Summary:

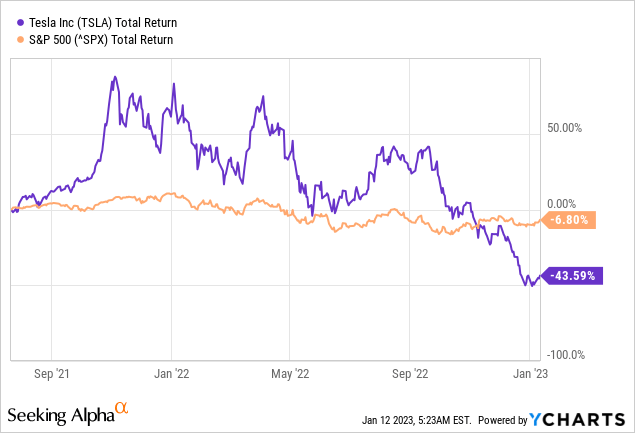

- Tesla’s disastrous performance over the past year has resulted in the company no longer being among the Top 10 largest U.S. public companies.

- Market commentators remain laser-focused on business fundamentals, while outside factors are still in the driver’s seat.

- Tesla does not appear to be a bargain, unless we see yet another wave of liquidity flowing into equity markets.

Justin Sullivan

Back in April of last year (less than a year ago) the optimism on Wall Street was running high. Valuations of some businesses were so exuberant, that even the phrase ‘optimism was running high’ sounds like an understatement.

At that time, everyone who was sounding the alarm that valuations are too detached from reality and that this whole bull market was caused by unsustainably loose monetary policy, was either ignored or proclaimed to ‘not understand’ this new reality of technological advancement and breakthroughs.

As it happened (and as it always does), the euphoria soon died and with that the largest beneficiaries of the excessive liquidity provided by the Federal Reserve were hit the hardest. There are countless examples, but here I would like to focus on by far the largest in absolute terms – Tesla (NASDAQ:TSLA).

Falling Out Of The Top 10

The reason why I chose April of last year in the first paragraph is because at that time, the Top 10 largest components of the most widely-used index – the S&P 500 were as follows:

| Company (Symbol) | Index Weighting: |

| 1. Apple Inc. (AAPL) | 7.1% |

| 2. Microsoft Corp. (MSFT) | 6.0% |

| 3. Amazon.com, Inc. (AMZN) | 3.7% |

| 4. Tesla, Inc. (TSLA) | 2.4% |

| 5. Alphabet Inc. Class A (GOOGL) | 2.2% |

| 6. Alphabet Inc. Class C (GOOG) | 2.0% |

| 7. Nvidia Corp. (NVDA) | 1.8% |

| 8. Berkshire Hathaway Inc. (BRK.B) | 1.7% |

| 9. Meta Platforms, Inc. Class A (META) | 1.3% |

| 10. UnitedHealth Group Inc. (UNH) | 1.3% |

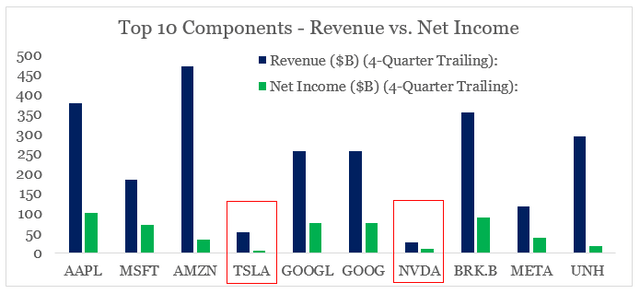

There were a number of anomalies associated with the list above. Firstly, the 10 largest components (9 companies) of the index were almost exclusively technology names. Secondly, the amount of concentration within the index was near an all-time high with the nine companies listed above making almost 30% of the whole index. Finally, Tesla and Nvidia (NVDA) were the biggest outliers with the lowest amount of revenue and profits at the time.

prepared by the author, using data YCharts

That is the main reason why both companies are not part of the Top 10 anymore, while all other tech names are still within the largest companies by market cap (with the exception of Meta).

On both occasions, I wrote extensive thought pieces on why share prices of these two companies have become detached from the current economic reality.

