Summary:

- Tesla, Inc. has surprised markets with a robust Q2 2023 delivery beat that outperformed consensus estimates by wide margins.

- The results underscore that Tesla’s touch-and-go volumes-over-profitability strategy this year, ladened by aggressive price cuts, is starting to payoff.

- While the price cuts will inevitably eat into Tesla’s near-term vehicle profit margins, the resilient volumes during Q2 2023 justify optimism for longer-term compensation through the lifetime value on vehicles sold.

- Q2 delivery volumes also put Tesla’s full-year delivery target of 1.8 million vehicles within reach.

Sundry Photography

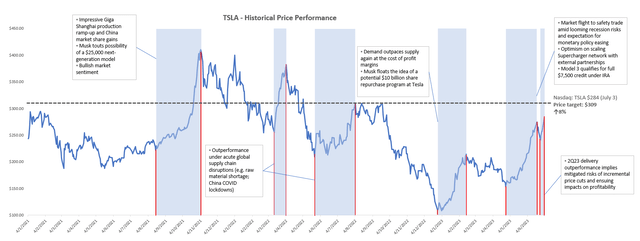

Admittedly, the Tesla, Inc. (NASDAQ:TSLA) has remained one of the most fundamentally overvalued names in the market, sustaining a lofty valuation premium through even the toughest of times within its internal operations and across the broader macroeconomic environment. And there has been no surprise to that, as markets remain optimistic about the electric vehicle (“EV”) maker’s leadership in pioneering a revolutionary transition to electric, while also boasting a strong balance sheet with sustained profitability.

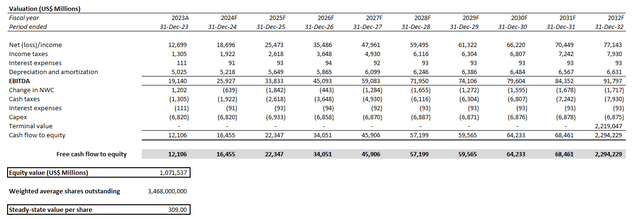

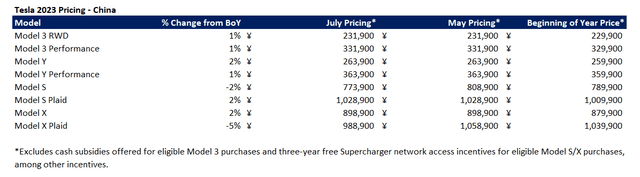

In our previous coverage on the stock, we had dived into gauging the implications of its valuation at current levels. The eyewatering rally observed in recent months has taken the estimated implied perpetual growth rate of the underlying business’ cash flows to 8%, despite looming concerns over the durability of Tesla’s profit margins amid recurring price cuts, as well as the potential impact of impending recessionary pressures over its demand environment. Yet, despite our recognition of market’s flight-to-safety sentiment amid elevated borrowing costs and persistent inflation buoyed by the resilient labor market, which we believe to have been a key charge to Tesla’s rally this year (contrary to benefits of the AI frenzy), we had stayed incrementally cautious of impending risks to the underlying business’ near-term fundamental prospects given cyclical headwinds.

However, Tesla’s record-setting delivery numbers (466,140 EVs) released for the second quarter have effectively assuaged the incremental caution by demonstrating unmatched resilience against deteriorating macroeconomic conditions that could impact its demand environment – as long as the price is right. Tesla’s record quarterly sales, which beat consensus estimates by wide margins, underscores that it has found the right balance between all of pricing, demand, and profitability across its core markets spanning the U.S., China and Europe. And in addition to being a barometer for EV demand and adoption, Tesla’s outsized reacceleration in delivery volumes observed during the second quarter also underscores consumer resilience in the industry despite brewing weakness in broader autos.

While Wall Street is turning increasingly cautious on Tesla’s valuation outlook at current levels – and reasonably so, given lofty premiums typically call for incremental catalysts to maintain durability – the company’s delivery outperformance and narrowing inventory build-up are likely to bolster the flight-to-safety trade that has been driving the stock. The blockbuster delivery number also brings to light that while price cuts will inevitably impact its profit margins in the near-term, Tesla continues to gain market share and reinforce its industry leadership, which is critical to ensuring optimization of the anticipated lifetime value per customer and drive longer-term durability to its balance sheet strength. The record-setting quarterly deliveries also differs from signs of demand weakness in the preceding quarters despite recurring price cuts, which assuages investors’ wariness for incremental slashes to global Tesla vehicle MSRPs to come, alleviating some of the ensuing pressure on Tesla’s profitability outlook.

