Summary:

- Tesla, Inc. Q2 earnings are out and Tesla stock is down.

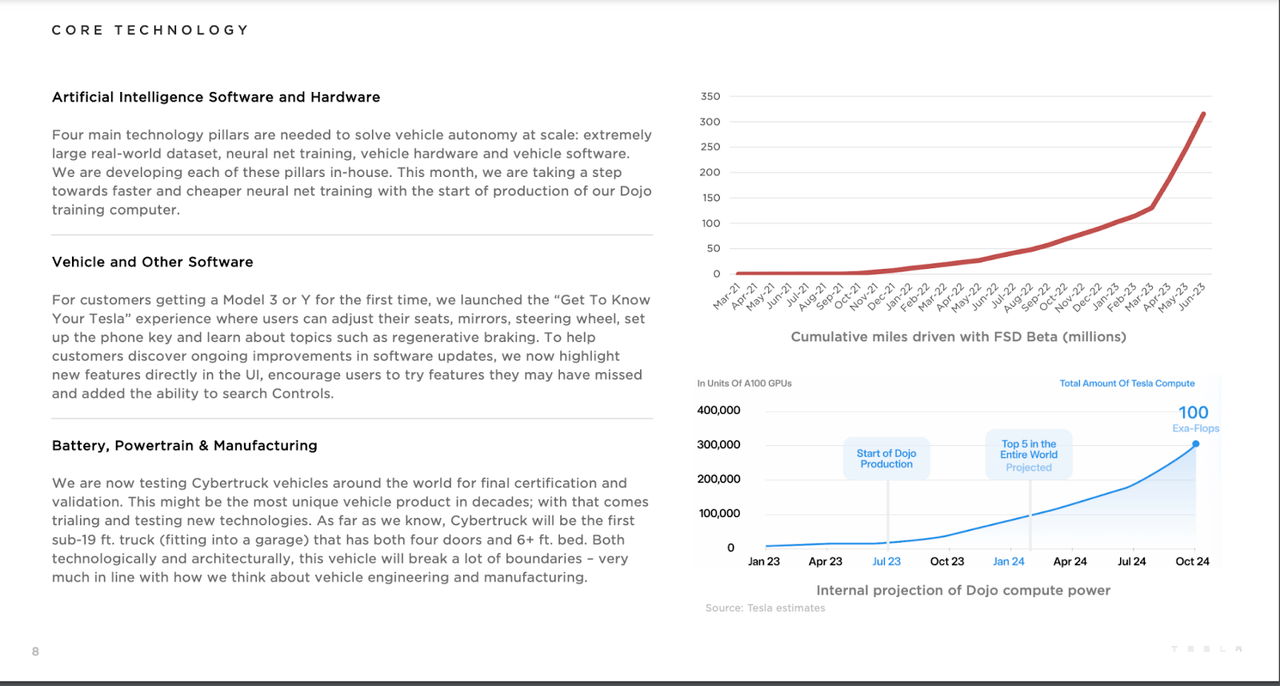

- Though I see the earnings as fundamentally good, this selloff seems justified given the technicals.

- The earnings call gave us great insights into FSD, Cybertruck progress, and the energy segment.

- I’ll be looking to add more Tesla shares if we hit my target zone.

VCG

Thesis Summary

Tesla, Inc. (NASDAQ:TSLA) provided a Q2 earnings beat on both revenue and earnings, but TSLA stock is down 4% pre-market.

Looking through the Q2 earnings call transcript, there are a lot of fundamental reasons to be bullish long term. These include progress on the Tesla Cybertruck, the growth of its energy storage unit, and the advancements in full self-driving (“FSD”).

However, fundamentals are only half the picture. Even before earnings, the technicals suggested that Tesla stock was near a local top.

I’m bullish long term, but believe more of a selloff will ensue. Thus, I am changing my rating to Neutral.

Q2 Overview

Tesla’s Q2 results have, so far, failed to impress investors, even though the company beat EPS by $0.09 and revenues by $200 million.

