Summary:

- Tesla, Inc. shares dropped 12% post Q2 earnings, but I believe the long-term bullish view remains due to Musk’s focus on growth and innovation.

- Recovery from Q1 sales slump, stable auto sales, and robust cash position support ambitious projects like autonomous driving and Optimus.

- Despite EPS miss and margin concerns, Tesla’s focus on long-term growth, operational efficiency, and potential in the robotaxi market indicate a strong buy opportunity.

- I think once their non-auto revenue opportunities pickup (including energy, robotaxi mobility and robots) the stock will jump 25%.

Justin Sullivan/Getty Images News

Investment Thesis

Tesla, Inc. (NASDAQ:TSLA) shares have dropped over 12% following what many have perceived as an underwhelming second quarter from the global EV giant. While an EPS miss and margin compression spooked many investors, I believe there are actually several reasons this quarter reinforces my long-term bullish view on Tesla.

CEO Elon Musk’s strategy has always revolved around future growth and innovation. This quarter’s results are no different, as the company continues to invest heavily in their ambitious, but I believe disciplined projects, including autonomous driving technology and the Tesla robot (Optimus). These ventures, although not immediately profitable, have the potential to revolutionize their respective markets and solidify Tesla’s position as a leader in AI hard-tech innovation.

On top of this, Tesla appears to have recovered from a Q1 sales slump in their EV division, which, I believe, will provide the cash-flows to support their ambitious projects. In Q2, the company reported 443,956 vehicle deliveries, surpassing the consensus estimate of 439,302 vehicles. Tesla is now operating at a stabilized rate for auto sales, which should provide a steady revenue stream.

While the company has entered stressful growth phases in the past, I think the company is now well-equipped to finance this next leg up, which I believe greatly increases the probability of success. The company ended the quarter with a robust cash position of $30.7 billion.

Despite the recent decline in share price and the company falling short on EPS estimates, I remain optimistic on Tesla’s future. I still believe shares are a strong buy.

Why I’m Doing Follow-Up Coverage

Post this quarterly call, the market’s general reception to Tesla has been negative. Investors have been concerned about the decline in gross margins. But, when we do a deep dive into overall margins, the company’s margins are generally where they were last year (and higher than any quarter since Q2 2023). Gross margins hit 18.0% in the quarter, down only 23 bps from this quarter last year.

Tesla Gross Margins Q2 (Seeking Alpha)

Despite this, Tesla’s margins remain higher than those of most legacy automakers, which average around 10%, demonstrating what I believe to be Tesla’s strong operational efficiency.

I think it is important to emphasize that Tesla is still a growth stock. The company’s investments in future-oriented projects like autonomous driving technology and robotaxi services indicate a focus on long-term potential rather than immediate profits. The story is likely similar here to what we saw with Amazon (AMZN) in the 2010s. While the robotaxi launch has been delayed to October, the promise is still there.

After all, at this point in Amazon’s journey under founder Jeff Bezos, EPS numbers weren’t groundbreaking. As a reference, Amazon’s quarterly net income did not get above even $1 billion/quarter until the fourth quarter of 2017. So for most of the 2010s (2010-Q4 2017) the company oscillated between losing money, breaking even and making under $1 billion a quarter as founder Jeff Bezos poured resources back into the company to accelerate innovation and growth. I believe the same is happening here.

The point of this article is to demonstrate why I think that despite the market’s reaction to Tesla’s second quarter, the stock (and the company’s story) is still intact.

Q2 Deep Dive

Tesla’s second-quarter results reported on Tuesday are mixed but, with how I see it, ultimately produced an encouraging picture of the company’s current performance and future prospects. The company missed the consensus estimate for EPS, reporting $0.52 compared to the expected $0.62/share, they managed to exceed revenue expectations. Tesla beat revenue expectations by $760 million, hitting $25.50 billion, which represents a 2.3% year-over-year increase. Although the market is concerned with this outcome, I really think this is a testament to their growth investments vs. concerns that EVs are becoming fundamentally less lucrative for this EV giant.

Really, this is a typical Elon Musk quarter, as he is usually focused on the long run vision rather than immediate financial results.

