Summary:

- Tesla, Inc.’s Q3 delivery underperformance has led to a decline in its growth and profitability, with revenue and earnings per share during the period also coming in below already-tempered market expectations.

- The results underscore rising demand risks, particularly in China, where competition and macroeconomic challenges have led to aggressive price cuts.

- Investors’ confidence in Tesla’s speculative growth drivers, such as the Cybertruck and Full Self-Driving technology, is likely also waning, adding further downside risks to the stock.

Spencer Platt

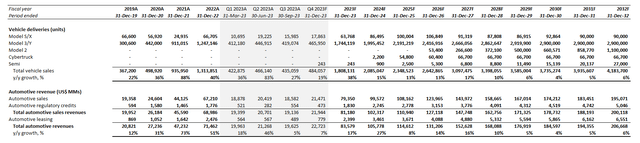

Tesla, Inc.’s (NASDAQ:TSLA) Q3 delivery underperformance has followed with a similar trend in its growth and profitability for the period, despite the increased slew of downward revisions to consensus estimates over the past three months, which set a lower bar on expectations. Revenue expanded by just under 9% y/y, compared to the average estimate of 13%, while earnings per share finished at $0.66, underperforming market expectations of $0.73. Auto gross margin ex-credits for the quarter was 16%, also underperforming the average consensus estimate of about 18.2%, while also marking deterioration from the previous quarter’s 18.1%. The stock’s slight initial rise in post-market trading in response to the results underscores investors’ continued sensitivity to the underlying business’ volatile performance in recent quarters.

This largely diverges from the stock’s historical level of resilience, which has failed to budge even in the midst of bad news given the army of dip buyers confidence in Tesla’s prospects in the electric vehicle (“EV”) industry and broader technology sector. Even in the midst of macroeconomic and geopolitical uncertainties, Tesla would have been back strongly in the green by afternoon. But this resilience is rapidly losing its grip, as Tesla’s stock valuation has yet to recover from the downtrend following the release of Q3 delivery results that underperformed. While management’s latest commentary appears to downplay emerging demand risks and margin pressure at Tesla, there is no doubt that signs of waning investors’ confidence are being priced into the stock, especially given its diminishing valuation premium in recent months.

Despite still having multiple levers to pull given Tesla’s unmatched competitive advantage against competing auto OEMs, we think risks of a normalizing stock premium are slowly becoming reality – especially as the timeline to realization on some of the company’s speculative long-term growth drivers underpinning its lofty premium becomes increasingly uncertain.

Downplaying Demand Risks

Tesla’s Q3 delivery miss had initially set off a kneejerk selloff, which caused the stock to open 2% lower before a swift rebound in the afternoon following clarification that the underperformance was merely a result from extended factory downtimes during the period. This brings back into focus ongoing market fears over Tesla’s increasing exposure to demand risks, which management sought to assuage during the latest earnings commentary. Citing one-time disruptions from global plant shutdowns for pre-scheduled retooling for Q3’s volume underperformance, management reiterated their confidence in achieving at least 1.8 million vehicle deliveries before the end of the year. However, the unending cycle of aggressive price cuts – which management has, time and again, tried to downplay by calling it a “dynamic pricing” advantage – continues to highlight growing pressure from broader macroeconomic uncertainties and rising competition on Tesla’s sales.

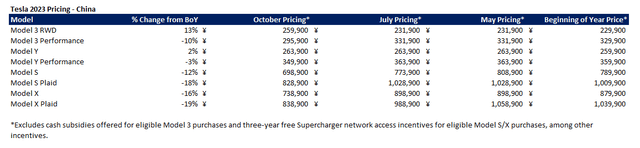

China

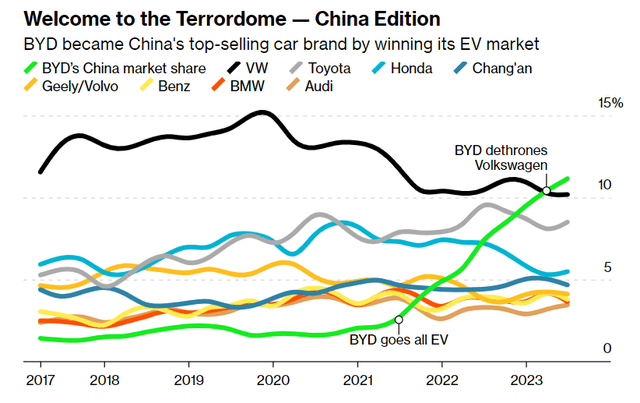

This includes the rapid deceleration in China delivery growth during recent quarters, likely due to the region’s mixed economic environment, exacerbated by rising competition. The Chinese economy has continued to reel from the aftermath of its pandemic-era slowdown, alongside a broader property market slump which has soured consumer confidence in the region over the past year. This has resulted in a growing chorus of value-for-money demands among consumers, which has likely benefited Tesla’s key rival BYD Company Limited (OTCPK:BYDDF, OTCPK:BYDDY) over the past year.