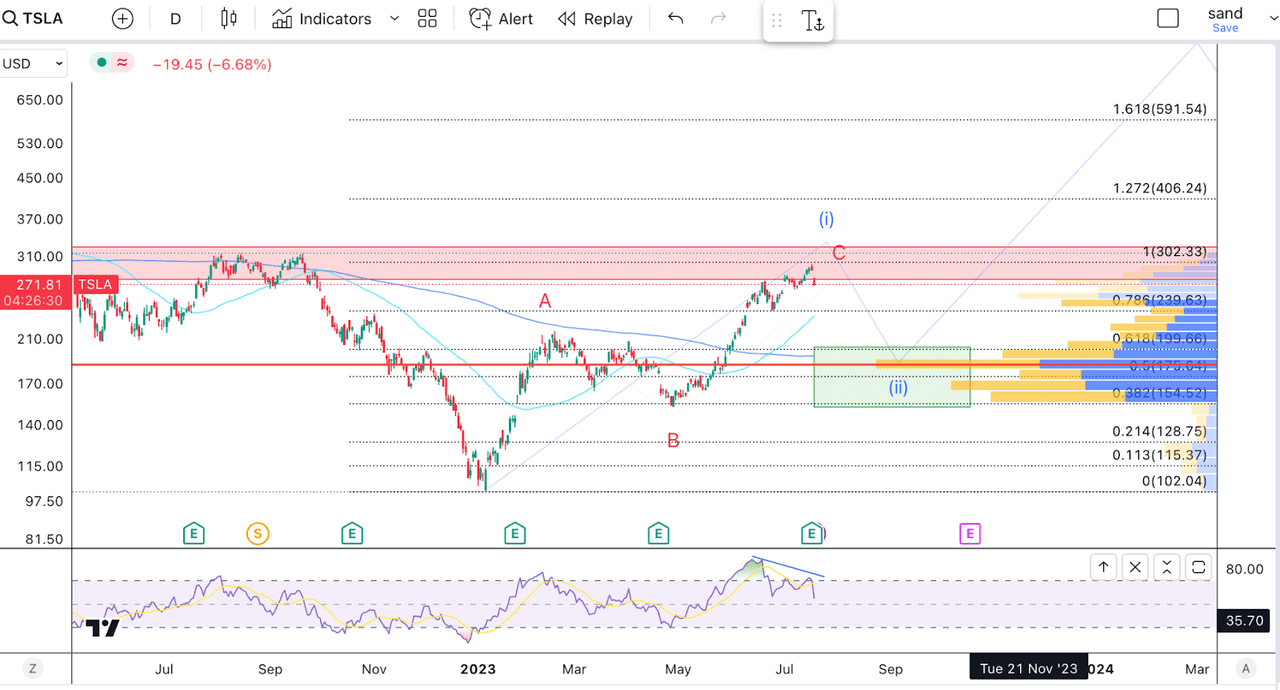

Tesla Q2 Overview (Investor Presentation)

Automotive revenues were up 46% YoY, while Energy and storage revenues were up 74%. Gross margin was a little weaker in the quarter, which was expected given the price cuts, which is also reflected in the adjusted EBITDA.