Taken together, we believe Tesla’s bull case has only gotten stronger as it kicks off the second half. Although visibility into broader macroeconomic conditions remain low, as inflation remains elevated and borrowing costs are set to rise further, Tesla’s outsized second quarter delivery numbers are providing clarity on its resilience and ability to weather through potential demand risks better than its auto peers. This marks a shift in the narrative from just three months ago when record first quarter deliveries were helped by only a slim growth rate, which did little to prove durability to Tesla’s market share gains in proportion to the aggressive price cuts levied across its global line-up.

The lack of visibility into the monetary agenda and the broader economy is fueling market demand for names with quality fundamentals, which Tesla’s robust second quarter delivery growth is evidence of, underscoring that its risky volume-over-margins strategy appears to be paying off. With auto margins (ex-credit sales) still sitting comfortable in the double-digit zone to bolster its cash-generous balance sheet, and sales set for growth in the 20% range this year despite a dynamic pricing strategy, the Tesla stock remains a favorable tech haven, underscoring a rally that potentially still has legs.

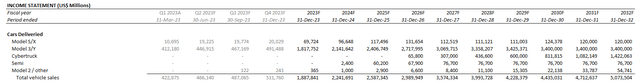

Tesla Q2 2023 Volumes

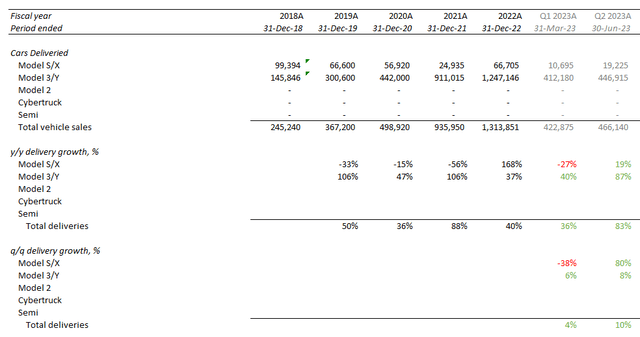

Tesla reported deliveries of 466,140 vehicles during the second quarter, up 83% y/y (recall acute demand headwinds in PY due to China’s COVID restrictions) and 10% q/q. In addition to acceleration in take-rates for the best-selling Model 3/Ys, the premium Model S/Xs have likely benefited from purchase incentives offered during the second quarter as well. Delivery volumes for the premium models during the period returned to growth at 80% q/q, putting the preceding two consecutive quarters of sequential declines to rest.

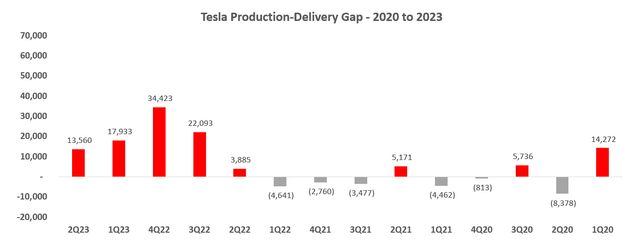

The robust delivery volumes also made a difference in Tesla’s accruing inventory levels – the lead in production volumes to units delivered during the second quarter has reduced to the 13,000-level, down from close to 18,000 in prior quarter and more than 34,000 exiting 2022. The improvement underscores that incremental output from the EV maker’s new and expanded manufacturing facilities continue to get absorbed by resilient market demand, especially as Tesla finds a balance in ongoing price adjustments to changing consumer sentiment amid rising borrowing costs and inflationary pressures that have weighed on discretionary spending.

Striking a Three-Way Balance between Pricing, Demand and Profitability

Tesla’s strong second quarter delivery figures underscore a dynamic pricing strategy that is starting to pay off as it finds balance with market demand and operating profitability. Instead of the slim 4% sequential growth rate in total delivery volumes observed during the first quarter, ladened by persistent declines in the premium segment and only modest gains in the lower-priced models despite MSRP cuts across the board, the reacceleration to 10% during the second quarter implied a much more durable demand environment, marked by both annual and sequential increases in take-rates for all models.

