Summary:

- Tesla, Inc. stock has always traded at a premium, which was (at least) partly justified by superior growth and margins.

- But recently, Tesla’s operational metrics have deteriorated and aren’t much better than the industry average anymore.

- Moreover, now is not the time to pay top dollar for the promise of future earnings from AI-related projects.

RoschetzkyIstockPhoto

Dear readers,

I started covering Tesla, Inc. (NASDAQ:TSLA) in September in an article titled Tesla: A Great Company At A Bad Price. I issued a SELL rating at $245 per share, because an expensive valuation made the risk-reward very unappealing to me. My conclusion was that the stock was priced for perfection, with a capped upside of 15-20% per year and a very possible 50% downside if margins contract further and revenue growth slows.

The company reported their Q3 2023 results recently, missing expectations with EPS of $0.66 vs forecast of $0.73, and showed significant slowdown in growth, as well as margins. As a result, the stock price fell by about 20% to $200 per share.

Part of my thesis has, therefore, materialized, but the stock continues to trade at a high valuation of 60x forward earnings and 6x forward sales. I find this troublesome, because recent earnings show that Tesla is more similar to a traditional car company than the bulls would have you belief. This exposes investors to a large potential downside if the valuation re-rates closer to the peer group which averages 13x forward earnings and 0.75x forward sales.

Why Tesla no longer deserves a premium

Historically, the Tesla stock has always traded at a significant premium relative to the rest of the EV sector. And by significant I mean forward P/E and forward P/S ratios 5-8x higher than its EV peers. The logical question is why.

I see two objective reasons:

1. Faster growth

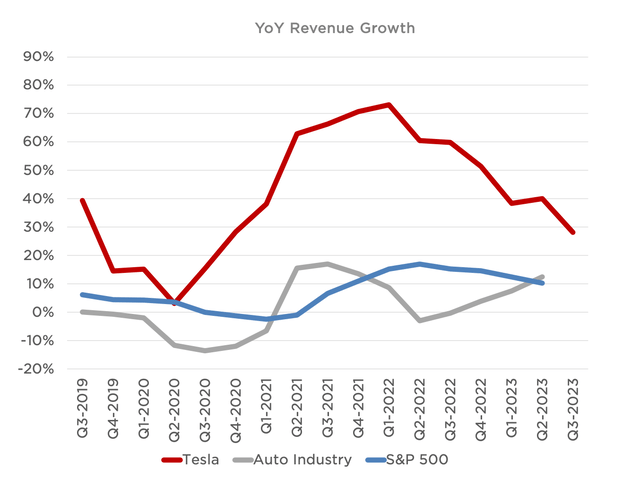

Tesla has been able to grow their car deliveries and revenues much faster than its peers. Historically, we’re talking 30-60% annual growth for Tesla vs 0-10% for its peers. In late-2021, the spread reached over 50% and at that point in time, it was fair to value Tesla at a significant premium.

But growth has slowed a lot since!

And actually even more than the chart below would have you belief. This is because the chart shows revenue growth over the trailing 12-month. So the most recent result of about 27% YoY growth compares the revenue between Q3 2022 – Q3 2023 and Q3 2021 – Q3 2022.

If we look closer, we’ll see that over the most recent quarter (Q3), revenue has grown by just 8.9% YoY, which is not much above the long-run average of the Auto industry. The slowdown in growth has therefore put Tesla much closer to its peers and the valuation should follow.

Moreover, a weakening consumer, high interest rates, geopolitical risks and the Cybertruck ramp-up (discussed later) are all likely to contribute to lower growth going forward. And at a valuation of 60x forward earnings, it’s really hard to see growth under 25-30% as acceptable.

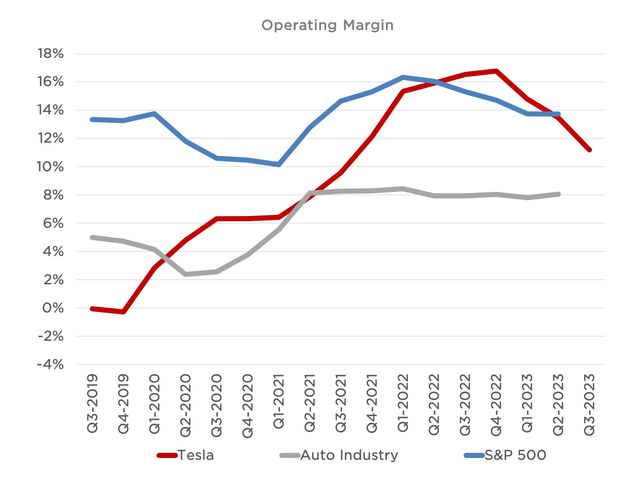

2. Higher margins

On a similar note, Tesla has also historically maintained significantly higher gross and operating margins over the years. But recently, due to weak consumer demand which has forced the company to decrease prices, the operating margin has reached just 7.6%. This is down from 10% last quarter and down from more than 15% last year. And the gross margin isn’t doing much better as it came in at 17.9%, down from 18.2% last quarter and from over 25% last year.