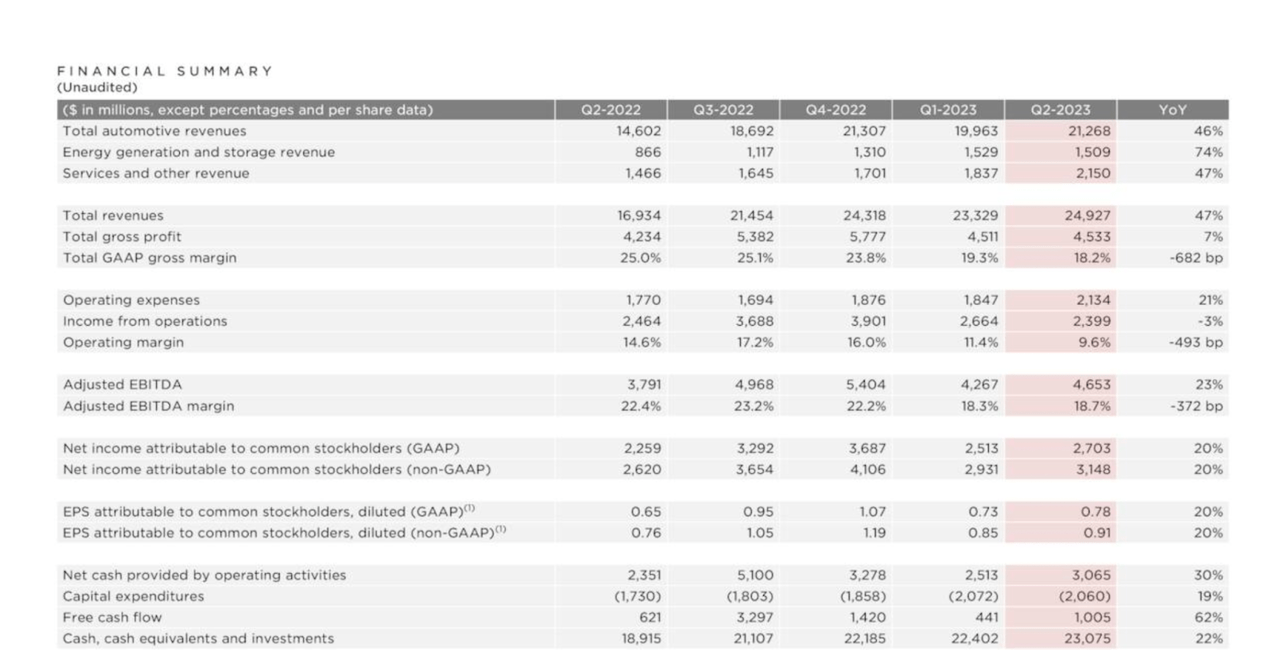

Vehicle Capacity (Investor Presentation)

Production capacity continued to increase across the board to meet the increased demand. As we can see above, Tesla is growing market share in Europe, the U.S., and China.

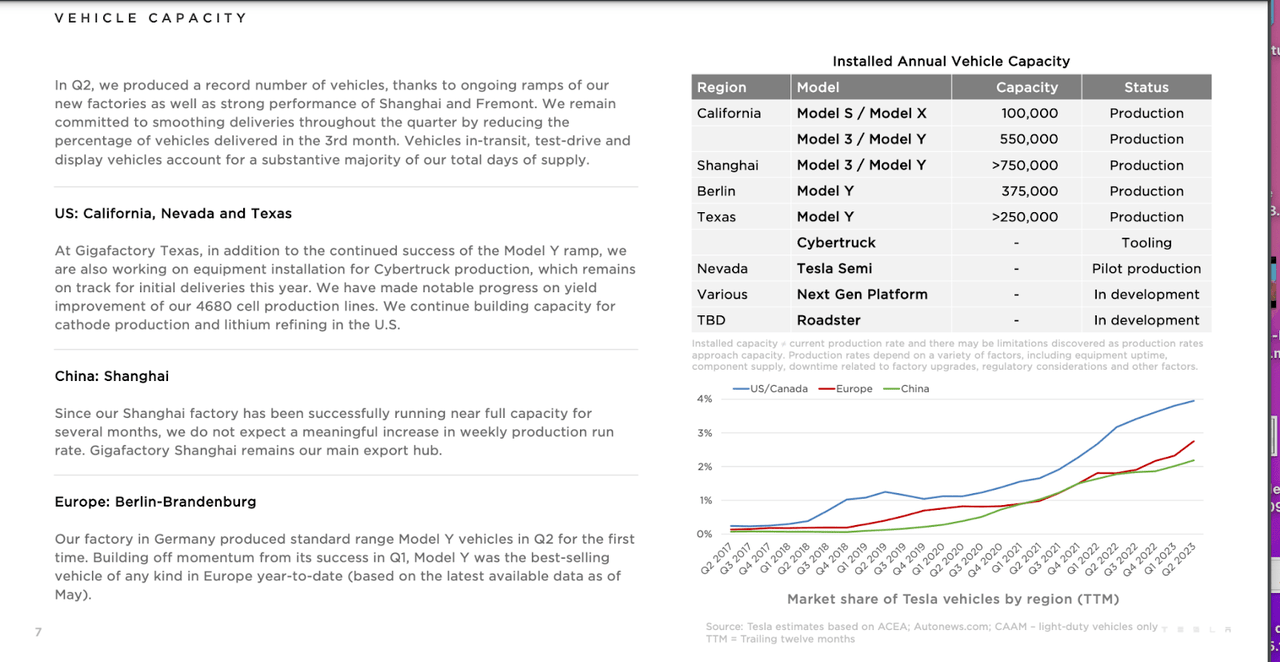

Core Technology (Investor Presentation)

Tesla’s FSD continues to ramp up miles, and the company projects that its supercomputer, Dojo, will reach 100 exaflops of power by October 2024.

