Summary:

- Despite a sharp sell-off, Tesla, Inc. is still up 50% from the April lows, indicating a potential bottom in revenue, margins, and stock price.

- CEO Elon Musk’s AI dream for Tesla, including FSD/robotaxi initiative and Optimus, could lead to significant growth potential, with a $5 trillion market cap projection.

- While Musk may be overly optimistic, we can now at least buy into his Ai dream with a margin of safety.

cagkansayin

Thesis Summary

Tesla, Inc. (NASDAQ:TSLA) sold off heavily after earnings as it missed EPS estimates, margins weakened, and the robotaxi event was delayed.

However, while YoY growth was negative, we’ve seen an improvement in QoQ in automotive revenues and energy deployment doubled on a sequential basis.

Despite a sharp sell-off, we are still up a solid 50% from the lows back in April and if you ask me, the evidence says that a bottom is in.

And I mean a bottom in terms of revenue, margins and stock price.

Q1 was Tesla’s low point, which was reflected in the stock’s valuation, but I expect both Tesla’s core business and AI initiatives to trend upwards from here.

In my last article on Tesla, I discussed the risks associated with increased financing needs. However, this risk seems to be smaller now as we have seen a reversal in margins and revenues.

On the other hand, we are coming closer to fulfilling Musk’s AI dream, and while this is still a long shot, I believe it is one we can now take with a certain margin of safety.

Latest Earnings

Tesla’s lackluster Q2 earnings sparked a double-digit sell-off. Let’s try to understand why:

TSLA Financial Summary (Investor Presentation)

Teslas’ auto revenues fell 7% YoY, while services grew 21% and energy generation and storage increased 100% YoY.

However, operating expenses were notably higher, up 39%, and this took a toll on the company’s operating margin, which came in at 6.3%.

Adjusted EBITDA fell by 21% YoY and while there was a sequential increase, the margin was slightly lower than in Q1.

If you ask me, there’s something for both bulls and bears here. Clearly the auto business has not delivered its promises from a few years ago, but to be fair, the whole EV adoption has been underwhelming.

On the other hand, service revenues and energy revenues are growing at a fast click, now representing over 25% of Tesla’s total revenues.

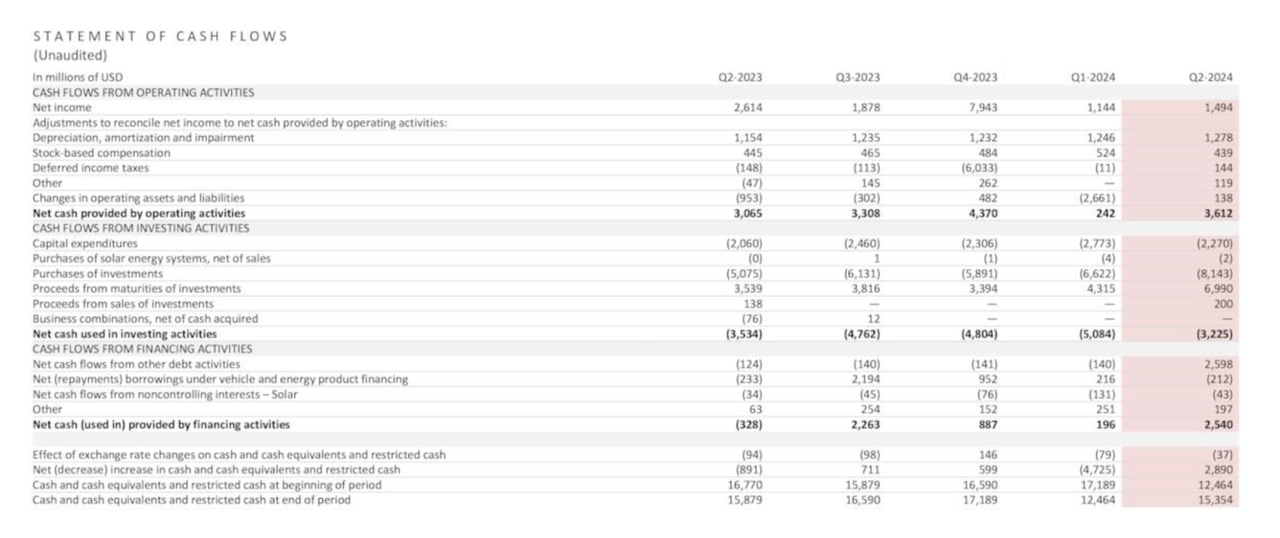

Statement of cash flow (Investor Presentation)

Now, in terms of cash flow, which is an issue I talked about in my last post, we have seen Tesla’s operating cash recover to its previous levels, and it has grown YoY.

