Summary:

- Tesla, Inc. is the world’s leading electric vehicle manufacturer, with a mission “to accelerate the world’s transition to sustainable energy.”

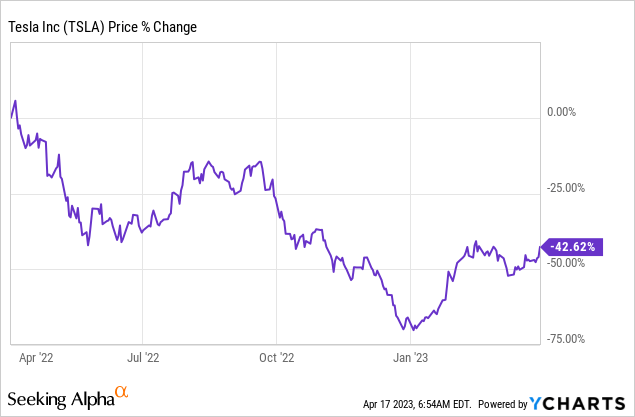

- Tesla shares have been cut in half from their 2021 highs, following a difficult 18 months for all investors in fast-growing businesses.

- Tesla released Q1 delivery numbers earlier this month, beating analysts expectations on deliveries for the first time since 2021.

- I think investors will see some pain when Tesla reports is Q1 2023 results on April 19 post-market, driven by margin pressures and CEO Musk’s recent antics.

- However, the long-term opportunity remains very attractive, and the current share price is equally attractive for those with longer time horizons.

MikeMareen

Investment Thesis

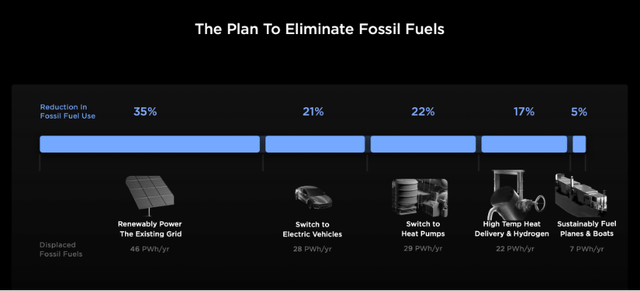

Tesla, Inc. (NASDAQ:TSLA) is the world’s leading electric vehicle manufacturer, with an inspiring mission to “accelerate the world’s transition to sustainable energy.” It has been at the forefront of this industry since its inception almost 20 years ago, but it is in the last five years where Tesla has truly transformed itself from a challenger into an industry behemoth.

I analyzed and outlined my investment case for Tesla in a previous article, but I will summarize my investment thesis in short.

The company has already shown an ability to achieve operational efficiencies and margins that are far greater than its incumbent ICE (internal combustion engine) competitors, but this is only the beginning. According to Statista, the Global Electric Vehicle market is expected to grow achieve a 17.02% CAGR from 2023 through to 2027, reaching a size of $858 billion, and Tesla is leading the charge.

Tesla also has a load of different routes to success within the business, from energy storage to full self-driving, which the company is taking on big challenges and, so far, succeeding.

Tesla 2023 Investor Day Presentation

Despite the bright future ahead, there have been a lot of headwinds facing Tesla recently, from CEO Musk’s acquisition of Twitter, to geopolitical tensions between the U.S. and China, to broader macroeconomic difficulties. Tesla shares have responded by falling more than 50% from their all-time high.

So, how should investors be feeling as Tesla heads towards its Q1’23 results?

Honestly – a bit nervous.

Tesla’s Q1 Expectations

Tesla is set to report its Q1’23 results on Wednesday, April 19, after the market closes, and there are plenty of things for investors to keep their eyes on.

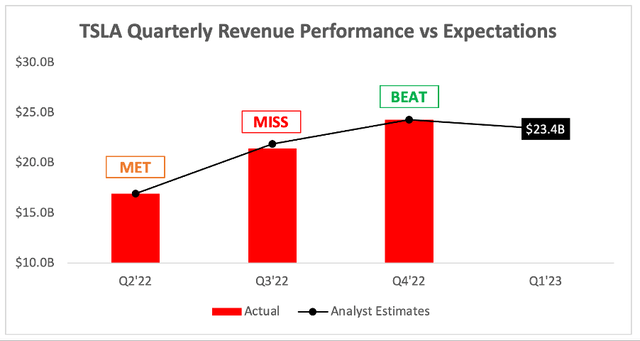

Starting with the headline numbers, and analysts are expecting Q1’23 revenue of $23.38B, representing YoY growth of 24.7%. Whilst that may look like an impressive number in this current macroeconomic environment, it is slower than the hyper-growth that Tesla investors have been accustomed to in recent years.

