Summary:

- Tesla, Inc. stock is significantly under pressure due to a variety of reasons: insider selling, increased competition, and a lowering of demand.

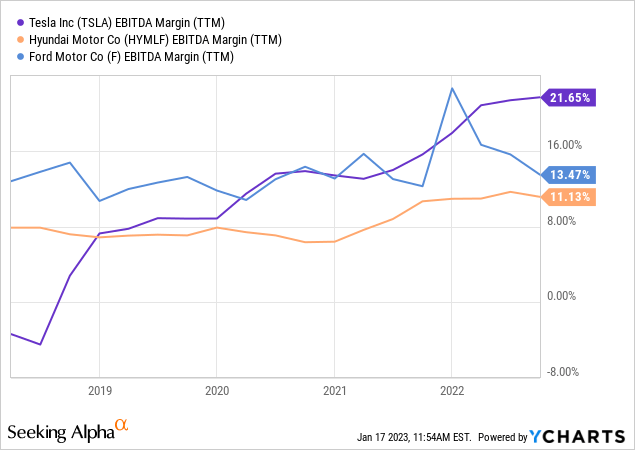

- However, Tesla management has room for price cuts; its EBITDA margin is extraordinarily high.

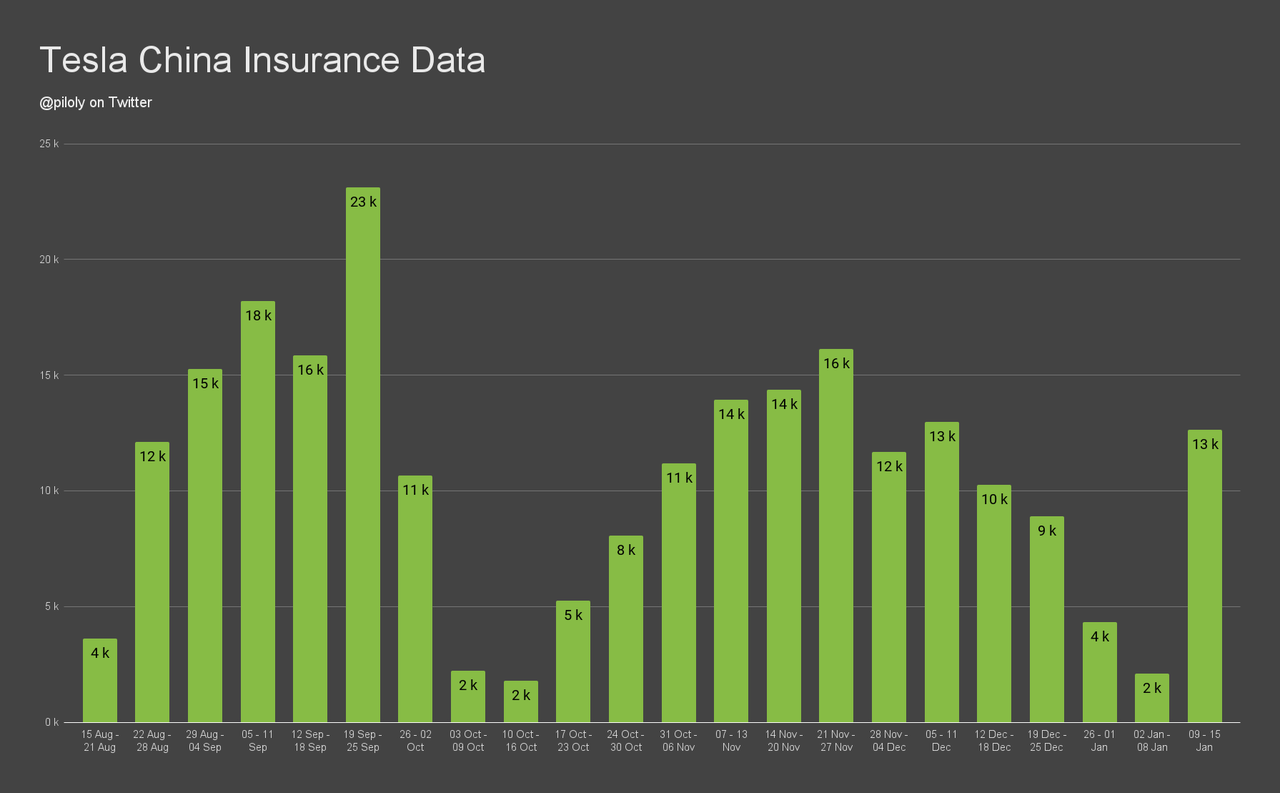

- Price cuts could not be as bad as everyone is screaming. Very preliminary weekly data from the Chinese market shows a significant boost in demand.

- Due to the new tax credit, a similar increase could also be spotted in the USA.

- Tesla’s EBITDA margin will likely decline and lower the spread between its competitors, but a volume-based approach could boost EPS in 2023.

