Summary:

- Tesla has seen a significant turnaround with an approximately 80% return since its Q1 report on April 19th, 2023.

- The company’s stock had fallen due to erratic price cuts and a significant impact on margins, with gross margin collapsing nearly 1000 basis points.

- Tesla’s ecosystem approach and technological leadership should maintain Tesla’s relevance for years to come.

IGphotography/iStock via Getty Images

Preamble

A deeply inverted yield curve, a record-setting rate hike cycle, and tense geopolitical developments foreshadowed a bleak 2023. Tesla, Inc. (NASDAQ:TSLA) stock was no exception, turning the year around its 52-week low around the low $100s. Elon’s Twitter escapades and the alleged certainty of the great recession of 2023 set loose a rampage of selling that Tesla owners are unlikely to forget soon. I initiated coverage of Tesla in March of this year, followed up by an article on price cuts and the Tesla ecosystem.

All three of these articles were fundamentally bullish on Tesla and its future prospects. Overall, I believe Tesla is a superb business with a brilliant business model, a compelling growth story, and a promising long-term investment. Although I remain firmly in the bullpen, I admit that bears do have many cogent concerns.

Despite a pessimistic backdrop, Tesla’s performance across the first quarter was respectable, with it already trading back in the $200 range by the beginning of April. This winning streak was snapped temporarily in a revisitation of the $160 mark following a bleak Q1 earnings report. The response to Q1 earnings was characterized by a disdain for Elon’s erratic pricing regime. While Tesla cars were getting cheaper for consumers, investors were trembling at the likelihood of severe margin erosion. These fears were realized in the Q1 report with the gross margin collapsing nearly 1000 bps while the operating margin plummeted 779 bps. This report sparked a rapid selloff from $187.15 on April 18th to $153.75 by April 26th.

Since the April 19th earnings report, Tesla is up roughly 80%. Certainly, much of this can be attributed to the strong Nasdaq bull market across the first half of 2023. Tesla has kept pace with the big 5 in Tech for a reason – the value proposition is still strong. Despite this promising price appreciation, Tesla has once again hit turbulence.

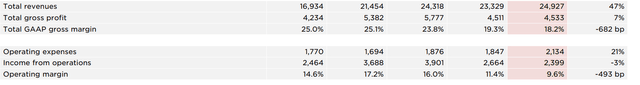

Margin compression has significantly changed the investment case in Tesla. The narrative in recent history was that Tesla is different than competing car companies because of its industry-leading margins. With the Q2 report, this narrative has been laid to rest. This week, Tesla got hit by another margin-driven price drop. Total GAAP operating margin fell to 9.6% in Q2 from 11.4% in Q1, 14.6% a year ago, and 20.8% two years ago. Gross margin came in at 18.2% in Q2 vs. 25.0% a year ago. Investors are wise to be cautious in the face of such a trend.

Margin data (Tesla Q2 2023 earnings report)

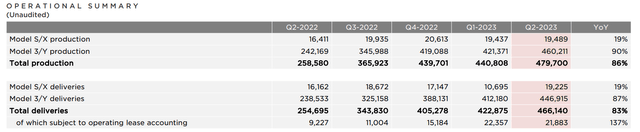

Bears are concerned that margin compression will materially impact growth prospects, thereby leading to a multiple compression and re-baselining of the stock price at a much lower level than the near $1T market cap we are currently trading at. It’s a fair concern. However, it’s important to also consider the strong trend in both production and deliveries:

Production and Delivery data (Tesla Q2 earnings report)

As will be discussed below, Tesla is more than just a car company. Analyzing Tesla as solely a car company is a mistake. Further, it is of foremost importance for Tesla to continue moving units and scaling manufacturing. If price decreases help achieve this, then margin compression is a worthy sacrifice for the autonomous driving future.

Despite the bleak margin trend, I remain fundamentally bullish on Tesla as a business, although I will be rating Tesla a “Hold” considering the hefty earnings multiple it’s currently trading at. I firmly believe Tesla will be a long-term compounder, so I do not recommend selling. At current levels, I would only recommend adding modest amounts to an existing position. I would neither recommend opening a position nor making significant purchases. Following that, I feel it’s required to note that I increased my stake in Tesla after the 10% drop following the earnings call.

Still a Positive Story

As discussed in previous articles, Tesla has a compelling product ecosystem. The gateway to the Tesla ecosystem is the car itself, which is made more valuable by a growing set of complementary offerings. Tesla owners will soon be able to nearly electrify their whole life with Tesla products, across their transportation, home-energy storage and use (Powerwall), home-energy production (Tesla Solar), HVAC (heat pumps), and what is soon to be a centerpiece of Tesla’s value proposition: AI and supercomputing.

The future of AI will be characterized by one thing: an unyielding demand for more computational power. Increasing computing power is mostly dependent on chip fab innovation and hardware architecture optimization. Between leadership by both ASML Holding N.V. (ASML) and Taiwan Semiconductor (TSM), the chip industry is bumping up against the laws of physics with 3nm chip fab technology. Nvidia Corporation (NVDA), the early victor of the age of AI, recently launched a new line of supercomputing chips. These GPUs are optimized for AI applications; in other words, for the jaw-dropping level of computational power needed to train and operate large-scale AI models. Tesla has been a huge customer.

