Summary:

- Tesla, Inc. saw rapid gains — up 42% in a one-month rally, with 37% of those gains in eight sessions — after it reported Q2 deliveries ahead of expectations.

- Tesla delivered 443,956 EVs in Q2, about 1% more than the consensus for 439,302 deliveries.

- Tesla’s 42% one-month rally follows its Q2 delivery beat and budding optimism for its robotaxi reveal event, but under the surface, Q2’s delivery numbers do not seem quite as strong.

baileystock

After months of being the lowest performing Mag 7 stocks, Tesla, Inc. (NASDAQ:TSLA) saw rapid gains — up 42% in a one-month rally, with 37% of those gains in eight sessions — after it reported Q2 deliveries ahead of expectations and a surge in energy storage deployments.

Optimism had also been building for its much-anticipated robotaxi reveal on August 8, but that now has reportedly been pushed back until October. Despite the surge in share price and renewed delivery growth in Q2 relative to Q1, Tesla is still facing an EV demand problem, with production and deliveries set to decline in 2024. Investors are hoping Tesla is at a meaningful bottom, yet that will require significant growth in the back half of the year.

Production & Deliveries Decline

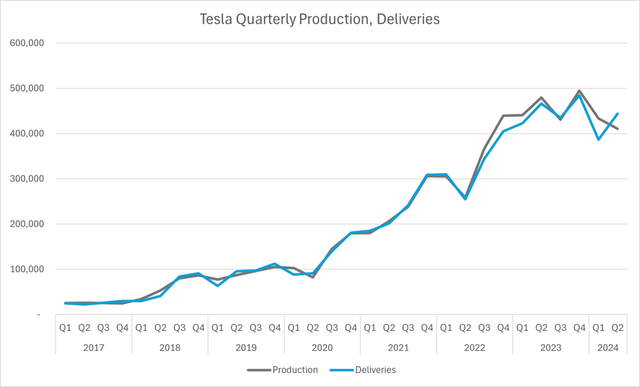

Tesla delivered 443,956 EVs in Q2, about 1% more than consensus for 439,302 deliveries. Despite rebounding to a 57,000 QoQ increase from Q1, Q2 notched a second straight YoY decline, at (4.8%), though this was an improvement from Q1’s (8.5%) YoY drop.

Production fell to the lowest level in seven quarters, falling to 410,831 vehicles – this represented a (5.2%) QoQ and (14.4%) YoY decline in production. This follows production issues the EV maker faced in Q1. These were primarily impacts from ramping up the refreshed Model 3 in Fremont, and more recent issues with lowered Model Y production in China and five days of production pauses in Germany in June.

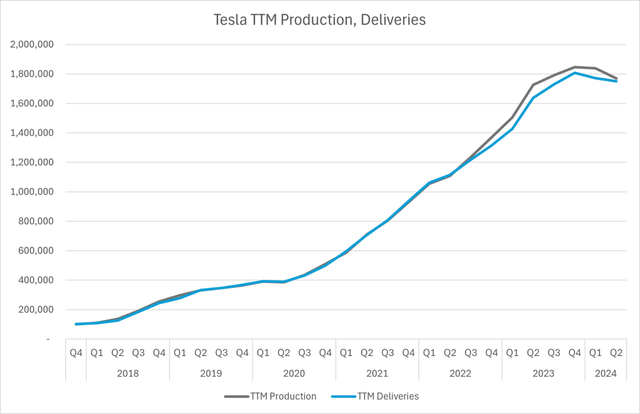

While the QoQ increase in deliveries was a positive sign to see after Q1’s sharp sequential decline, production and deliveries are both peaking in the short term on a TTM basis. Both have pulled back below the 1.8 million mark in Q2 – production totaled 1.769 million vehicles, with deliveries at 1.75 million vehicles. This comes after Tesla warned in Q1 that 2024’s “vehicle volume growth rate may be notably lower than the growth rate achieved in 2023.” Currently, we’re tracking for a (3%) to (4%) decline.

