Summary:

- Tesla, Inc.’s production has declined quarter-over-quarter, indicating a changing growth story and weaker demand.

- Increased competition from China’s EV industry poses a major risk to Tesla’s market position and international sales.

- EV competition is growing dramatically, with traditional automakers ramping up production, leading to a decline in Tesla’s market share.

Дмитрий Ларичев

Tesla, Inc. (NASDAQ:TSLA) has seen its share price more than double YTD. However, the company has released a quarter-over-quarter decline in electric vehicle (“EV”) production, which, while it had guided to this in the past, indicates a changing growth story. As we’ll see throughout this article, Tesla is dramatically overvalued, and a strong short opportunity.

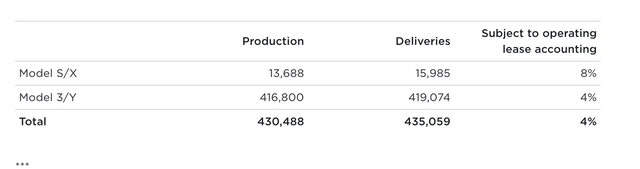

Tesla Production

Tesla has announced its most recent quarter’s production.

The company’s production was 13.7 thousand Model S/X and 417k Model 3/Y. That represents a ~5% drop in Model 3/Y production and a ~33% drop in Model S/X production. Model S/X production has continued to fall off a cliff, not surprising given that a substantial part of the EV competition has been in the high-end space.

The company is maintaining its guidance for 1.8 million vehicles for the year, which is in line with 2Q 2023 production. Tesla is also cutting Model 3/Y prices by another ~5%. The company has guided for long-term 50% vehicle production growth, but it looks like 2023 will land at 38%, and we expect subsequent years to be weaker.

Continuing to lower prices while production is low is a sign of weak demand. Of course, other things could cause this, but our Occam’s Razor conclusion is that the company is barely managing to sell the vehicles it produces. The lead time for a custom vehicle being this month supports this same conclusion of weakness in demand.

Unfortunately, because car margins are incredibly dependent on economies of scale, lower production leads to an even faster decline in margins. In the last quarter, the company’s margins were down almost 7% QoQ despite an increase in automotive production, due to the impact of lower prices.

China EVs

A major catalyst that can hurt the company in the upcoming months is increased competition from EVs.

China EVs have a strong production advantage. In China, EVs average 40% less than in Europe and 50% less than in the U.S. The country’s dominance in the battery supply chain gives it a massive advantage. China is 25% of the global vehicle market and 20% of EVs. Production is so high that there are concerns about excess production impacting other countries, as it outstrips local demand.

It’s worth noting that Tesla demand is not non-existent. The company is a top-ranking producer in almost every single EV market it operates in. In China, though, BYD Company Limited (OTCPK:BYDDF) has increased vertical integration with its battery production, and the benefit with wages much lower than Tesla which has substantial U.S. wage costs.

It’s also worth noting that when we talk about Tesla’s difficulties, it’s in relation to its valuation. The company’s market cap is 3x the size of Toyota (TM), which produces 10% of global vehicles. Even if Tesla becomes tied for the largest vehicle producer in the world, it’s still heavily overvalued.

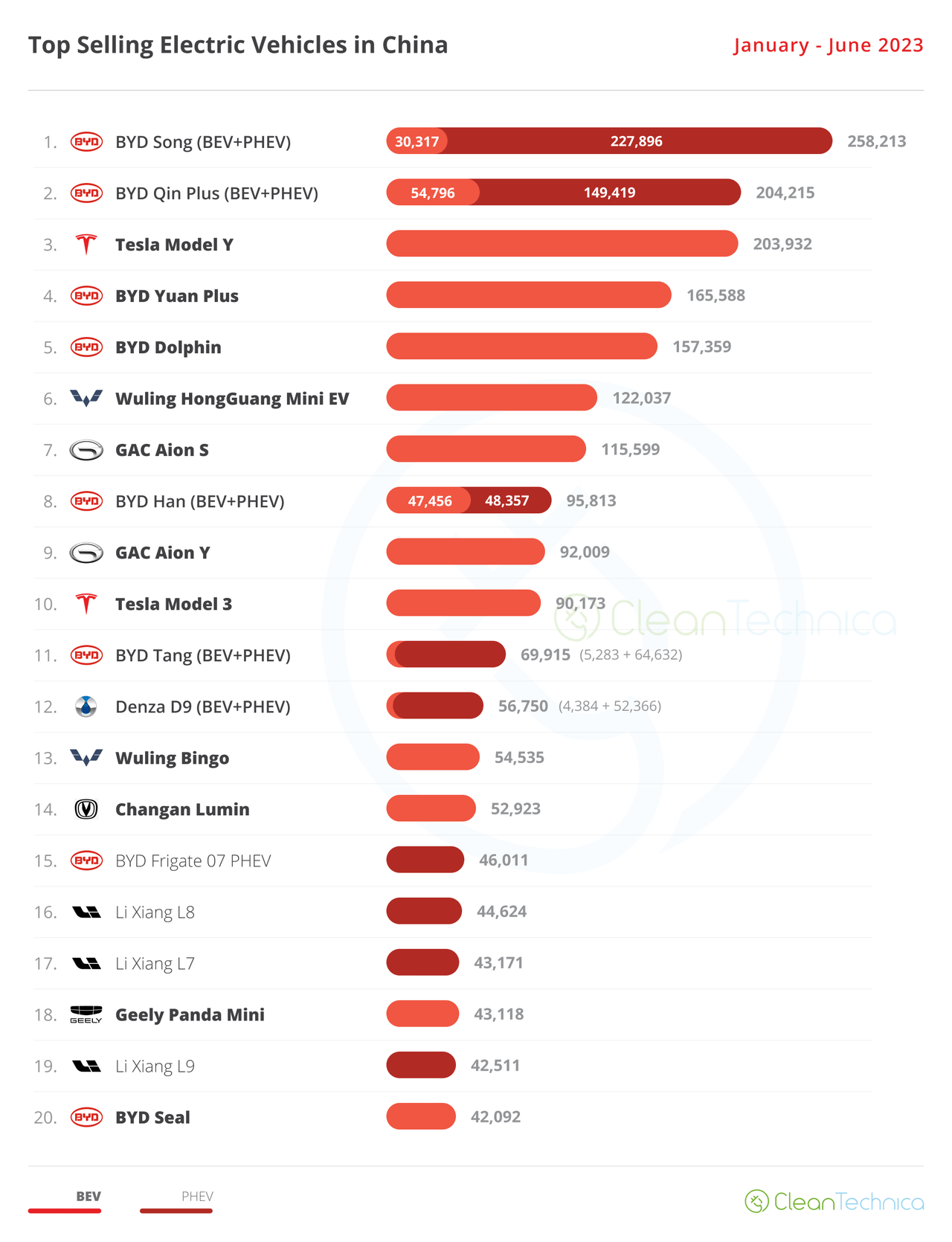

38% Plugin Vehicle Market Share In China! (China EV Sales Report) – CleanTechnica

Unfortunately, Tesla’s market position is much weaker in China, where BYD dominates. BYD is growing faster than Tesla and is a larger EV company in China by units produced. That strength is enabling BYD to expand to the local market such as Southeast Asia etc., showing its strength. Brand loyalty is much weaker for EVs.

BYD is targeting exporting 250k vehicles, showing its growing strength in the export markets, and we expect that strength to continue. The company’s exports have gone up 4x YoY. It’s worth noting that while we don’t expect BYD to necessarily completely wipe out Tesla, in China it does have 4 out of the top 5 slots and a strong manufacturing advantage.

The risk here is that while BYD might never compete in the U.S., they will put strong pressure on Tesla to increase its international sales. Given Tesla’s immense valuation, it needs strong global growth. For perspective, Tesla is worth ~3x more than Toyota, which sells 10 million vehicles/year. U.S. vehicle sales are ~15 million/year.

The growth and increased exports of China EVs present a major short-medium-term risk for Tesla.

EV Competition

In general, EV competition is increasing dramatically.

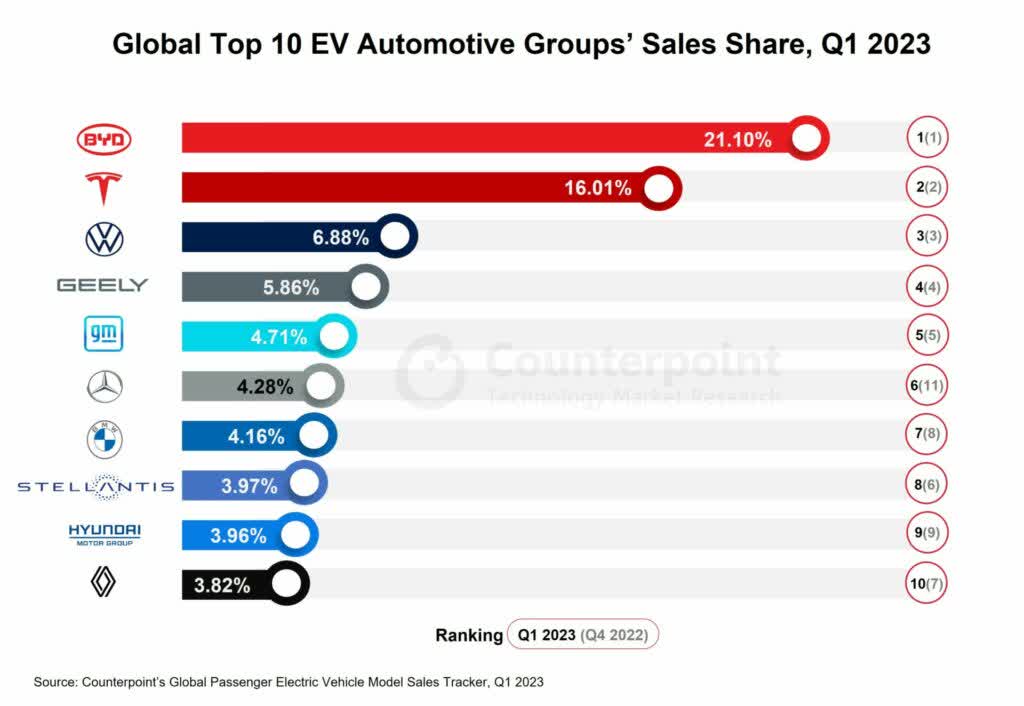

Global EV Sales Up 32% YoY in Q1 2023 Driven by Price War – Counterpoint

Anecdotally, located in California, the author, yours truly, has seen many more Mercedes EVs than expected. The above chart, shows, by global sales, an EV company’s market shares. Volkswagen (OTCPK:VWAGY), General Motors (GM), Mercedes (OTCPK:MBGAF), BMW (OTCPK:BMWYY), and more have quickly become major players in the market and are working to ramp up production.

Ford (F) is expecting 2024 EV production/sales to hit ~600k units. For perspective, that will put it at ~4% in the above. Increased EV production from traditional producers means that, in our view, Tesla has hit its peak market share, and its market share will likely decline from current levels.

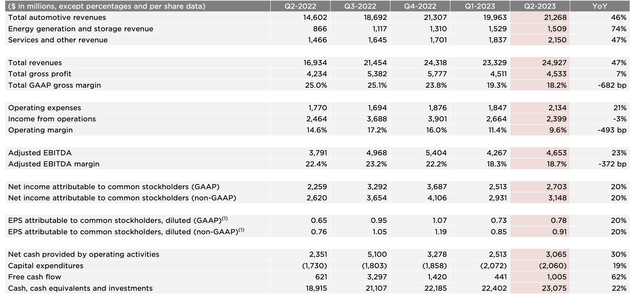

Tesla Earnings Potential

Tesla’s earnings potential is the problem with the company’s valuation.

The above chart shows Tesla’s free cash flow (“FCF”) picture and change. The company’s FCF was $1 billion in the most recent quarter, and net income was $2.7 billion. That net income declined from prior quarters. The company’s operating margin is down almost 5% YoY while its adjusted EBITDA margin has declined almost 4%. That decline has negated the impact of the company’s revenue strength.

The company is trading at a market cap of $800 billion, which in a volatile capex heavy industry means that it needs $80 billion in long-term profits to justify the valuation, or at least a path to that. How do we get that $80 billion number? Not only is it in line with other car companies, but when a company stops growing, it’s in line with what’s needed for long-term market returns.

The company’s current annual profit is ~$10 billion, or 12% of that. Increasing competition and the company missing its targets, along with declining margins, means that, in our view, the company is not far from peak profit now. We expect continued struggles here and see now realistic path for the company to hit $80 billion.

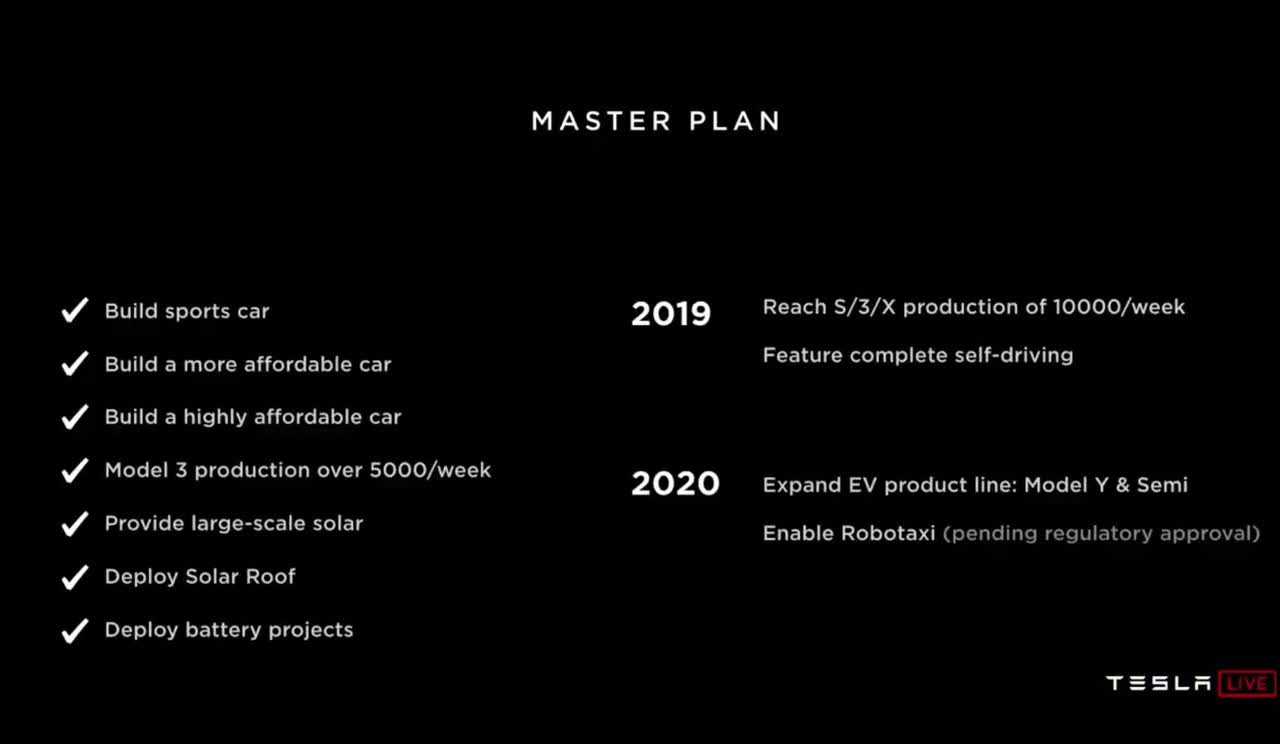

Full Self Driving

We’d be amiss if we didn’t discuss Tesla’s other businesses. Namely, full self-driving (FSD) and a potential robotaxi fleet the company states can be the next wave of its industry.

The company’s initial master plan discussed enabling robotaxi in 2020 pending regulatory approval. Now, as we approach 2024, not only is the company nowhere near full regulatory approval, it’s actually fallen out of the lead. San Francisco has approved robotaxis from Cruise and Waymo to operate 24/7 offering paid rides, as they already make money.

A collision of a firetruck with a robotaxi, as the firetruck was driving in the wrong lane to bypass a red light, also shows how complex the problem of self-driving vehicles is. Tesla hasn’t even reached that level of testing, and when they do, we forecast substantial effort will be needed to operate a profitable taxi fleet in even one city.

After that, the company will need to slowly expand outwards to other major cities, with potentially equally strong local opposition. As competition remains strong, we expect it’ll realistically take many years for this to be accomplished.

How To Invest

For those looking to bet against Tesla, we recommend using a bearish put spread. Buy the Jan 2026 $250/share strike price PUT at $60/share and sell the $200 PUT at the same time for $37/share. Your net outlay is $23/share. That’s your downside if Tesla stays at the current price.

If Tesla is well below that price, which we expect, your max profit is $27/share if the price is at $200/share or below. Given what we’ve discussed above, that’s by far the more likely scenario in our view. More pessimistic investors can lower their breakeven prices at the cost of lower max losses. The same spread between $150 and $100 costs $12/share, meaning half the outlay and 50% higher potential profit.

The major risks of shorting are two-fold. First, the borrow fee. When you sell short, you are selling stock now and buying it back in the future. In exchange, you pay a separate fee for that time period to borrow stock. Borrow fees for stock can hit extraordinarily high rates, and those rates can force you to unexpectedly exit a short position.

Second, when you short a stock, you have unlimited downside. We never expected Tesla’s recent stock price appreciation, and we’ve been wrong about the company before. The company’s market cap could conceivably go up 5x with the right bullish event combination or black swan event. That could take a $1k investment and turn it into a $5k loss, a massive risk.

Options as well are risky, but with the trades above, your risks are capped. We clearly define what those caps and max losses are, but it’s worth noting there’s a realistic chance you “lose it all” in terms of the max loss above.

Thesis Risk

The largest risk to our thesis is a technological breakthrough for Tesla that puts it heads and shoulders above the competition, enabling it to completely dominate the market. Full AI or a major battery breakthrough would be examples of this, but we think that they’re incredibly unlikely to happen. Still, it’s worth noting.

Conclusion

We think Tesla has peaked. Despite the company’s incredibly strong performance, YTD the company’s valuation has left any sense of reasonableness. The company’s ability to ever justify its valuation is incredibly unlikely in our view. Now the company doesn’t just face long-term risks, it faces short-to-medium-term risks from China’s EV industry.

For those interested in betting against Tesla, we recommend shorting Tesla or using a bearish PUT spread. Let us know your thoughts in the comments below.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.