Summary:

- Tesla once again managed to increase volumes from both production and sales but at the cost of substantial price cuts.

- The company seems to need price cuts to maintain volumes, with additional recent tax cuts and short delivery times. That doesn’t count tax subsidy wind-downs.

- The company’s profits already took a hit in the first quarter as a result of price cuts, and we expect that to have gotten worse in this quarter, hurting profits.

Дмитрий Ларичев

Tesla, Inc. (NASDAQ:TSLA) has gone up another 7% towards $900 billion and near its all-time high of a $1 trillion market cap. The company was buoyed by strong order numbers, however, those order numbers were buoyed by massive price cuts. As we’ll see throughout this article, we expect the company to underperform going forward.

Tesla Order Numbers

Tesla’s announcement that’s being celebrated is the company’s order numbers.

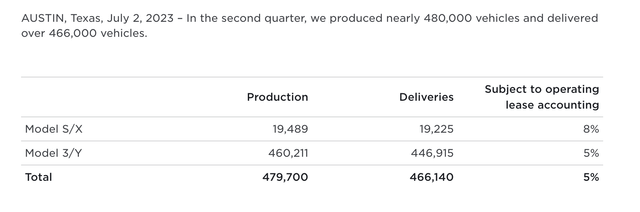

The company announced 479,700 vehicles in production and 466,140 vehicles delivered, with 5% average total subject to lease accounting. The numbers for last quarter were 440,808 and 422,875, respectively, with the same 5% subjected to lease accounting. That does represent 8.8% QoQ growth for the company.

We’ll give credit where credit is due. The company has managed to grow its production substantially QoQ, and it’s managed to close the gap between production and deliveries. That means less inventory (CASH) sitting on the lot. It’s relatively impressive to see from a manufacturing perspective how the company can keep getting vehicles into customer’s hands.

Now on to the downsides. The Model S/X business is effectively dead, and unfortunately, it represents the company’s highest-margin vehicles. The company has closed the delivery gap from the prior quarter, but clearly even with substantial price cuts, demand remains relatively low.

Tesla Price Cuts

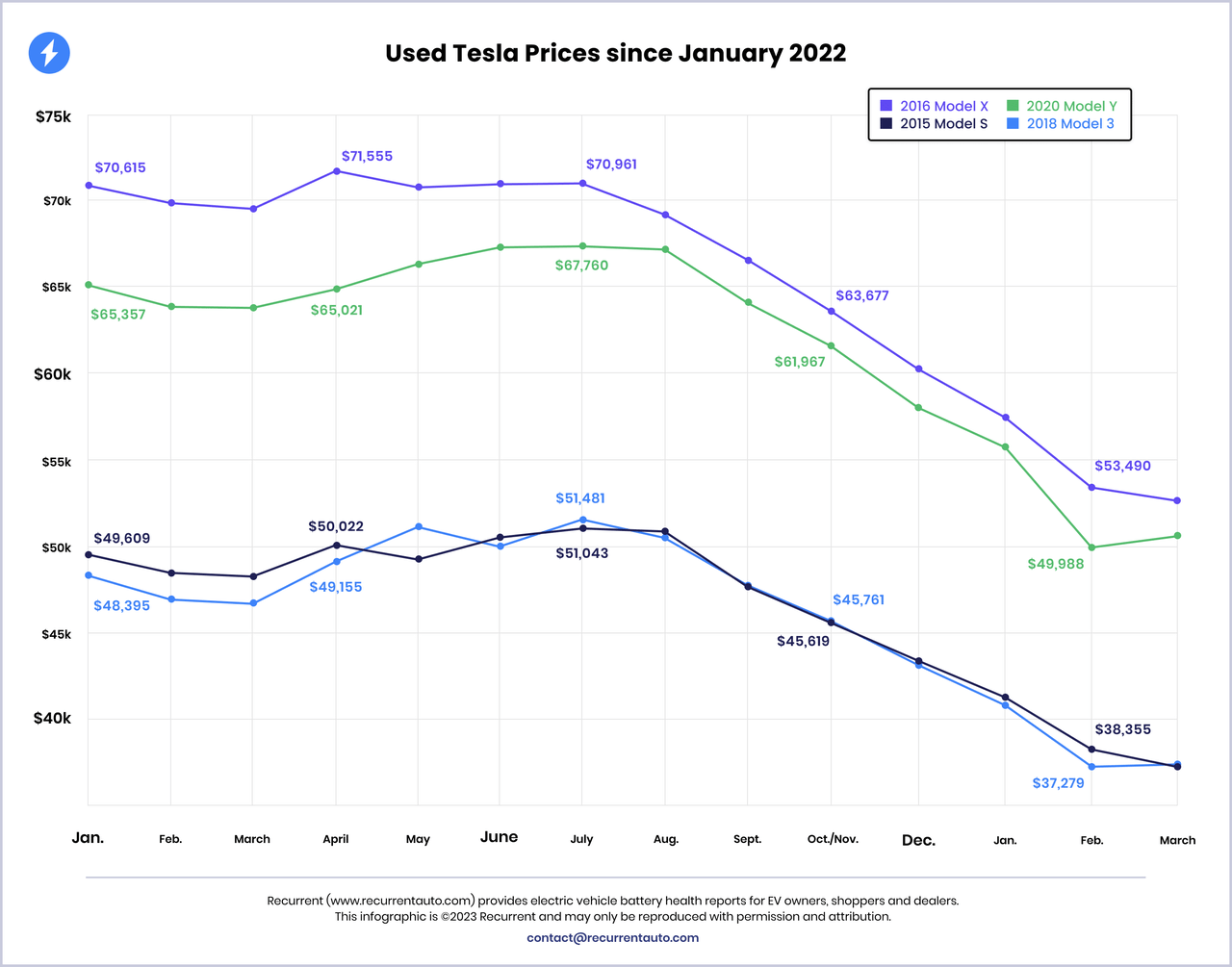

The company’s results, in our view, from a demand perspective were buoyed by massive price cuts. The company cut prices by leading models by double-digits (20+%). An evolution of that effect is clearly visible in the used car market, which we prefer more than the new car market because it also indicates the cost for those who don’t want to wait for a new car.

