Summary:

- As part of its global expansion, R&D, and product strategies, Tesla will continue being exposed to several risk factors, and price cut is the least of concerns.

- With ~21% automotive gross margin, Tesla can afford price cuts. It is also in a good position to explore various cost-based options to improve margins.

- News about price cuts has pressured the stock price, creating a potential buy opportunity for the bulls.

Xiaolu Chu

Tesla (NASDAQ:TSLA) has recently made headlines and drawn the attention of both enthusiasts and skeptics with a series of price cuts on all of its models. This latest move has implications not only for the company but for the entire Electric Vehicle / EV market. On one hand, the price cut ultimately affects the business’ near-term profitability. But on another hand, I view the price cut as a tactical move that will strengthen competitive positioning under the ongoing challenging macro backdrop. The situation has created uncertainty, and as of today, the stock has dropped by ~11% since the Q1 2023 earnings call last week.

For the long-term, I have a bullish view of Tesla. Notwithstanding its premium valuation, occasional shortcomings, the quirks of its co-founding CEO Elon Musk, as well as its exposure to the cyclical nature of the auto industry, I believe that overall Tesla is one of the most attractive growth stories we can find today. It is a tech company that actively innovates to problem-solve in a very challenging industry, yet operates with a proven track record of consistency of strong growth and profitability.

This first coverage of Tesla will reflect my long-term view. I start with my viewpoint on the price cuts and how they can create positive consequences as part of Tesla’s competitive strategy based on my latest understanding of where the company stands as of Q1:

- Tesla can more than afford to do a price cut. It remains one of the most profitable companies in the auto sector, even after price cuts.

- Pricing is only one of the two ways to drive profitability. The other one is the cost structure. I believe that Tesla has both the best infrastructure and capability to implement any cost-based strategy to drive higher profitability if it wishes and needs to.

- I expect the price cuts to be tactical and temporary in nature to capture stronger competitive positioning and volume during the current economic downturn.

In the end, I highlight a few long-term growth and profitability drivers for Tesla between today and FY 2027 as I attempt to estimate a fair target price based on a probability-weighted 5-year revenue forecast.

Tesla Can Afford Price Cuts

Since the beginning of the year, Tesla has been lowering the price of its vehicles globally to create more demand during economic downturn. Consequently, we saw a record delivery number in Q1 2023. With ~422k deliveries, Tesla beat its previous record of 405k deliveries achieved in the previous quarter, Q4 2022.

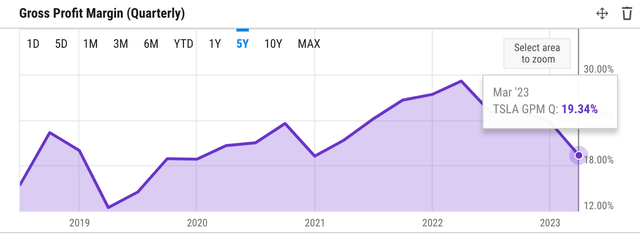

On the flipside, the price cuts have affected Tesla’s profitability. Gross margin was ~19% in Q1, a quite significant decline from ~24% in Q4 2022. Likewise, Q1 diluted EPS was also down to $0.73 from $1.07 the previous quarter. However, despite the financial impact, I believe that it would be underestimating Tesla to suggest that the price cut was not a calculated move that came out of desperation.

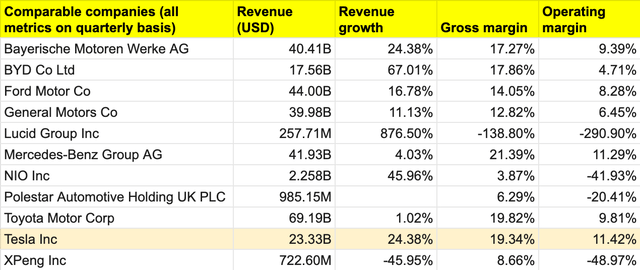

To begin with, Tesla still maintains a relatively very healthy gross margin. Excluding the non-automotive segments, gross margin stands at ~21% instead of ~19%. For context, mass-market-focused traditional auto manufacturers such as Ford (F) and General Motors (GM) had gross margins between 12% – 15% in the most recent quarter, while the luxury auto makers like BMW (OTCPK:BMWYY) or Mercedes Benz (OTCPK:MBGYY)’s gross margins were between 17% – 21%.

author’s own analysis – auto / EV universe

Except for Tesla and BYD (OTCPK:BYDDY), most EV-only manufacturers today struggle to generate double-digit gross margins. Tesla, moreover, produced best-in-class gross margin similar to those of luxury automakers even after the price cut.