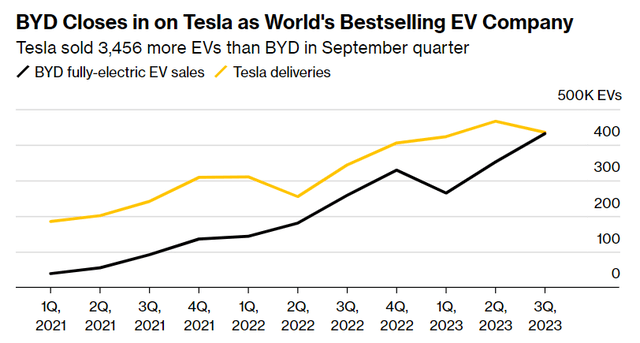

This is also corroborated by market’s expectation that BYD will inevitably overtake Tesla as the “world’s biggest seller of EVs” by Q4, as the Chinese automaker works tirelessly towards closing the market share gap.

Meanwhile, a portion of Tesla’s share of the Chinese EV market is also being gradually displaced by local EV pure-plays such as NIO (NIO), XPeng (XPEV) and, more notably, Li Auto (LI), which have all posted significant delivery growth during the third quarter. This competitive and macroeconomic dynamic has likely continued to propel Tesla’s implementation of aggressive price cuts in the region – even the updated versions of its best-selling Model 3/Y vehicles in the region have kept prices largely unchanged from their predecessors.

Data from Tesla China sales website

But with Tesla’s slowing pace of sales growth in the region, sub-20% auto (ex-credits) margins are likely to become the near-term norm. Much of Tesla’s margin expansion observed over the past two years have been driven by industry-leading auto production efficiency at its Shanghai facility, paired with robust demand in China – the largest and fastest growing EV market. Restoring current profit margins to said levels would require the combined return of elevated MSRPs, demand, and production at scale, which have become harder to execute in the face of rising competitive headwinds, alongside broader uncertainties over China’s economic outlook.

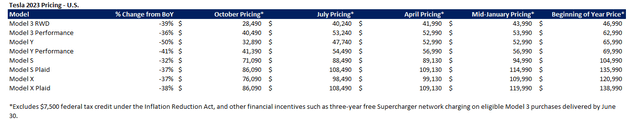

U.S.

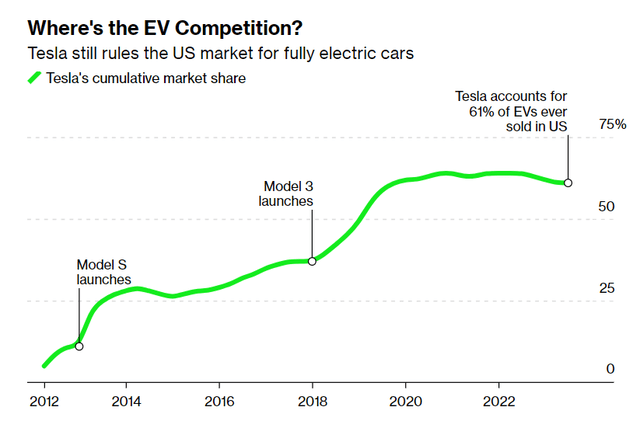

Tesla also faces persistent challenge in its largest home market in the U.S. Similar to its demand trends in China, the combination of rising competition and macroeconomic challenges have led to continued price cuts.

Data from Tesla’s U.S. sales website

Prices on Tesla’s line-up in the U.S. have fallen as much as 50% for the entry level RWD Model Y. Along with the Model 3, two of Tesla’s lower-priced best-sellers are now priced meaningfully below the $48,000 average vehicle price in the U.S., kicking the price parity roadblock on EV adoption to the curb. Yet, improved affordability has done little to drive accretive demand growth for Tesla in the U.S. Outside of extended factory downtimes during Q3, we believe the latest delivery miss is also a caution for emerging demand risks.