For top-tier models of sports cars, for example (i.e., Ferraris) we’ve seen initial post-launch used car prices above new car prices. Looking at the website today for our location (in the U.S.), the ETA on new custom-ordered vehicles is July-August 2023, very quick versus other popular vehicles right now (i.e., a RAV4 Hybrid Prime is 1+ years around us).

The above chart shows the collapse in used vehicle prices, partially as the model year has aged, but also as price cuts have impacted the manufacturer. The 2020 Model Y dropped by 30% over a 6-month period. Given Elon Musk’s own recent warnings of a tough economy and the potential of advertising to boost demand, indications are that the price cuts were a necessity.

Indications to us are that Tesla’s current problem might be more demand than supply. The company has not provided an indication to us that if it actually keeps ramping manufacturing at the current pace for multiple additional years it’ll be able to sell those vehicles without further price cuts.

Tesla Competition Performing

At the same time, unfortunately for Tesla, its competition is also figuring out manufacturing.

Rivian

We view Rivian Automotive, Inc. (RIVN) as one of the largest competitors for Tesla given the higher-end focus of the company’s vehicles, its ramp, and the fact that it beat Tesla to produce a high-tier electric truck. The company saw its stock price go up on the basis of managing to produce almost 14k vehicles for the quarter, indicating it’s been ramping well and is on track to hit its annual quarter.

Perhaps impressively, the company’s high-end vehicle production is now within 30% of Tesla’s Model S/X. Tesla’s strategy for new companies of focusing on a high-end versus low-end vehicle is proven, and it’s not surprising that we’re seeing new competitors win here first.

At the same time, existing manufacturers are rapidly catching up from a production standpoint. Ford Motor Company (F) EV production is expected to exit 2023 at 600k vehicles a year and hit 2 million vehicles/year by 2026. 3 years, Tesla is behind, but way closer than where the company once was. BMW (OTCPK:BMWYY, OTCPK:BAMXF) is aiming for 2 million/year by 2025.

Honda and Hyundai are targeting 2 million/year by 2030, Toyota (TM) 3.5 million, and Stellantis (STLA) 5 million. These are experts at vehicle manufacturing that are ramping up slowly, and if nothing else they will put strong pressure on Tesla’s margins. Arguably, that impact is already visible.

Tesla Valuation

Vehicle numbers and margins aside, at the end of the day, Tesla’s value comes down to a single thing: Profits.

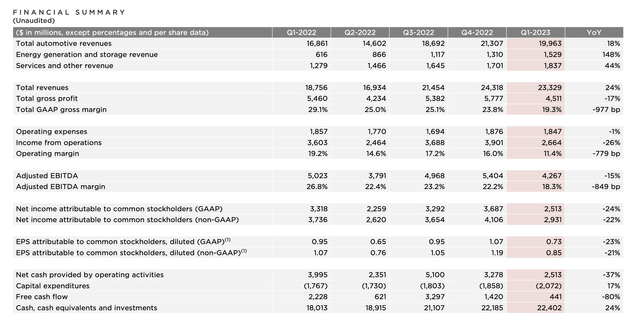

The company has yet to indicate its revenue numbers, but we can guess what to expect. The company has already lowered its prices since the end of the 1Q. However, even in that quarter, revenue dropped more than 5% QoQ, with YoY growth decreasing to 18% despite massive vehicle growth. That resulted in a 17% drop year-over-year in gross profit and a nearly 10% drop in margins.

At the end of the day, the company’s GAAP net income dropped by 24% YoY to $2.5 billion. Despite the company’s volume growth, we’re expecting total revenue, versus $23.3 billion to come in at $25 billion or less. And with higher expenses, we expect the net cash provided by operating activities to come in at less than $3 billion.

That number at the end of the day, a lack of free cash flow growth (“FCF”), is what counts.

Thesis Risk

In our view, Tesla is so overvalued, that the only way it’ll be able to justify its valuation is an unexpected black swan event that drastically increases value. For example, if the company were to completely solve self-driving flawlessly in the next year and get full approval. Without something like that, we expect the company’s share price to underperform as the company does not return to prior strength.

Conclusion

Tesla doesn’t seem to be finding unlimited demand for its vehicle as the company ramps up production. The price cuts seem almost necessary to maintain demand as delivery times remain incredibly short (potentially same-month in the U.S.) That doesn’t count the impact of rapidly scaling production from competitors or the impact of potential tax reductions.

Going forward, we expect the numbers that actually matter (revenue and profits to struggle). Last quarter, with also record volumes, the company’s revenue declined noticeably. Profits and especially FCF remain incredibly low. At an almost $900 billion market cap, even if the company had 100% margins, it’d barely be justifying its valuations.

As a result, despite the market thinking otherwise, Tesla, Inc. stock remains a poor investment.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.