Cost-based Strategies To Drive Higher Margins

I believe that while pricing strategy is important, the capability to drive down production costs remains a superior profitability lever for any auto company, especially EV-focused ones. Unlike in the traditional auto industry where all of the automakers have probably reached the ceiling when it comes to innovating new ways to reduce production costs, EV is still an evolving industry that will benefit a lot from technological innovation across the board, especially in supply chain, design, and manufacturing – key areas driving production costs.

EV companies can usually be differentiated by their technological innovation and approach in those areas. EV startup Arrival (ARVL), for instance, innovates by using a specialized assembly approach to fit the process of microfactory-based manufacturing which has a lower capex requirement and footprint than a conventional factory. The idea is that Arrival should be able to produce cost-efficient EVs with the concept.

I continue to anticipate various cost-reduction opportunities that leading EV companies like Tesla can capture through technological innovation, and therefore, I also see opportunities where Tesla can still generate outsized profit margins even if it wishes to continue its cost-leadership pricing strategy. In Investor Day 2023, I noticed a few upcoming technologies that will put Tesla further ahead of its competition in terms of bringing down EV production costs:

- Next-generation vehicle manufacturing process: a new manufacturing approach where parts of the cars, such as the front, rear, sides, and doors will be built by different operators on separate lines in parallel pre-assembly. Tesla expects that this new approach will reduce the manufacturing footprint by at least 40% and bring down the Cost of Goods Sold / COGS per unit by 50%. This concept of redefining the traditional manufacturing process to reduce footprint is similar to what Arrival is doing.

- New powertrain transistors with 75% less SiC / Silicon Carbide: SiC is often used in power electronic components such as converters or inverters. In an EV, these components are integrated into a powertrain, which can easily make up ~20% of the total cost of an EV. It seems that Tesla is coming up with a new way to design their proprietary power electronic components without using the expensive SiC.

- Switch to 48V electrical architecture – Tesla plans to adopt a 48V system to reduce current by a factor of four in comparison to the 12V systems it is using in its models. The reduction in current also means that Tesla can use smaller, less expensive wires than it is currently using.

- Replacement of lead acid with lithium-ion / Li-ion batteries – Tesla is also looking to use Li-ion batteries for its new low-voltage system in all of its next-generation vehicles, which will reduce mass by 87%. Previously, Tesla already made the change to 12V Li-ion batteries in both models S and X. With the vehicle being lighter, we should ideally expect range and COGS improvements.

Competition During Downturn

Tesla’s recent decision to cut prices on its vehicles has the potential to drive demand during a period of economic downturn, while also helping the company expand its production capacity and revenue growth.

Aside from increasing the affordability of Tesla vehicles, I believe that the lower price point can attract new customers who may have previously been hesitant to make the switch to electric vehicles. Moreover, the price cuts can also enable Tesla to drive enough demand to scale up production, leading to increased efficiency and higher overall output.

I think that the price cut is also an opportunity for Tesla to also put pressure on its competitors. More recently, Tesla’s price cuts have been followed by some rivals, such as XPeng (XPEV) and Ford. Ford most recently lowered the price of its Mustang Mach-E, a model comparable to Tesla’s Model Y.

The impact of price cut will be much harder on EV makers like Lucid (LCID), Xpeng, or Polestar (PSNYW) Given their relatively lower production capacity as early-stage EV makers, it could be financially damaging for these companies to match Tesla’s price point. On the other hand, maintaining their price can lead to conceding a lot of their market shares to Tesla.

Risk

As part of its ambition to dominate the global EV market, Tesla has made a significant investment in China, the biggest EV market in the world. Tesla’s Gigafactory in Shanghai is one of its key assets in the region, and the company has plans to expand production capacity at the facility in the coming years. However, the company is facing intense competition from both established automakers and new entrants.