Again, since this is a growth stock (with definitely growth stock forward multiples) the importance of perpetually investing in new projects leaves me really optimistic. During the most recent earnings call, Musk acknowledged this:

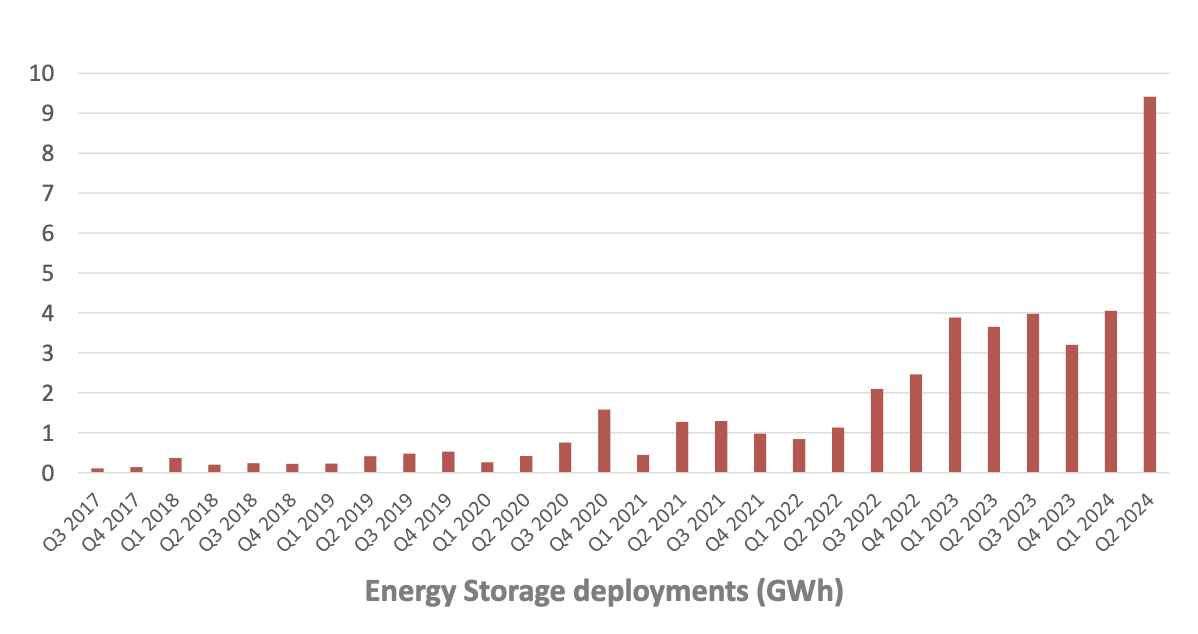

Despite many challenges the Tesla team did a great job executing and we did achieve record quarterly revenues. Energy storage deployments reached an all-time high in Q2, leading to record profits for the energy business. And we are investing in many future projects, including AI training and inference and great deal of infrastructure to support future products – Q2 2024 earnings call.

In this call, he mentioned many of these projects which, I think, are the future of the firm, stating:

We’re also nearing completion of the South expansion of Giga Texas, which will house our largest training cluster to date. So it will be an incremental for 50,000 H100s plus 20,000 of our hardware 4 AI5 Tesla AI computer – Q2 2024 earnings call.

He then went on to discuss Optimus:

Optimus is already performing tasks in our factory. And we expect to have Optimus production Version 1 in limited production starting early next year. This will be for Tesla consumption. It’s just better for us to iron out the issues ourselves. But we expect to have several thousand Optimus robots produced and doing useful things by the end of next year in the Tesla factories. And then in 2026, ramping up production quite a bit, and at that point we’ll be providing Optimus robots to outside customers. That will be Production Version 2 of Optimus – Q2 2024 earnings call.

As I mentioned above, it is important to focus on the long-term vision of this company rather than short term financial results. With this emphasis on project investment, especially in such a competitive market, I am confident this will yield positive results down the line. Energy is actually a great example of this, given that Tesla bought SolarCity in 2016, and they are just now starting to see the exponential growth they were expecting. This is long-term thinking at its finest.

During the call, Musk also touched on energy:

For the energy business, this is growing faster than anything else. This is — we are really demand constrained rather than production constrained. So we are ramping up production in our U.S. factory as well as building the Megapack factory in China that should roughly double our output, maybe more than double — maybe triple potentially – Q2 2024 earnings call.

The success of Tesla Energy was further emphasized during the earnings presentation, as seen by the chart below. I think this visual is powerful. It really shows how this is going parabolic.

Tesla Energy Storage Deployments (Seeking Alpha)

As seen above, in the second quarter of 2024, energy storage deployments have shot up to over 9 GWh.

Not only do Tesla’s new projects seem to be on track, but their energy business seems to be excelling as well. As we continue to see this sector grow and meet demand, I think revenue will continue to beat expectations.