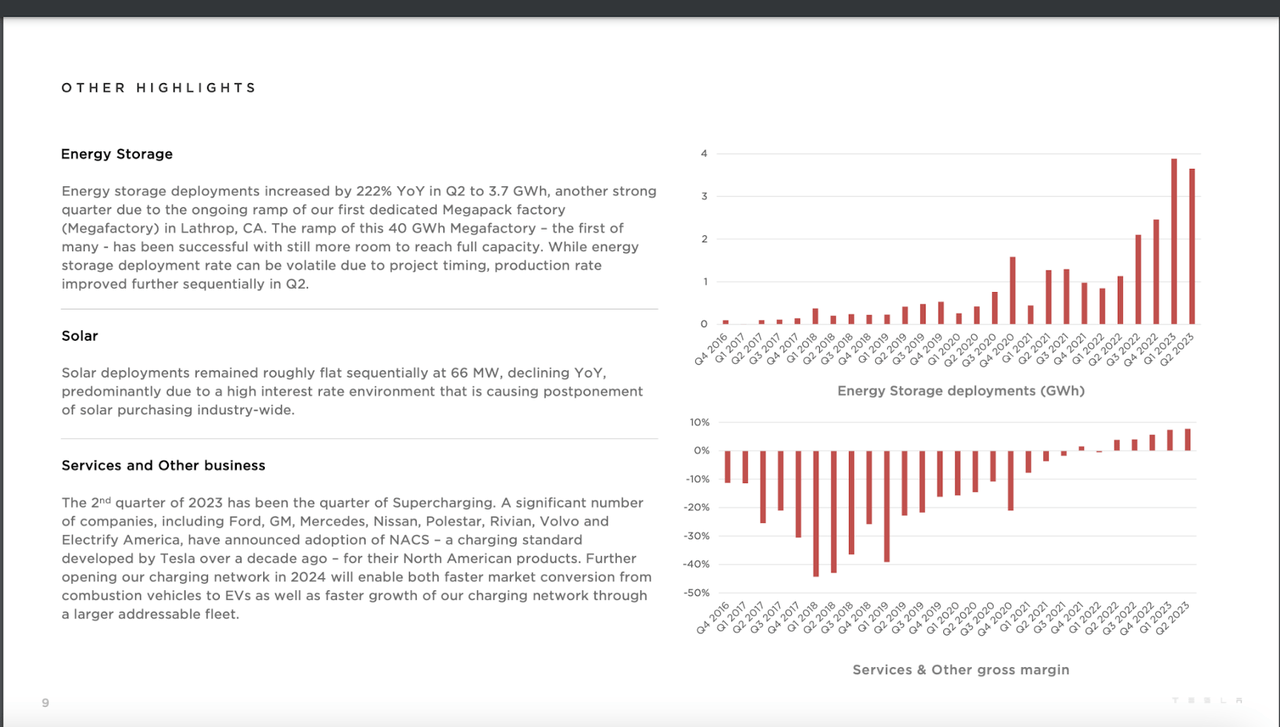

Tesla Energy Storage (Investor Presentation)

Lastly, it’s worth mentioning that Energy storage grew 222% YoY thanks to the ramp-up of the Lathrop Mega Factory.

And, following the addition of numerous companies into the Tesla Supercharger ecosystem, the company has now actually begun to turn a gross profit on its Services & Others segment.

Three Reasons To Love Tesla

The numbers posted by Tesla are within the expectations of investors and analysts. More interesting insights can be found in the earnings call, which addresses some of the most important bullish factors moving forward.

Let’s kick things off with the Cybertruck:

Demand is so far off the hook, you can’t even see the hook. So, that’s really not an issue. I do want to emphasize that the Cybertruck has a lot of new technology in it, like a lot…

…But first order approximation, there’s like 10,000 unique parts and processes in the Cybertruck. And if any one of — it will go as fast as the least lucky, least well-executed element of the 10,000. So, it’s always difficult to predict the ramp initially, but I think we’ll be making them in high volume next year, and we will be delivering the car this year.

