging Standard. Overall, things have been going well for them in recent months.

Their forward looking statements indicate that they expect Q3 to have lower revenue due to scheduled upgrades causing down-time through the summer months.

TSLA Q3 Guidance (Earnings Call Transcript, Q2 2023)

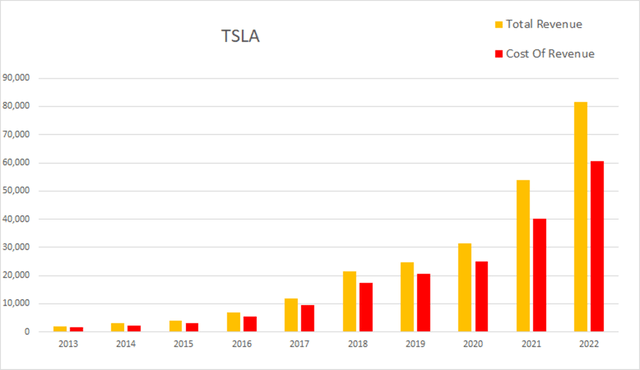

Annual Financials

Tesla’s annual revenue has been growing at an impressive rate. In 2013 they had an annual revenue of $2,013.5M. By 2022, that had grown to $81,462M. This represents a total increase of 3945.8% at an average annual rate of 438.4%.

TSLA Annual Revenue (By Author)

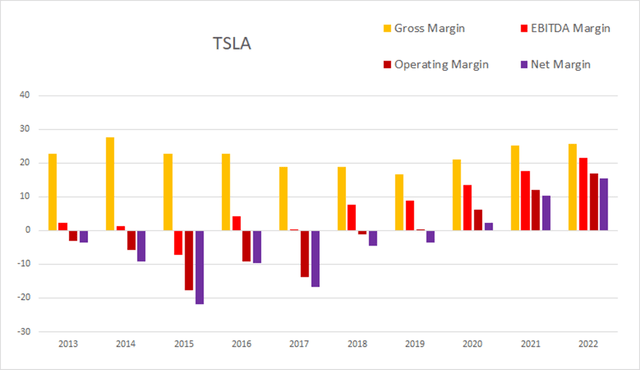

Their annual margins have been improving over the last several years. As of the most recent annual report, gross margins were 25.60%, EBITDA margins were 21.41%, operating margins were 16.81%, and net margins were 15.41%.

TSLA Annual Margins (By Author)

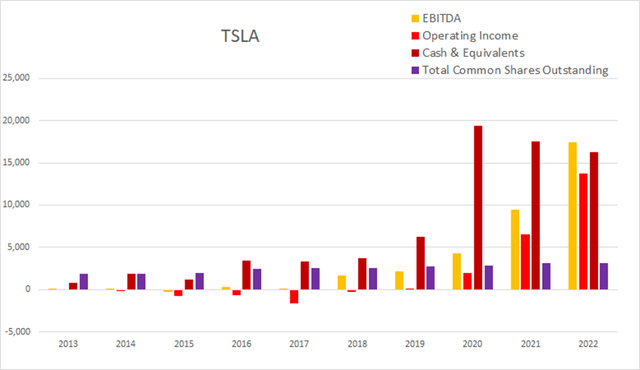

Like many growing companies, Tesla has been diluting to help fund expansion. Total common shares outstanding was at 1,846.4M in 2013; by the end of 2022 that rose to 3,164M. This represents a 71.4% rise in share count, which comes out to an average annual rate of 7.93%. Over that same time period, operating income rose from -$61.3M to $13,692M. Because it has come with significant improvements to income, I view this dilution as accretive.

