Summary:

- Shares of Tesla fell more than 9% after disappointing Q3 earnings resulting from significant declines in operating profit margins and a struggling Cybertruck offering.

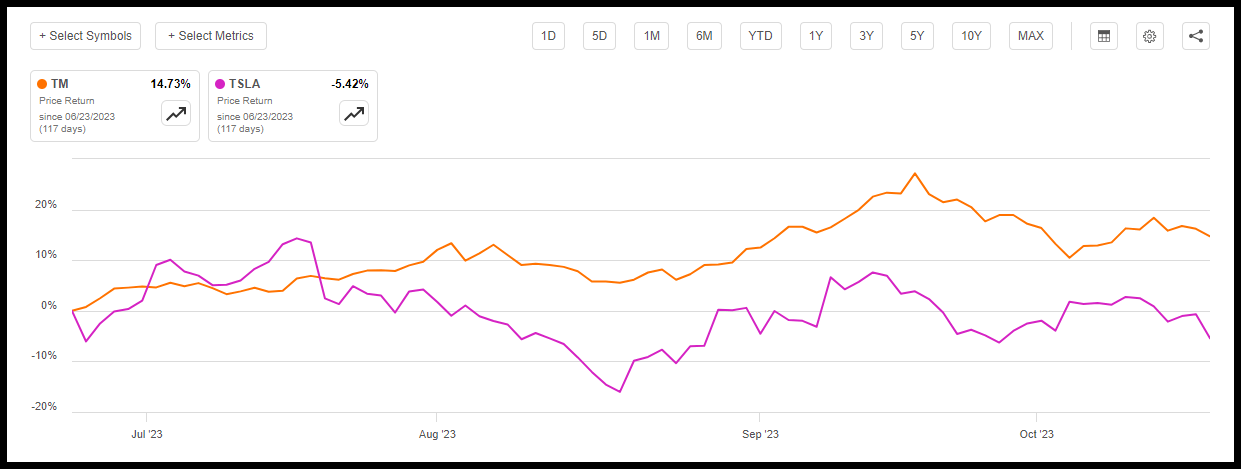

- Toyota remains a top auto manufacturer, +14% since I wrote Toyota Trumps Tesla on June 23, 2023, vs. Tesla, down 5% for the same period.

- Toyota outperforms Tesla on several metrics, and after inking a next-gen battery deal to rival Tesla’s EV strategy, aims to stay at the forefront of manufacturing vehicles and related parts.

- Strong fundamentals highlight Toyota as a top auto manufacturing stock, trumping its biggest EV competitor and benefiting from demand tailwinds and a robust global network.

nadla

The month-long United Automobile Workers (UAW) strike should be music to Tesla (NASDAQ:TSLA) and Toyota’s (NYSE:TM) ears, according to Ford (F) executive chairman Bill Ford. The strike has resulted in headwinds for the auto industry as it ties up the production for Tesla and Toyota’s rival auto manufacturers like Ford and General Motors (GM). Bill Ford called on the autoworkers to end their strike, stating, “Toyota, Honda, Tesla, and the others are loving the strike because they know the longer it goes on, the better it is for them. They will win, and all of us will lose.”

Toyota continues to outperform Tesla

Toyota continues to outperform Tesla (SA Premium)

Where Tesla should be capturing market share, the stock experienced a sizable drop in early trading after poor third-quarter earnings results. I wrote an article earlier this year titled Toyota Trumps Tesla based on Toyota’s legacy, forward growth estimates, and strong fundamentals. Since publication on June 23, 2023, the chart above showcases Toyota well ahead of Tesla, +14% versus -5.42%, respectively. At the forefront of manufacturing vehicles and related parts since 1933, Toyota is up 32.57% YTD versus Tesla’s 10.21%, showcasing why Toyota’s popularity and gold standard manufacturing process has boosted its profits, and it consecutively beats top-and-bottom-line earnings.

Tesla slides on poor Q3 earnings results

Competition in the electric vehicle space continues to heat up. Morgan Stanley downgraded Tesla earlier this year from Overweight to an Equal Weight rating when it was trading at $256.60, and the stock continues to experience declines, falling nearly 9% on Thursday to $221.88 per share following missed earnings.

“We dug our own grave with Cybertruck,” Musk said. “Cybertruck’s one of those special products that comes along only once in a long while. And special products that come along once in a long while are just incredibly difficult to bring to market, to reach volume, to be prosperous. I do want to emphasize that there will be enormous challenges in reaching volume production with the Cybertruck, and then in making a Cybertruck cash flow positive,” said Elon Musk.