Now you might look at that chart above and think “Wow, analysts are pretty good at predicting these revenues!”, and you would be right – they are very accurate.

However, the reason they can predict these fairly accurately is thanks to Tesla releasing its vehicle production and delivery figures before its quarterly results, which give analysts a much clearer picture in terms of what to expect.

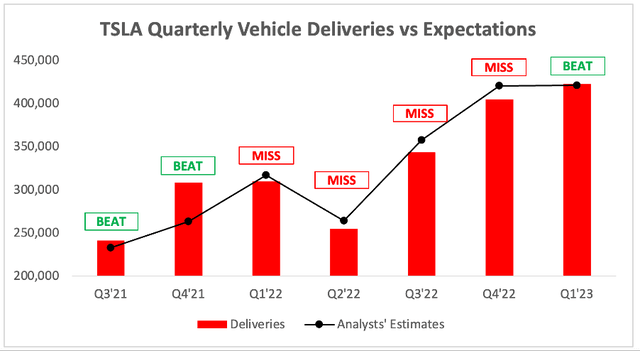

And as we can see below, analysts have not been as good at predicting Tesla’s delivery figures (although they were pretty spot on this quarter).

Tesla announced at the start of April that it delivered 422.9k vehicles in Q1’23, which came in very slightly ahead of analysts’ estimates of 421.2k. Whilst this may only be a small beat, investors should take the win after four consecutive quarters of missed delivery estimates – with Tesla shares demonstrating the impact of what happens when these delivery estimates continually fall below expectations:

But maybe this quarter will signal the start of Tesla becoming a Wall Street favorite once again, with a surprise to the upside for the first time since Q4’21 in terms of deliveries.

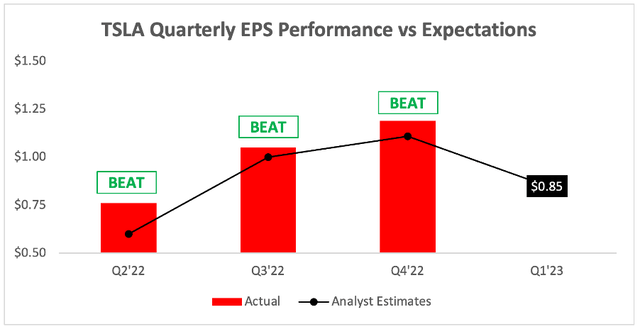

Moving onto the bottom line, analysts are expecting Tesla to deliver EPS of $0.85, which is actually down from the $1.07 achieved by Tesla in Q1’22.

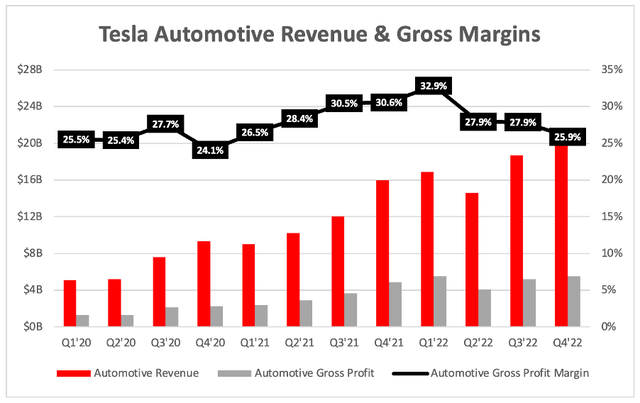

Whilst I’m not overly concerned about EPS, I am going to be keep a very close eye on Tesla’s margins. This is a company that has managed to succeed in being incredibly efficient whilst also boasting a powerful brand, a recipe for success that has led to industry-leading margins.

Yet I think the trend, at least for the near term, will not be as pretty when it comes to Tesla’s impressive profitability.

Short-Term Pain

There are plenty of issues that I think we could see crop up in this latest earnings report, with maybe the most substantial relating to Tesla’s margins, driven by repeated price cuts.