Note once again that the chart below looks at the trailing 12 months, but recent results put Tesla’s operating margin right in line with the sector average of 8%. In other words, Tesla is now no more profitable than a regular car company.

Moreover, I fear that margins might compress further in Q4 as the company tries to catch up to their annual deliveries target of 1.8 Million, which Elon Musk has confirmed. The target is achievable, but following a 7% QoQ drop in Q3, it will require very strong deliveries of 477k vehicles in Q4.

Additionally, the fact that Tesla is currently about to start deliveries of the Cybertruck will likely further pressure margins, as the production scale-up needs a lot of time and capital before it starts to make money. Musk has stated that it will take at least 12-18 months before the Cybertruck production becomes profitable.

So, following Q3 earnings, Tesla’s growth and profitability have declined substantially and now stands more or less in line with Auto industry averages.

Still, the valuation is nowhere near that of its peers. So, let’s look at one likely (subjective) reason why the premium exists:

3. Multiple promising (future) business lines

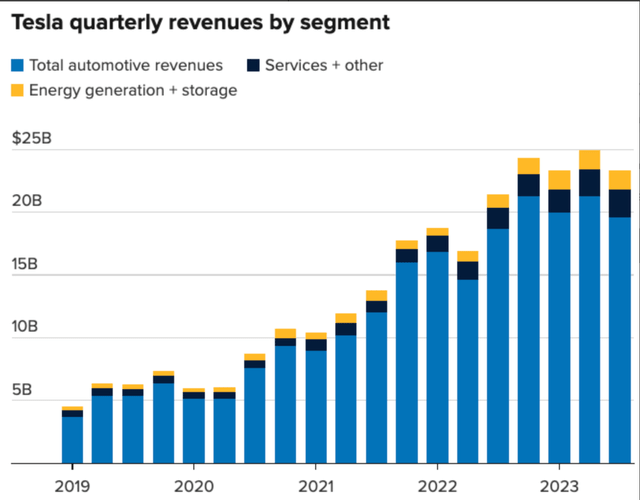

A large part of Tesla’s growth story has been that they’re not just a car company and will eventually have multiple business lines which will significantly enhance their growth and profitability.

It’s clear that management is focused on this part of the business as they spend about 75% of the earnings call discussing autonomous driving and the Dojo project. And if successful, these projects certainly could bring additional growth.

But I’m not comfortable paying for growth many, many years in the future which may or may not materialize. Especially at a time when interest rates are high, the consumer is weakening, and there are increased geopolitical tensions which negatively impact Tesla’s car business, but also their AI business as the vast majority of chips are manufactured in Taiwan.

For now, Tesla remains predominantly a car company as 85-90% of their revenues are generated from car sales. Consequently it should be valued, for the most part, as a car company. Some premium is justified here, given the asymmetric upside from autonomous self-driving and other AI-related projects that Tesla is working on, but not the 5x premium valuation currently priced-in.

Valuation

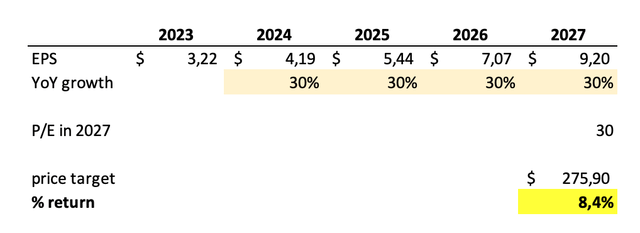

Following Q3 results, consensus estimates for 2023 EPS dropped from $3.45 to $3.22. Beyond this year, analysts expect annual growth of 25-35%.

My base case is quite optimistic and assumes that Tesla will deliver on their guidance and grow their EPS by 30% per year. That would put Tesla’s market share in 2027 at 25% in the U.S. and around 12% in Europe and China.

Assuming a 30x P/E exit multiple in 2027 yields a price target of $275 per share, or a total annual return of 8.4%. That’s very sub-par, even at a still-aggressive 30x multiple.

My bear case is that the company fails to deliver on their AI-related projects or that the development takes far too long. As a result, margins and revenue growth fail to recover and stay at levels commonly seen for car companies. While in this case, I don’t expect Tesla to fall all the way to the Auto industry average of 13x forward earnings, I continue to see at least 50% downside.

There are simply too many uncertainties regarding future AI-related projects to pay top dollar for them. Moreover, the car segment performance has deteriorated substantially over the past year, putting Tesla’s growth and margins in line with its peers.

I reiterate my SELL rating for Tesla and would only consider upgrading the stock at $100 per share, which would bump my expected annual return from 8% to 28%, while providing a sufficient margin of safety from the potential multiple downgrade.

Upside risks include a strong community of retail investors that like the Tesla story and aren’t as focused on fundamentals, increased demand for Tesla cars along with higher sale prices, as well as significant growth in monetization of non-auto segments.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to our Portfolio and all our current Top Picks, feel free to join us at High Yield Landlord for a 2-week free trial

We are the largest and best-rated real estate investor community on Seeking Alpha with 2,500+ members on board and a perfect 5/5 rating from 500+ reviews:

![]()

You won’t be charged a penny during the free trial, so you have nothing to lose and everything to gain.