TSLA Annual Share Count vs. Cash vs. Income (By Author)

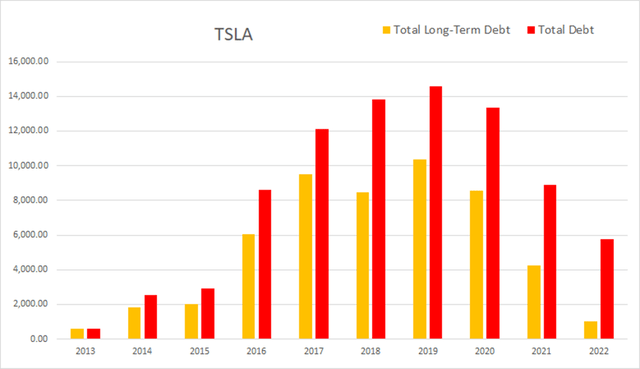

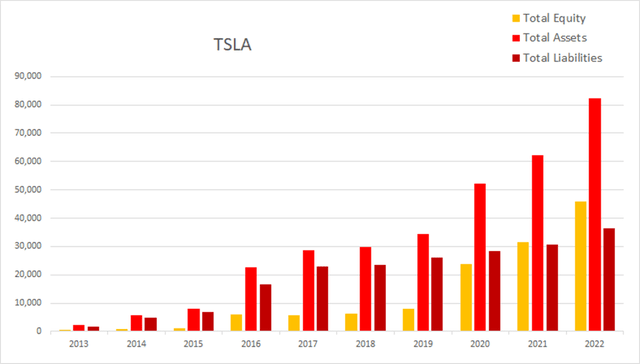

Their debt situation has been improving over the last several years. As of the 2022 annual report, they had $106M in net interest expense, total debt was $5,748M, and long-term debt was $1,029M.

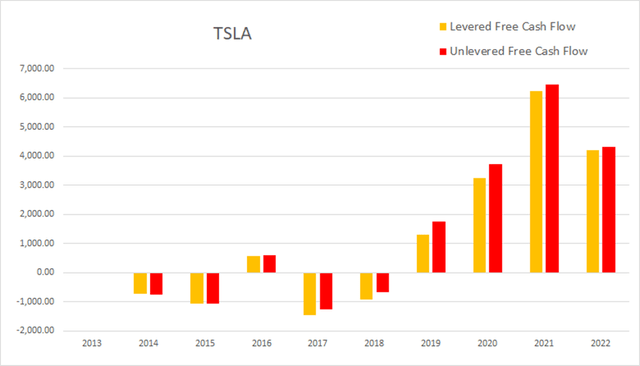

As of this most recent annual report, cash and equivalents was $16,253M, operating income was $13,692M, EBITDA was $17,439M, net income was $12,556M, unlevered free cash flow was $4,327.5M, and levered free cash flow was $4,208.1M.

TSLA Annual Cash Flow (By Author)

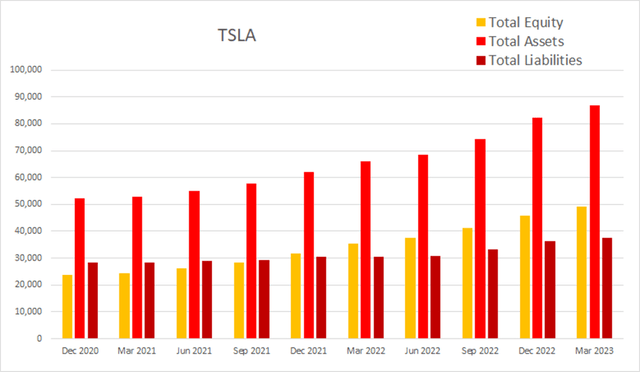

Their total equity has been growing quite quickly.

TSLA Annual Total Equity (By Author)