This intense competition is a significant risk for Tesla, as China remains a critical market where Tesla generated ~22% of the company’s total sales as of FY 2022. Any significant decline in Tesla’s market share in China could have a significant impact on the company’s overall financial performance.

BYD is Tesla’s biggest competitor in China and has already surpassed Tesla in terms of units sold in 2022. Additionally, Nio and XPeng are also vying for a share of the market. Furthermore, Tesla faces other risks in China beyond the competition. This includes a complex regulatory environment, potential intellectual property theft, geopolitical tensions between the US and China, and cybersecurity risks.

On the other hand, a lot of growth stories on Tesla, including my own version, have been built on its reputation as a technological innovator in the EV industry.

While these technological innovations can be game changer, they also carry noteworthy risks as Tesla attempts to bring them to market. Full Self Driving / FSD technology, in particular, exposes the company to potential reputational risk. Tesla’s FSD has come under scrutiny in recent months due to concerns over safety and the accuracy of the system.

Cybertruck is another innovation that presents a potential risk for Tesla. The vehicle’s radical design may appeal to some consumers, but it could also be a turnoff for others. Cybertruck’s success will depend on its ability to attract a broad range of consumers, and failing to do so will impact Tesla’s overall growth prospects.

Valuation/Pricing

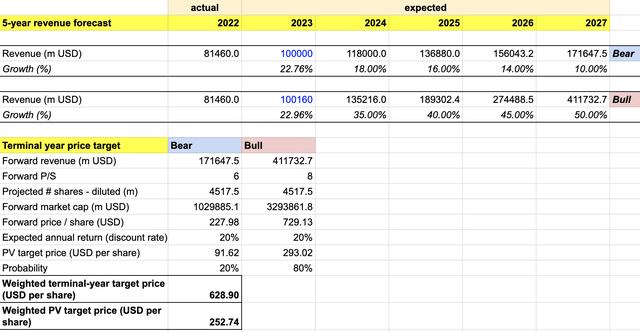

In estimating my target price for Tesla, I came up with a 5-year revenue forecast based on my version of the growth story under the probability-weighted bull vs bear scenarios.

1. Bull scenario (80% probability) – Deliveries to hit another record high in FY 2023, while revenue modestly grows by ~20% to ~$100 billion as we consider the effect of lower vehicle prices and ongoing economic downturn. I expect the economic downturn to soften starting in FY 2024 onwards and growth to gradually reaccelerate on a yearly basis to 50% until FY 2027, similar to YoY growth in FY 2022. Tesla will end FY 2027 with ~$400 billion in revenue and ~$3.3 trillion in market cap. The growth story depends on some assumptions:

- Tesla will see success in unlocking higher cost efficiencies per vehicle for all new models with its next-generation vehicle platform, driving higher operating margins from cost-based strategies. I would probably expect Tesla to launch this somewhere in 2024 or the beginning of 2025 and see operating margins expand to +20%.

- On the revenue side, I expect Tesla’s capability to produce EVs with more efficient cost structures to enable entering the mass market, whether with its popular model 3 and model Y, or with a new model). I also expect Tesla’s pricing strategy to drive market share growth further at the expense of its competitors.

- While it is relatively difficult to set an expectation regarding the numbers for Cybertruck and FSD, I would expect minimal revenue contributions (< 2%) from these segments starting in FY 2024. For comparison, Tesla’s energy business contributed ~4% of Tesla’s overall revenue as of Q1 2023.

- Tesla’s energy and storage segment, in the meantime, will continue to grow and make up at least 10% of the business by FY 2027, driven by its Megapack business globally, especially in China, where Tesla already set up a factory in Shanghai to make Megapack batteries.

- From a valuation multiple perspective, I will be a little conservative and assign an FY 2027 P/S of ~8x for Tesla, a figure that is just above today’s ~7x P/S. This P/S reflects Tesla’s continuing EV market leadership, outsized growth and profit margins compared to the rest of its competitors due to its technological leadership (e.g. next-generation vehicle platform), and most importantly the success of broader FSD roll-outs that will earn the company a $5 to $7 billion of additional revenue at SaaS-like margins in FY 2027. As a caveat, my conservative P/S is not taking into account Tesla’s very high popularity, which may drive exceptionally high market demand for the stock in any future milestone-reaching event. When Tesla reached its first year of positive net income in 2020, we saw the stock traded as high as +28x P/S. As Elon Musk said during the recent earnings call, FSD remains the next key milestone for Tesla. With Tesla unlocking next-generation platform and then FSD gradually into FY 2027, I see a possibility of P/S to expand significantly from ~7x level today. As such, the midpoint of 7x – 28x P/S would also be appropriate to account for that technical aspect of the stock.