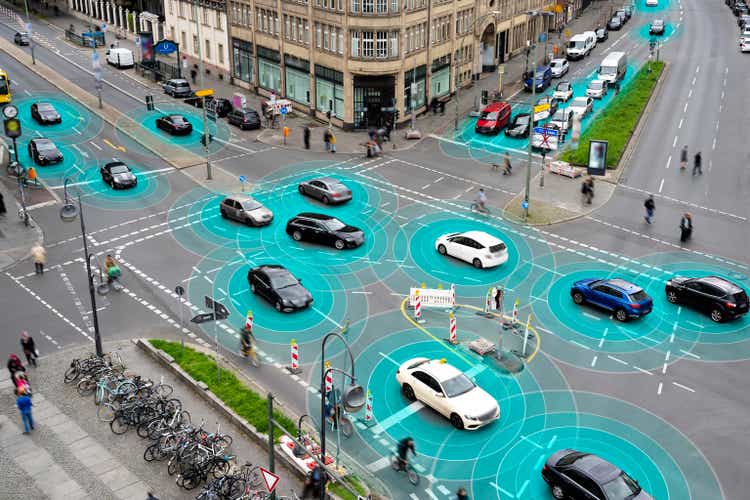

Without getting deep into technical detail, suffice it to say that this computer offers unbelievable computational power. The supercomputer consists of 5,760 NVIDIA A100 graphics cards installed in 720 nodes of eight GPUs each and is capable of 1.8 exaflops of performance. Few computers exist in the world with more power than this. This computer currently completes a lot of auto-labeling, which is real-time label assignments of raw data collected by the AI model from the real world. For those unfamiliar, Tesla’s full self-driving (“FSD”) uses multiple cameras on the car to construct a 360-degree view of the world surrounding the vehicle, interpreting this data, and then making AI-powered decisions about the safest driving behavior. To power, this requires truly unfathomable levels of computing power.

Enter Tesla Dojo

As of July 2023, Tesla Dojo has been deployed to production and has begun model training in real-time. This has flown under the radar, at least by Tesla’s highly-public standards, as it was mostly overshadowed by the announcement of the shiny robot Optimus at AI Day. Dojo contributes immensely to Tesla’s growing moat, which has been characterized by software development that far outpaces rivals. As Henry Ford pioneered a new and immensely more efficient production process, Elon Musk pioneered a stark shift in what it means to be a car company. This shift is a software-led approach to the driving experience. In one of his appearances on the Joe Rogan Experience podcast, Elon commented that his desire is for Tesla cars to provide the best possible driving experience, not just the best possible vehicle. This experience extends far past foot pedals and a steering wheel. This includes the full spectrum of car ownership across ordering, customization, servicing, replacement, and of course convenience of operation.

If Full-Self Driving (“FSD”) achieves fully autonomous driving, it will cause a singularity in vehicle ownership. Despite having one of the most powerful supercomputers and very sophisticated AI models, FSD’s success is far from guaranteed.

Nvidia is a specialist in GPU-driven architecture. GPUs differ from CPUs in their core count (GPUs have significantly more cores) and computing specialty (GPUs are really good at matrix multiplication, which has proven to be very useful in AI applications). Dojo exists somewhere in the middle. Per Forbes:

Instead of combining lots of smaller chips, its D1 tile is one big chip with 354 cores specifically aimed at AI and ML. Six of these are then combined into a tray, alongside supportive computing hardware. Two of these trays can be installed in a single cabinet, giving each cabinet 4,248 cores, and a 10-cabinet exapod 42,480 cores. A CPU-based supercomputer would have fewer cores in the same space, and a GPU-based one many more. But since Dojo is specifically optimized for processing AI and ML, it is orders of magnitude faster than either for the same datacenter footprint.

This has the potential to catalyze a virtuous cycle. As more owners purchase FSD, the model will have more real-world training, which will increase the efficacy of the FSD system, thus incentivizing more owners to purchase the software. Not to mention, price cuts in vehicles widen the TAM (total addressable market) for FSD, since vehicle ownership is the only pre-requisite.

Leadership in product quality is becoming Tesla’s competitive advantage. While scaling its manufacturing and distribution processes, Tesla’s management focused intensely on vertical integration. Few car companies build as many components in-house as Tesla, which gives greater pricing flexibility, easier maintenance and servicing, cheaper replaceability of vehicle components, and more effective quality assurance. The benefits of vertical integration extend into the software world, with Tesla creating most of its own AI models and chip designs. As previously noted, Tesla is a huge customer of Nvidia A100 chips, but the D1 chip coupled with the Dojo architecture reduces Tesla’s dependence on Nvidia. Even if Nvidia cannot meet the demand for A100 chips, as long as Tesla can get 7nm or better chips from TSM or Samsung (OTCPK:SSNLF), FSD progress should not slow.

Seriously – is there another car company that touts one of the most powerful supercomputers in the world? Much more than that, what other car company could have developed the underlying architecture themselves? None other than Tesla. This is why Tesla remains a compelling investment opportunity.

Nobody can predict the future with any reasonable degree of certainty. We can, however, predict what might be important characteristics of the future, like the fact that AI will continue to drive demand for more and more computational power. Similarly, whatever the future of autonomous driving and car ownership holds, we can be certain that Tesla will be a player. That is the spirit of this company; it is a constant engine of innovation and continues to be at the forefront of technological advancement. Agile companies that embrace the AI future should be the winners over the course of the next 20 to 30 years, and I steadfastly believe that Tesla, Inc. is one of those businesses.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.