In addition to a dynamic pricing strategy that has continued to be more volatile than usual during the second quarter, Tesla has also offered several purchase incentives to customers – spanning free charging and rebates – in addition to government policy support, such as subsidies via the Inflation Reduction Act in the U.S., and federal tax breaks alongside local government incentives for EV purchases in China. Although consumer price elasticity remains an uncertainty, especially amid deteriorating financial conditions, the combination of price cuts and incentives appears to have finally led Tesla to a balance in its risky volume-over-margins strategy during the second quarter, providing just enough of an adjustment to MSRPs across the board to address affordability concerns while also retaining profitability. It marks a successful toggling of pricing metrics that few of its rivals – both EV upstarts and legacy incumbents – can afford given persistent losses in their respective transitions to electric, and the significant investment outlays amid the elevated cost of capital environment.

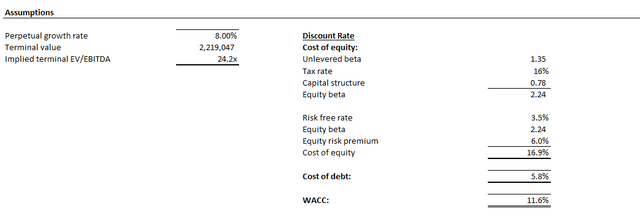

U.S.

Specifically, in the U.S., Tesla has implemented incremental price cuts across some of its best-selling models, alongside additional incentives, during the second quarter to reduce inventory and retain demand amid a weakening economic outlook. Tesla’s reaccelerated volumes amid a slowing market is an impressive feat, defying recent data that shows a “decrease in real spending on goods [which] largely reflected a drop in purchases of motor vehicles.”

Data from Tesla’s U.S. sales website

The price cuts have averaged 20% this year before Tesla was able to shore up demand with durability. While Model 3 prices have stayed the most resilient, the best-selling model has benefitted from the most incentives, spanning three months of free Supercharger network access offered in mid-June for deliveries by June 30. The incentive adds another $170 discount to the MSRP, considering the estimated monthly average spent on EV charging at $56 (potentially higher for fast-charging offered by the Supercharging network). Paired with the $7,500 purchase incentive under the IRA, customers can walk away with the a Model 3 at a final price in the low $30,000-range, which undercuts the average EV price at about $55,000 by more than 40%.

The starting price, inclusive of incentives, for the standard Model 3 with 272 miles of range per charge also bodes competitively amongst comparable models in the U.S., such as the Mini Cooper SE which starts at $30,900 with only 114 miles of range per charge and Nissan Leaf which starts at $28,040 with 149 miles of range. And with the starting MSRP after incentives sitting comfortably within the average American household annual income of $65,000, Tesla’s Model 3 has renewed its reputation as a mass market share penetrator for another while as CEO Elon Musk holds off on unveiling a $25,000 model.

Meanwhile, setting the prices for its premium models at tops in the low $100,000 range (Tesla had been offering incremental discounts of more than $7,500 on the Model S/X purchases during the last two weeks of June), with incremental government incentives likely pushing the consideration down to the five-figure range, is also gaining traction amongst the one-third of American households that take home more than $100,000 a year. This is further corroborated by the drastic sequential acceleration in Model S/X delivery volumes observed during the second quarter.

While the incremental price cuts and incentives in the U.S. have likely squeezed auto margins (ex-credit sales) further, they have likely remained in the mid- to high-teens, which is still competitive amongst legacy automakers such as Ford (F) and GM (GM).

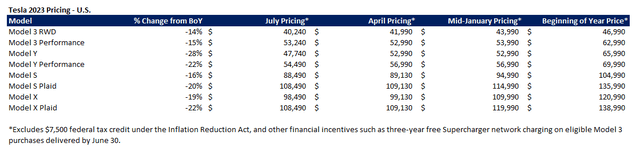

China

Meanwhile, in China – Tesla’s second largest market – the EV titan’s dynamic pricing strategy is also finding better ground in fending off stiff competition from local automakers such as BYD Company Limited (OTCPK:BYDDF, OTCPK:BYDDY), as well as upstarts like Li Auto (LI), XPeng (XPEV) and NIO (NIO). While the industry had earlier voiced concerns that the heightening price war might give consumers “perception that car companies will continue to cut prices” and counter-act aims at shoring up demand, record delivery numbers from both Tesla and BYD – two of the region’s EV juggernauts – during the second quarter underscore a resilient demand environment, and additionally, robust traction for the two names as they outperform rivals that have also latched onto the price cutting trend.