Source: Elon Musk, Earnings Call.

Cybertruck has been on investors’ and customers’ minds for years now. Based on Musk’s latest comments, we should have high-volume production by next year.

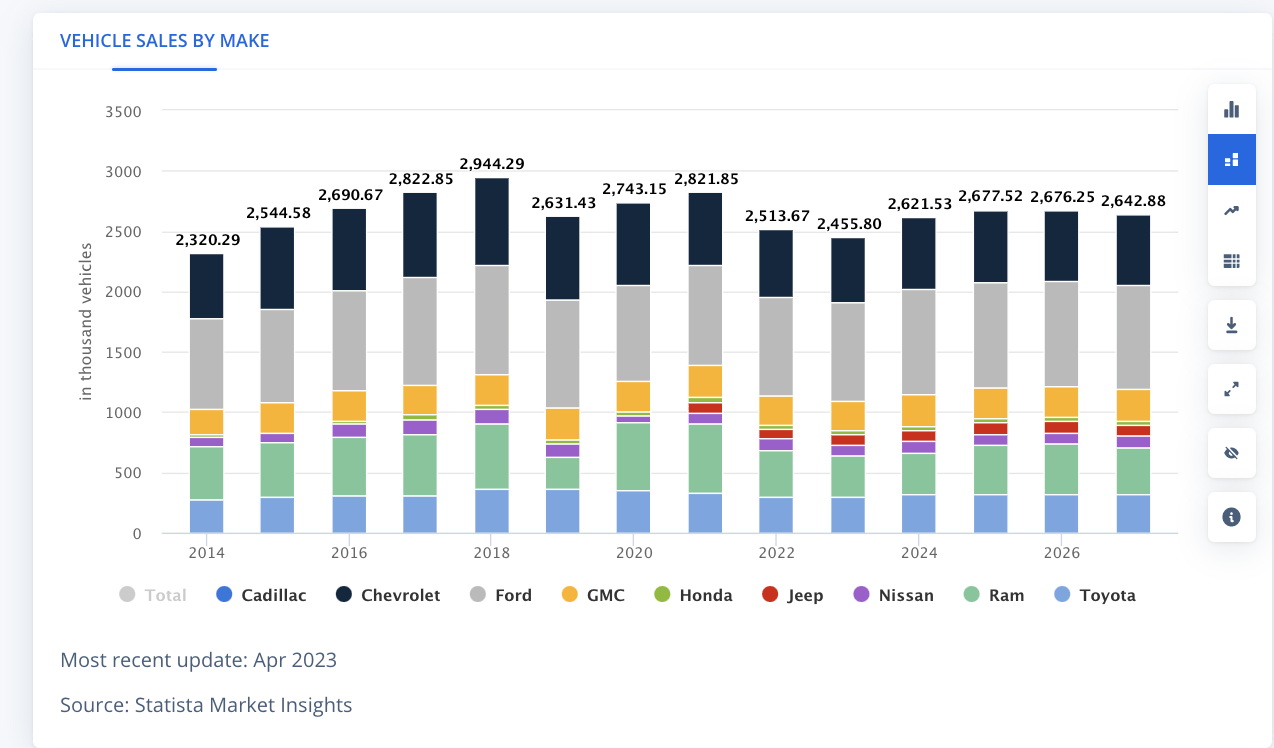

Pick-up trucks are the most sold vehicle in the U.S., and the market is, for the moment, highly dominated by a few players:

Pick-up truck market (Statista)

Data from Statista shows that Chevrolet, owned by General Motors (GM), Ford (F) and Ram, owned by Stellantis N.V. (STLA), combined control most of the market, with Toyota and GMC trying to gain some market share.

Famous investor Cathie Wood from Ark Invest (ARKK) has predicted that the Cybertruck could equal the Model Y in terms of popularity. The Model Y is now the world’s best-selling vehicle in Q1.

Last year, Tesla sold over 740,000 Model Ys, and Cathie Wood thinks the Cybertruck will match this.

Musk believes the Cybertruck could sell 250,000-500,000 yearly. A slightly less optimistic view than Ark, but still a very substantial number. We do know that there are approximately 1.7 million pre-orders for the Cybertruck.