2. Bear scenario (20% probability) – Revenue modestly grows by ~20% to ~$100 billion, but the prolonged economic downturn affected Tesla’s flexibility in pricing strategy and overall demand for EVs into FY 2024 onwards. Growth to gradually subside from 18% to merely 10% in FY 2027. Tesla will end FY 2027 with merely ~$171 billion of revenue and ~$1 trillion in market cap. Assumptions are as follows:

- Tesla to experience further delay in launching its next-generation vehicle platform, and face operational challenges to fall short of its promise of lowering per-unit cost.

- The same thing with FSD, Tesla will continue to face delays and difficulties in rolling out FSD in various states and other geographies due to regulatory barriers.

- Cybertruck to see minimal demand and will be discontinued in FY 2025.

- US-China tension to escalate and affect the Chinese government’s relationship with Tesla, making the Chinese government unofficially favor BYD and limiting Tesla’s flexibility and potential upside in China.

- From a valuation multiple perspective, the bear outlook would reward Tesla with ~6x P/S, which is slightly lower than today’s level.

author’s own analysis – TSLA 5-year target price model

I arrived at an FY 2027 target price of ~$228 for the bear scenario and an FY 2027 target price of ~$729 per share for the bull scenario. Further, I estimate Tesla to have around 30% of share dilution between FY 2023 and FY 2027, the same for both scenarios.

Consolidating these two scenarios, I arrived at a probability-weighted (80/20 for bull/bear) FY 2027 target price of $628.9 per share. This figure is higher than the all-time-high ~$407 per share in November 2021.

Applying a discount rate of 20%, which represents the fair expected return for a growth stock like Tesla, the weighted target price in today’s term would be ~$253 per share.

This means that Tesla is undervalued today, as the stock is currently trading at ~$170 per share. For investors, this simply means that $253 is the maximum entry point to purchase the stock to realize that 20% return annually until FY 2027, where we expect to see a price per share of $628.9, based on my model. The difference between $170 and ~$253 represents an opportunity to realize discounts on the target price.

One more thing I would like to highlight and elaborate further is the application of P/S instead of P/E valuation multiple in my model. While P/E is commonly used in evaluating traditional auto stocks, I view P/S a more fair metric in evaluating EV makers, who aside from Tesla and BYD, are still largely loss-making and building production capacities to meet growing demand. Pure play EV makers like Tesla should also be valued differently than the traditional auto makers entering EV industry. Pure play EV makers are generally more agile, not burdened with the legacy Internal Combustion Engine / ICE business, and can focus all their resources on developing and refining their EV technologies and business models across the value chain (e.g. assembly process, powertrain, battery, self-driving, etc).

Conclusion

Tesla’s recent price cuts have garnered attention and affected the company’s short-term profitability, nonetheless, I see it as a strategy that could strengthen their competitive positioning. Despite recent selloffs due to fear of Tesla conceding margins further, Tesla remains one of the most attractive growth stories.

As it stands, I also see multiple ways for Tesla to drive higher margins through its cost-based strategy. I am also of the view that the price cuts are likely temporary and aimed at capturing market share during the current economic downturn.

I expect Tesla to continue being exposed to several risk factors, and the price cut is the least of concerns. Intense competition from established automakers and new entrants like BYD, Nio, and XPeng in China and other geographies is something investors need to pay attention to. China is a critical market, and any decline in Tesla’s market share could impact the company’s financial performance. Nonetheless, Tesla’s China presence also comes with its own set of geopolitical risks. Meanwhile, new initiatives like FSD and the Cybertruck also carry risks, such as regulatory, reputational, and demand risks.

I continue to maintain an optimistic view of Tesla. Based on my growth story and projection, its probability-weighted target price is around $253 per share, making the stock undervalued today. Investors should aim to purchase below $253 for a maximum 20% annual return until FY 2027 when we hope to observe a $628.9 per share price target according to the model.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.