Summary:

- Tesla, Inc. management has again mentioned the monetization ability of Full Self-Driving in latest earnings.

- Most bullish analysts point to FSD and robotaxis as a possible differentiator for Tesla which can improve margins and become a key revenue stream.

- However, even if Tesla is able to deliver level 5 full autonomy capability, the long term margin expansion would be limited due to this feature.

- Any autonomous driving platform which is cleared by the regulators will have similar customer perception and there will be negligible pricing leverage.

- FSD can morph into new monetization options, but as a standalone feature it is not very profitable.

jetcityimage/iStock Editorial via Getty Images

Tesla, Inc. (NASDAQ:TSLA) has made its autonomous driving feature a key differentiator from the competition. However, it is possible that the long-term monetization potential of Full Self-Driving, FSD, might not be as robust as estimated by the company.

The management regularly mentions the FSD feature as a key revenue stream in the future. In the recent earnings call, CEO Elon Musk spent close to 80% of his opening remarks on the future potential of Autonomy and FSD features. A big chunk of questions from analysts were also directed toward this feature. Tesla is “in discussion” to license FSD to another major automaker. Most of the bullish analysts point to FSD as a major profit center in the future. Gene Munster from Loup Ventures has mentioned that FSD alone can bring as much as $20 billion annually in very high-margin revenue. The ability to have margin flexibility is already giving Tesla a significant advantage over rivals.

Tesla has completed 300 million miles being driven with FSD software and is projecting tens of billions of miles driven with FSD in the near future. However, the biggest issue with autonomous driving platforms is the lack of long-term pricing leverage. Once regulators have cleared a platform for autonomous driving, it will become safe for customers without relying on a single brand. In this scenario, customers are likely to buy the lowest-priced option which has received regulatory clearance. Even with two or three main autonomous driving platforms, we could see a race to the bottom in pricing.

Tesla stock is still a Buy due to the growth potential and new monetization options. However, investors should carefully gauge the over-enthusiastic prediction regarding FSD.

Emphasis during recent earnings call

The recent earnings call seems to be centered around FSD and the future potential it will have in different ways. Elon Musk mentioned, “In the long-term, autonomy we think is going to just drive volume through the ceiling next level.”

There was a long discussion regarding Autopilot and Dojo computer which mentioned the various technical details of how this platform is built. The management also mentioned the massive amount of training data required to build this system. Musk mentioned that this training data is not easily available to any other platform, which made Tesla’s FSD platform unique and gave it a bigger competitive edge over other platforms.

Tesla Filings

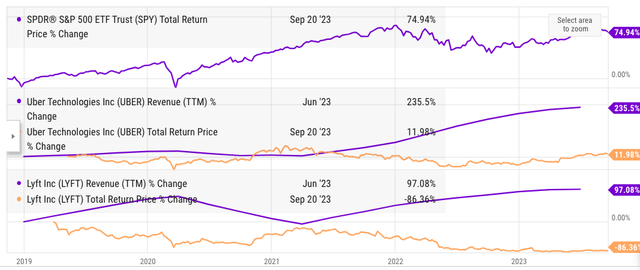

Figure 1: Miles driven with FSD Beta option. Source: Tesla filings.

More than 300 million miles have been driven with FSD and the company is estimating this number to cross 10 billion miles in the next few quarters. This would give Tesla a massive amount of user driving data which can help the software become better. The management mentioned that eventually, they hope the FSD option would be 10x safer than human driving. This would mean that there are one-tenth the number of accidents per million miles traveled on FSD compared to the average human driver.

Considering the level of importance and investment made by Tesla in FSD, it is very important to gauge the future potential of this feature.

No Pricing Leverage

Autonomy and FSD are still new concepts that have not been tried by a bulk of customers in the entire auto industry. We can accept the most optimistic views from the management that a highly autonomous system might be available and get regulatory approval by 2026-27. However, the bigger question regarding FSD is not about the speed at which it might be launched but rather how can it generate sustainable revenue and profits in the long run. It is highly unlikely that FSD can enjoy a pricing premium similar to Apple’s (AAPL) iPhone or other branded products.

There are several other well-funded platforms that are trying to build their own self-driving capabilities. These include Google’s Waymo (GOOG), Cruise (GM), Nvidia Drive (NVDA), Baidu’s Apollo (BIDU), and others. If the regulators decide to give approval to Tesla’s fully autonomous system, they would likely be more inclined to give approval to other platforms in order to prevent a monopolistic self-driving platform. Even with three or four autonomous driving platforms, there could be strong downward pricing pressure.

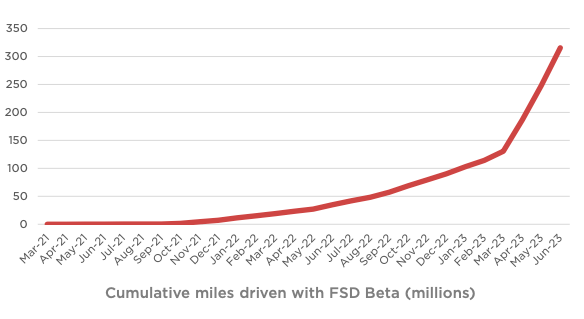

We can look at the example of Uber Technologies (UBER) and Lyft (LYFT) in the last few years. Both companies have struggled to deliver good margins because their service is interchangeable with other operators. Customers end up choosing the platform that gives them the lowest price causing a very strong downward pressure on pricing and margins. A similar scenario could take place with autonomous driving platform. If there are three or four regulatory-approved autonomous driving options, customers are likely to pick the cheapest one.