- In September of 2021, I wrote “Nvidia: Fundamentals Matter Less Than Ever“, where I concluded the following:

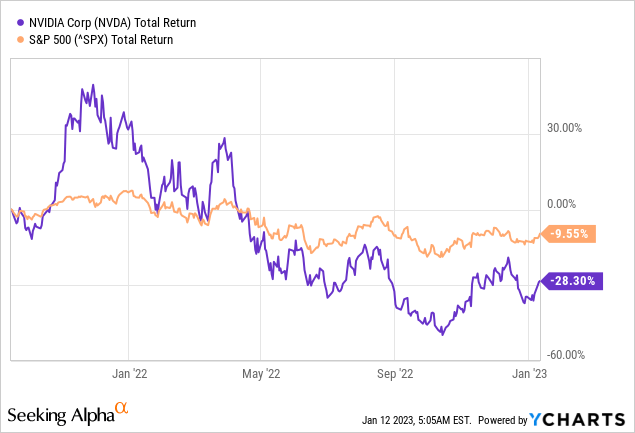

Nvidia was one of the growth stocks that benefited the most from the recent drop in interest rates and as such is at the highest risk of a sharp reversal, should bond yields normalize.

Source: Seeking Alpha

Since then, not only did Nvidia massively underperform the broader equity market as the monetary policy began to normalize, but also it experienced significant volatility in the process.

- A few months prior, in July of 2021 I wrote ‘Tesla: The Narrative Bias‘, where the analysis led me to the following conclusion:

(…) shareholders should be careful about picking the right periods to increase their stakes in the company as either a sustained rotation into value stocks or a sharp reversal of the momentum trade could easily spell a disaster, even if the company continues to execute well on its current strategy. Shareholders should also pay close attention to overall market liquidity and real interest rates, as an extreme level of market intervention has put Tesla in a spot where market wide forces are more important for its valuation than the company’s own financial performance.

Source: Seeking Alpha

Although shareholders were rejoicing for a brief period of time, TSLA’s performance since then has been far worse than that of Nvidia.

As a result, bulls now see TSLA as a bargain given the past highs in the share price, while bears are doubling down on their thesis that TSLA has further downside.

Although there are some good arguments to be made in both camps, the reality is that both sides are wrongfully attributing TSLA’s recent and next year performance to changes in business fundamentals.

Making Sense Of The Whole Monetary Experiment

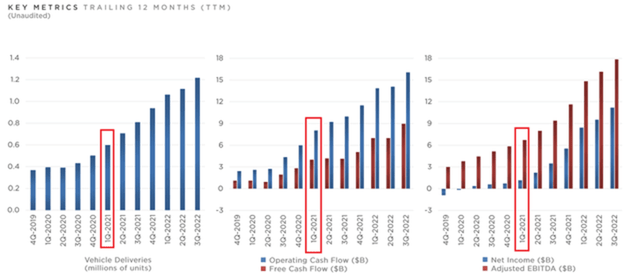

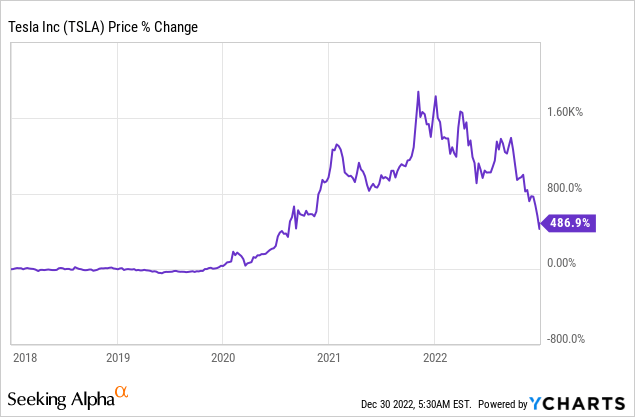

At the time I wrote my analysis on Tesla, the company’s deliveries, operating cash flow and net income were far below their current levels (see red markings below).

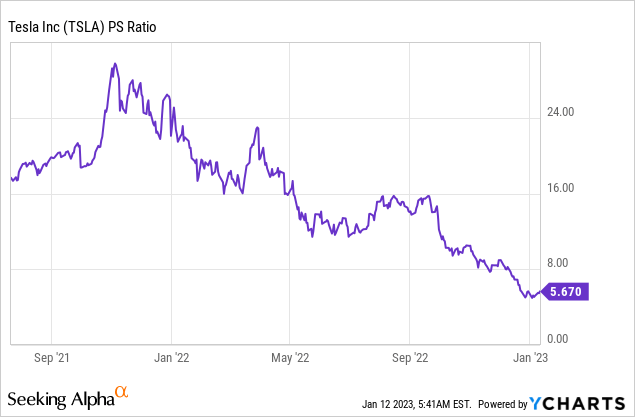

Even though, Tesla appears to be in a much better position currently (in spite of the potential demand cool-off), the share price went from trading at nearly 30-times sales to roughly 5-times sales.