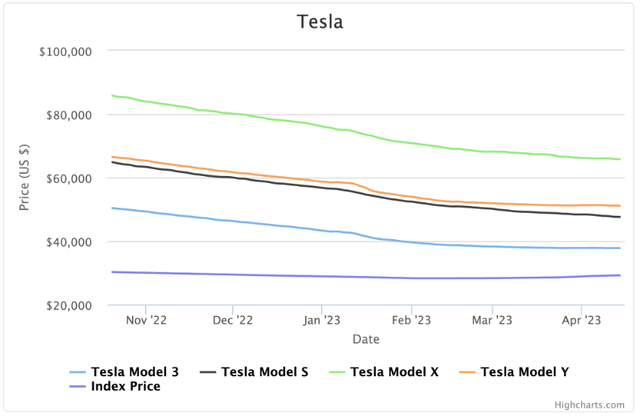

As we can see from the below graph courtesy of CarGurus, Inc. (CARG), Tesla has been consistently dropping its prices over the last six months in the United States.

Whilst Tesla might have beaten analysts estimates on deliveries, it could be as a result of heavier-than-expected discounting. This doesn’t concern me too much as a long-term investor, because I think Tesla is in a much better position to control its prices than its competitors, and Tesla has always planned to make its cars more affordable anyway.

However, Mr. Market is not always long-term focused, and could certainly throw a tantrum if these price cuts were to negatively impact margins and profitability in Q1.

As the above graph shows, Tesla’s automotive gross margin has been suffering in recent quarters for plenty of reasons, including a number of Giga Factories not yet operating at full capacity and efficiency combined with some of the more recent price cuts.

Despite this, Tesla was still able to maintain industry-leading operating margins of ~17% in 2022!

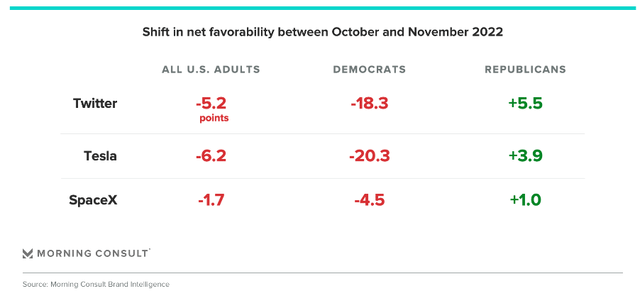

I think my biggest concern with the price cuts is perhaps that they aren’t solely driven by the economic difficulties in the world right now, but are potentially being driven by the deterioration of Tesla’s brand – and that does concern me as a long-term investor.

In my view, the blame for this lies solely at the feet of CEO Elon Musk.

Musk Needs To Get His Act Together

Now a quick background on myself, because I think it’s important for this section: I’m a 26 year old guy from the UK, and consider my political views to be pretty centrist.

When deciding whether or not to invest in Tesla, I thought about Elon Musk as both a benefit and risk to my investment. Right now, I believe he is far more of a risk to Tesla than a benefit.

It would appear that Musk has decided to plunge into the culture wars that are plaguing the U.S., with inflammatory tweets left, right, and center over the past few months, including ones accusing a Twitter employee of using an apparent disability as an excuse not to work:

Or a tweet about the deadly “woke mind virus”:

Or a tweet about “Child sterilization”

These are the kind of things I would expect to see from a dog-whistling politician, and it makes me incredibly uncomfortable to see the CEO of a company I invest in tweeting such controversial and divisive things regularly, not least because Musk is so heavily linked to Tesla’s brand and he apparently is having a pretty negative impact.

Even worse is that the above figures were taken before all those recent tweets, so I can’t imagine that Tesla’s brand perception has improved since.

All I can pray for is that these price cuts are due to macroeconomic weaknesses alone, but I’m concerned that signs point to potential brand deterioration. If that’s the case, then I can only hope that Musk gets a wake-up call at some point – and if not, I would be more than happy to see Tesla start to search for its Tim Cook, and do away with Musk’s controversy.

Long-Term Gain

I feel like this article has been quite negative so far, and that’s kind of what I’m expecting for Tesla’s results – but hey, if everyone else is feeling the same, perhaps this is the perfect time to be looking at purchasing shares?

Because there’s undoubtedly a huge opportunity remaining for Tesla, and I think the future continues to look extremely bright. It is still the industry leader by miles (get it?) with enviable profit margins, its Full Self-Driving technology could create mind-blowing new revenue streams, there’s plenty more vehicles to be rolled out, and the company continues to see incredible growth in its energy storage business.