Production and deliveries both declined below 1.8 million on a TTM basis. (Tech Insider Network)

Q2’s deliveries point to inventory reduction/channel clearing efforts. Q1 had excess inventory of more than 46,000 vehicles, and thus Tesla had lowered production for this excess to be absorbed in Q2.

In Q1, Tesla noted that it began lowering vehicle and subscription prices, and offering leasing and financing deals to help boost demand, and its TTM trend seems to confirm that weaker demand from Q1 is persisting through to Q2. The industry backdrop in the US remains challenged, as EV demand “has grown more slowly than expected due to high borrowing costs, economic uncertainty and consumer preference for gasoline-electric hybrids.”

To ease these fears, Tesla would need to report strong sequential growth in Q3 and Q4, for both production and deliveries. Assuming 5% QoQ growth in production in Q3 and 7% QoQ growth in Q4, for volumes of ~431,370 and 461,570 respectively, and 2% residual inventory in each quarter, Tesla would end the year at 1.737 million vehicles produced and 1.705 million delivered. This would mark a nearly (6%) YoY decline.

China Deliveries, Market Share Slip

Tesla continues to face major headwinds in China, with China-made deliveries declining on a YoY basis for a third consecutive month in June. We noted to our free readers in November and December 2023 that primary rival BYD’s strong growth presented a tangible and challenging headwind for Tesla in that nation.

Now, we’re seeing more evidence that Tesla’s growth challenges are unique for China. Tesla’s China-made deliveries totaled 71,007 vehicles in June, a 2.2% MoM decline and a 24.2% YoY decline. Stripping out exported vehicles, local deliveries were 59,261, down nearly (20%) YoY but up 7.3% from 55,215 deliveries in May.

BYD outsold Tesla more than 2-to-1 in June, delivering 145,179 BEVs in the month, up 13.2% YoY. Smaller EV rivals Nio and Zeekr also saw strong deliveries, posting record high tallies for June. Industry-wide growth was strong, with NEV sales projected to rise 8% MoM and 28% YoY to 970,000 vehicles. Tesla’s market share dropped below 7% in June, down from more than 11% a year ago as industry growth remains strong and as BYD continues to outsell Tesla significantly in China.

Tesla has an easy comp for July, where China-made deliveries were 64,285 vehicles, including exports. It’s imperative that Tesla break this string of declines in one of its core automotive markets as it heads into Q3. China-made sales were 205,747 vehicles in Q2, or more than 46% of total deliveries.

Watch my interview on this issue here.

Energy Storage a Bright Spot, But EPS Impact Likely to be Minimal

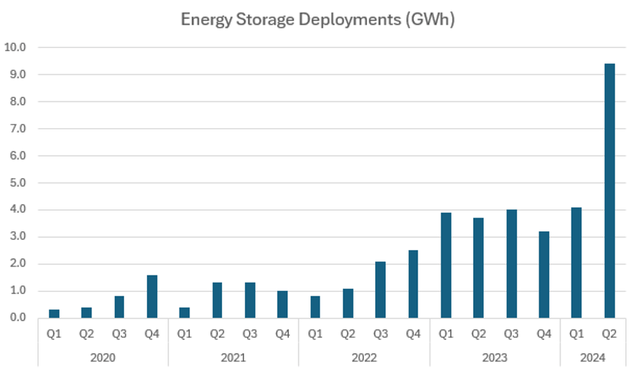

Energy storage was a bright spot in Q2, with Tesla reporting a record 9.4 GWh in deployments, up more than 129% QoQ and 154% YoY. Q2’s deployments exceeded historical levels at 4 GWh per quarter, at a maximum.

This strong growth in deployments should help the segment contribute more to both revenue and gross profit, as its contribution to gross profit has increased significantly through 2023 and 2024. Energy storage contributed less than 8% of revenue in Q1, but could contribute 14% or more of total revenue assuming revenue more than doubles sequentially.

