Summary:

- Tesla, Inc. stock has rallied 30% since May despite a top line challenged by a harsh macro environment, demonstrating solid operating leverage and a strong balance sheet.

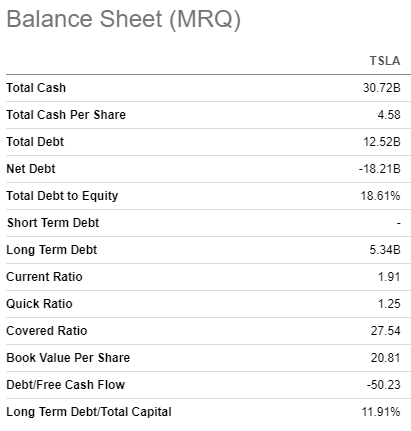

- The company’s fortress balance sheet gives me high confidence in its ability to pursue key strategic priorities and unlock new highly profitable revenue streams.

- My discounted cash flow model values Tesla at $928 billion, 31% higher than the current market cap.

Brandon Woyshnis/iStock Editorial via Getty Images

Investment thesis

My previous bullish thesis about Tesla, Inc. (NASDAQ:TSLA) aged extremely well, as the stock rallied by almost 30% since early May, significantly outperforming the broader market.

The stock surged despite the company’s top line continuing to stagnate due to the harsh macro environment. I consider the market’s optimism as fair, as the company demonstrates solid operating leverage despite challenges for the top line and continues to ramp up its R&D spending. The company’s fortress balance sheet leaves no doubt that it will be able to weather the storm without sacrificing its strategic expansion and innovation priorities.

I consider the progress in getting approvals for Tesla’s autopilot capabilities by the end of 2024 and the expected in 2025 introduction of an affordable model to be the company’s most vital strategic priorities. The increased footprint of its autopilot will help Tesla in widening its technological differentiation gap with competitors. Expanding into the more price-sensitive segment will help Tesla to become a more well-rounded business and will likely help in decreasing the company’s dependence on trends in the broader economy.

Moreover, the valuation is still extremely attractive, and I reiterate my “Strong Buy” rating for TSLA.

Recent developments

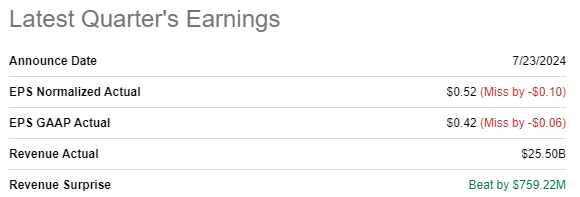

The latest quarterly earnings were released on July 23 when TSLA missed EPS consensus expectations. On the other hand, the company delivered a positive revenue surprise in Q2. Quarterly revenue grew by 2.3% on a YoY basis. This looks positive after an 8.7% YoY decline delivered in Q1. Despite a slight revenue rebound, the adjusted EPS shrunk YoY from $0.91 to $0.52.

Seeking Alpha

The operating margin narrowed from 9.62% to 8.58% on a YoY basis. On the other hand, the decrease is mostly explained by the boost in R&D spending. Since Tesla’s strategy is to differentiate itself by unmatched technological excellence, I am optimistic about the increased R&D spending.

Moreover, the company can afford to bet big on innovation with its around $30 billion cash pile and insignificant leverage levels. Tesla’s profitability is exceptional, increasing the probability of the R&D spending paying off in the future. The balance sheet looks strong enough for the company to continue moving in line with its strategic plans to expand its production capacity and develop new models.

Seeking Alpha

I think that Tesla’s operating leverage remains solid as profitability metrics keep up well even though the company continues navigating a challenging environment of high interest rates. Since approximately 80% of new car purchases in the U.S. are financed with some form of debt, and the Fed’s current tight monetary policy appears to be a constraint for the entire U.S. automotive industry. Therefore, a 5% YoY slip in Q2 deliveries is explained by external factors rather than Tesla’s cars losing their appeal.

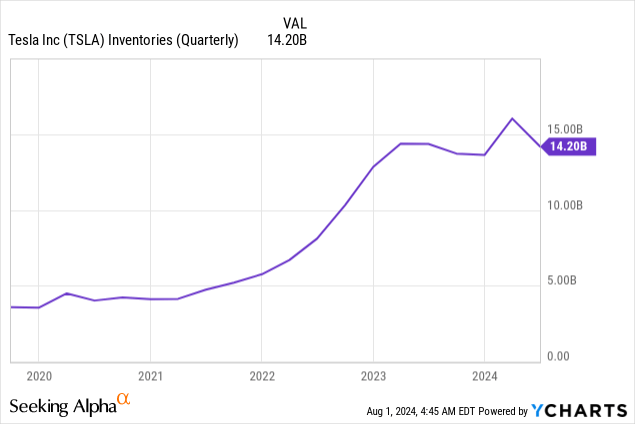

I think that the management deals well with the challenging environment from the working capital perspective. Inventory levels are more or less steady since early 2023, which is solid evidence of the management’s efficiency in dealing with unfavorable trends in the macro environment.