The company is investing a lot more money due to AI, but it has also raised enough cash to counter this. For now, with cash and equivalents of over $15.3 billion, there is no immediate risk to solvency.

Tesla AI Update

Of course, Tesla has been redefining itself as an AI company for some months now, so it’s important to look at the latest updates on this, namely, FSD/robtaxi initiative and the Optimus.

It’s difficult, obviously, my predictions on this have been overly optimistic in the past. So I mean, based on the current trend, it seems as though we should get miles between interventions to be high enough that — to be far enough in excess of humans that you could do unsupervised possibly by the end of this year. I would be shocked if we cannot do it next year.

Source: Earnings Call.

At least Musk is self-aware enough to realize that he has been overly optimistic. Still, he believes that FSD will be a thing at the very latest by next year.

This will power Tesla’s fleet of robotaxis, which Tesla will showcase on October 10th.

Although the numbers sound crazy, I think Tesla producing at volume with unsupervised FSD essentially enabling the fleet to operate like a giant autonomous fleet. And it takes the valuation, I think, to some pretty crazy number. ARK Invest thinks, on the order of $5 trillion, I think they are probably not wrong. And long-term Optimus, I think, it achieves a valuation several times that number.

Source: Earnings Call.

Musk cites and agrees with the ARK Invest (ARKK) valuation, which puts the company at a $5 trillion market cap.

Of course, this is just the tip of Musk’s AI dream.

I think everyone on earth is going to want one. There’s 8 billion people on earth, so it’s 8 billion right there. Then you’ve got, all of the industrial uses, which is probably at least as much, if not way more. So I suspect that the long-term demand for general purpose humanoid robots is in excess of 20 billion units.

Source: Earnings Call.

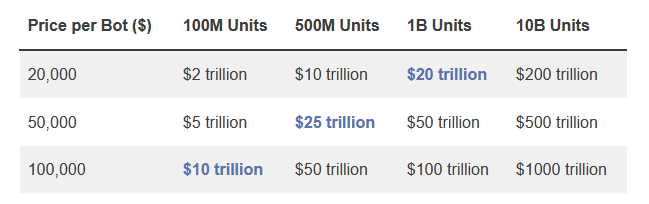

Musk believes long-term demand for robots like Optimus could reach 20 billion units. Of course, even if Tesla doesn’t serve the whole market, it is still a huge number.

In a previous article, I estimated the potential value of Tesla’s AI initiatives.

Optimus Projections (Finxter)

According to Finxter, at a $20,000 price with a billion units sold, this would push revenues to $20 trillion. Analyst estimates suggest the robotics industry could achieve a market size of over 270 billion by 2032.

Musk is perhaps overly optimistic, but to be fair, that’s certainly at least part of his job.

In any case, there’s no shortage of potential catalysts. Reality will likely fall short of Musk’s lofty expectations, but even then, we could be looking at an entirely different Tesla in 2–3 years.

Already, 25% of revenues are not coming from auto sales.

The Bottom Is In

Investing in Tesla for the AI potential is not completely crazy, but it is certainly speculative. Nonetheless, I think there’s a good argument to be made that we have seen a bottom in revenues, margins and the stock price. This means we can invest in Musk’s AI dream with a certain margin of safety.