On one hand, delivery times for Model 3/Y custom orders have already normalized to under two months, with purchases placed today ready by the end of November. This highlights how Tesla’s historical “supply problem” has been largely addressed – even in the face of extended factory downtimes during the third quarter, which had placed a bigger than expected impact on volumes. On the other hand, Model S/X deliveries remain weak relative to the aggressive price cuts implemented through the year, with the last reduction effective early September putting the premium models at their cheapest ever. Taken together, Tesla’s leading market share in the U.S. has started to show signs of structural decline in recent quarters.

The decelerating growth trends are casting a shadow over management’s reiterated full-year guidance for volumes to hit 1.8 million vehicles. Based on deliveries completed to date this year, Tesla is still about 476,000 vehicles out from hitting its full-year volume target. This would represent q/q delivery growth of 9.4% (or 17.6% y/y), suggesting a requirement for productions across Tesla’s global factory footprint to ramp up towards normal levels quickly following their summer downtimes. Yet, this undertaking will also coincide with potential ramp up challenges on the incoming Cybertruck, which poses a mixed outlook on the volume ambitions set by management and further weaken investors’ confidence in the stock over the near term. R&D expenses related to the breakthrough vehicle segment for Tesla has already contributed to an uptick in R&D spend in the third quarter, in line with an anticipated impact on near-term profit margins due to Cybertruck ramp-up costs.

When It Rains, It Pours

In addition to demand risks, we also see emerging cracks in investors’ previously resolute confidence in some of Tesla’s speculative growth drivers in the longer term.

Cybertruck: Circling back to the Cybertruck, its repeated delivery delays have driven up uncertainties and concerns on potential “holdups” behind the scenes. While Musk has committed reiterated his commitment to “delivering the car this year,” the lack of progress details are starting to put a dent in some of the stock’s valuation premium attributable to the new vehicle segment on Tesla’s portfolio.

Admittedly, the car has generated significant interest from consumers – especially amongst existing Tesla owners in the U.S. About 37% of recently surveyed Tesla owners currently looking to add another car have indicated interest in the Cybertruck, beating single-digit percentage interest observed across competing offers like Rivian’s (RIVN) R1T or Ford (F) and GM’s (GM) electrified versions of their best-selling gas guzzlers. This is in line with Musk’s emphasis on “off the hook” demand on the Cybertruck, which has observed almost 2 million reservations to date.

Despite previous concerns that the emerging volume of electric pickup trucks offered by both EV start-ups and legacy automakers in recent years could rid Tesla of its first-mover advantage on the Cybertruck, said fears have also yet to materialize. After 18 months of F-150 Lightning sales, the electrified version of Ford’s best-selling F-Series pickup truck still only accounts for just a nominal share of the automaker’s total volumes. Meanwhile, rival Rivian has also struggled with driving demand acceleration even as it makes progress in ramping up productions. This could be due to Tesla’s unwavering fanbase, and/or the fact that the Cybertruck – despite being a pickup truck – is establishing a new vehicle segment of its own, which offers differentiation from existing electric alternatives available in the market.

However, extended delays on Cybertruck deliveries could potentially dilute consumer interest in the vehicle, nonetheless. And uncertainties over the timeline to materializing growth from the impending revenue driver also risks diminishing investors’ confidence and hurts the stock’s performance from current levels.

Full Self-Driving (“FSD”): A key component of Tesla’s valuation premium built in recent years comes from investors’ confidence in the eventual realization of FSD-driven growth. This spans beyond realization of existing deferred revenue attributable to FSD subscriptions, and into potential monetization through the deployment of robotaxis and licensing the technology to other OEMs. FSD has been the foundation to shielding the stock from impact related to recent price cuts and ensuing margin contraction, given the technology’s prospects of driving the bulk of post-sales revenue expansion for Tesla in the longer-term.

However, increasing stock volatility in recent months is likely a reflection of cracks in previously unaverred investors’ confidence over the eventual realization of FSD-related contributions to Tesla’s growth and profitability trajectory. Despite the nascent technology’s claims to improving road safety and saving lives, FSD’s gradual deployment and usage by drivers is also driving incremental regulatory scrutiny over its viability and readiness. The hurdles are also further clouding visibility into the already opaque timeline to full FSD deployment and monetization, which adds pressure to the durability of the Tesla stock’s valuation premium at current levels.