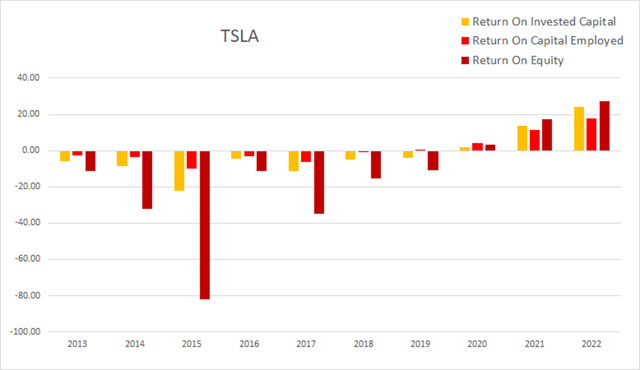

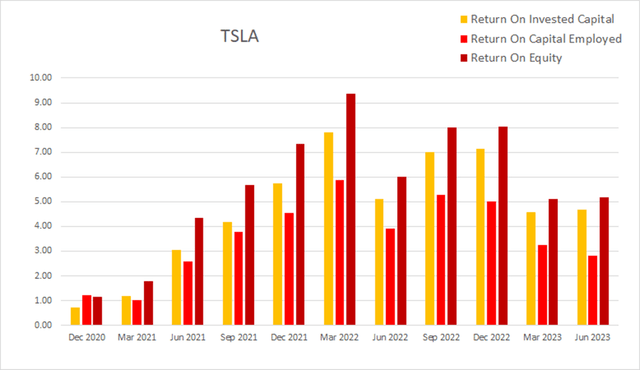

Annual returns have also been improving. As of the most recent annual report ROIC was 24.31%, ROCE was 17.64%, and ROE was at 27.36%.

TSLA Annual Returns (By Author)

Quarterly Financials

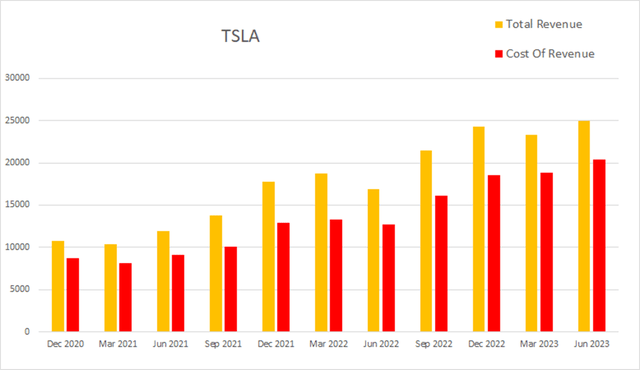

Their quarterly financials are showing significant revenue growth over the last two years. Eight quarters ago Tesla had a quarterly revenue of $11,958M. Four quarters ago that had grown to $16,934M. By this most recent quarter that had grown to $24,927M. This represents a total two-year rise of 108.4% at an average quarterly rate of 13.6%.

TSLA Quarterly Revenue (By Author)

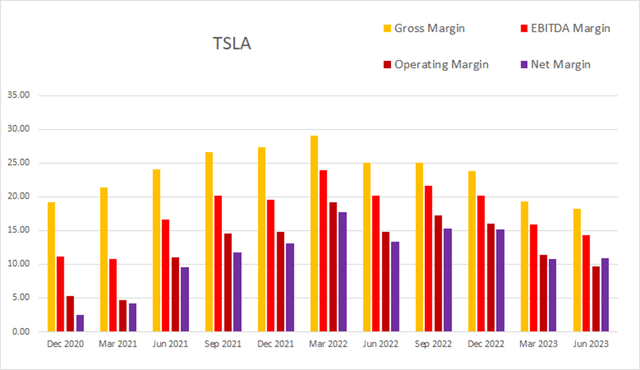

Their margins have been contracting over the last several quarters. As of the most recent quarter gross margins were 18.19%, EBITDA margins were 14.25%, operating margins were 9.62%, and net margins were at 10.84%.

TSLA Quarterly Margins (By Author)

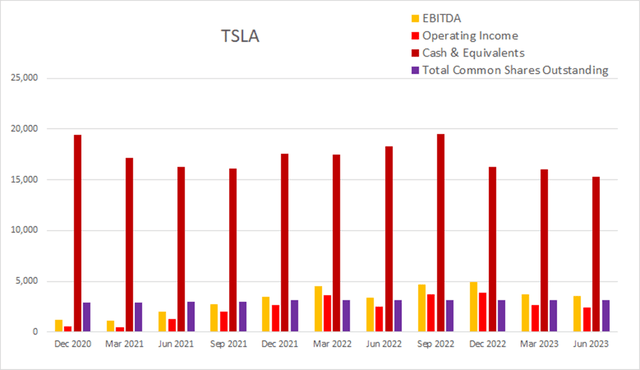

Their dilution rate appears to have dropped in more recent quarters. The sum of their last eight quarters of dilution comes to 7.32%; over the last four quarters this has dropped to 1.63%.