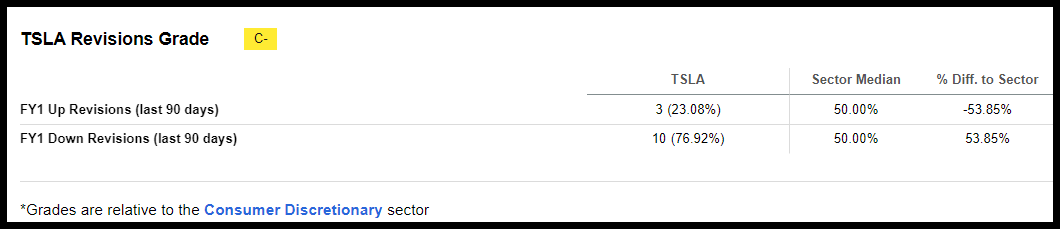

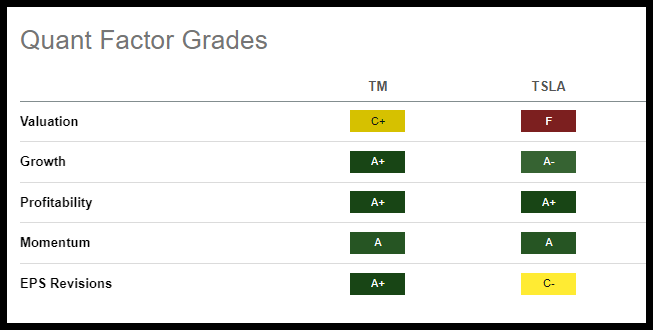

Although the popularity of Tesla remains, as shown in its year-to-date price performance of +105%, as I stated in my last article, Tesla’s price run-up may be history. Tesla stock is rated a Hold by Seeking Alpha’s Quant ratings. A Hold does not mean sell. Typically a Hold indicates that the stock is trading in line with its sector and may result from one of the stock’s core factors not ranking as high as when it was rated a Strong Buy. For instance, Tesla has a premium valuation, evidenced by an ‘F’ grade and 10 downward Wall Street analyst revisions over the last 90 days.

Tesla Revisions Grade

Tesla Stock Revisions Grade (SA Premium)

Severely overvalued, Tesla, whose market capitalization is $770.26B (as of 10/19/23), continues to have uphill battles after disappointing earnings. Tesla’s Q3 EPS of $0.66 was missed by $0.07, and revenue of $23.35B missed by $794.43M. Currently ranked #9 out of 31 in its industry compared to Toyota’s #1 rank, Toyota shares have continued their gradual uptrend this year since announcing plans and inking the deal for an all-solid-state battery to cut charging times and the delivery of +1.5M EVs by 2026 and 3.5M by 2030.

“With the evolution of the vehicle’s operating system, the next-generation battery EV will also enable customization of the ‘driving feel,’ with a focus on acceleration, turning, and stopping,” said Toyota President Koji Sato.

Toyota’s vision continues to evolve, and its lower cost and unique designs rival that of Tesla, whose Morgan Stanley downgrade was followed by Barclays, citing that shares of Tesla stock would likely cool. As we see, Toyota’s future looks bright as the seasoned Japanese carmaker gives Tesla and its investors a run for their money.

Best EV Stock to Buy

One of Seeking Alpha’s Top Quant-Rated Auto Manufacturers, Toyota Motor Company maintains strong financials. It continues to crush its competition despite global macro and geopolitical concerns. In September, the carmaker’s U.S. sales were up nearly 14%, with an EV sales surge of ~82%. Maintaining a strong balance sheet and enviable fundamentals compared to Tesla and other auto manufacturers, Toyota wants to bring the next-gen of vehicles and performance to your portfolio.

Toyota Motor Company

-

Market Capitalization: $240.66B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 10/19/23): 4 out of 533

-

Quant Industry Ranking (as of 10/19/23): 1 out of 31

The Japanese auto manufacturer is the largest automaker in the world. Extremely profitable and focused on quality and innovation, Toyota’s design and sale of passenger and commercial vehicles, parts, and accessories is a force to reckon with. Although Toyota has faced economic challenges, its growth, bullish momentum, and discounted valuation make it a more attractive consideration for upside potential, especially as it prepares for the first phase of mass production of solid-state EV batteries.

Toyota Stock Valuation & Momentum

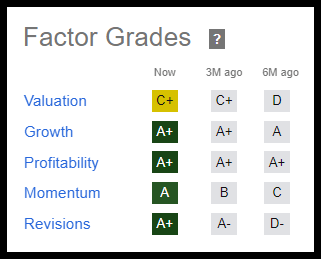

Toyota trades at an extreme discount. Unlike Tesla, whose valuation grades are nearly all ‘Fs,’ Toyota’s overall valuation grade is C+, supported by a forward P/E ratio of 9.19x vs. the sector’s 14.30x, a 35% discount. Toyota’s Price/Book (TTM) is more than a 41% discount to the sector, and the stock is trading just above its mid-52-week range and has rallied nearly 30% over the past six months.

Toyota Stock Momentum Grades (SA Premium)

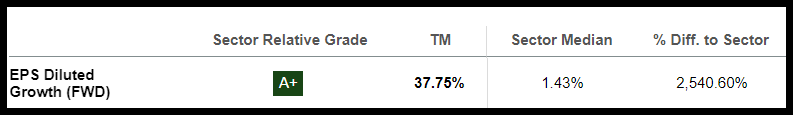

Toyota Stock Growth & Profitability

In addition to bullish momentum and diversified product offerings, Toyota’s growth and profitability have been tremendous. The weakening Japanese Yen compared to the USD was a key profit growth driver for Toyota by nearly 14%, contributing to operating income growth and helping offset raw material costs. Seeking Alpha’s Factor Grades rate a stock’s characteristics on a sector-relative basis.