Amid the heated, albeit consolidated, race to autonomy between Tesla and comparable rivals such as GM’s Cruise and Google’s (GOOG, GOOGL) Waymo, the EV titan has been at the center of both regulatory and legal scrutiny due to its exposure to a greater volume of accidents and casualties. On one hand, the challenge raises concerns over the technology’s competence, while on the other hand, the incremental scrutiny levied on FSD could also be attributable to the unregulated human driver factor involved when activating and operating the function, which is not yet ready for level 3+ hands- and eyes-free autonomy. With high hopes on FSD currently priced into the stock, and an increasingly uncertain timeline to full deployment and monetization, the combination foreshadows further downside risks ahead.

Batteries: As mentioned in the earlier section, Tesla’s path to restoring profit margins above the 20% range would require further input cost reductions enabled through production at scale. With the battery being the primary cost contributor to EV manufacturing, improving this technology and scaling relevant productions would be key to alleviating recent pressures on Tesla’s profitability.

Yet these ambitions are likely still years away from being realized into a meaningful impact on Tesla’s bottom line. While Tesla manufactures its EV batteries in the U.S., which gives it eligibility to credits under the Inflation Reduction Act (“IRA”), some of the benefits are currently shared in a 50/50 split with cell supplier Panasonic. Recall that Panasonic still produces all of Tesla’s legacy 2170 cells at a dedicated facility within Giga Nevada, while Tesla assembles the packs. This gives Tesla access to 50% of the $35/kWh cell credit, with full access to the $10/kWh pack credit under the IRA on existing capacity of about 35 GWh to 38 GWh of capacity at Giga Nevada. Meanwhile, the company receives the full $45/kWh battery production credit on 100 GWh capacity currently ramping up in Giga Austin.

Looking ahead, Tesla is considering plans of adding another 100 GWh of capacity at Giga Nevada, where it will produce 4680 batteries from cell to pack, which would make it eligible for the full $45/kWh IRA credit – a welcomed plus for its auto margins. Considering the average 75 kWh pack size per vehicle, this gives Tesla a $3,375 IRA rebate per vehicle, or more than 10% of current vehicle MSRP. Taken together with the existing 100 GWh capacity in Giga Austin, Tesla stands to benefit from full credit eligibility on close to 3 million total battery packs (assuming average 75 kWh battery packs per vehicle). This implies more than $10 billion in incremental cost-savings without consideration for future improvements in battery production, offsetting the estimated $1.2 billion annualized impact from current price reductions.

This level of battery output capacity also gives Tesla potential to becoming a tier 1 battery supplier further out in the future, as it far exceeds its vehicle output volumes within the foreseeable future. Relevant ambitions are further corroborated by Tesla’s lithium refinery capacity currently under construction, which bolsters the company’s critical supply advantage in the electrification era. The potential to becoming a tier 1 battery supplier could give Tesla a leg up in its competition against top rival BYD, which is currently also the second largest supplier of EV batteries after CATL.

However, the relevant credit benefits and potential incremental revenue stream from being a tier 1 battery supplier are likely still years from realization, let alone making an evident impact on Tesla’s bottom line. While it is a step in the right direction, the extended timeline to monetization provides little respite to anticipated near-term volatility in the stock and buttressing investors’ confidence.

Fundamental and Valuation Considerations

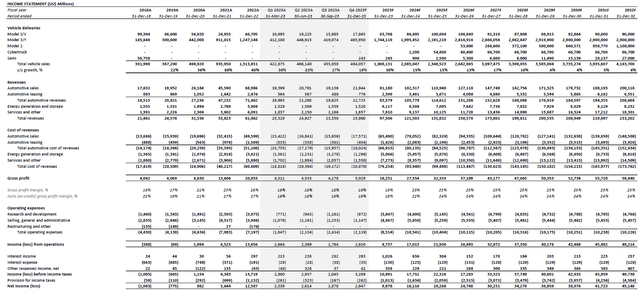

Adjusting our previous forecast for Tesla’s actual Q3 delivery miss and fundamental performance, we expect full year 2023 revenue to expand 20% y/y to $97.5 billion. Automotive sales (ex-credits) are expected to grow 18% y/y to $79.4 billion in 2023, based on projected full year delivery volumes of 1.8 million vehicles in line with management’s guidance. We expect continued deceleration in Tesla’s volume growth through mid-decade, with potential alleviation approaching 2030 with the anticipated ramp-up of an additional model based on Tesla’s next-generation low-cost platform currently in the works.