TSLA Quarterly Share Count vs. Cash vs. Income (By Author)

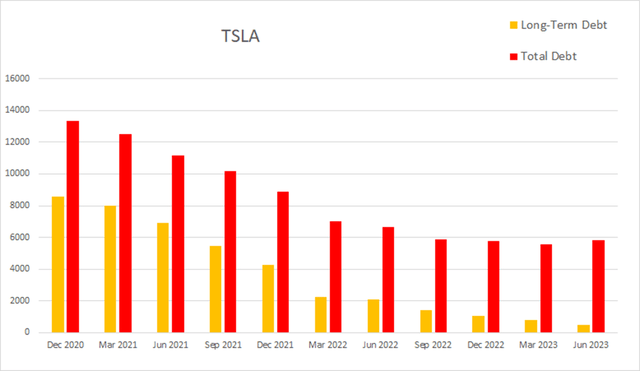

Their debt situation is improving. This most recent quarter, Tesla had $210M in net interest expense, total debt was at $5811M, and long-term debt was at $504M.

TSLA Quarterly Debt (By Author)

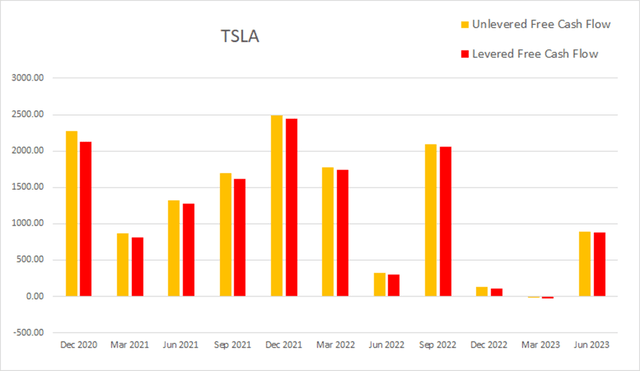

Their quarterly cash flow is inconsistent. As of the most recent earnings report, cash and equivalents were $15,296M, quarterly operating income was $2,399M, EBITDA was $3553M, net income was $2,703M, unlevered free cash flow was $894.4M, and levered free cash flow was $876.9M.

TSLA Quarterly Cash Flow (By Author)

When viewed on a quarterly basis, their total equity continues to rise.

TSLA Quarterly Total Equity (By Author)

Their returns are trending in a similar pattern with their margins. As of the most recent earnings report ROIC was 4.66%, ROCE was 2.81%, and ROE was 5.18%.

TSLA Quarterly Returns (By Author)

Valuation

As of October 11th, 2023, Tesla had a market capitalization of $836.73B and traded for $262.99 per share. They do not pay a dividend, so using their forward P/E of 91.03x, and their EPS Long-Term CAGR of 19.72%, I calculated a PEGY of 4.616x and an Inverted PEGY of 0.2166x. As the PEGY value is well above 1, this implies the company is presently significantly overvalued.

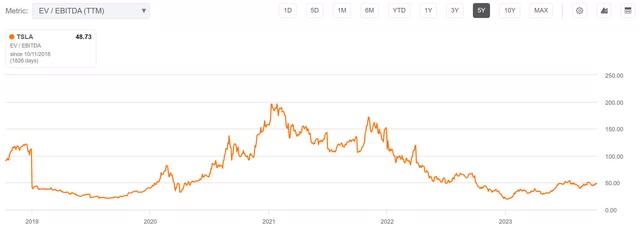

However, TSLA has a history of trading at elevated valuations. They are currently trading with an EV/EBITDA of 48.73x. When viewing their EV/EBITDA over the last 5 years, it’s clear that its present valuation is historically not as overvalued as it has reached in the past.