According to the latest earnings call, the company is still on track to deliver a more affordable model in the first half of the next year. This is a bullish sign to me because if Tesla releases its affordable model in 2025, it will be two years ahead of Volkswagen’s (OTCPK:VWAGY) plans to launch sales of its $22,000 car in 2027.

Launching an affordable model will be a crucial milestone for Tesla, as its presence in this segment currently appears to be the company’s only fundamental deficiency. Cheaper models are likely to be less vulnerable to changes in macroeconomic cycles, which will likely help the company to decrease its dependence on the broader economic environment. Expanding into the sub-$30,000 models’ segment will help to blend cost-leadership and differentiation strategies, making it a more well-rounded and complete business.

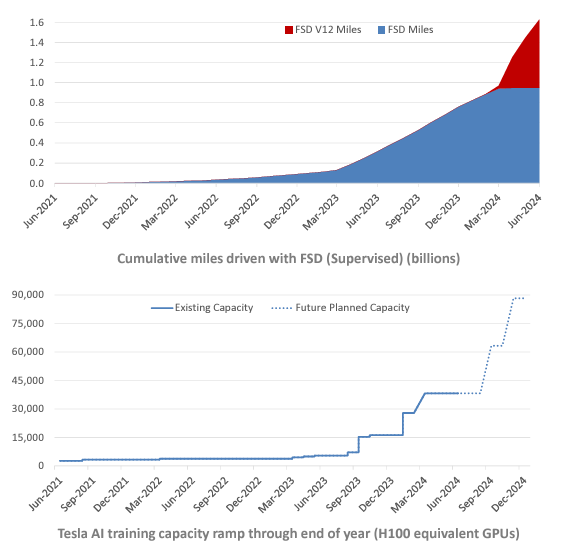

Tesla’s latest earnings presentation

Tesla continues betting big on its Full Self-Driving [FSD] product as the number of miles driven with the algorithm continues growing exponentially. The company also expects that its AI training capacity will also grow multiple times by the end of 2024, which means that miles driven with FSD will continue rolling exponentially and make the product smarter and safer. The company started its FSD v12.5 wide release recently, which is another indication that the product keeps improving. According to Global Times, China may approve Tesla’s FSD entry by the end of 2024.

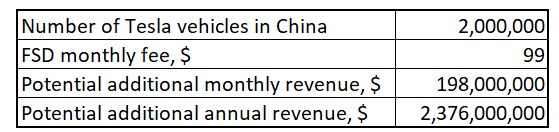

This is a massive positive potential catalyst for the business because Tesla’s footprint in China is substantial. Last September, Giga Shanghai celebrated its two millionth vehicle produced at this facility. Having over two million potential FSD customers in China suggests that the company could potentially boost its annual revenue by $2.4 billion. Since most of the FSD costs are related to the research and development phase and are already incurred, I believe that the additional future FSD revenue will be highly profitable.

Author’s calculations

It is certain that not all two million Chinese Tesla owners will buy the FSD subscription, but we should not forget that Tesla Shanghai is ramping up. For example, in 2023, this facility delivered 947,000 vehicles. If this level of annual deliveries is sustained, Tesla’s Chinese customer base will grow multiple fold within the next five years. I am confident in FSD’s bright prospects in China because none of Tesla’s competitors have invested more in autonomous driving than Tesla.

To summarize, I think that Tesla performs extremely well as a business despite a very challenging environment for the whole automotive industry. The company continues moving in line with its roadmap, where innovation is the top priority. The expected launch of an affordable model next year will likely make TSLA a more well-rounded business with exposure to a more price-sensitive segment of the market. This will likely help to decrease cyclicality in the company’s financial performance.

Valuation update

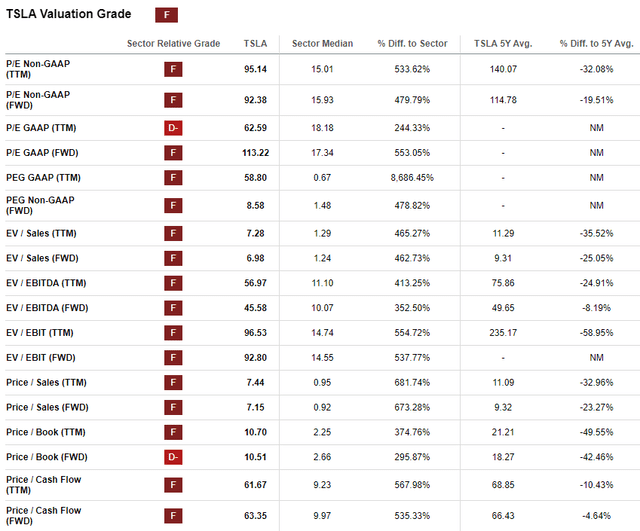

Tesla delivered a 13% share price decline over the last twelve months, lagging the broader U.S. market. Performance in 2024 is also a bit disappointing for TSLA since the stock price declined by 7% YTD. Tesla’s valuation ratios are inherently high due to the company’s historical revenue growth rate and unmatched profitability in the automotive industry. However, I want to emphasize that due to the expected rapid EPS expansion, the P/E ratio is expected by consensus to drop below 30 in FY 2028 and below 20 in FY 2031. That said, I think that Tesla’s currently high valuation ratios are justified by the expected EPS expansion.