Revenues May Have Bottomed

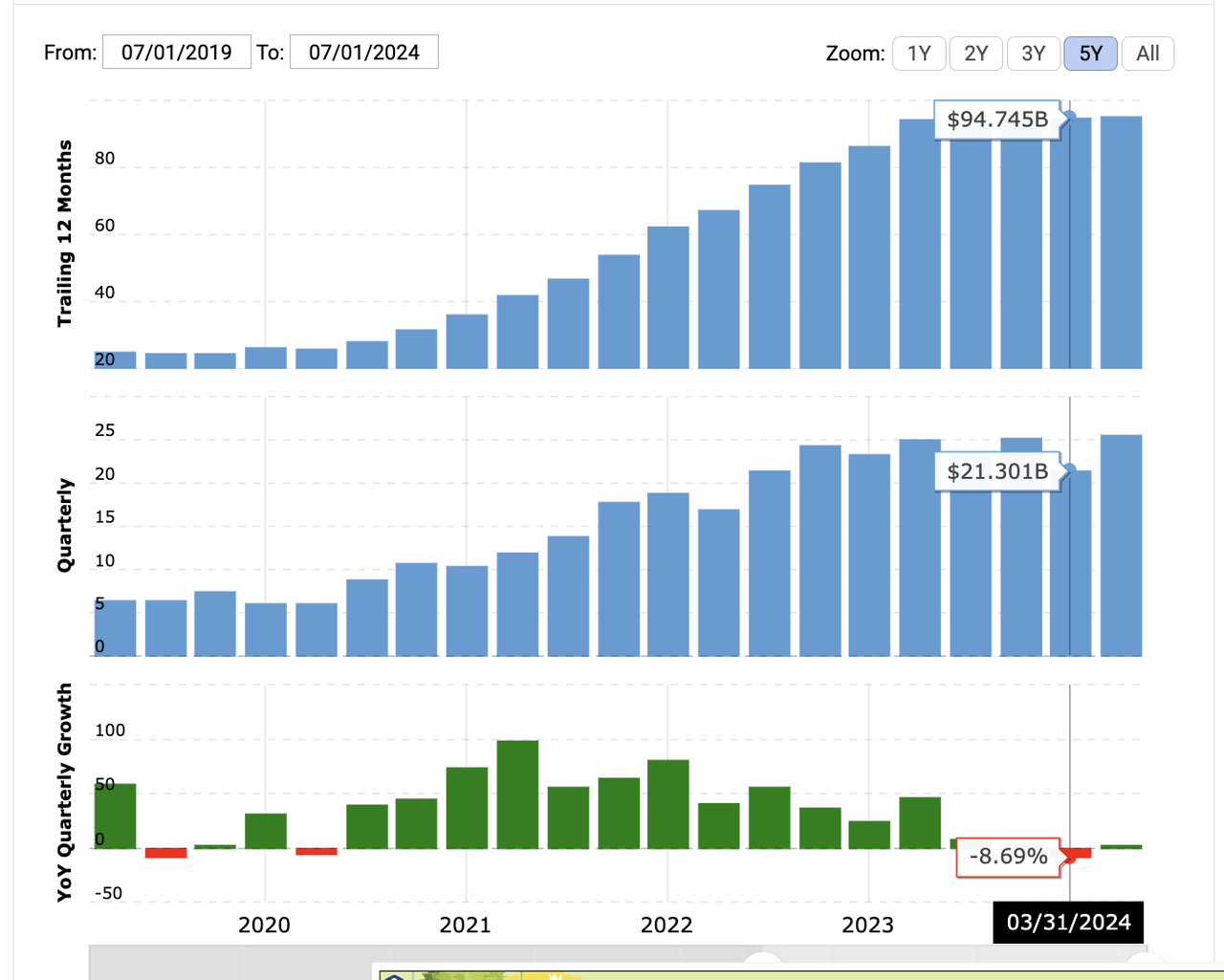

This is not to imply that we will see revenues grow at double digits starting tomorrow, but the worst may be behind us

On a TTM basis, we actually saw revenues plateau in 2023, and actually decrease by over 8% in Q1 of 2024. But, we have already seen a return to growth in Q2, and this should continue to improve.

Back in 2023 the company was facing issues as they geared up for the production of the Cybertruck, but both Cybertruck and Model 3 are ramping up.

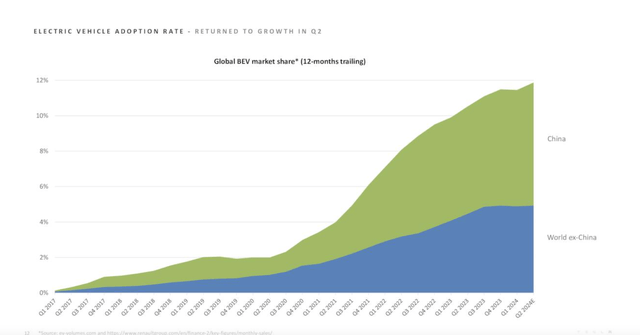

Furthermore, we are also seeing a return to growth in terms of BEW adoption.