As a result, profitability is likely to remain pressured in the near term, especially with expectations for further price cuts being Tesla’s primary strategy in fending off competition and navigating through macroeconomic impacts on vehicle affordability for consumers. The ramp-up of its future low-cost and lower-priced model will be critical to Tesla’s margin re-expansion prospects, in addition to contributions from more profitable post-sales revenue (e.g., FSD and other software feature add-ons) and potential realization of battery production cost efficiencies at scale.

Tesla_-_Forecasted_Financial_Information.pdf.

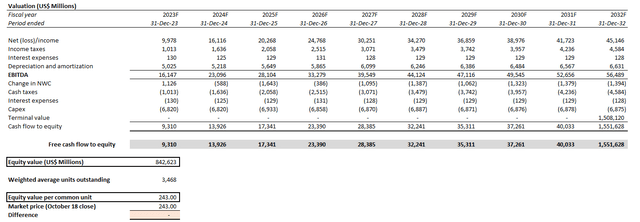

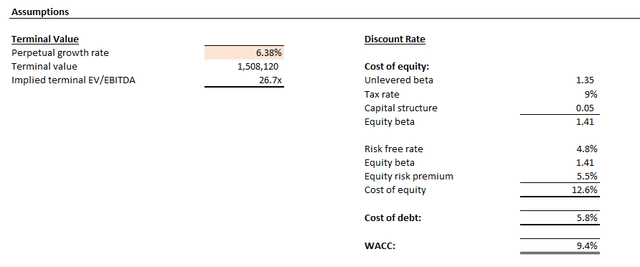

On the valuation front, projected cash flows taken in conjunction with our fundamental forecast for Tesla implies a perpetual growth rate of more than 6% at the current market valuation. The figure is determined through a discounted cash flow analysis, with the application of an 9.4% WACC which considers Tesla’s capital structure and risk profile.

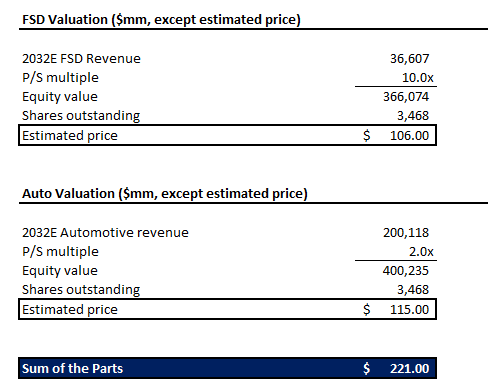

The implied perpetual growth rate at the stock’s currently traded levels underscores a lofty premium to both Tesla’s EV and auto manufacturing peers, as well as the anticipated pace of economic expansion at its core operating regions. As discussed in the foregoing analysis, much of the stock’s premium is likely attributable to the future deployment of high-margin subscription software and features (e.g., FSD), and other after-sales services. Under the sum-of-the-parts analysis, our base case price target is set at $221, composed of 10x 2032E FSD sales and 2x 2023E automotive sales.

Author

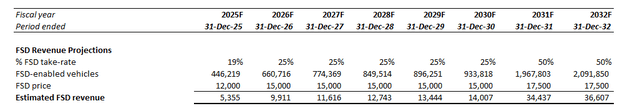

2032E FSD revenue of $36.6 billion is computed based on a conservative 50% take-rate assumption (versus current average ~19%) on estimated sales of 4.2 billion vehicles, at a package price of $17,500 (up from the current $12,000), and assumes full recognition into P&L on the expectation for level 3+ autonomy approval by then.

The 10x P/S ratio applied is consistent with the average multiple observed across the high-margin, high growth software peer group, which is in line with considerations that FSD can be deployed at close to zero marginal cost at scale. Meanwhile, the 2x P/S ratio applied on 2032E automotive sales is in line with the historical average valuation observed for “mid-cycle U.S. OEMs,” as well as the S&P 500’s current average to reflect Tesla’s position as a market driver given its EV leadership.

The Bottom Line

In addition to the broader risk-off market climate, the recent moderation in Tesla, Inc.’s stock performance is likely a reflection of waning investors’ confidence in the company’s fundamental prospects. The underlying Tesla, Inc. business’ fundamental weakness is becoming increasingly structural, with limited near-term respite to lift Tesla out of its tepid sales growth and mixed profit outlook amid rising competition and softening consumption trends. And coupled with an increasingly uncertain materialization timeline for FSD – a key component to Tesla’s lofty valuation premium at current levels – the stock faces potential downside risks ahead.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly in chat, more research content and tools designed for growth investing, and joining a community of like-minded investors, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to our portfolio of research coverage and complementary editing-enabled financial models

- A compilation of growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!