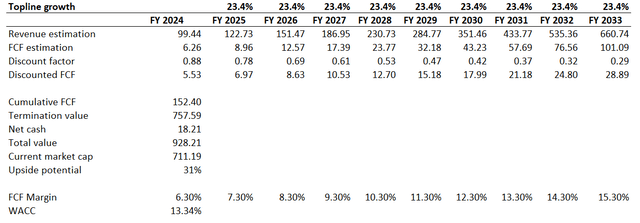

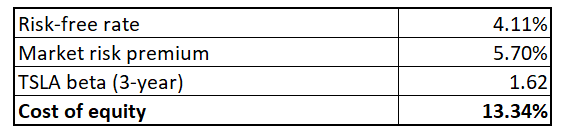

Looking at valuation ratios is never enough for me, though. Therefore, I am proceeding with the DCF model. The CAPM approach is used to figure out the discount rate for Tesla’s financial modelling. I am ignoring the cost of debt for TSLA due to its extremely low leverage. I use the current 4.11% 10-year Treasuries yield (US10Y) as a risk-free rate, and use a 5.7% U.S. equity market risk premium and a 3-year TSLA beta of 1.62. As a result of high beta, the WACC is high at 13.34%. However, I am fine with this level given the current challenging environment and highly volatile stock’s performance in 2024.

Author’s calculations

Now, allow me to continue with the remaining DCF assumptions. For the base year, I rely on FY 2024 revenue consensus estimates and project a 23.4% revenue CAGR for the next decade. I expect the free cash flow [FCF] margin to expand by one percentage point yearly, which is a conservative assumption compared to the expected 23.4% revenue CAGR. For the base year, I take the last five years’ FCF margin average of 6.3%.

According to my DCF valuation, Tesla’s fair value of the business is $928 billion. This is around 31% higher than the current market cap. That said, my target price for Tesla is $304.

Risks update

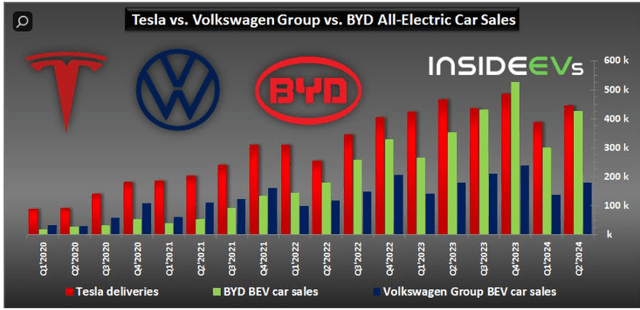

While Tesla continues to dominate in the U.S. market, I consider global competition to be the most significant risk for Tesla. Despite the vast long-term potential, I see from the expected release of affordable EVs and FSD advancements, I also have to admit that Tesla underperformed globally in Q2 compared to other large EV players. Tesla delivered 443,956 vehicles in Q2 2024, which was 5% lower on a YoY basis. To provide context, BYD Company’s (OTCPK:BYDDF) EV sales were up by 21% YoY in Q2, and Volkswagen (OTCPK:VWAGY) demonstrated a mere, but still growth by 0.03%.

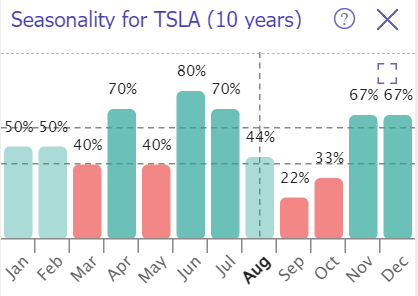

The stock’s historical seasonality trends look quite unfavorable for the next three months, as September and October are historically the weakest months for TSLA. Therefore, there might be some temporary stagnation and even a pullback in the upcoming months before the stock returns to its growth trajectory. I am not the one who tries to time the market, but I would not discount long-term seasonality trends as well.

TrendSpider

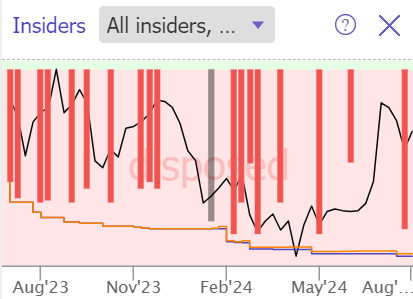

Insiders’ activities over the last twelve months do not look favorable as well. While I usually do not consider insider selling as a red flag, no stock purchases from insiders over the last twelve months might suggest that they do not find current valuation appealing.

TrendSpider

Bottom line

In my opinion, Tesla is still a “Strong Buy.” The company continues to differentiate itself by constantly innovating, and it has all the resources to remain at the forefront of the innovation in the automotive industry. I consider all the challenges to be temporary and ease once the Fed’s pivots its monetary policy. Moreover, the valuation is very attractive with a 31% upside potential for TSLA.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.