Summary:

- The January 2023 reduction in the car prices by up to 20% on some Tesla, Inc. models came as a shock that no one expected.

- The price cut not only increased demand for Tesla’s products, but also delivered a pre-emptive strike to the competition.

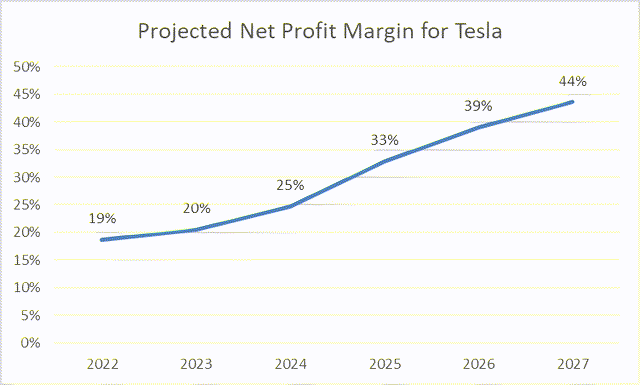

- The temporary drop in the margins resulting from this price change is only transient, and Tesla’s margins are expected to grow up to 40% within five years.

- Even with this drop in the auto prices, my analysis is still showing that Tesla is potentially a $3T company.

Tesla Cuts Its Prices Robert Way/iStock Editorial via Getty Images

What prompted this article?

Tesla, Inc. (NASDAQ:TSLA) auto price cuts of up to 20% for some of its models is quite remarkable. When we add the $7,500 U.S. Federal Tax Credit, we would discover that the cuts can be as high as over 30% rather than 20%. Take for example, the Model-Y which dropped from 65,990 to $52,990 (before the credit). Adding $7,500, the electric vehicle (“EV”) now costs $45,490, which is a 31% discount from the original $65,990. Of course, not all Tesla cars received such a price cut or are eligible for the tax credit, and the details of the price cuts can be found in Tesla Car Price History.

A one-time cut in prices by up to 30% is unheard of in the auto industry, and the business literature analysts did not hold back on commenting on this action. The analysts provided sometimes, diametrically opposing views of this decision; some analysts praised this decision, and others considered it the start of Tesla’s demise.

I went through Seeking Alpha articles and could not find a clear fundamental analysis of where the auto prices are heading in the future and how the price cuts are related to the company valuation. I decided to perform my own analysis related to the Tesla price cuts and I am sharing it here.

Article Thesis

Tesla’s price cuts of up to 20%, remarkable as it might look, may just be the start of many future price cuts. The article predicts that further price cuts may be coming, although not as dramatic.

While margins should be dropping, the increased sales would compensate for that from a bottom-line perspective resulting in an unprecedented increase in the total earnings for Tesla. The article explains why the sales should be growing beyond the traditional supply/demand relationships.

Tesla has competitive advantages that competitors do not have and its pricing strategy relies on these advantages. The article shows how Tesla’s action has caused competitors to suffer from this price cut and how this suffering would most likely continue into the future.

Finally, the article performs a valuation on TSLA, and comes with the same conclusion that I came up with before, this time, taking the price cut angle into consideration: Tesla is a three trillion-dollar company.

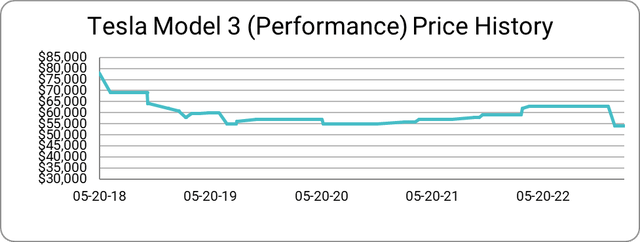

Tesla’s Auto Price History

Source: Compiled by Author from Tesla Car Price History; Data from 2018/05/20 at $78,000 to 2023/02/12 at $53,990.

The current price of Model-3-Performance is the lowest it has ever been, at $53,990. However, the above chart does not take inflation into consideration. Taking the inflation into consideration, based on the CPI Inflation Calculator, the $53,990 should have been worth $64,200 based on May 2018 prices. This is certainly not the lowest price it has been. More details about Tesla’s price history can be downloaded from Tesla Car Price History.

Let’s now take a moment and try to explain what might have happened in this chart:

- In May 2018, Model-3-Performance was at a high and soon after, its price dropped to maintain competitiveness of the car and increase its sales volume.

- As the company continued achieving economies of scale, it continued dropping the price to a low of $58,000, while maintaining its healthy margin.

- With the increased demand, the company started increasing the price up to $62,900 in mid-2022 to further increase the margin and achieve higher profitability.

- We then had the dramatic drop to $53,990 in January 2023, which we are addressing next.

Why did Tesla cut its prices?