BEV market share (Investor Presentation)

Then we have the energy business, which will be set to double/triple when TSLA finishes building the megapack factory in China

For the energy business, this is growing faster than anything else. This is — we are really demand constrained rather than production constrained. So we are ramping up production in our U.S. factory as well as building the Megapack factory in China that should roughly double our output, maybe more than double — maybe triple potentially.

Source: Earnings Call.

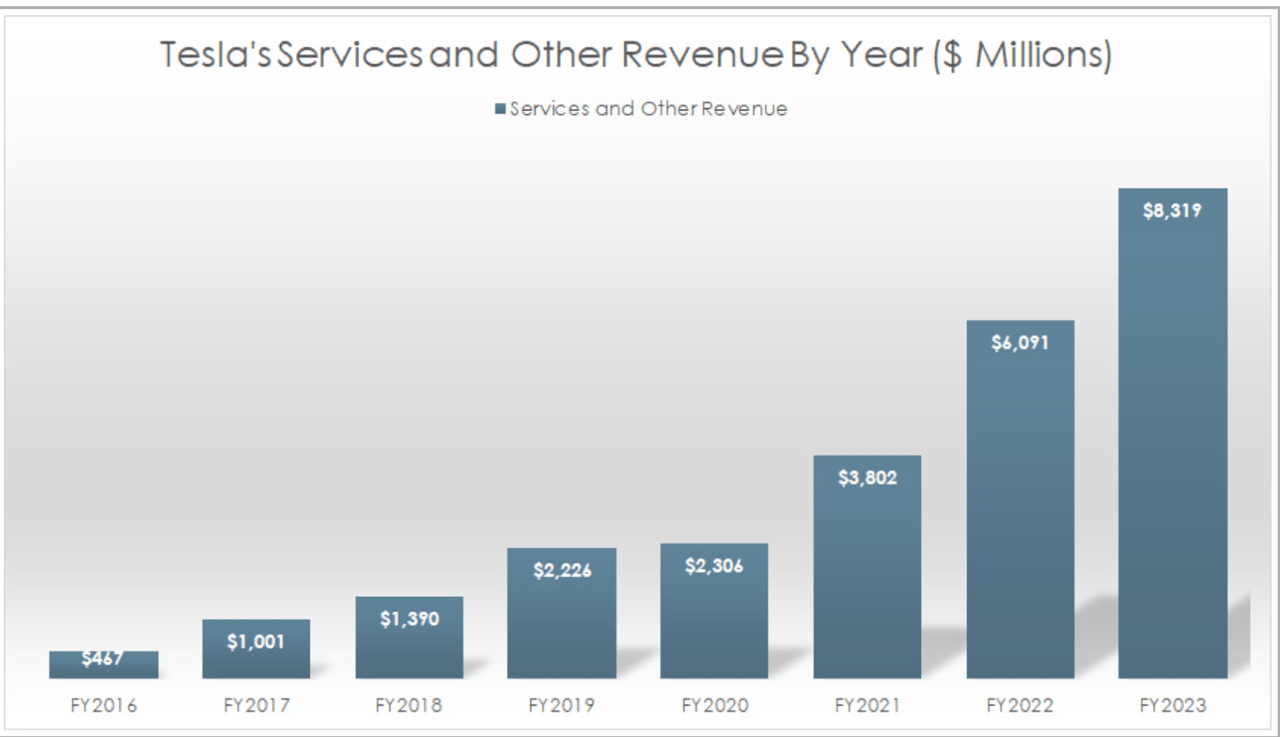

And of course, Service revenues continue to grow at a fast-click.

TSLA service revenues (Stockdividendscreener)