They have also defied concerns about the looming challenges of a mixed post-COVID recovery in China that looks to be in urgent need of incremental government aid to stimulate the economy. Official data from the government shows passenger car sales in China are expected to have declined by 6% y/y last month, reversing gains observed in the two months prior as post-COVID spending loses steam.

While the Chinese government is eager to support its auto market – particularly its new energy vehicle market – via “targeted policies and measures” that would improve consumer access to auto financing, and overall affordability (e.g., federal level tax breaks; local government level subsidies), there has been little follow-up on the incremental aid so far to stem deceleration. In the meantime, BYD and Tesla remain top players in the industry to plough through with aggressive price cuts and purchase incentives offered to their customers, and compensate for what public incentives lack in buoying auto demand in the region.

Our view is that while markets remain optimistic about additional stimulus – whether they are specific to the auto industry or for the broader economy – from the Chinese government within the near-term, Tesla’s second quarter delivery results have proven that they can do just fine without, and only better with, especially as it masters the trade-off between pricing-demand-profitability in the competitive Chinese EV market. This is further corroborated by Tesla’s ability to reverse some of the aggressive price cuts implemented across its best-selling Model 3/Ys in early May, in exchange for moderate cash subsidies, likely without having to compromise too much on sales volumes considering the impressive consolidated second quarter delivery numbers. Recall that the Model 3/Y are the highest margin models for Tesla – especially for units churned out from Giga Shanghai – thus resilience in both pricing and demand are positive signs for the company’s fundamentals.

Data from Tesla’s China sales website

Meanwhile, retreating the incremental price cuts to the premium Model S/X line-up this week after slight increases to their respective MSRPs in early May underscores the ongoing challenge of competition and impact of deteriorating consumer sentiment in the Chinese market. Tesla has also leveraged its Supercharger network again as a mean to boost premium model take-rates in the region – the company has been offering three years of free charging on the network for Model S/X purchases between May 5th and September 30th, further lowering the total cost of ownership on premium models for prospective buyers. We believe Tesla’s use of both nominal price fluctuations alongside incremental incentives is a prudent strategy to gauge consumers’ price elasticity for EVs in China, while also mitigating risks of meaningful margin contraction. By offering free charging as an incentive, Tesla is able to preserve auto gross margins (ex-credit sales) while also improving utilization on its Supercharger network and contribute to economies of scale for the service over the longer-term.

Fundamental Considerations

The persistent trend of price cuts at Tesla this year is likely starting to find stability given adequate demand response observed during the second quarter. This is likely to mitigate risks of further price cuts and, inadvertently, erosion into profitability within the foreseeable future as Tesla continues to favor sales volumes.

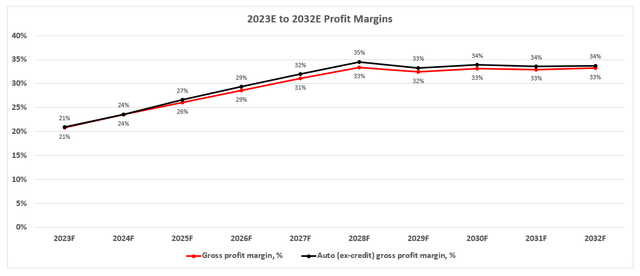

Recall that Tesla’s auto gross margins (ex-credit sales) have falling from the 30% range at peak earlier last year, to the high-teens during the first quarter, due to the combination of new manufacturing facility ramp-up costs, as well as the ongoing price cuts. This had added to investors’ angst late last year, as much of the stock’s premium had historically been priced on optimism over Tesla’s industry-leading auto production margins, complemented by its leading global market share of EV sales. Meanwhile, the widening gap between production and sales volumes towards record levels also suggested emerging demand risks. Yet, improvements observed this year as explained in the earlier section indicates that the price cuts are reaching a state of relative equilibrium. Tesla’s “cost leadership” in EV manufacturing has continued to come through in ensuring its dynamic pricing lever is not going to push the company into losses like its rivals.

Additionally, a point often overlooked is the lifetime value of Tesla vehicle sales. In addition to full self-driving (“FSD”) subscription sales that have no definitive timeline on realization into revenue due to mounting regulatory hurdles for Level 4/5 autonomous mobility, Tesla vehicle sales are also source to adjacent revenue streams such as in-vehicle infotainment subscription sales and Supercharging network sales. As vehicle sales volumes continue to grow – albeit at lower profitability in the near-term – adjacent revenue streams would benefit from additional demand at incrementally lower marginal costs over the life of the vehicle.