In terms of gross profit contribution, energy storage contributed 10.9% of Tesla’s $3.69 billion in gross profit last quarter, compared to 3.7% in Q1 2023. Energy storage has a superior margin profile versus Tesla’s automotive segment, at above a 24% gross margin in Q1. However, EPS impacts will be minimal in Q2 despite the likely triple digit QoQ revenue growth, as automotive margin has stabilized in the 18% range.

Assuming energy storage gross margin expands at the same pace in Q1 at 3 percentage points, to a 28% gross margin, the segment could generate $1.05 billion in gross profit, up from $403 million in Q1. This $600 million sequential growth would be a primary driver of sequential growth in gross profit company-wide, likely to $4.7 billion to $4.8 billion in Q2, up from $3.7 billion in Q1.

However, this boost to gross profit, driven by energy storage, won’t translate into a meaningful bottom-line impact. Assuming a 10% QoQ increase in operating expenses, net income would project to $1.85 billion, or ~$0.62 per share, just $0.01 ahead of the current consensus estimate for $0.61.

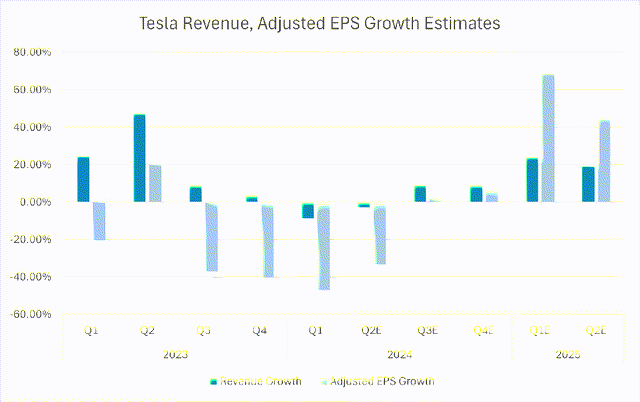

Revenue, EPS Growth Muted

Q2 is currently expected to be the last quarter in which Tesla registers negative growth on both the top and bottom line, with analyst estimates pointing to (2.8%) revenue growth to $24.24 billion and (33.5%) adjusted EPS growth to $0.61.

Analysts expect Tesla to return to YoY growth in Q3, with revenue growth of 9.2% and adjusted EPS growth of just 2%, suggesting margin headwinds are expected to persist as this comes against a weak comp. It also highlights that despite this recent rapid growth in energy storage, automotive sales and margins will be a primary driver of bottom-line strength or weakness. Should energy storage continue to grow from Q2’s level of deployments, it may shape up to be a more significant driver in 2025.

Margins Yet To Rebound

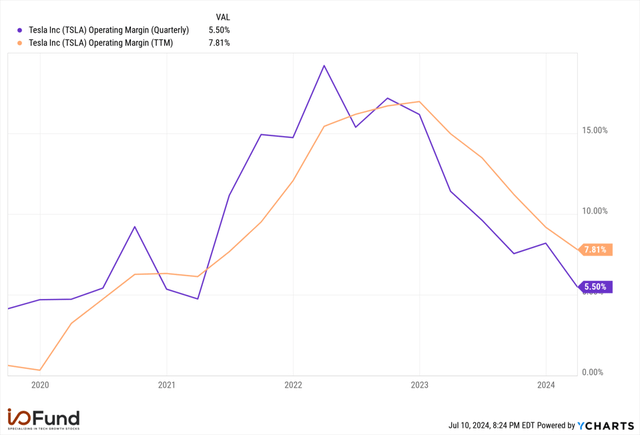

We have tracked Tesla’s margins for nearly a year now, assessing how low Tesla’s margins could go in an analysis in August 2023. Our projection was that Tesla’s operating margin would decline to 7.8% in our base case, or to 6.2% in a more bearish case. We also reiterated after Q3 earnings that this continual decline in margins highlights a broader concern for investors, in that Tesla has provided no concrete guidance on how far margins will decline.