Margins May Have Bottomed

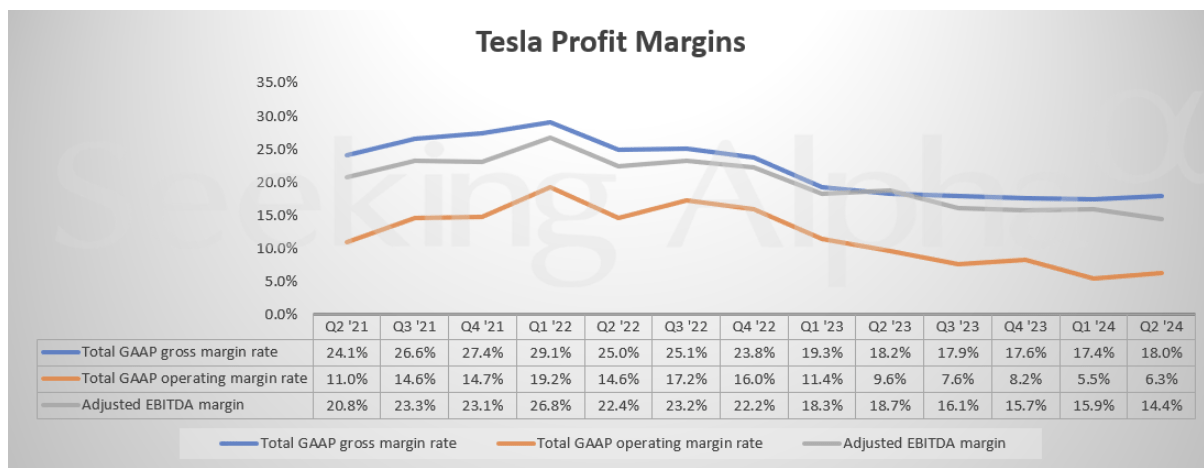

Investors are also worried about profitability, but fundamentals also seem to suggest that margins should improve from here.

Tesla profit margins (Seeking Alpha)

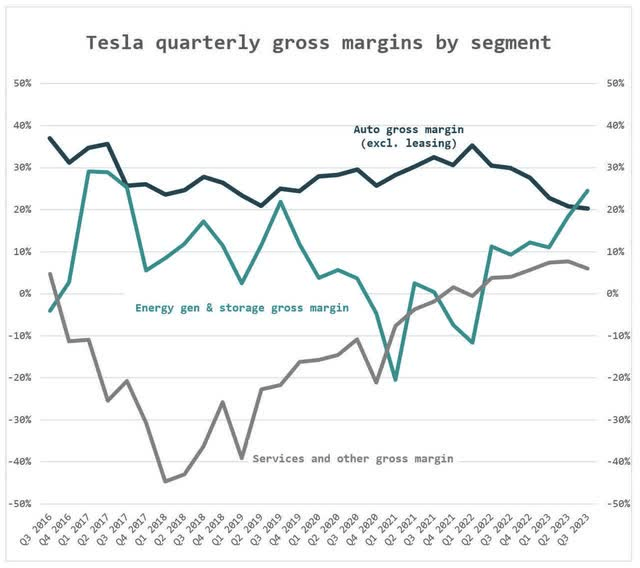

GAAP operating and gross margins have already increased in the last quarter. Auto margins have been helped through higher tax credits in the last quarter. However, the truth of the matter is that even without these improvements, we should see overall margins for Tesla increase as the share of revenue begins to shift towards energy, services, and other AI initiatives.

Tesla gross margins (Heller House)

Energy generation already boasted a higher margin than auto since 2023 and while there’s still work to do, I believe service revenues should eventually have a higher margin too, especially as the company perfects it FSD.

