Summary:

- Tesla, Inc.’s stock has surged recently after solid Q3 results and Donald Trump’s re-election.

- While Trump may create a clearer regulatory pathway to robotaxi deployment, full self-driving performance remains the largest barrier.

- GM’s exit from the robotaxi market highlights the challenge of operating such a service and the risk of scaling too aggressively.

- TSLA stock’s valuation hinges on the company achieving autonomy in the near term, creating significant downside risk.

FinkAvenue/iStock Editorial via Getty Images

Tesla, Inc.’s (NASDAQ:TSLA) stock has moved sharply higher recently on the back of Trump’s re-election and growing enthusiasm about a widespread Cybercab deployment in the next 1–2 years. While the regulatory pathway could become clearer in 2025, full self-drive (“FSD”) performance remains the real barrier to the launch of a Tesla robotaxi service.

I previously suggested that Tesla’s recent investments in AI meant that the company had a relatively short window within which to demonstrate meaningful progress toward autonomy. While the company’s commentary remains positive, it is difficult to square this with real-world data.

I still think that Tesla is likely to develop a high performing self-driving solution, but the timeline is likely to be longer than is currently expected, particularly given the logistical challenges of deploying a robotaxi service at scale.

Policy Tailwinds

Elon Musk’s strong support for Donald Trump in the recent election, and the close relationship that seems to have developed between the two, could reasonably be considered a positive for Tesla.

It is believed that Trump could push to eliminate regulatory barriers to the widespread introduction of self-driving vehicles. This could include the introduction of supportive regulations at the Federal level. There have also been suggestions that Trump’s team wants to remove self-driving vehicle crash reporting requirements. This would not be surprising, as both of these are known pain points for Tesla.

I tend to think the importance of Trump’s support is being overestimated, though. If Waymo and Cruise’s experiences have demonstrated anything, it is that performance on the road is the real barrier to scaling, as a single incident is potentially enough to derail a company’s future.

Tesla Business Updates

Tesla’s business has struggled in recent quarters, which is largely related to macro factors impacting the entire industry. Despite this, Tesla’s automotive revenue increased YoY in the third quarter, with volume growth offsetting a reduction in ASPs. The reduction in ASPs was attributed to financial incentives, which the company has leaned on recently to help try to offset demand headwinds.

Some of Tesla’s third quarter strength was the result of temporary tailwinds, though. For example, the release of software features resulted in the recognition of 326 million USD revenue and Tesla has also benefitted from strong credit sales.

Musk recently suggested that 20-30% growth in vehicle sales was likely in 2025, setting an enormous hurdle for the company. Achieving this target will depend on lower cost vehicles, autonomy and a supportive macro environment.

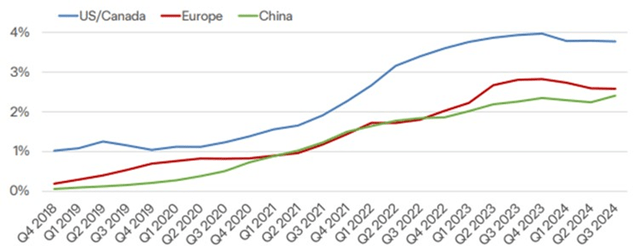

Figure 1: Tesla Market Share by Region (Source: Tesla)

Version 12.5 of FSD was released in the third quarter, along with FSD (supervised) for Cybertrucks and Actually Smart Summon, which enables vehicles to autonomously drive to the owner in parking lots. Version 12.5 of FSD was developed using increased data and training compute and has a 5x increase in parameter count relative to the prior software version.

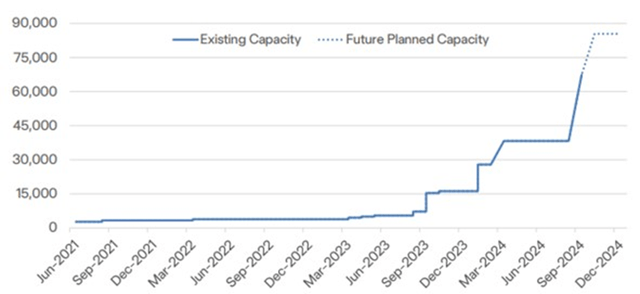

Tesla continues to expand its AI training capacity and has stated that it is no longer training compute-constrained. The company recently deployed a 29,000 H100 cluster and is now training on it ahead of schedule. A 50,000 H100 cluster was also expected to be deployed in Texas by the end of October.