Tesla’s operating margin continues to slide on a quarterly and TTM basis (YCharts)

Q1 2024’s actual operating margin was 5.5%, down from 11.4% in Q1 2023. On a TTM basis, operating margin fell to 7.8%, back to 2021 levels, and down from a peak of 17% at the end of 2022. Automotive margin has yet to rebound, and energy storage’s contribution is still not large enough to drive a meaningful inflection in operating margin.

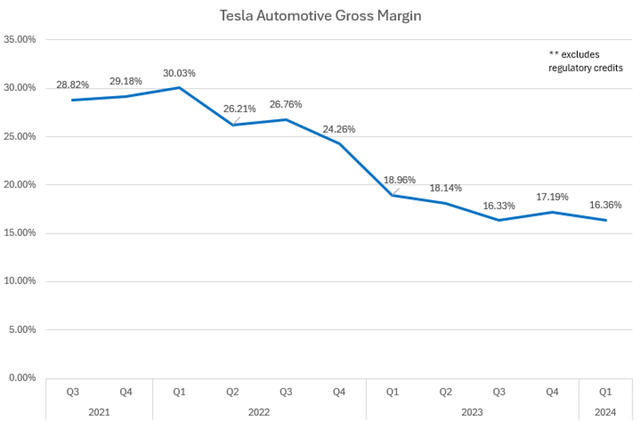

Tesla’s automotive operating margin dropped back below 16.4% in Q1, just a fraction above Q3 2023’s low. (Tech Insider Network)

Automotive operating margin dropped back below 16.4% in Q1, just a fraction above Q3 2023’s low. If this is a sign of stabilization in the 16% to 17% range, Tesla is facing a rocky road ahead, as operating margin has weakened consistently with automotive gross margin below 20%.

Conclusion

Tesla’s monster 42% one-month rally follows its Q2 delivery beat and budding optimism for its robotaxi reveal event, but under the surface, Q2’s delivery numbers do not seem quite as strong. TTM production and deliveries both peaked and have begun to decline, and it would take strong double-digit sequential growth through the remainder of the year to break this trend and return to positive YoY growth.

Demand issues look to be persisting as Tesla has lowered production to sell off a large chunk of existing vehicle inventory, with Q2’s production volume the lowest in seven quarters and more than 5% below delivery volume. Energy storage was a bright spot with triple-digit sequential growth, but its contribution down the line is not yet meaningful enough to drive a significant EPS beat.

While many will argue that Tesla is one of the most advanced AI companies in the world, my response is “sure,” but Tesla is also heavily exposed to consumer spending — and this is entirely out of their control. It’s been our contention for some time that Tesla is a Fed-related stock, as vehicle financing and EV demand hinges on interest rates.

Interest rates are truly the most important data to track for Tesla in the current environment, as high interest rates mean Tesla must lower prices (or vice versa). Therefore, it’s not surprising that Tesla has rallied during a period of increased optimism that a rate cut may be on the horizon.

Some will talk about recurring software revenue from robotaxis as the most significant catalyst, but the harsh reality is that the Fed lowering rates is the most critical catalyst for Tesla today. That may not be as exciting as AI, but Tesla is one of many tech stocks whose revenue growth and profitability depends on the Fed instilling a more dovish policy.

Recommended Reading:

- AI PC Stocks: Emerging 2024 And 2025 Story

- AI Power Consumption: Rapidly Becoming Mission-Critical

- With Bitcoin At All-Time Highs, Here’s What’s Next For COIN, HOOD

- Here’s Why Nvidia Stock Will Reach $10 Trillion Market Cap By 2030

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in TSLA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

We offer tech sector coverage that combines fundamentals and technicals. After recommending a stock, we provide entries and exits.

Our cumulative returns are 131% and a lead over institutional technology portfolios by as much as 157% since inception.

We are the only retail team featured regularly in Tier 1 media, such as Fox, CNBC, TD Ameritrade and more.

Our services include an automated hedge, portfolio of 10+ positions, broad market analysis, deep-dives, real-time trade alerts PLUS a weekly webinar every Thursday at 4:30 pm Eastern.