The price may have bottomed

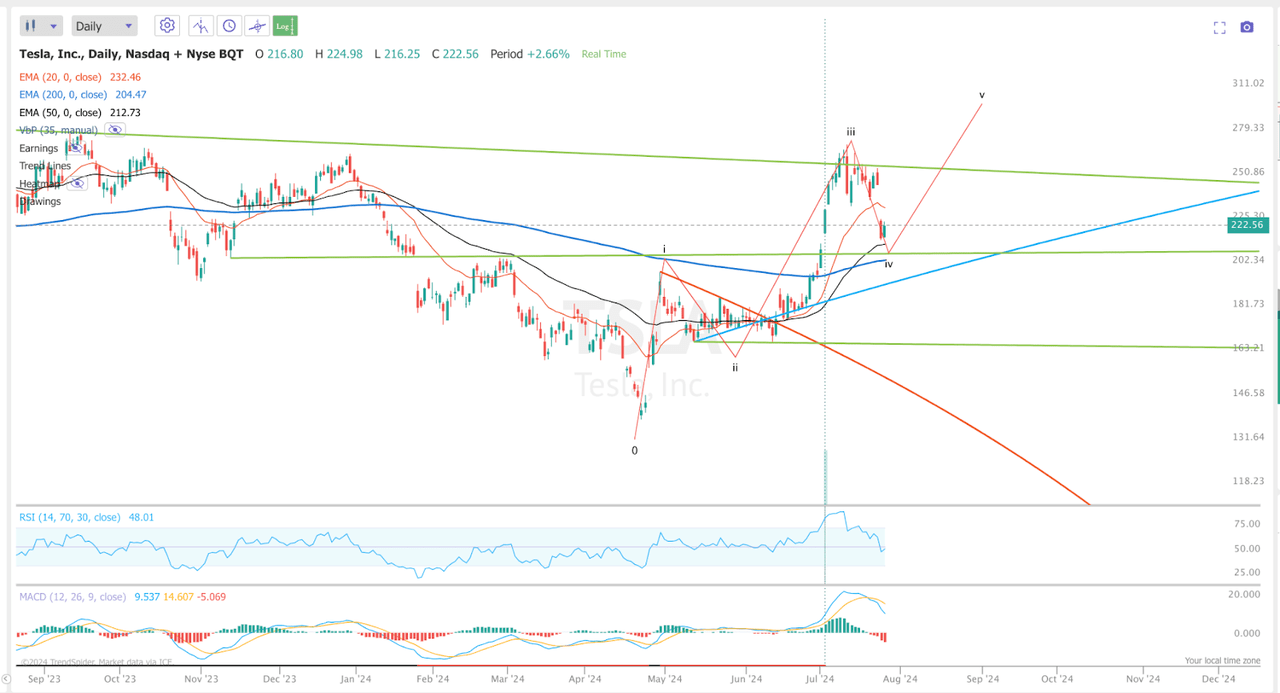

Technically speaking, we’ve established a strong uptrend, and this means a low could be in place.

Tesla went as low as $140 back in May but has since bounced back over 50%. Since then, we’ve seen the 20 EMA cross the 50 EMA, and both have now exceeded the 200 EMA, which is presently acting as support for TSLA.

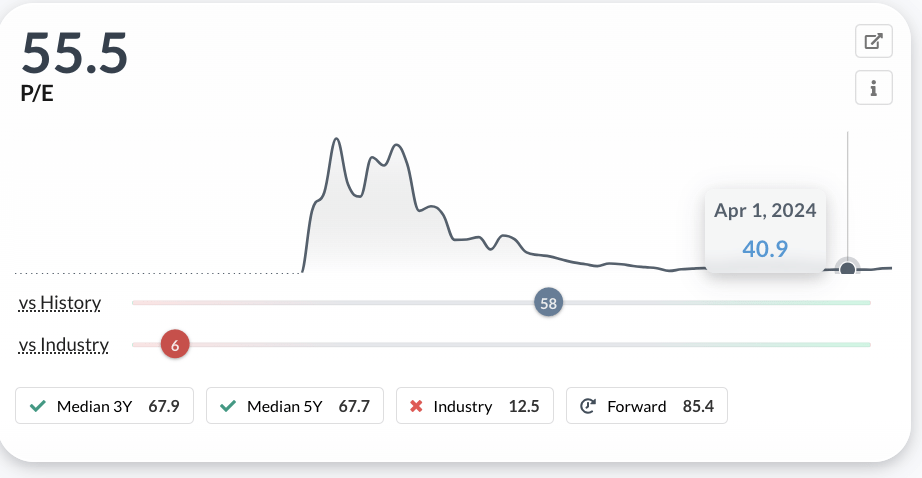

It’s also worth noting that back in May, TSLA’s P/E dipped to around 40.

TSLA PE (Alphaspread)

While this could still be considered high, it was well below the company’s 3 and 5-year median P/E.

In my opinion, Q1 2024 was a perfect storm for Tesla, and investors were pricing in the worst. Now, it seems like the worst could be behind us, and while the company still faces challenges, investor confidence may soon begin to come back.

Takeaway

In conclusion, I believe that the worst-case scenario was priced into the stock a few months ago, and the latest earnings show at least a change in the trend. Overall, I think we should begin to see Tesla’s revenues keep growing while margins improve. For this reason, I am upgrading this to a Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This is a high-risk/high-reward opportunity, which is exactly what I look for in my YOLO portfolio.

Joint the Pragmatic Investor today to get insight into stocks with high return potential.

You will also get:

– Weekly Macro newsletter

– Access to the End of The World and YOLO portfolios

– Trade Ideas

– Weekly Video