Unlike legacy automakers and pureplay EV upstarts available in the market today, Tesla currently boasts the best “after point of sales value” for each of its vehicle’s owners – almost like the best smartphone benefitting from the strongest app sales, but on wheels. In addition to FSD, Supercharger utilization is rapidly ramping up, helped also by Tesla’s recent decision to open up its North American network to a broader population of EVs. Tesla owners are typically subscribed to other connectivity services, such as in-vehicle WiFi access and satellite-view maps, representing another high-margin recurring revenue stream for Tesla over the longer-term. In some regions – such as Texas, California and Illinois – Tesla is also offering insurance for its vehicles. Taken together with its leading global EV market share and manufacturing cost leadership, the near-term contraction to auto sales margins due to price cuts is unlikely to be a permanent loss of income, supporting that Tesla’s focus on “growing volumes is still the right decision”. Continued success in maintaining elevated EV delivery volumes could also bolster longer-term acceleration in Tesla’s energy generation and storage segment sales, which would improve scale to the emerging recurring revenue stream buoyed by both service subscriptions and hardware sales.

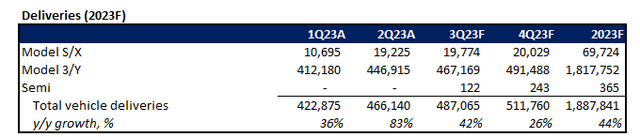

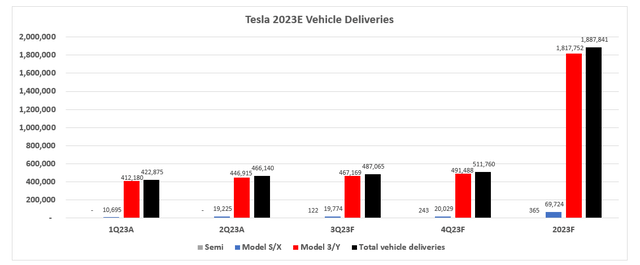

And recent delivery volumes that show Tesla is finding a balance in this risky strategy marks another step in the right direction that will likely benefit the stock further by increasing investors’ confidence amid the mixed market climate. Having delivered more than 889,000 vehicles in the first half of the year, Tesla is bolstering market’s confidence in its ability to meet or outperform its full year sales guidance of 1.8 million vehicles. Historically, Tesla’s EV sales in the second half of the year have been strongest, averaging more than 30% of full year sales based on observations from 2019 through 2022.

Despite the lack of visibility into the global economy and auto demand environment for the remainder of the year given market headwinds, Tesla’s delivery volume improvements in the second quarter shows it is adjusting well to consumers’ sensitivity to prices, which reinforces its prospects of repeating another year of stronger second half sales. Tesla’s robust second quarter delivery volumes are increasing our confidence in the bull case scenario where full year sales could near 1.9 million vehicles, and represent another catalyst for further charging investors’ confidence in the stock.

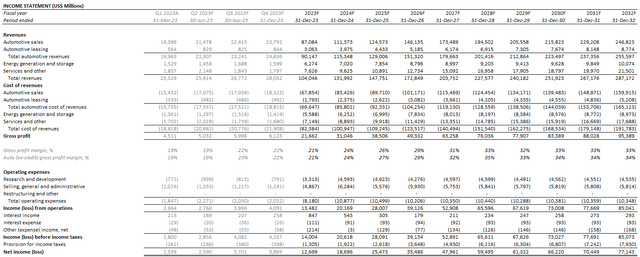

Meanwhile, as the average vehicle selling price remains modest amid Tesla’s continued exertion of its dynamic pricing strategy to boost volumes, we expect auto gross margins (ex-credit sales) to have remained in the teens during the second quarter, with modest improvements back towards the 20% range in the second half as ramp up improvements continue at the new manufacturing facilities, alongside impacts from other federal incentives under the IRA. Auto gross margins (ex-credit sales) are estimated to return to the 30% range with durability in the latter half of the decade, helped by the continued ramp up of EV sales as cyclical tailwinds return to boost secular growth opportunities, incorporation of the lower-cost next-generation EV platform, and a supply chain advantage underpinned by long-term material contracts at favorable pricing, as discussed in a previous coverage.

