Summary:

- Tesla, Inc.’s Q3 ’24 earnings exceeded expectations with strong revenue growth and margin improvements, driven by energy generation & storage.

- Tesla may realize significant economies of scale through the release of its Cybercab and its low-cost models. Margins may compress in the near-term as the firm ramps up production.

- Tesla is nearing the completion of an entirely independent autonomous ecosystem driven by its internally developed AI.

Yagi Studio

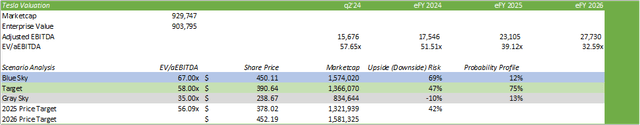

Tesla, Inc. (NASDAQ:TSLA) outperformed the market’s expectations in its Q3 ’24 earnings, with strong revenue growth paired with significant margin improvement. As CEO Elon Musk lays out Tesla’s project plan to deploy FSD (“full self-driving”) and its driverless vehicle fleet, the firm is realizing significant economies of scale in its Energy Generation and Storage segment. Looking ahead past eFY24, I believe Tesla will realize strength in both this segment as operations scale in Shanghai, as well as its Automotive segment through the release of its low-cost electric vehicle. Given the strong outlay for the company, I am upgrading my rating to a STRONG BUY with a price target of $378/share at 56x eFY25 EV/aEBITDA.

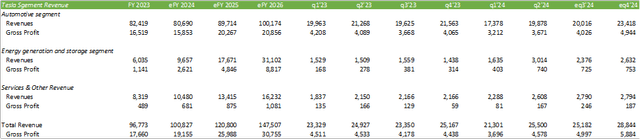

Tesla Operations

Tesla outperformed the broader automotive industry with significant improvements to its operational performance in q3’24 with 6% growth in total vehicle deliveries.

Elon Musk suggested in the Q3 ’24 earnings call that the firm remains on track to deliver more affordable models in e1h25. This can potentially be a major catalyst for vehicle volumes sold, as price is one of the biggest impediments for consumer adoption of EVs. For example, Ford (F) experienced a strong tailwind in Mach-E sales in q1’24 after marking the selling price down by -17%.

Nonetheless, Tesla has been successful at selling profitable vehicles notwithstanding the markdowns over the years. Mr. Musk is expecting volumes to grow by 20-30% in eFY25 with the lineup of low-cost vehicles. Given the improvement in margins in Q3 ’24, one needs to consider whether these lower-cost vehicles will be margin accretive. The fleet, after incentives, is expected to cost consumers under $30,000 per vehicle, making this vehicle cost-competitive with internal combustion models. I believe margins, in part, will improve going into the end of eFY24 as the Cybertruck ramps up production and will likely offset some margin decay as Tesla rolls out its low-cost vehicles.

Looking out to eFY26, Tesla should be rolling out its first round of the Cybercab with 2-4mm units per year at $25,000 per unit. Given the autonomy of the vehicles, I believe that the rollout may impact margins head-on with a higher fixed cost but will quickly normalize as the only direct costs for the program will be electricity, replacement parts, and software development. Between Tesla’s fleet and customers’ vehicles, I believe the Robotaxi program will be a successful addition to Tesla’s operations and may have a significant positive impact on margins over time.

Management also updated their outlook for the semi-truck in the Q3 ’24 earnings call. The firm has deployed the capital investments to the factory based in Reno and should begin ramping up production in e1h26 and ramp to its full run rate throughout the back half of the year. The next generation of semis will have the full capabilities of FSD, allowing for enterprises to automate their entire fleets. If the rollout goes according to the provided timeline, which may get pushed back a few quarters or years, this can be a major step for Tesla and the logistics industry. Given that range anxiety can be a limitation for an electric fleet, especially when considering long-distance manned vehicles, I believe Tesla can create a network of measured charging stations throughout the plausible routes to optimize range and deliverability. I have reason to believe that utilizing of FSD by the semi fleet will result in time to charge becoming a dead issue, as a human driver will be removed from the equation. This would result in logistics operators only having to consider the total cost to operate the vehicle.

One step before full autonomy is rolling out v12.5 with Actually Smart Summon on the EV fleet. This will be a major step in terms of the transition from supervised self-driving to autonomous driving for the vehicle fleet. Actually, Smart Summon acts as a valet in which a driver can call for their vehicle in a private parking lot, allowing for the vehicle to pull out of the parking spot and relocate to its owner. This is a baby step in the grand scheme of things as the firm ramps up towards fully unsupervised, self-driving capabilities.

Tesla also experienced significant growth in its Energy Generation & Storage segment, driven by strong demand for its Megapacks and Powerwalls. As noted on the q3’24 earnings call, production at the Lathrop Megapack Factory in Lathrop, California, has reached 200 Megapacks per week and has now scaled to a 40GWh annual run rate. Once the Shanghai factory is ramped up, Mr. Musk anticipates 100GWh per year of production of stationary storage.