Few analysts have pointed out that a “safer” option might be able to get better pricing. However, this is unlikely because once a platform gains regulatory approval, which is already very difficult to get, it will be considered safe by most customers. We can look at the airline industry as an example. Few customers will pick one airline over another based on safety because we know that all airlines have to undergo rigorous protocols to gain regulatory approval.

Hence, it is very likely that all autonomous driving platforms might struggle to give good margins as the competition heats up in this industry.

Robotaxi faces a similar issue

Another major discussion point in the earnings call was robotaxis. Elon Musk mentioned “dedicated robotaxi products we think have like quasi-infinite demand. The way we’re going to manufacture robotaxi is, is also itself a revolution.”

All self-driving platforms are looking to build robotaxi options. This is seen as more profitable as it will remove the cost of the driver and give an instant return on investment. This would be extended to robotrucks which is a much bigger market for autonomous driving. There are over 3.5 million truck drivers according to Census Bureau. There are several ideas regarding autonomous truck fleets with one or two safety drivers or fully autonomous point-to-point trucks. These autonomous systems might even be modified for other warehousing tasks which can further increase the total addressable market.

However, it is one thing to increase the addressable market and revenue, while it is a completely different thing to build a moat that can give pricing leverage over the long term. We can see this issue with Uber and Lyft, who have given poor returns despite showing good revenue growth.

Figure 2: Comparison of revenue and price movements of Uber and Lyft. Source: Ycharts.

Robotaxis will also face a similar issue where we could see a race to the bottom. If two or more autonomous driving platforms get regulatory approval to offer services for robotrucks, almost all customers would opt for the cheapest option. This will reduce any pricing leverage with Tesla’s FSD or any other autonomous driving platform.

Tesla a Buy without FSD

Tesla is still a Buy even if we do not take any material impact of FSD on its bottom line. One of the reasons is that, in the short term, FSD subscription or one-time purchase brings significant cash. It could be a long while before regulators give approval for Level 5 autonomous driving platform. Until then, Tesla’s FSD will be the closest option for customers willing to try this feature.

Another reason why Tesla stock is a Buy is because of new monetization options that can open up. We can look at the example of how Amazon (AMZN) has added new high-margin segments on the back of its retail business. The margins within the retail segment are still wafer-thin for Amazon. However, AWS was built to support the e-commerce platform which eventually led to a high-margin cloud business. The advertising business of Amazon is also very high-margin business, which grew due to high customer traction on the e-commerce platform. Similarly, Amazon’s subscription business has over $35 billion annualized revenue rate due to regular purchases on the e-commerce platform.

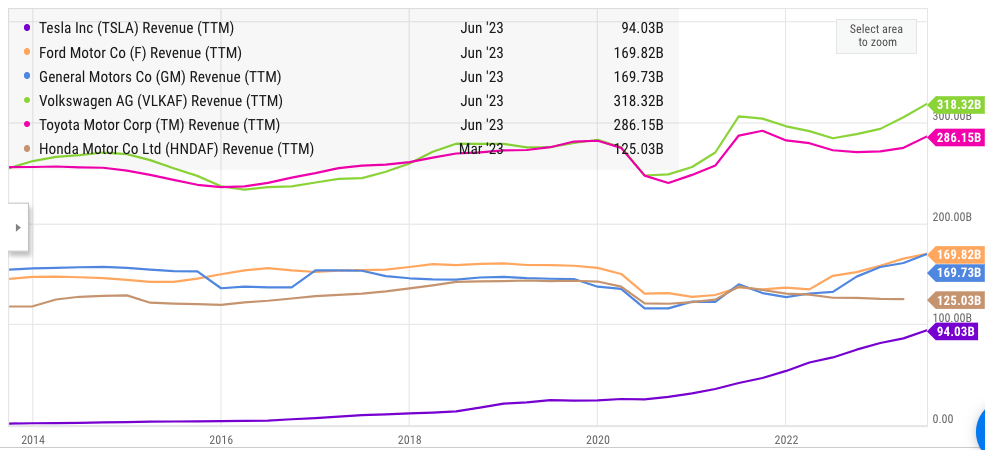

Ycharts

Figure 3: Revenue growth of Tesla compared to other major automakers. Source: Ycharts.

Tesla has reported close to 50% compound annual growth rate in the last ten years. Its revenue base increased from $1.7 billion in 2013 to $94 billion. The management has forecasted a similar 50% CAGR till 2030. Even if the company is able to deliver a more modest 25% CAGR, the revenue base of Tesla will hit $500 billion by 2030. This would likely make the company a market leader in auto industry. It would also have tens of millions of customers who could be monetized with new services, similar to how Amazon did in the last few years. Rapid growth in Tesla can also lead to consolidation in the auto industry. Fewer competitors should improve the margins for Tesla over the long run.

Investor Takeaway

The jury is still out on the future potential of FSD. If the management is correct on the projections about autonomy and FSD, we could see strong margin improvement. However, investors should also consider the other possibility where FSD is not able to deliver on the profitability promises. As mentioned above, the pricing leverage could be quite low once there are multiple companies with autonomous driving features that have received regulatory approval. The robotaxis and robotrucks might similarly face a similar race to the bottom in terms of pricing.

Both Uber Technologies and Lyft are a cautionary tale for investors. It is better not to get caught in the hype and wait for actual results. Tesla stock is still a Buy due to other monetization options and a clear growth runway which will likely make the company a market leader in terms of auto sales by 2030.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.