Tesla_-_Forecasted_Financial_Information.pdf

Valuation Analysis

On the valuation front, we expect Tesla’s second quarter outperformance on delivery volumes to have bolstered the flight-to-safety trade on the stock amid a broader market climate that lacks visibility. While holding our previously estimated implied perpetual growth rate constant at 8%, and applying a WACC of 11.6% to Tesla’s projected future cash flows in conjunction with the fundamental forecast explained in the earlier section, the stock could potentially enter the next phase of its rally towards the $300-range. This would represent upside potential of about 8% from the stock’s current price at about $284 apiece (July 3).

Given expectations that the flight-to-safety trade will remain the continuing theme for the broader market amid mounting costs of capital and persistent inflationary pressures, the application of a premium 8% implied perpetual growth rate on Tesla’s projected cash flows is in line with levels observed across its mega-cap peers that have exhibited the highest quality fundamentals and strongest balance sheets to weather through the looming storm. For instance, NVIDIA Corporation (NVDA), which has been helped by an incremental AI boost that we do not think Tesla has been a key beneficiary of, is trading at an estimated implied perpetual growth rate of more than 10%, while Amazon (AMZN) nears 7% and Apple (AAPL) at approximately 4.2%. All of which are trading at an implied perpetual growth rate that exceeds the anticipated pace of economic growth within their core operating regions, and defies their respective exposures to looming macro pressures, as investors flock to stocks with strong underlying cash flows and durable long-term growth.

Risks to Consider

Admittedly, a bullish bet on Tesla at current levels is not for the faint of heart, especially as the stock’s valuation has been difficult to gauge based solely on traditionally quantifiable fundamental considerations. Some risks to consider include:

- Uncertainties to consumer price sensitivity: the situation over mounting macroeconomic uncertainties remain fluid and could disrupt the so-called balance we believe to have been observed between Tesla’s dynamic pricing strategy and robust delivery volumes during the second quarter. Tesla operates in an inherently cyclical and macro-sensitive industry, nonetheless, and there remains a risk that improvements to delivery volumes observed during the second quarter will not be durable in the face of rapidly deteriorating economic conditions. This could cause a resurgence in sentiment that Tesla has “cut prices for nothing,” bringing demand risks back into focus.

- Lofty premium calls for incremental catalysts: considering weaker revenue growth and pressures on the bottom-line due to lower vehicle ASPs, Tesla’s increasingly lofty valuation premium at current levels are diverging further from its near-term fundamental prospects. This could cause markets to demand perfect execution from Tesla with little room for error, and/or encourage a potential liquidation of positions to an extent that would offset anticipated flight-to-safety demand in the stock. While we believe the potential lifetime value per vehicle sold could compensate for the near-term impact of price cuts on Tesla’s bottom-line, the looming impact of mounting macroeconomic challenges, alongside heightening competition, could be worse than anticipated and weigh further on the stock’s performance.

Other risks to consider include uncertainties to Tesla’s regulatory environment (e.g., uncertainties over FSD adoption and regulatory approval timeline), as well as disruptions to management team that might impact investors’ view on the proficiency of decision-making at the company (e.g., dilution of Musk’s focus), which have been headwinds to the stock’s performance at times in recent years. Related risks could diminish the luster of the Tesla stock as a haven pick amid market uncertainties, and inadvertently lead to a downward adjustment to its premium from currently elevated levels. In such a worst-case scenario, we would expect the stock to revert towards our bear case price target at the $150 range, which would reflect Tesla’s implied fair value based solely on conservative valuation assumptions in line with market benchmarks (further discussed here).

The Bottom Line

Since predicting Tesla’s declines during the last leg of 2022, we have largely missed out on the stock’s entire rally this year given caution over the durability of divergence between the underlying business’ fundamental risks and its lofty valuation premium. While turning bullish at current levels is a bold call, we believe the second quarter delivery volumes implies more than just resilient demand, but also confirms management’s expertise in retaining Tesla’s market leadership through the uncertain market environment, which would be critical to ensuring that the near-term sacrifice on its bottom line would be adequately recuperated in the long term through lifetime value generated on incremental volumes sold going forward. This represents the fundamental consideration that would justify the stock’s increasingly lofty premium.

Meanwhile, Tesla’s outsized delivery beat underscores strength in second quarter earnings results, and increased visibility into second half demand. This would represent Tesla’s improved prospects amid the lingering flight-to-safety trade that has been benefiting haven tech stocks with solid fundamentals and durable balance sheet strength.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly in chat, more research content and tools designed for growth investing, and joining a community of like-minded investors, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to our portfolio of research coverage and complementary editing-enabled financial models

- A compilation of growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!