In terms of internal operations, Tesla should be completing its 50,000 GPU cluster at its Texas gigafactory by the end of October. Having this facility built out and utilized may have the capability to reduce compute costs as Tesla will no longer need to rely on the hyperscalers for GPUs and cover related consumption costs. Completing the cluster drove capital investments for Q3 ’24 to reach $3.5b and has pushed management’s guidance to $11b for eFY24.

The internal cluster will be leveraged to further develop FSD, Optimus, and potentially interconnect the entire ecosystem of the software and hardware fleet. My speculation is that the cluster at the Texas gigafactory will act as the brain, the Starlink satellite fleet as the network, and the vehicles and humanoid robots as the endpoints. If this is the case, the entire Tesla ecosystem will be totally self-contained and depend on no outside forces. On top of this, Tesla’s solar panels and Megapacks can create a self-sustaining power ecosystem to fuel the fleet of Cybercabs at their respective charging stations.

Tesla Financial Position

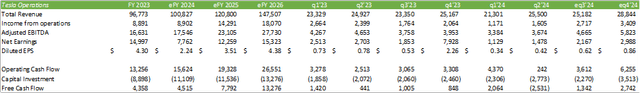

Looking out to the duration of eFY24, I’m forecasting Tesla to generate $100b in total revenue, driven by growth in Energy Generation and Storage & Services. Looking out beyond eFY24, I believe Tesla has a strong opportunity to capitalize on the lower-cost vehicle sales paired with a strong tailwind in its Energy Generation segment.

Given the strong uplift in margins in q3’24, I believe that Tesla has a case for a return for stronger margins as it scales production of the Cybertruck. The Cybercab fleet may have some impact to margins as the fleet is developed and rolled out; however, I believe the cost-effective model and Energy Generation may create a durable baseline to offset costs associated with the ramp-up.

For eFY24, I’m forecasting Tesla to generate a diluted EPS of $2.24/share. I’m forecasting free cash flow generation to come in ahead of consensus estimates at $4,515mm for the year, with the assumption that capital investments will come in at around $11b for the year.

Risks Related To Tesla

Bull Case

In the near-term, Tesla is scaling up its Energy Generation and Storage capacity, with its Shanghai facility commencing operations in tandem with scaled capacity at its domestic site. For Automotive, Tesla offers independent financing rates that may be more appealing to consumers when compared to the bank rate, allowing for consumers to purchase and finance their vehicles at a more appealing price. With the rollout of a cost-effective model, I believe the lower-income band consumers will have access to the EV market, allowing for Tesla to expand its exposure to the total market of vehicle owners.

My long-term outlook is more bullish with the addition of its robotaxi fleet under its autonomous umbrella. Given that Tesla will have near total control of its ecosystem, I believe that the firm will have stronger control over costs and have the ability to deploy mobility more efficiently than otherwise. Because the question isn’t if but when, this long-term outlook isn’t necessarily fully baked into my model. Pending regulatory approval, I believe complete mobilization of autonomous vehicles may continue through the latter end of the decade.

Tesla is also nearing the finish line in its humanoid robot, Optimus, as showcased at the Robotaxi Event on October 10, 2024. Though I believe that Elon Musk is looking at the addressable market a bit too optimistically, this product has a major potential for Tesla. It could both optimize internal operations and to be leveraged in the manufacturing and materials industries. I do expect some personal use cases for Optimus; however, I do not expect personal adoption of the robot to take form far after corporate utilization.

Bear Case

Tesla will be ramping up production of its low-cost model in eFY25, which may add pressure to margins through the ramp-up as well as price/cost dynamics. Geopolitical tensions may add pressure to Tesla’s operations in China and how the firm does business in the country going forward if tensions were to escalate. Given that regulatory approval will be the hang-up for its robotaxi fleet, the ramp-up and rollout may be pushed out further than anticipated, leading to tighter margins before deployment.

Valuation & Shareholder Value

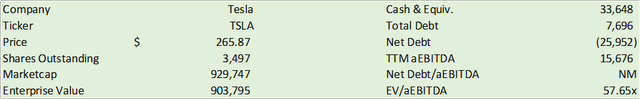

TSLA shares reacted poorly post-Robotaxi Day, with a major rebound post-Q3 ’24 earnings. I believe the price action post-earnings was driven by the significant improvement to margins and strong cash flow generation.

Looking out, I believe TSLA shares can provide significant upside potential as projects begin to materialize. Timing will be a major factor whether they will be impactful on the firm’s operating statement and will likely impact the share price in the short term. I believe the company has a strong long-term outlook that will be reflected in the share price over time. For eFY25, I’m upgrading my rating to a STRONG BUY with a price target of $4378/share at 56x eFY25 EV/aEBITDA. If the project outlay is successful for eFY26, my long-term price target is $452/share at the same valuation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.