Summary:

- Tesla’s Full Self-Driving, or FSD, technology is becoming the focal point of debate between bulls and bears.

- Tesla’s generalized approach to self-driving is proving to be increasingly ineffective against the pre-mapped approach.

- While Tesla may be losing the FSD battle, the company still maintains a tight grip on the booming EV market.

Xiaolu Chu

It is not a stretch to say that Tesla, Inc. (NASDAQ:TSLA) may be the most overanalyzed company in modern history, with its technology, financials, and management scrutinized from seemingly every angle conceivable. While some of the most bullish and bearish takes in years past have been proven wrong, bulls and bears still hold wildly divergent opinions on Tesla.

The degree to which bulls’ and bears’ views on Tesla differ is practically unheard of for a near-trillion-dollar market-cap company like Tesla. Even well-respected investors like Ron Baron and Jim Chanos hold comically divergent views on Tesla, with the former predicting that the company will 5x by 2030 and the latter believing Tesla stock to be a house of cards.

The contention surrounding Tesla’s fair market valuation can increasingly be boiled down to one thing, whether or not Tesla is an AI company ahead of the curve, or just a typical automotive company that had a head start on the rest of the electric vehicle (“EV”) industry. At the core of this artificial intelligence (“AI”) debate is whether or not Tesla’s FSD (Full Self-Driving) technology will truly bring the value that many bulls predict it will.

Investors increasingly view FSD as the lynchpin to Tesla’s future success.

Steelmanning the FSD Bull Case

Far too often, bears will “straw man” Tesla bulls in an attempt to bolster their own arguments and delegitimize opposing viewpoints. However, to truly understand the FSD bear case, it is important to understand the bulls’ arguments in their most robust forms. As such, I will attempt to steel man the bull case by laying out their strongest arguments.

Bulls will argue that because Tesla is one of the few companies capable of taking a vision-based, generalized, and end-to-end neural net approach to the self-driving problem, it is the only company that will come close to how humans actually approach driving. In essence, the bulls argue that this approach will allow FSD to learn organically similar to how a human brain works. This approach stands in contrast to the more popular approach of using human-written code for the vast majority of decision-making.

A key aspect of this argument is that since this approach takes a huge amount of data and compute power, Tesla is the only company that has the resources, talent, and most importantly, real-world data to effectively implement it. This means that once Tesla achieves FSD, it will take competitors many years and untold billions of dollars before they can build out a similar FSD system. Many bulls go even further and believe that this will demotivate Tesla’s competitors from building out their own FSD systems and instead decide to license Tesla’s FSD technology.

In the meantime, Tesla will be practically uncontested in the FSD market, which will allow Tesla equipped with FSD to make absurd sums of money for the company. By Ark Invest’s calculations, even if Tesla is able to charge a fraction of current ride-hailing costs at a price of $.50 per mile, the net present value of Tesla’s cash flows from its robotaxis would be around a whopping ~$11.9 trillion if the company were to charge 60% platform fee.

If one were to believe that this is the path that Tesla is headed towards, the ~$4000 per share price targets of super bulls like Cathy Wood appear outright conservative. The logic that leads to such an abundant future for Tesla has even captured the attention of Tesla CEO Elon Musk, who has repeatedly alluded to this FSD math in earnings calls. In fact, Elon Musk seems to have directly referred to this FSD math in the 2021 Q4 earnings call, where he stated:

So, over time, we think Full Self-Driving will become the most important source of profitability for Tesla. It’s – actually, if you run the numbers on robotaxis, it’s kind of nutty – it’s nutty good from a financial standpoint. And I think we are completely confident at this point that it will be achieved. And my personal guess is that we’ll achieve Full Self-Driving this year, yes, with data safety level significantly greater than present.