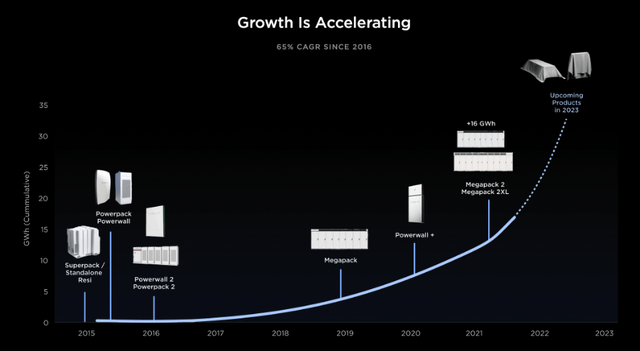

Tesla 2023 Investor Day Presentation

I remain very bullish on Tesla as a business, and I do think that what we’re seeing now is more due to difficult macroeconomic circumstances rather than anything else. My main fear is with the brand deterioration, and hence why I’m more concerned than ever about Musk’s decision to wade into the culture wars.

Tesla Stock Valuation

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Tesla is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

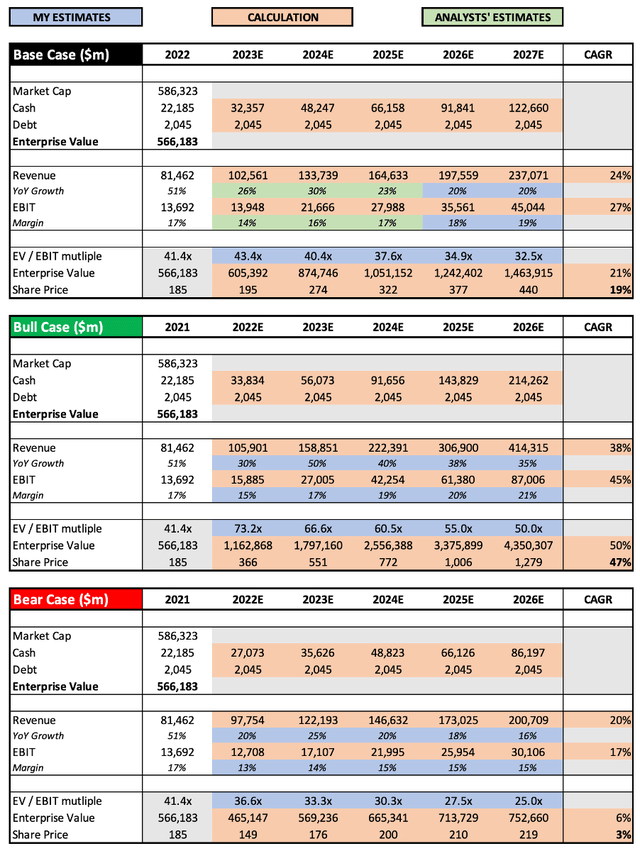

Author’s Work / Seeking Alpha / TIKR.com

I have changed the approach to my valuation model slightly from my previous article, as I have started to incorporate analysts’ estimates from Seeking Alpha and TIKR into my base case scenario to try and stop my own biases from taking over – plus, analysts have way more data and insights than I could ever hope for.

Instead, I use the bear and bull case scenarios to help me get an idea about the best- and worst-case scenarios. In the bull case scenario, I’m assuming that Tesla’s growth reignites after a more challenging 2023, which could be due to several catalysts including FSD, EV demand, new vehicles and models, or continued growth in energy storage.

The bear case scenario effectively assumes the opposite, which I think would only be achieved by a severe economic slowdown, a big unforeseen execution risk, or Musk’s mayhem decimating Tesla’s brand – all of which I think are unlikely.

Put all that together, and I can see Tesla’s shares achieving a CAGR through to 2027 of 3%, 19%, and 47% in my respective bear, base, and bull case scenarios.

Bottom Line

I think there are clear risks that Tesla faces going into this quarter’s earnings release, but judging from the potential returns in my valuation model, Mr. Market also sees these risks and is pricing Tesla as such.

In short, I do think that Tesla remains an incredibly attractive long-term investment, but I’m also expecting some bumps in the road this year. I’m not optimistic about seeing great margins or profits in Q1, but my approach to investing does not look to hop in and out of businesses from quarter to quarter.

I believe that Tesla, Inc. is a truly brilliant business, and as the long-term positives continue to outweigh the short-term negatives. With shares currently at an attractive price, I will be reiterating my previous “Buy” rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.