Traditionally, based on the laws of supply and demand, as the price drops, the demand, and thereby the sales volume increases, assuming there is enough supply. When the objective of companies is to increase the demand, they tend to drop the price slowly and gradually for two reasons:

- Not to alert the competition and prompt a price war

- To determine the inflection point at which the rate of increased demand will start declining.

Once the inflection point is determined, the company may still choose to continue dropping its price to reach a more optimal equilibrium price, but it would do that very cautiously.

Tesla did not do that. It enacted a massive price cut instead; a company cutting its prices can be explained as follows:

- Overstocking and excess inventory: The company may have overestimated the demand for its product and produced more units than it can sell. In this case, the price drop could be a way to clear out excess inventory. This is not the case for Tesla, as there is a wait time of 1-2 months for Tesla cars.

- Seasonal fluctuations and sales promotions: The company may introduce a price cut as part of a seasonal sale or promotion to encourage customers to buy during a specific period such as a holiday or seasonal event. This is not the case of Tesla, as it did not indicate that the price drop is a “limited-time offer.”

- Economic factors: The company may be facing economic challenges, such as a recession or a decline in consumer spending, and the price drop could be a way to maintain sales and revenue. While the prospect of a recession may be rearing its ugly head, the EV market is expected to grow even during a recession (Reuters: Electric vehicle production set to surge in 2023 despite low sales).

- Increase in competition: The company may be facing stiff competition from rival firms, and lowering the price of its products could be a strategy to attract more customers and increase sales. Tesla is not yet facing stiff competition in the luxury EV market although it is expected to happen with the commitment of most companies to enter into this market. We cannot assume that the massive price cuts are because of competition.

- Strategic pricing and/or price war: The company may have determined that a price drop is necessary to achieve a specific business objective, such as capturing a larger market share, increasing brand awareness, entering a new market segment or engaging in a price war that it thinks it can win. This is most likely the thinking behind Tesla’s massive price drop: entering a pre-emptive price war to capture the biggest market share before competition starts producing its EVs and potentially even driving some competitors away from the EV market.

Entering into a price war is usually a race to the bottom. So, is Tesla entering into a price war and a race to the bottom with this price cut? And, is this the preamble to the demise of Tesla ?

I strongly believe that this price drop would not lead to the demise of Tesla. On the contrary, I believe that given the current economic and competitive situation, it is the optimal choice that Tesla has to continue its aggressive growth trajectory.

From my perspective, capitalizing on the company’s core competencies and delivering a pre-emptive strike to the competition based on this is the right action for any company to take. Given that Tesla’s key core competency is its low production cost, the pre-emptive strike was the massive price cut.

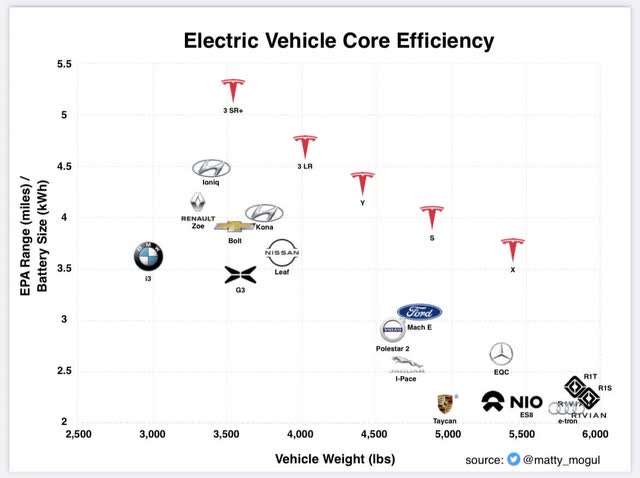

How is the low production cost Tesla’s core competency?

Tesla has many competitive advantages which I enumerated in my October 2021 article: Tesla: A Justification For A $3T Company. This section will focus only on the low production cost advantage that Tesla has over its competition.

Source: Inside Tesla Fremont Factor, Tesla.com

There are a few reasons why Tesla has a low production cost compared to the competition:

- Manufacturing economies of scale: Tesla has developed innovative and efficient manufacturing processes, such as the use of automated robots and smart machines to speed up production, reduce labor costs, and improve product quality. This required huge upfront costs that were mostly already incurred and Tesla is continuing to invest in this area. As Tesla produces more vehicles, it is able to spread the fixed costs over a larger production volume (expected to grow at a rate of 50% in 2023) resulting in lower costs per unit.

- Battery technology: Tesla has invested heavily in developing advanced battery technology, which is a significant part of the cost of electric vehicles. Tesla has a staggering advantage over its competition related to battery technology, and this advantage is expected to grow. By developing its battery technology, Tesla is able to reduce the cost of the most expensive component in its electric vehicles.