TSLA 5 Year EV/EBITDA (Seeking Alpha)

Risks

Tesla faces a large number of competitors. A majority of the already established auto manufacturers on the planet are developing or already producing their own EV’s and alternative fuel vehicles. This developing industry has also attracted a significant number of speculative startups. Because of Tesla’s first mover advantage, and the time it will take to develop a viable product from nothing, I expect that the effects of this increasing competitive pressure will come on gradually.

Autonomous driving may take longer to reach full maturity than they expect. Progress is expected to continue on its logistic growth curve, with most of the easy breakthroughs having already been made. The company already has a viable product, but they need a huge amount of additional data and time to fine tune it and make further safety and reliability improvements. It will likely be difficult to tell when they have actually crossed above the threshold where their FSD software can be called “fully mature.”

As always with innovators, Tesla runs the risk of overspending to stay relevant. Developing their own hardware and software for machine learning may end up costing more than they expect, or not be as profitable as they project. The push to develop A.I. is spawning development across the industry, and Tesla is merely one of many companies working on their own projects. While I believe the decision to move into machine learning was good for the long-term health of the company, it’s always possible the additional cost of joining the first movers will not be worth the benefits.

Catalysts

Tesla faces several catalysts, most of which are not near term. Tesla has cut prices several times earlier this year. This should produce additional demand and help them capture market share. Tesla has been normalizing electric vehicle use; at some point we will cross the threshold where it’s more normal culturally to drive an electric or alternative fuel vehicle than a gasoline or diesel.

Tesla’s overall engineering quality is extremely high. Tesla is several generations into EV development and their design philosophy has them continuously making performance improvements. For a specific example of what I am referencing, YouTube has videos of Sandy Munro comparing the thermal systems of the Mach-E and the Model Y. They are eye-opening.

As stated above, I believe demand for their FSD software will increase once the insurance providers are willing to offer discounts. Organizations which maintain fleets of vehicles will have to justify not transitioning to the cheaper option. This is likely to affect everyone from car rental companies and taxi services, to government employees and utility vehicles. Demand for FSD may also spur their competition into producing vehicles which are capable of using Tesla’s driverless software.

Tesla is joining several others in the development of Iron-Air batteries. These types of batteries are significantly cheaper than the Li-ion we are all accustomed to. Tesla already operates a grid scale energy storage facility in Texas. The dramatic cost savings of Iron-Air batteries makes them a disruptive technology. Our electric grid currently requires a significant contribution from base load providers. As we increase its storage capacity, I believe the bargaining power the base load providers currently have will diminish as most of the negotiating power will shift to the storage providers.

Also, storage providers will experience sustained tailwinds from the continued adoption of solar as they profit from daily arbitrage opportunities. Because of their dramatically lower cost of production, the adoption of iron-air batteries should both lower cost of expansion and improve margins for their energy storage division.

Tesla achieves rather high margins for a manufacturer. As producers in other industries realize that the reason Tesla is achieving superior margins and return on capital is due to their preference for automated manufacturing, the demand for Tesla-style facilities should rise. The company could eventually open a subsidiary which establishes automated manufacturing facilities for other companies.

Conclusions

Normally, I refuse to place buy ratings on any company this overvalued. However, I believe the current UAW strike will provide continued tailwinds for Tesla, Inc.’s share price as it continues. Add to this the fact that they have a history of achieving unreasonably high valuations and its present valuation becomes less of a concern. This is one of the few occasions where I am willing to hand out a buy rating on a ticker when I am unable to clearly see that it’s trading below its intrinsic value. I believe Tesla has unrecognized long-term growth potential, so it potentially may have a hidden margin of safety.

Overall, Tesla, Inc. appears to be an extremely attractive investment because of their culture of adaptation and innovation. While I cannot guarantee that their current endeavors will lead to future moats, they have already established themselves as a premier EV producer and have the potential to find themselves with multiple high margin revenue streams. Although their margins have been contracting over the last several quarters, they have proven they are capable of producing attractive returns.

I believe Tesla stock is likely to become the long-term compounder that its present investors hope it will be. So even if buying at today’s prices ends up being a lackluster entry in the short or medium term, long-term Tesla, Inc. shareholders are unlikely to be punished for it.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.