Justin Sullivan/Getty Images News

The Tesla, Inc. (NASDAQ:TSLA) stock price has been badly affected by market turmoil. In November 2021, the stock price peaked at $414.5 USD (after split-calculation). Currently, the share price has decreased by roughly 70% and is approaching $128 USD. The stock experienced a short-term low of $101.8 USD on January 6, 2023, as a result of numerous negative events.

The enterprise value of Tesla, Inc. declined considerably for a variety of factors, including insider selling paired with the Twitter transaction, declining demand, intensifying competition, and automobile price reductions. Nonetheless, as evidenced by the most recent data from China Merchants Bank International (“CMBI”) via Reuters, the recent Tesla price decreases have significantly increased demand in China during the first week following their introduction. Remember that price reductions have been observed not just in China, but also in the European Union and the United States. If the outcome is the same, this managerial action could be compared to a full house in poker – but not a straight flush. Let’s move through this step by step.

Insider selling

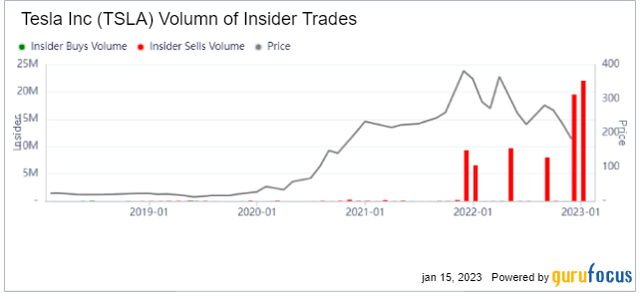

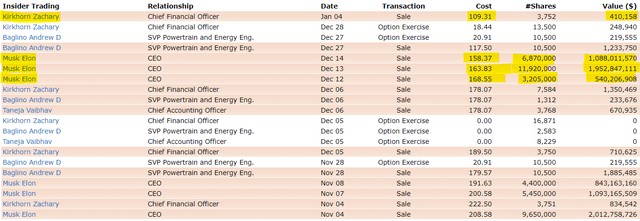

First and foremost, it is common knowledge that Elon Musk, the CEO of Tesla, backed via shares and also sold numerous Tesla shares for his Twitter acquisition. Elon Musk used cash and stock as collateral for this deal, allowing him to proceed. However, not just Musk, but also the CFO and other key management sold a substantial number of shares. The initial phase of selling occurred close to the stock price’s peak, but more selling activity continued in November and December. According to Gurufocus, the total volume of shares sold exceeds 22 million, as shown below.

Tesla – Volume of Insider Trades (gurufocus.com)

December insider sales volumes in U.S. dollars beat the previous record of $3.5 billion, largely due to Elon Musk. The insider selling continues in January 2023, with the CFO (Kirkhorn Zachary) selling an additional 3,752 shares at an average price of $109.3 USD for a total of $410k USD.

Tesla – Insider Trading (Finviz.com)

If this pattern persisted, it would be a catastrophe for the shareholders. Nevertheless, based on Elon Musk’s declaration, he will stop selling Tesla shares:

I won’t sell stock until, I don’t know, probably two years from now. Definitely not next year under any circumstances and probably not the year thereafter.

It would be an excellent starting point for Tesla bullishness. I must say that I was quite optimistic about Tesla as a company and its management, but I was skeptical about the stock price and its valuation in 2021 and 2022. I still trust in Tesla’s management since it’s a revolutionary company, but I’m gradually becoming positive on TSLA stock as well. Why? Because the price is now considerably more attractive.

Q4 2022 negative surprise

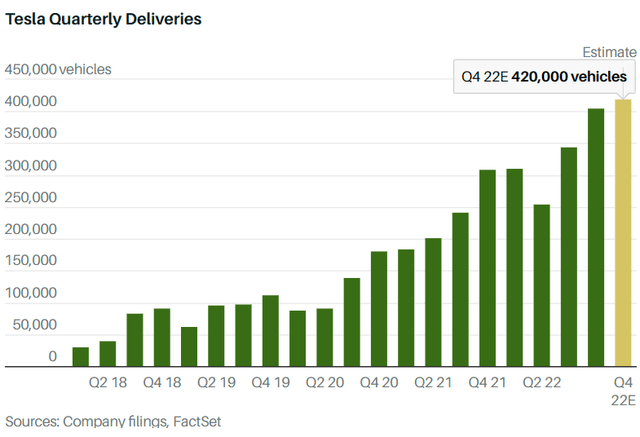

Regarding Q4 deliveries, Tesla failed delivery projections for the second consecutive quarter. The graph below illustrates the reality and estimates for the 4Q. In early January, Tesla investor relations provided its customary company-compiled estimate of approximately 420,000 units. We might conclude that it was a significant miss compared to analyst expectations. However, looking once more at the historical delivery trend, it is easy to conclude that Tesla is a very successful story. As previously noted, the company’s fourth-quarter deliveries and pricing fell short of expectations, which could result in a decline in EPS for fiscal year 2022.