- Vertical Integration: Tesla has vertically integrated its production process; it controls almost every aspect of the production of its electric vehicles, including the design, engineering, software (including FSD) and production of most components. By all means, Tesla is the most vertically integrated auto manufacturer and auto manufacturers are keen to copy it. Through vertical integration, Tesla is able to keep its cost low by avoiding markups on parts and components and achieving economies of scale as its volume increases.

- Supply chain optimization: Tesla has worked to optimize its supply chain management by sourcing materials and components at the lowest possible cost and maintaining strong relationships with suppliers to ensure reliable and consistent supply. It is now even contemplating acquiring a lithium-producing company to ensure the supply of the raw material for its batteries. This supply chain optimization, combined with vertical integration, should result in lowering the cost per unit.

This low production cost advantage is currently giving Tesla a very high profit margin, higher than Mercedes-Benz Group AG (OTCPK:MBGYY) and 8 times as high as Toyota (TM). This high margin, combined with the desire to further increase its economies of scale, gives Tesla a great incentive to drop its prices and enter into a price war while increasing its net income.

How can cutting the prices increase the net income?

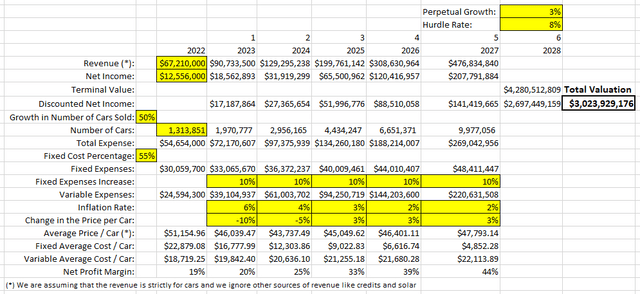

Before we conduct the price cut analysis and its impact on the net income, we need to state some facts and assumptions with their justifications:

- Assumption: The fixed cost component of the cars in Tesla is 55%. The exact amount of the fixed cost component for Tesla cars is not publicly available, as it is not disclosed by the company. However, given the points of the prior section, 55% seems to be a conservative number.

- Assumption: The growth in the volume of cars sold would continue at 50%. This is the projection that Tesla made. In 2022, this growth rate was 40%, lower than the projected target of 50%. The reasons for not hitting the target are mostly supply-side challenges like production issues, supply chain issues and COVID lockdowns; these challenges are not expected to persist in 2023 and I believe that 50% is a conservative number.

- Assumption: The total fixed expenses would increase by 10% annually. Again, this is just a guess, and without the internal management reports and plans from Tesla there is no way to determine this number.

- Assumption: Actual prices of the cars would drop by 10% in 2023, by 5% in 2024 and will increase by 3% thereafter. As more competition comes through, I am expecting Tesla to continue cutting its price for the next two years; by that time, Tesla’s prices will already likely be lower than most other competitors, unless competitors are taking a hefty loss on their sale of EVs.

- Assumption: All the variable expenses would increase by the inflation rate. This is a conservative assumption as it does not consider the impact from the economies of scale.

- Assumption: Inflation rate would be 6% in 2023, 4% in 2024 and 3% in 2025 and in perpetuity. These are just guesses and no one knows where the inflation is actually heading.

- Fact: The starting net income in 2022 is $12,556M based on $67,210M of revenue. This is according to the company last financial statement filing for the year ending December 31st, 2022.

- Fact: Starting number of cars sold in 2022 is 1,313,851. Interestingly, half of these cars were made in China at the Giga Shanghai factor.

Source: Copy of the Valuation Spreadsheet created by Author

I put these numbers on a spreadsheet and applied the discounted net income to get a valuation of $3T. Coincidentally, this is very similar to the valuation I came up with in my last two articles about Tesla: Tesla: A Justification For A $3T Company and Musk Got It Wrong, Toyoda Got It Right, But Tesla Will Win.

The spreadsheet assumes that all the revenue is coming from cars, and is ignoring the solar business. While it might be the topic of another article, I personally believe that the growth prospects of Tesla’s solar business are higher than those of the auto business, and this renders the spreadsheet conclusions to be conservative.

This spreadsheet also indicates that the margin is projected to continue growing to be higher than 40% despite the price cuts in the first two years.

Source: Created by Author from Valuation Spreadsheet

Conclusion

Tesla is doing the right thing to cut its car prices. In addition to continuing to grow the volume of the sold cars by increasing the demand for its cars, Tesla is also delivering a pre-emptive strike against the competition.

Tesla’s competitors may be facing a major problem competing with Tesla at these price levels, especially if Tesla continues its price cuts. Tesla already has the low-cost competitive advantage, and the competitive manufacturers are expected to face a massive challenge selling their EV cars without taking a loss. While taking a loss may be an alternative for the short term, it is not a sustainable model on the long term.

In summary, the price cut provides a better prospective for Tesla’s bottom-line growth and should eventually propel its margin to grow to over 40%.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I don’t own a Tesla, but rather an Camaro (ICE); My next car will be a Tesla.