Summary:

- Tesla released its Q2 results, showing the impact of price cuts on delivery growth, which has hit new records this year.

- While Q2 revenues were decent, auto margins were light, and the bottom line beat was driven by a bunch of other income items.

- For Tesla stock to remain elevated, overall demand needs to show progress in the coming quarters.

Justin Sullivan

After the bell on Wednesday, we received second quarter results from Tesla, Inc. (NASDAQ:TSLA), which can be seen in full in this shareholder letter. The EV giant has seen its stock soar this year alongside many big tech names, as price cuts have allowed delivery growth to hit new records. Going into the report, investors and analysts mainly wanted to know how much these discounts had on the bottom line. The overall results were fairly decent, which has kept the stock near its recent highs.

Tesla started a series of price cuts last year in China, which happened again multiple times early in 2023. For Q2, that country basically held steady with some prices rising slightly, but the U.S. and Europe saw varying degrees of lowered prices, depending on the country and vehicle variant. Tesla delivered over 466,000 vehicles in Q2, up from less than 423,000 in Q1. As a result, analysts were looking for revenues to tick up to $24.73 billion. That average would rise to $24.81 billion, or about $1.5 billion over Q1, if you took out the curiously low estimate that implied a sequential decline of half a billion dollars in revenue, despite the delivery surge.

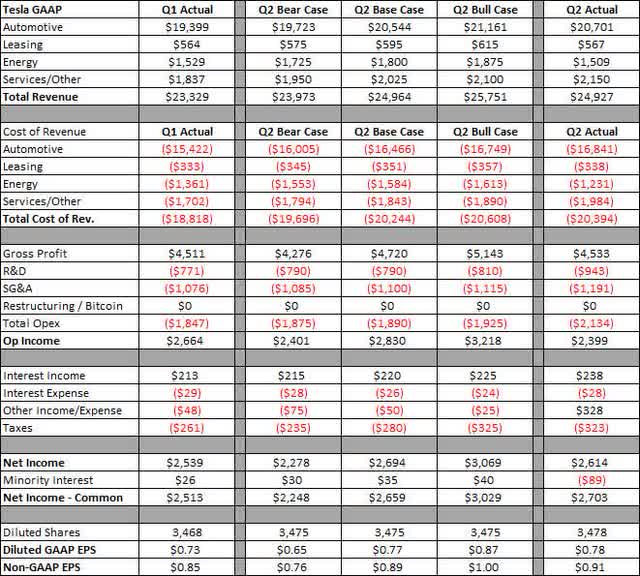

Analysts were expecting lower automotive gross margins for the period due to the discounting. As a result, the Street was looking for 82 cents in adjusted EPS, which would be down three cents from the Q1 2023 level. In the graphic below, you can see the three earnings cases I usually present, with my adjusted earnings estimate being based on the 7-cent average beat of non-GAAP EPS we’ve seen over the past 4 fiscal quarters. Dollar values are in millions, except per share amounts.

Tesla Q2 2023 Results (Author’s Estimates, Tesla Earnings Report)

I was nearly spot on when it came to total revenues, although as usual, the individual categories varied a bit. Tesla did a little better when it came to adjusted vehicle pricing than I expected, partially offset by a $239 million sequential decline in regulatory credit sales. The Services and Other segment continues to do quite well as the overall business grows, although Energy revenues declined sequentially as both solar and storage deployments declined over Q1 levels.

The biggest question for Q2 was perhaps gross margins, and Tesla seemed to disappoint a little here. Automotive margins excluding credit sales came in at 18.14%, which was about 18 basis points below my estimate and a little further below the street. Energy margins did jump, while services margins came in a little light of my expectations. Tesla also spent a bit more on the operating side than I forecast, but a lot of that was offset by other income gains, primarily related to currency movements. Losses attributable to non-controlling interests also helped pull the bottom line up. Overall, Tesla came in 9 cents ahead on the adjusted bottom line, 2 cents ahead of my projection.

When it comes to guidance, Tesla didn’t really update its forecast that much. Annual guidance remains at production of about 1.8 million units, although bulls are hoping deliveries will be a bit more than that given results in the first half of the year. The shareholder letter stated that initial Cybertruck production remains on track for later this year, although the company tweeted out a picture of the first one a couple of days ago. No specific guidance was given for margins going forward in the shareholder letter, so we’ll see what is said on the call for that key item.

It was just a couple of quarters ago when Tesla bears were celebrating shares being just a few bucks away from trading in double digits. In recent days, the stock has been trading near $300 again. Going into the Q2 report, the average price target on the street was $227, and that number has been rising steadily in recent weeks. I think we’ll see more price target hikes given the double beat in the coming days, but the street average will probably still represent some downside unless the stock really pulls back.

At the moment, I would personally rate Tesla as a hold. We have seen a huge rally lately, and Q2 results were decent. However, we need to see more long-term demand come in before I’d suggest buying Tesla, Inc. stock, as evidence suggests the company’s backlog is almost gone right now. The Cybertruck production ramp will be interesting to watch after plenty of delays, along with the potential for robo-taxis and true full self-driving features.

In the end, Tesla reported a decent set of results, holding the stock steady after a massive rally recently. Revenues and earnings came in about as I expected, both beating the street as usual. However, margins were a little light, with currency gains and non-controlling interest losses driving a meaningful part of the bottom line beat. I believe that guidance could have been better, which may be why the stock is only up a dollar or so in the after-hours session. In the next few quarters, the Cybertruck production ramp and overall demand will be the major catalysts for which direction Tesla stock heads next.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.