While the pricing of the Cybertruck is still unclear, $60,000 is in line with other pick-up trucks. Half a million units at that price would imply revenues of $30 billion. Tesla made $81.4 billion in 2022, so that’s over a third of Tesla’s current revenues.

The second reason I am very bullish on Tesla is its FSD technology, something which I have talked about in the past. The latest earnings call just reinforced my view:

Well, obviously, as people have sort of made fun of me and perhaps quite fairly have made fun of me, my predictions about achieving full self-driving have been optimistic in the past. The reason I’ve been optimistic is — it tends to look like is the — we’ll make rapid progress with a new version of FSD, but then it will curve over logarithmically. So first, logarithmic curve looks like just sort of fairly straight upward line, diagonally up. And so, if you extrapolate that, then you have a great thing. But then because it’s actually logarithmic, it curves over, and then there have been a series of stacked logarithmic curves.

Now, I’m the boy who cried FSD, but I think we’ll be better than human by the end of this year. That’s not to say we’re approved by regulators

Source: Elon Musk, Earnings Call.

Musk has been wrong in his assessment of FSD so far; even he can admit that. However, he still thinks Tesla’s FSD will be superior to a human by 2024.

And while Musk thinks about the logarithmic curve, I see an exponential one moving forward. In fact, we can actually see this when looking at the hours driven by FSD, and this is only going to increase as Tesla makes this available to other companies.

And we think we may reach in-house neural net training capability of a 100 exaflops by the end of next year. So, to date, over 300 million miles have been driven using FSD beta. That 300 million mile number is going to seem small very quickly. It’ll soon be billions of miles, then tens of billions of miles…

And we are already in discussions with — early discussions with major OEM about using Tesla FSD.

Source: Elon Musk, Earnings Call.

The FSD is a piece of tech that can’t be valued traditionally, and it will be a major factor in bringing in more revenues moving forward.

Lastly, we have also seen very encouraging stuff from the energy segment:

For our energy business, we improved margins and gross profit driven by cost reductions and deal economics, particularly with Megapack. As a reminder, storage volumes are typically volatile sequentially based on the types of projects and their specific revenue recognition milestones.

Source: Elon Musk, Earnings Call.

Energy storage grew over 200%, and profitability is also on the up and this is in great part thanks to the Megapack:

Despite a significant ramp-up in production capacity over the last year, the lead time on new Megapack orders shows that it is basically sold out for the next two years.

Source: electrek.co.

So, expect more from the energy segment and services and other revenue, which grew 17% QoQ.

You Can’t Fight The Technicals

Though the earnings are very encouraging in my opinion, something is weighing down on Tesla in the short term, and that is the technical outlook.

I call myself the Pragmatic Investor because I judge an investment approach by its utility. In my time investing, I have found that TA is useful when determining short-term swings in stocks.

Take Tesla, for example:

Since bottoming out at the beginning of the year, the stock has come up almost 200%, stopping just shy of $300.

One could say the recent selloff is due to the earnings, but technical analysis would have suggested that a selloff was due even before the earnings.

Firstly, we can see that a significant bearish divergence has been building in the RSI since June. Furthermore, we have been nearing an important area of trade as highlighted by the red rectangle. The $300 level has been a key area of trade, and you’d expect to see some resistance.

So – if a pullback has begun – where can we expect it to end?

As I see it, we have formed an initial ABC structure from the lows in wave 1 of a five-wave impulse. This means that wave ii could now take us down to the 61.8% retracement of this rally, which lands us at $198.

We can see that this is also a very important area of support, as shown by the Visible Range Volume Profile. And, of course, we have the 200 day Moving Average offering support around this level, too.

Final Thoughts

In conclusion, though I see the results as bullish for Tesla, I am not surprised by the selloff. This is why I always complement the fundamental analysis with technical. With that said, if Tesla, Inc. stock does fall into my target range of $200, I’ll be looking at adding more to my position.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This is just one of many exciting and fairly priced tech stocks you can buy right now!

Join The Pragmatic Investor to stay ahead of the latest news and trends in the tech space and you will receive:

– Access to our Portfolio, which features “value tech stocks”.

– Deep dive reports on tech stocks.

– Regular news updates

Technology is changing the future, don’t just watch it, be a part of it!