Barron’s anticipates Tesla to deliver approximately 445 000 units in the first quarter of 2023 and 1.9 million for the full fiscal year. Based on the global price reductions and available tax credits (totaling $7,500), I believe that Tesla can surpass this consensus. On the other hand, this agreement was likely reached with greater EPS or projected prices than those announced in the preceding weeks. And thus concludes the beginning competitive market.

Tesla Quarterly Deliveries (Barrons.com, Tesla)

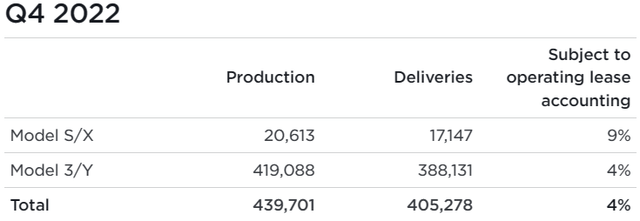

According to Tesla investor relations:

“In the fourth quarter, we produced over 439,000 vehicles and delivered over 405,000 vehicles. In 2022, vehicle deliveries grew 40% YoY to 1.31 million while production grew 47% YoY to 1.37 million.”

Tesla 4Q2022 production and deliveries (Tesla IR)

The negative aspect is that the entire performance falls short of analyst expectations. On the other hand, as seen by the above graph, Tesla’s trajectory is extremely positive and will likely continue.

Margin contraction, EPS fall, or demand reset?

Price cuts and tax credit

As Tesla, Inc. reduces prices in key markets, experts reduce its profit forecasts for 2023. A portion of the community asserts that price reductions enhance market share. In the last cycle, European performing car-models were reduced by 6% to 20%. According to SA news, the electric vehicle (“EV”) market leader reduced its Chinese prices by 13% to 24% in January. In addition, it is unknown if this strategy can improve EPS (due to demand growth) or if margin contraction will result in EPS decline. However, this management action was very certainly the consequence of a decline in demand and the possibility that certain customers may qualify for a tax credit of $7,500:

“The IRS released new guidelines for vehicles qualifying for the $7,500 tax credit on Thursday. The terms of the tax credit include specifications that vehicles must be assembled in North America and sets price caps on qualifying cars and SUVs. For the former, $55K is the max MSRP while SUV MSRPs are allowed to extend to $80K.”

China’s stunning numbers

I believe that the price reductions is an excellent short-term strategy and that Tesla management’s actions can be beneficial. In just two weeks following the announcement of a price reduction for Tesla products, the China retail market experienced a considerable surge in demand.

Average daily sales for Tesla in China during the Jan. 9 to Jan. 15 period jumped 76% from the same period in 2022 to 12,654 vehicles.

On the chart below, it is evident that Tesla’s management decision was prompted by the recent demand deceleration. This outstanding chart by Roland Pircher illustrates its recent development. This week’s outcome is an outlier, and similar statistics will likely persist in the weeks ahead. It’s really very attractive for many clients. If such data will be comparable in USA and Europe, I believe Tesla may greatly outperform Q1 consensus also by the deliveries, but also from an EPS point of view.

Tesla China Insurance Data (Roland Pircher, Twitter)

Risks and margins

Tesla’s performance is not quite as impressive as that of BYD Company Limited (OTCPK:BYDDF), but when considering the medium-term trend, the results are quite remarkable. Yes, I am aware that these price cuts would impact margins, but the volume-driven effect can increase EPS because the pricing of the items is much more attractive, particularly in the United States and the European Union. Tesla is in a highly competitive and very cyclical business, with profitability mostly reflecting the economic cycle. Consequently, if an economic recession or merely a slowdown occurs, it is expected that demand will decrease regardless of the circumstances. I believe that the 2023 first and second quarters will benefit significantly from the program of price reduction. The primary concern is that it may be short-lived, and economic cycle-influenced demand destruction (increased interest rates and inflation) might considerably affect expected deliveries and limit growth.

However, this policy measure could mitigate this negative impact. Ford Motor Company (F) and Hyundai Motor (OTCPK:HYMLF) reached their highest margins in 2022, but still lagged well behind Tesla. Tesla’s competitors began to observe symptoms of a demand downturn as well. In contrast, Tesla’s EBITDA margin has stayed strong and expanded over the past few quarters. Due to price reductions on its automobile models, this story will end soon, but the company can also win market share and be better equipped for the competitive race against its indebted competitors.

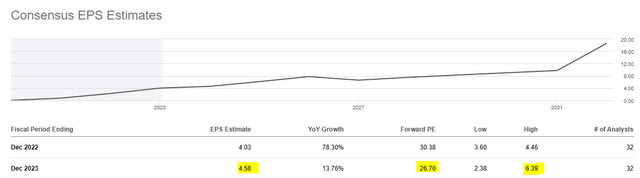

I believe Tesla has the potential to increase estimated 2023 EPS above the median estimate of 4.58. According to current pricing, a Forward P/E (2023) valuation of 26.7 is neutral. It is not the best, but the valuation includes a growth premium. A price pullback between $100 and $115 USD would be an excellent Tesla entry position from a long-term perspective.

Consensus EPS Estimates (Seeking Alpha)

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in TSLA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.