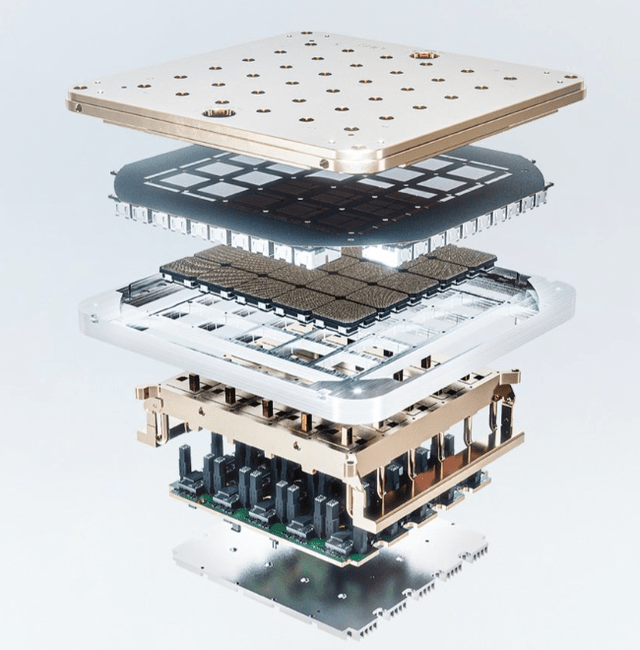

Such a lucrative market explains Tesla’s willingness to pour billions of dollars into developing its own chips, building out its own supercomputer, and taking enormous regulatory risks to put FSD beta in the hands of customers in order to gather data. After all, the upside is unfathomable from a financial perspective and could make Tesla the most valuable company by far. Unfortunately for the bulls, there are many reasons why this vision is unlikely to be realized.

Tesla is not sparing any expenses in its effort to achieve FSD. The company is spending billions of dollars developing its own chips and building out its own supercomputer.

Differing Self-Driving Approaches

Players in the self-driving space are taking one of two approaches for the most part. The first approach, which Tesla is currently taking, utilizes a vision-based system that relies heavily on neural nets to navigate more generalized settings. The second and more popular approach, which is being implemented by companies like Alphabet’s Waymo (GOOGL) and General Motors’ Cruise (GM), is to utilize a lidar-centric approach that relies more heavily on human-written code to navigate geofenced and pre-mapped locations.

Perhaps the biggest counter to the second approach is that the approach is not scalable, as it is not building an artificial intelligence that can reason like a human brain would. Instead, the approach uses techniques such as pre-mapping, lidar, and human-written code to navigate geofenced locations. Bulls will argue that while such an approach has already been proven far safer than that of Tesla, it is only safer in incredibly small areas and cannot be generalized to any random location.

Tesla FSD bulls ignore the fact that the vast majority of ride-hailing takes place in concentrated locations, namely cities. If the majority of ride-hailing occurs in cities like San Francisco or New York City, it is not a big deal if self-driving services have to occur in pre-mapped and geofenced locations. After all, if ~80% of ride-hailing revenue comes from such locations, companies like Waymo or Cruise will not be missing out on much from a revenue perspective despite their geographic limitations.

Tesla FSD bulls have argued that even if most of the ride-hailing revenues come from concentrated areas, there are still too many of these areas for the pre-mapped and geofenced strategy to compete with Tesla’s generalized FSD. After all, it will take way too much time and resources to operate in all these areas. However, this ignores the fact that there are so many players taking the second approach that they could easily end up geographically splitting the markets amongst themselves.

As such, no one company will be burdened with pre-mapping all the major ride-hailing markets in order to gain market share from Tesla. For example, it could be the case that a company like Waymo spends its resources on the major West Coast cities whereas another company like GM focuses on major East Coast cities. Tesla FSD bulls ignore the fact that Tesla will be competing with multiple companies taking the pre-mapped approach rather than just one. In such a reality, the generalized approach of Tesla could very well be ineffective, especially considering how expensive the generalized approach is.

Unproven Technology

In theory, there is no reason a vision-based neural net could not eventually solve FSD. After all, the human brain is basically a neural net that relies entirely on vision to navigate. The issue with this line of reasoning is that we still have a very limited understanding of how the brain works, which makes building a neural-net FSD system incredibly hard.

To make matters worse, Elon Musk, who is responsible for steering the company in this directly, has been proven laughably wrong in his FSD predictions. Every year for nearly a decade, Elon Musk has been recorded confidently stating that FSD will be solved within a year or a few years at the time of his prediction.