That is why, many people now believe that provided that Tesla resolves its current problems and demand issues, it could quickly recover to its previous highs. This, however, does not appear to be the case as the level of excess liquidity within the markets is by far the most important driver of Tesla’s share price and although it affects all publicly traded equities, the role it plays in Tesla’s share price returns is far greater.

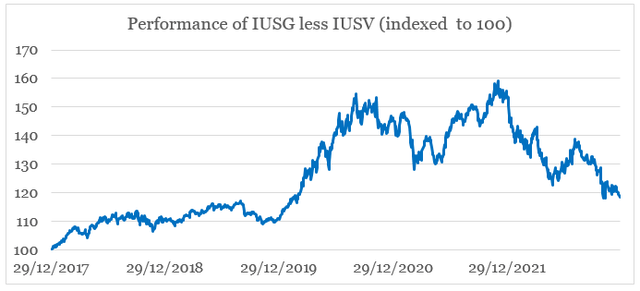

To illustrate that, back in July of last year, I used an index constructed by taking a long position in the iShares Edge MSCI USA Momentum Factor ETF (MTUM) and a short position in the iShares Edge MSCI USA Value Factor ETF (VLUE). Due to the recent rebalancing of MTUM to include more value stocks within it, I now use iShares Core U.S. Growth ETF (IUSG) and iShares Core S&P U.S. Value ETF (IUSV) respectively.

The performance of the IUSG less IUSV index over the past 5-year period (indexed to 100 in the beginning of the period) is shown below.

prepared by the author, using data from Seeking Alpha

The return profiles of the index and TSLA are remarkably similar and only differ by Tesla’s far more violent movements – both on the upside and the downside.

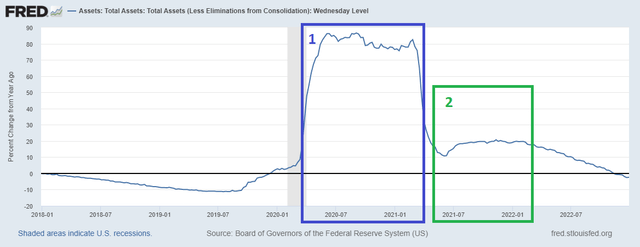

These movements were caused by the massive influx of liquidity following the pandemic of 2020. The first leg of the rally came as a result of the initial monetary response to the pandemic and the second one came in the second half of 2021 as the quantitative easing reached its peak levels.

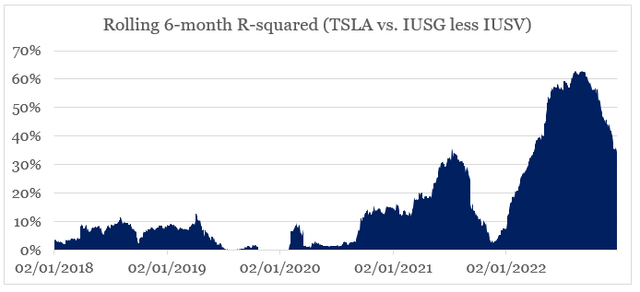

It is hardly a secret that high growth and momentum stocks were by far the biggest beneficiaries of this development, however, Tesla’s share price exposure to the momentum trade has increased dramatically. In the graph below, we could see the rolling six-month R-squared between Tesla and the IUSG less IUSV index.

prepared by the author, using data from Seeking Alpha

What we notice is that the expansion of the Federal Reserve’s balance sheet had a lagging effect on the R-squared between the two variables of roughly six months. Moreover, the relationship between the two remains extremely high (even though it has been declining) and with that Tesla’s share price remains under the influence of broader market forces.

Conclusion

The road ahead for Tesla shareholders remains challenging. Over the coming year, returns will continue to depend heavily on decisions made in Washington, D.C. and not at Tesla’s headquarters. Provided that the Federal Reserve does not reverse its course of monetary tightening anytime soon, there’s likely more pain ahead. What’s even worse is that unless we see another massive influx of liquidity entering the equity market, it will take years of outstanding business performance until Tesla’s share price comes even close to its past highs.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author’s opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including a detailed review of the companies’ SEC filings. Any opinions or estimates constitute the author’s best judgment as of the date of publication and are subject to change without notice.

Looking for better positioned high quality auto manufacturers?

Looking for better positioned high quality auto manufacturers?

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning. The opportunities laid out in the service also capitalize on inefficiencies in the market associated with short-termism, momentum chasing and narrative driven expectations. For more information follow the link provided.