Toyota Stock Factor Grades

Toyota Stock Factor Grades (SA Premium)

Toyota’s FY24 Q1 earnings remain strong, surging to a quarterly record of $9B. From April through June 2023, Toyota’s net profits increased by 78% compared to the previous year as vehicle sales increased across major markets like Japan and North America. Ramping up its sale of electric vehicles, Toyota sold 29,000 EVs compared to the 4,000 sold during Q1 of 2023. Morningstar equities strategist Seth Goldstein, CFA, forecasts 40% electric vehicle adoption by 2030, up 10% from 2022, a big benefit for Toyota’s EV strategy.

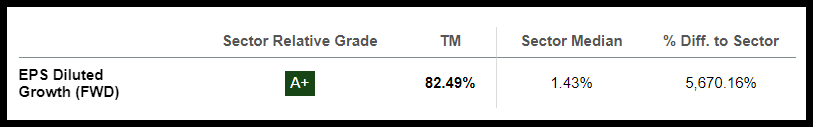

Toyota Stock EPS Diluted Growth (FWD)

Toyota Stock EPS Diluted Growth (FWD) (SA Premium)

Vs.

Tesla Stock EPS Diluted Growth (FWD)

Tesla Stock EPS Diluted Growth (FWD) (SA Premium)

Tesla and Toyota showcase strong forward EPS Diluted growth. Given Toyota’s many product offerings compared to Tesla, it’s clear why Toyota’s earnings growth is significantly higher than the sector. Toyota has tremendous Cash from Operations (TTM) of $24.60B compared to Tesla’s $12.16B. As Toyota looks to more sustainable options and electrification, its legacy, diversified portfolio, healthy balance sheet, and investment choices offer investors a Strong Buy opportunity, according to the Quant ratings.

Risks

While there are many benefits to investing in auto manufacturing stocks, there are also risks, as exhibited by the recent autoworkers strikes. While Tesla and Toyota are less impacted, there are also challenges posed by the macroeconomic environment and supply chains. Geopolitical risks may also present given recent tensions abroad, more specifically, Tesla is heavily reliant on China for batteries. Competition in the EV space is increasing. New entrants in the development of electric and autonomous vehicles may cause a deceleration in sales growth, as shown by Tesla’s falling margins.

Environmental, social, and governance regulations are becoming stricter. More environmentally friendly processes can impact the costs of production, which are passed onto consumers, many of whom, in the current environment, are cautious of discretionary spending. Inflationary pressures and higher financing may result in auto manufacturers seeing a fall in sales. Additionally, the auto industry is subject to the risk of recalls, especially regarding tech-friendly and autonomous vehicles.

Conclusion

Since 1933, Toyota has been a legacy auto manufacturer, showcasing substantial growth and profitability, and continues to outperform its competitors while trading at a discount. Evolving as electrification, semiconductors, and technology advance vehicles, Toyota has chosen to enter the electric vehicle (EV) space, capitalizing on its growth and momentum. Where Tesla recently became profitable, when comparing both stock’s factor grades, Toyota significantly outperforms on valuation and showcases ‘A’ grades across the board for growth, profitability, momentum, and EPS revisions versus Tesla’s grades.

Toyota Stock Quant Grades vs. Tesla Stock

Toyota Stock Quant Grades vs. Tesla Stock (SA Premium)

Toyota Motor Company has been profitable for decades. Tesla’s fall in early trading Thursday amid a substantial drop in Q3 margins sequentially and from last year, Elon Musk cited lower model prices, operating expense pressures from factories, and the surge in AI spending. Although Tesla’s profitability and price performance have made strides, Toyota’s ability to innovate and become a leader in sustainability has allowed it to uphold its mission and vision statements:

Mission Statement: “To attract and attain customers with high-valued products and services and the most satisfying ownership experience in America.”

Vision Statement: “To be the most successful and respected car company in America.”

Toyota offers strong fundamentals and a good balance of growth and value. Toyota inked an EV battery deal that will allow it to diversify its offerings, and customers no longer have to pay a Tesla premium. Not only has Toyota continued its outperformance of Tesla since I last wrote about it in June, but Toyota maintains a quant Strong Buy rating – a most opportune of the auto manufacturing EV stock picks. We have many Top Consumer Discretionary stocks to choose from, or if you’re seeking a limited number of monthly ideas from the hundreds of top quant stocks, consider exploring Alpha Picks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given that any particular security, portfolio, transaction or investment strategy is suitable for any specific person. The author is not advising you personally concerning the nature, potential, value or suitability of any particular security or other matter. You alone are solely responsible for determining whether any investment, security or strategy, or any product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. The author is an employee of Seeking Alpha. Any views or opinions expressed herein may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank.