Summary:

- Tesla, Inc.’s stock is now slightly overvalued based on core business segments, leading to a downgrade to a hold rating.

- The automotive segment remains on track, but stagnant margins and declining China revenue are concerns.

- The energy business shows strong growth, but takes a valuation hit as I remove the solar projections from my model.

- Intangible segments like RoboTaxi and robotics are still considered optionality, I am not comfortable paying for them yet.

Xiaolu Chu

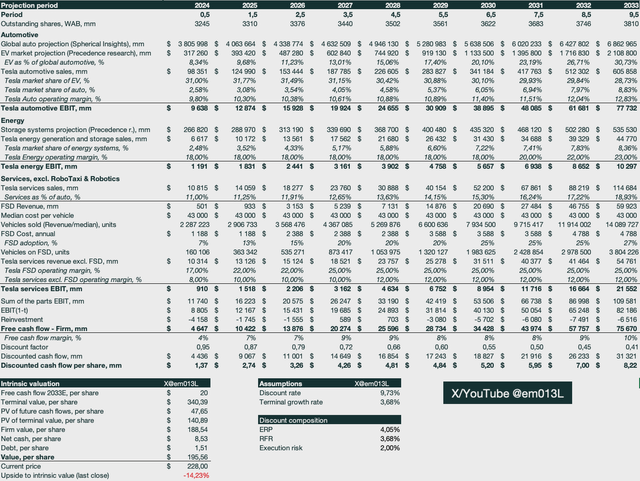

In my previous Tesla, Inc. (NASDAQ:TSLA), I laid out an investment thesis revolving around paying for the tangible parts of the business and having the rest as an optionality. In my intrinsic valuation, Tesla was trading around fair value, which was enough for me to buy the stock considering I did not include value from the RoboTaxi, robotics, or Supercharger network parts of the business. Tesla has run up since then and is now slightly overvalued when I only account for the core parts of the business, which is why I downgrade the stock to a hold.

Trajectory remains the same

When looking at Tesla, it’s important to do so on a sum-of-the-parts basis, as the segments provide vastly different outlooks and margin profiles. I am not one to track the daily stock quote, but I do find it essential to revisit the story and valuation whenever there is material development, such as quarterly earnings or major news. At the same time, if there is a need to react and adjust projections due to tiny result variations, the intrinsic valuation may have sensitivity issues and should demand a lot more equity risk premium. I have two quarterly results worth of additional information at the time of writing, so I will take you through what may have changed since my first article.

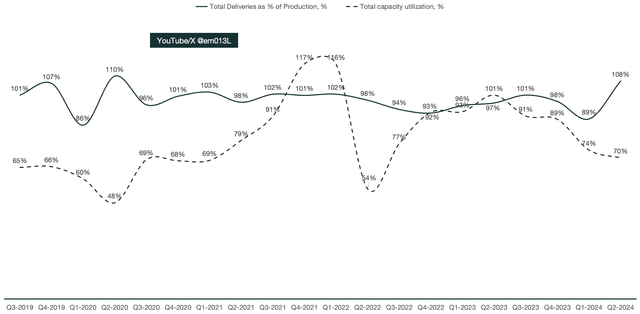

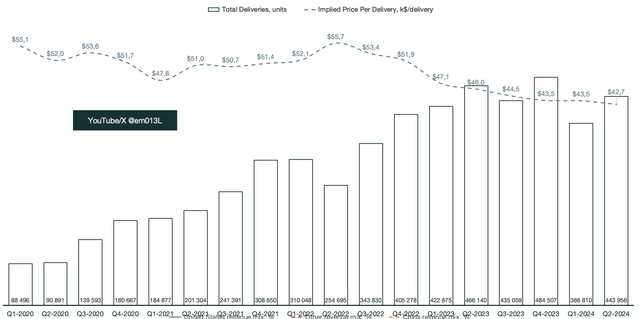

Looking at the automotive business, I had an initial scare, seeing huge drop-offs in factory capacity utilization and weakening in deliveries. However, a quarter is just that, a single period. Deliveries returned to historical averages where they are equivalent to or greater than the production rate. Capacity utilization, however, continues to trend down, eating away at the inventory supply built up from Q1.

Emir Mulahalilovic, Tesla SEC Filings

For anyone confused about Tesla deliveries exceeding the quarterly production capacity, it’s possible due to inventory surplus. This is reported in days of global supply availability. Before Tesla increased their capacity in Q2 of 2022, the available supply was getting dangerously low. However, since the introduction of Giga Berlin and scaling up existing facilities, the supply has been growing. As an investor, you want supply to be low as it implies that the demand for the vehicles is greater than the output, which in turn can drive margins up. Seeing supply at a month globally was an alarming figure as of Q1, but it’s important to understand the state of the global economy and not rely on this metric alone to understand demand for Tesla’s.

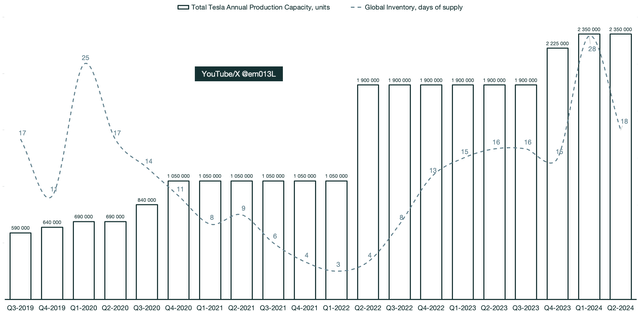

Emir Mulahalilovic, Tesla SEC Filings

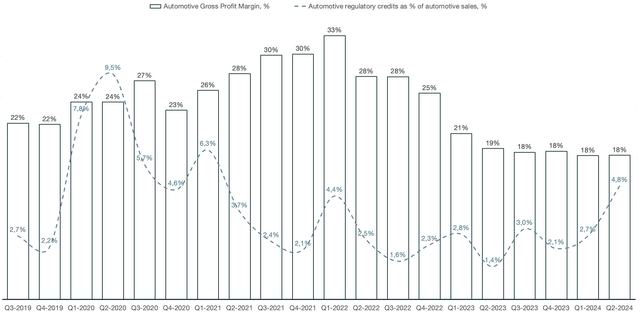

In terms of margins, the gross margins have stagnated at 18%; not even a large influx of regulatory credits could improve the margins for Q2 2024. The regulatory credits as a percent of total automotive revenues were the highest since Q1 2021.

Emir Mulahalilovic, Tesla SEC Filings

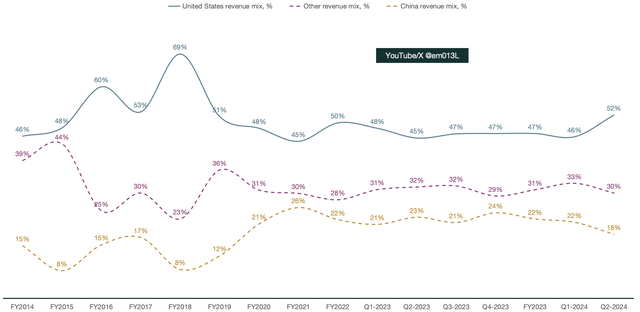

I derive that the reason for the stagnant margins in Q2 2024 is a decline in China-based revenue. We know that the vehicles produced in China drive the largest margins; therefore, taking a hit in that market hurts overall margins, which explains the regulatory credits not being sufficient to pass the 18% gross margin plateau. We now have 4 quarters of 18%, something that will have to increase in a couple of quarters if I am to keep my vehicle margin story intact for the periods leading up to 2033.

Emir Mulahalilovic, Tesla SEC Filings

The automotive segment in general is still on track in accordance with my past projections, and I see no reason to adjust them. I am tracking the margin story for the coming periods, as I may have to revise down margins in future valuations.

Something that may come to surprise to the upside is the energy business. CEO Elon Musk had rosy commentary for this segment in the Q2 2024 earnings call:

We previously talked about the potential of the energy business and now feel excited that the foundation that was laid over time is bearing the expected results. Energy storage deployments more than doubled with contribution not just from Megapack, but also Powerwall, resulting in record revenues and profit for the energy business.

Energy storage backlog is strong.

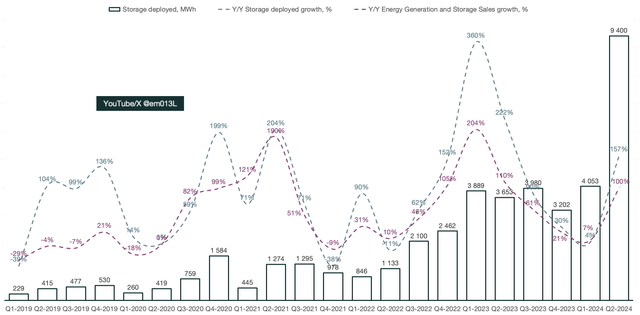

And more double it did. Looking at the development of the energy storage business, it is becoming quite impressive in its ability to scale. The correlation of storage deployed and energy storage sales is not quite 1:1, but they’re closely correlated. Revenues from that segment doubled year-over-year, while Tesla deployed 157% more storage.

Emir Mulahalilovic, Tesla SEC Filings

My intrinsic valuation for the sum of the energy segment has taken quite a hit as I have decided to completely remove the solar part of the business. If and when solar becomes a part of the core business, I will have another look. As of right now, the energy story is made up entirely of energy storage.

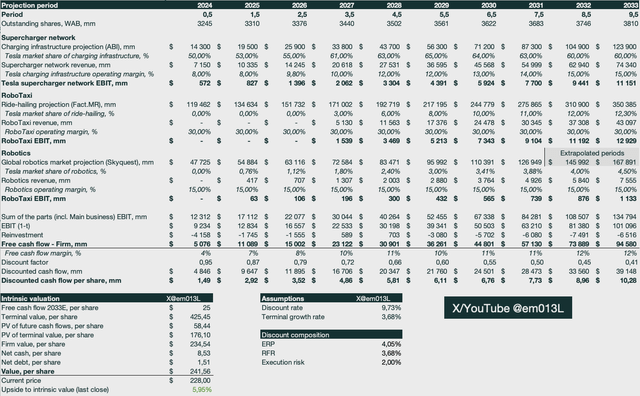

The final segment of the tangible Tesla business is the services side. I have formulated the segment to be made up primarily of full self-driving (FSD) and vehicle servicing revenues. It does not include RoboTaxi and robotics, as they’re part of the optionality I described in my initial thesis. Depending on what Tesla unveils at their autonomy event scheduled for the 10th of October, that may come to change.

I have left the vehicle servicing intact but made adjustments to the FSD projections. As stated in my previous article, I do not account for one-time purchases of FSD. Instead, I assume FSD adoption rates and annual subscription costs. The adjustment I have made is the average price per vehicle, as it has decreased compared to Q4 2023, which I initially based my assumptions on. This has a positive effect on the model as it implies there will be more Tesla vehicles available because I derive the vehicle sales by dividing automotive sales by the median vehicle cost. More vehicles mean net more vehicles on FSD, assuming the same adoption rates, which in turn drives the valuation higher.

Emir Mulahalilovic, Tesla SEC Filings

The reason I assume the current average price per vehicle for all future projection periods is because it’s impossible to know the full extent of the vehicle lineup Tesla will carry through 2033. There are other factors such as cyclicality, brand equity, inflation, and so forth. These are variables that can’t be estimated accurately; therefore, I use the current average. I have kept the FSD adoption rate projections intact, as I have not seen any material changes that would impact them.

In summary, the overall story I told through the numbers in my intrinsic valuation remains largely the same. There have been some minor changes, mainly the removal of the solar segment in its entirety, that have had some impact, but the overall trajectory of the business is intact.

Valuation

This brings us to the rating downgrade. Even though the trajectory of the business remains the same, the stock has pulled forward to such a degree that it now also values the intangible parts as reality. The intangible parts of the business, such as the RoboTaxi, robotics, and supercharger network monopoly segments, remain an optionality for me. I can’t tell a story and justify it in my valuation because we simply do not have enough information to accurately project these parts of the business; therefore, I am not comfortable paying for them either. In my previous article, I received all those segments for free as the business was fairly valued while only looking at the currently operational parts of the business.

Emir Mulahalilovic, Tesla SEC Filings

If I include my best estimates for the intangible business segments, there is ~5% upside to fair intrinsic value from where the stock is trading today. As I can’t tell that story with any confidence, I don’t find the risk/reward to be appealing enough.

Emir Mulahalilovic, Tesla SEC Filings

It is important to remember that valuations are not static, they are only a representation of our most accurate projections given what we currently know. Elon Musk has been very adamant for several quarters in a row that we should not invest in the business unless we believe that Tesla will solve autonomy. In that case, he sees the business being worth more than $5 trillion in the future. Here are two excerpts from the Q2 2024 earnings call:

the value of Tesla overwhelmingly is autonomy. These other things are in the noise relative to autonomy. So I recommend anyone who doesn’t believe that Tesla will solve vehicle autonomy should not hold Tesla stock. They should sell their Tesla stock. You should believe Tesla will solve autonomy, you should buy Tesla stock. And all these other questions are in the noise.

That’s why my rough estimate long-term is in accordance with the ARK [ph] Invest analysis of market cap on the order of $5 trillion for — maybe more for autonomous transport, and it’s several times that number for general purpose humanoid robots. I mean, at that point, I’m not sure what money even means, but in the benign AI scenario, we are headed for an age of abundance where there is no shortage of goods and services. Anyone can have pretty much anything they want. It’s a wild — very wild future we’re heading for.

I am excited about Tesla’s future, but I am still an investor. As such, I believe it is essential to keep grounded. Tesla may be worth several times $5 trillion in the future, but until I can tell the story, I can’t invest with such a perspective.

Summary

After reviewing two additional quarters from Tesla after the publication of my initial coverage, I still believe the business is largely on track in accordance with my first article. However, while the story may be intact from my perspective, Tesla, Inc. stock has already appreciated to such a degree that it exceeds my base projections.

At the time of writing my first article, I received the intangible parts of the business (namely Robotaxis, robotics, and the supercharger network monopoly) for free as a form of optionality. Until we see further development and clarity in those segments, I can’t justify paying for them and, as such, downgrade the stock to a hold rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.