There are only two conceivable reasons why Elon Musk has been so laughably off on his predictions. The first reason would be that Elon Musk is falsely advertising FSD capabilities to drive sales. The second reason would be that Elon Musk has such a flimsy grasp on the technology that he genuinely believes his predictions. Either option is bad news for investors considering the fact that the direction of FSD has been dictated by Musk.

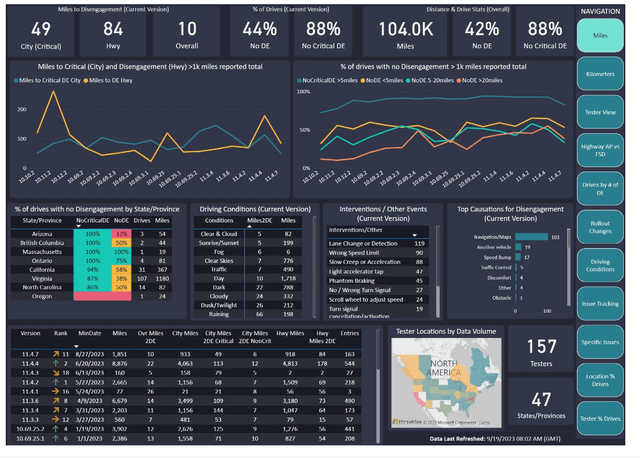

Moreover, intervention data clearly shows that Tesla’s FSD is improving at a snail’s pace compared to the exponential progress promised by Tesla and Tesla bulls. Tesla’s goal of creating an FSD system that is orders of magnitude safer than human drivers seems farfetched given the intervention data, which actually shows that the technology is currently orders of magnitude worse than human drivers.

Even if Tesla is eventually able to crack the code on a vision-based neural net FSD system, the resources it will take to achieve this goal may not be worth it. After all, there are alternative methods of FSD has already been proven to be safer than human drivers. In fact, companies utilizing the pre-mapped approach have already started their own robotaxi services in areas like Phoenix, and are rapidly expanding their footprints. Even if Tesla finally cracks FSD, the alternatives will likely be abundant at that point, which will likely make margins for FSD close to negligible.

Much of the hype surrounding Tesla FSD is the result of its perceived future potential. However, the reality is that Tesla FSD is performing far worse than the self-driving technologies of Waymo, GM, and Mercedes (OTCPK:MBGAF), which are categorized as level 4, level 4, and level 3 self-driving, respectively. Level 4 essentially means that the self-driving system is fully autonomous in limited regions, whereas level 3 offers conditional autonomy.

On the other hand, Tesla’s FSD is often categorized as level 2, which essentially puts it in the category of an advanced driver assistance system. While there can be arguments to be made that Tesla FSD fits the requirements of level 3 and has a far higher ceiling than rival self-driving technologies, it still does not negate the fact that Tesla FSD in its current form is far inferior to the software of other self-driving systems in terms of real-world interventions.

FSD intervention data shows that the technology is nowhere near improving at the exponential rate that many had expected when it first released to the public.

Conclusion

Tesla is beating the competition on nearly every front in the EV race. However, this is due to Tesla’s technological/manufacturing edge and not its FSD technology. This will likely not change even as Tesla continues to pour billions of dollars into its FSD technology, especially given the fact that self-driving competitors like Waymo and Cruise are already starting to roll out self-driving services.

Despite Tesla’s misguided self-driving ambitions, the company is still fairly valued at its current market capitalization of $786 billion and forward P/E ratio of 71. While this may appear expensive compared to other automotive companies, Tesla is still achieving growth rates of around ~50% per annum. Meanwhile, other automotive companies have to contend with a softening ICE business while attempting to catch up to Tesla.

If Tesla is able to maintain its EV market share at gross margins of ~20% moving forward, the company could easily grow into its current valuation. On top of this, Tesla has even started to tighten its grip on the overall charging infrastructure. By the looks of it, Tesla is on track to being the sole charging provider for the largest automotive companies, with more players joining its charging network every quarter. While FSD may not be the savior that the bulls are looking for, Tesla still has a lot going for it. Should Tesla fall back down to the $200 range, there is a strong case to be made for buying Tesla.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.