Tesla’s CapEx totaled $3.5 billion USD in the third quarter, driven by investments in AI compute. CapEx in 2024 is expected to be over $11 billion USD.

Figure 2: AI Training Capacity – H100 Equivalent GPUs (Source: Tesla)

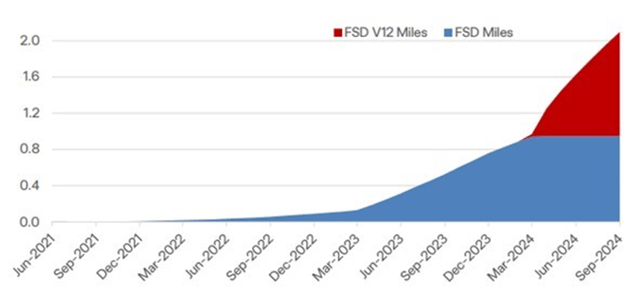

While Tesla continues to make large investments in AI, and the performance of FSD is reportedly improving, the real-world impact of this is unclear. Despite a growing user base and the use of free trials, the pace at which FSD miles are accumulating has moderated, suggesting user dissatisfaction with the software.

Tesla plans on offering a free 30-day trial each time there is a significant improvement in the software to try and drive adoption, with the company stating that the take rate improved significantly after the Cybercab event in October.

Figure 3: Cumulative FSD Miles – billion (Source: Tesla)

GM’s Exit from the Robotaxi Market

Cruise recently abandoned its robotaxi efforts, with General Motors Company (GM) citing the time and resources required, in addition to rising competition. This shift isn’t necessarily surprising given GM’s balance sheet/cash flows and the cash burn required to get a robotaxi network to scale.

The move could be viewed as a repudiation of Cruise and Waymo’s approach to self-driving, although I tend to think the performance of Cruise’s vehicles is only a small part of the decision. GM is folding Cruise into its own operations and is now likely to try to embed Cruise’s technology in its own vehicles to boost its own autonomy efforts.

FSD v13

Version 13 of FSD was recently released, with Tesla suggesting that it will result in a 5-6x improvement in miles between interventions compared to version 12.5. Version 13 was developed using 4.2x more data and 5x increase in training compute, with latency reduced 2x. The performance of this software in the real-world will be critical, as it is expected to take Tesla most of the way to autonomy.

There appears to have been issues meeting the self-imposed deadline for releasing this software though, with Tesla introducing a lightweight version as a stop-gap solution. As a result, Tesla is still planning a 3x increase in model size and a 3x model context length increase.

From the start of the year, Tesla believes there has been a 1,000x improvement in miles between intervention, and this trend is expected to continue into 2025. As a result, Tesla believes that it will surpass human level performance in the second quarter of next year.

Mobileye ADAS/AD

It would be easy to dismiss Tesla’s self-driving technology based on the company’s failure to meet its own timelines over the past decade. Recent improvements in AI hardware/software and Tesla’s data acquisition capabilities realistically mean that the company could be at an inflection point, though.

Mobileye Global Inc.’s (MBLY) recent commentary regarding its ADAS/AD capabilities certainly seems to back up some of Tesla’s statements. The intervention rate for SuperVision is currently around 10 hours, but Mobileye believes that it has a line of sight to around a 1,000-hour intervention rate for a camera-only system using the EyeQ 6 chip. Combined with other sensors (radar/lidar), Mobileye also believes that it will achieve the step function improvement in performance necessary for an eyes-off system. Mobileye is taking a cautious approach, though, and has stated that tens of thousands of hours between interventions is necessary for an eyes-off system.

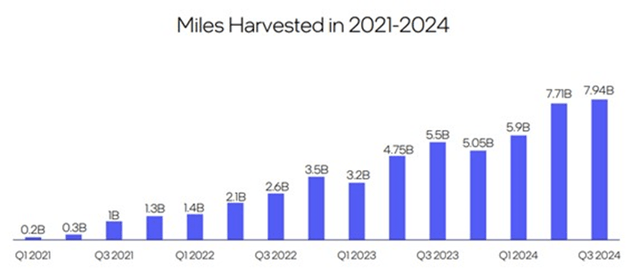

Figure 4: Mobileye Miles Harvested (Source: Mobileye) Figure 5: Mobileye’s ADAS / AD Solutions (Source: Mobileye)

Hardware 3

While version 13 of FSD has been widely released, it is not available on vehicles with Hardware 3. This isn’t surprising, as it is easier to develop software for the most advanced hardware and then backport it to older hardware. Tesla is not really sure whether v13 will ever be capable of running on Hardware 3, though.