The company’s operating margin actually improved slightly to 6.3% of sales, up from 5.5% in the previous quarter, though still below last year’s 9.6%. Tesla’s adjusted EBITDA for the quarter was $4.58 billion, with a margin of 14.4%, down from 18.7% a year ago. While this decline may appear alarming, I really don’t think this should be unexpected given Tesla’s aggressive investment in new technologies and production capabilities.

While Tesla’s Q2 results show some short-term pressures, particularly with gross margins and EPS, the company’s investments and operational improvements underscore their long-term potential. Optimus will be big. As I said at the beginning of this article, the company is much better off than they were 3 years ago, when they had a market cap much higher than this.

Valuation

As has always been the case for evaluating Tesla’s valuation, the main area of focus has to be centered around the company’s growth. In my previous analysis, I estimated Tesla’s base case valuation at $655 billion. Since then, the stock has jumped significantly, indicating that the market is beginning to price in the growth narratives I outlined.

Not only has the stock increased since my last coverage, but so have my valuation estimates. I believe that to effectively understand Tesla’s valuation, it’s key to consider the company’s potential in the robotaxi market, a segment that Musk has highlighted as a game-changer. The total addressable market (TAM) for robotaxis in 2030 is expected to be about $160 billion. Assuming Tesla can capture about 50% of the market share, they have an opportunity of $80 billion. I predict they will be able to capture 50% of the TAM due to their incredible driving data to power their robotaxis, which in 2020 sat at 3 billion (which is likely much higher today).

Tesla is known to have the best collection of driving data to train autonomous vehicles in the industry. I think this is key to powering the company. In fact, cars on the road today using this technology recorded an accident only once in every 6.57 million miles driven. They also claim this technology is 10 times safer than the US average driver. This is because the company has impressive data that allows them to train their models in ways no-one else can. This provides a powerful moat.

Looking at their FWD P/S ratio for 2030, this value is equal to 2.82. I see this 2030 price to sales ratio as a present value of the current price to sales ratio (meaning that as we get closer to 2030 we should actually expect Tesla to trade at a higher price/sales ratio but this 2.82 is the future value discounted back to today). Multiplying this on our estimated $80 billion in revenue capture creates an additional $225.60 billion in market cap upside from this data.

Adding this estimate to my previous base case valuation of $655 billion, the overall market-cap valuation of Tesla could increase to roughly $880.6 billion. Considering the market-cap currently stands at $703.62 billion, this growth represents upside potential of 25.15% for shares. I think this makes the stock well worth the risk.

Risks

One of the most immediate concerns is the declining gross margins. As I’ve mentioned in Q2, gross margins fell to 18% from over 18.2% in the previous quarter a year ago (and down from a gross margin of 25% in Q2 2022).

Personally, I do not think this decline is as concerning as the street makes it out to be because they are investing so heavily in the robotaxis and Optimus.

With these growth plans, we do have to talk about the elephant in the room: Elon Musk’s ambitious timelines.

Musk is known for setting aggressive goals, such as the deployment of a widespread robotaxi fleet and the production of the Tesla Semi by the end of 2025 (even as a bull, I recognize this will likely not happen). While these innovations have the potential to revolutionize the market, there is a risk that Tesla stock may seriously be impacted if the company does not meet these ambitious deadlines that Musk outlined on the most recent call (robotaxi in October and Optimus in production use at Tesla by late 2025).

In this case, however, I think results will come, just later than Musk is claiming (which may present a buying opportunity if the market overreacts).

I do believe that once the results from robots and robot taxis do hit, they will be immense (much akin to a ChatGPT moment for the company). It’s clear that the demand is there, but risks stem from if the technical risk can be resolved (and Musk is actually the person I trust most to solve these risks, given his grit and his team’s endurance).

Bottom Line

Despite a recent drop (post earnings), concerns about declining gross margins, and an EPS miss, I remain incredibly optimistic about Tesla’s future. The company continues to demonstrate resilience with a return to revenue growth and a robust cash position, thereby enabling significant investments in future technologies like autonomous driving, Optimus and energy storage.

While short-term challenges, including ambitious project timelines, present risks, Tesla’s long-term vision remains intact and strategic focus on innovation offers substantial growth potential.

Ultimately, investors should be focusing on the long-term path of Tesla. The EPS miss I believe is only a short run concern. Considering the vast investments in innovation, I think there is plenty of potential ahead. I believe Tesla is still a strong buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.