Mobileye has suggested using a teacher-student approach once a viable self-driving solution has been developed. This would involve creating a framework that enables a smaller student model to learn to replicate the performance of the larger teacher model. Presumably, Tesla wants to take a similar approach, where performance can be replicated by a distilled model that is capable of running on Hardware 3. If v13 cannot be run on Hardware 3, Tesla will upgrade those that bought Hardware 3 for free.

Robotaxi

Little is known about Tesla’s planned robotaxi service at this point, despite the event in October. Tesla is already offering ride-hailing to its employees in the Bay Area. The service is still utilizing a safety driver, though. Ride-hailing is expected to be made available to the public in California and Texas next year, with some other states possible as well. The regulatory approval process in California is long, though, and as a result, Tesla appears less confident about the timing of this market. Cybercab production is also expected to scale in 2026, with Tesla aiming for at least 2 million units a year.

Even if Tesla does have line of sight to human level performance in terms of distance between interventions, the company may still be some way off from successfully launching a robotaxi service. Human level performance may not actually be a good benchmark as statistics are skewed by bad behavior (drunk driving, texting, speeding). Consumer acceptance of failure in rare circumstances is also likely to be low, even if overall safety is better than with a human driver.

In addition, making the jump from ADAS to genuine autonomy may not be straightforward due to the extreme risk of failure once the OEM takes on liability. One of the more impressive aspects of Waymo’s business is that it is scaling without causing an excessive number of accidents or disruptions to other road users.

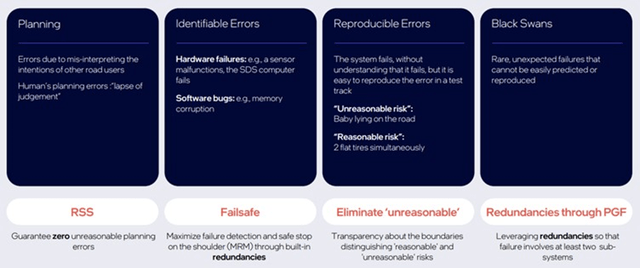

While Tesla’s end-to-end, vision-only approach receives a lot of praise from investors, from a failure perspective, it is worthwhile compared to Mobileye’s approach. Mobileye is targeting an overall time between failures exceeding human drivers and an absence of unreasonable risks. Despite making extensive use of AI, the company is still using rules to prevent planning errors. Mobileye is also using independent camera, Lidar, and imaging radar perception systems to reduce the probability of hardware and software errors.

It is not apparent how Tesla will handle inevitable software/hardware failures safely with its end-to-end approach once its vehicles are operating on the road without supervision. Presumably, Cybercabs will make greater use of redundant systems, but little is known about this so far.

Figure 6: Mobileye Safety Architecture (Source: Mobileye)

Conclusion

While Tesla’s stock has risen recently on the back of self-driving optimism, solid Q3 results and strong guidance for growth in 2025 have also helped. Analysts are currently projecting around 16% revenue growth in 2025, which could be a tough ask if recent macro trends persist. As a result, achieving meaningful progress towards the deployment of autonomous vehicles over the next 12 months is critical.

While Tesla’s commentary remains positive, it is difficult to reconcile this with the real-world performance of FSD, customer adoption of the software and a robotaxi event that contained no new information. There is also the issue of operating a robotaxi service at scale (selecting pick-up/drop-off locations, interacting with emergency vehicles, remote operations, fleet management).

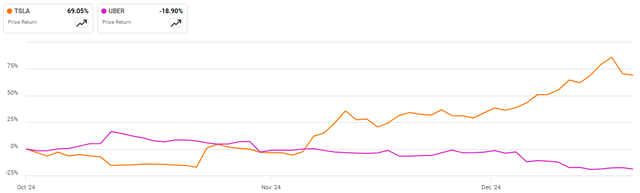

Trump’s re-election may end up creating an easier regulatory path, but this could end up being a curse. Software performance remains Tesla’s greatest challenge, and deploying unsupervised vehicles at scale before they are ready could create enormous problems. Investors only have to look at the experiences of Uber Technologies, Inc. (UBER) and Cruise to see how a single incident can doom a company’s self-driving ambitions.

Figure 7: Tesla and Uber Share Price Performance (Source: Seeking Alpha)

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MBLY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.