Summary:

- Tesla, Inc.’s Q3 earnings beat profit estimates but missed revenue expectations, with auto revenue showing minimal growth and declining average selling prices.

- The energy business performed strongly, with a 52% revenue increase and improved margins, partially offsetting the weak auto segment.

- Despite improved profits and cash flow, Tesla’s high valuation and weak auto growth make it a risky investment, especially amid rising competition.

- I remain bearish on TSLA stock due to its elevated valuation, the company’s minimal free cash flow yield, and significant competition in the EV and robotaxi markets.

BING-JHEN HONG

Article Thesis

Tesla, Inc. (NASDAQ:TSLA) reported its most recent earnings results on Wednesday afternoon. The company beat profit estimates, showing a small year-over-year improvement. There were other positives as well, although Tesla nevertheless does not look like a great investment here. The valuation remains very elevated, which is why I will continue to avoid TSLA.

Past Coverage

I have written about Tesla here on Seeking Alpha in the past. My most recent article is from July, when I covered the EV company’s weak Q2 results. I gave the company a Sell rating back then, which has worked out well so far, as Tesla currently trades below the price one quarter ago, despite the broad market rallying since then. With one quarter having passed and with Tesla reporting its next earnings results today, it is time for an update.

What Happened?

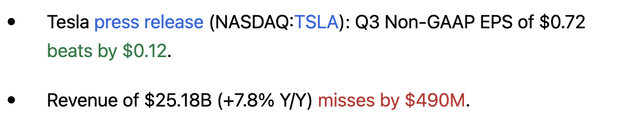

Tesla, Inc. reported its most recent earnings results, for its fiscal third quarter, on Wednesday afternoon, following the market’s close. The headline results can be seen in the following screencap from Seeking Alpha:

Tesla’s earnings results (Tesla earnings release)

We see that the company managed to beat profit estimates, which was a surprise — the company had missed profit estimates for a couple of quarters in a row before the Q3 report. On the other hand, Tesla missed revenue estimates by around 2%, showing a year-over-year gain of close to 8% — not bad, but not excellent, either.

Shares reacted positively to this announcement, trading up 12% at the time of writing. It looks like the market reacted positively to Tesla’s better-than-expected profitability during the quarter, while the positive cash flow numbers may also help explain the market’s positive reaction.

Tesla’s Q3 Report: Things To Like And To Dislike

Let’s delve into the details of Tesla’s third-quarter earnings report. We already knew what Tesla’s delivery numbers looked like, as those are reported before the earnings release each quarter. But despite delivery numbers being known, analysts had overestimated Tesla’s ability to generate revenues. The company managed to grow at a high single-digit pace, while analysts were looking for a revenue increase of around 10% compared to the previous year’s quarter.

Tesla’s revenue generation was very uneven, with the core automobile business delivering a meager 2% revenue increase. Considering inflation is still running north of 2% right now, Tesla’s biggest business unit by far is thus not generating any real growth, which is not a good sign.

The global electric vehicle market has not grown at a strong pace this year. This is due in part to a weak EV market in Europe, but the absence of any real revenue growth from Tesla’s auto business is still a bit disappointing. After all, Tesla is not at all priced like an “average” automobile company — for a company that trades at around 100x net profits, the biggest business unit should deliver considerable growth in nominal and in real terms, I believe.

The fact that vehicle volumes were up 6% compared to the previous year’s quarter, while automobile revenues rose by just 2%, is also an issue. Average selling prices clearly are coming down, despite the introduction of the high-priced Cybertruck, which should impact average selling prices positively. The fact that this was not enough to reverse the negative ASP trend could indicate margin issues for the automobile business down the road. Demand also seems to have been relatively weak, as indicated by the relatively meager volume growth despite price reductions, while the company’s growing inventory levels point in the same direction.

Global inventory levels rose to 19 days of supply, which is up from 16 days of supply one year earlier — a roughly 20% increase. If demand was very strong, supply would shrink, especially since Tesla has been lowering its vehicle prices. But if inventory levels keep climbing despite pricing incentives, demand unfortunately can’t be very strong. Macro uncertainties might play a role, but rising competition from Chinese EV players could also be a factor. Finally, it is possible that CEO Elon Musk’s pro-Republican positioning may have alienated some potential customers.

Thankfully, a weak automobile business was partially balanced out by a much stronger performance from the energy business. Here, revenues rose by a strong 52% compared to the previous year’s quarter, while the energy business also saw its gross margin expand to around 30%, up by a strong 600 base points on a sequential basis. The strong revenue growth rate for the energy business was largely the result of a great energy storage performance. The company hit a record high when it comes to Powerwall deployments, while total storage deployed rose to 6.9GWhs, which is up by a massive 75% on a year-over-year basis.

The energy business can be quite lumpy, so there is no guarantee that the business unit will perform equally strong during the fourth quarter and beyond. However, at least during the third quarter, the energy business did quite well on both a business growth and a financial perspective — sales volumes were attractive, and so were the unit’s margins.

On a company-wide basis, Tesla saw its margins expand compared to one year earlier, largely due to the nice performance of the energy business and due to higher regulatory credit revenues. Regulatory credit revenues are very high-margin, thus growth in this metric can influence profitability quite a lot. Q3 was the second-best quarter in terms of regulatory credit sales, which helps explain Tesla’s ability to beat profit estimates with the Q3 report.

Tesla’s operating margin rose to 10.8%, which is better than what Tesla achieved in the last couple of quarters, although an operating margin in the 10%-11% range is still not overly high compared to other automobile companies: BMW (OTCPK:BMWYY), for example, achieved a 10.8% margin over the last year as well, while volume manufacturer Toyota (TM) achieved a 12% margin over the same time frame. Tesla thus looks solid, but far from spectacular from a margin perspective right now.

Between some revenue growth and some margin growth, Tesla’s earnings per share climbed 9% on a year-over-year basis, rising from $0.66 to $0.72. At the current level, Tesla earns a little less than $2.50 annualized. Bullish investors seem to believe that this warrants a share price well exceeding $200, although others will disagree with that — but that’s what makes a market.

While cash flow generation had been an issue in the recent past, with free cash flow being negative during the first half of the year, that changed during Q3: With the help of changes in operating assets and liabilities that boosted operating cash flows by $1.6 billion, Tesla generated strong quarterly operating cash flows of a little more than $6 billion. Free cash flows were in the $3 billion range, which was a marked improvement versus the first half of the year. That being said, Tesla has now generated cumulative free cash flows of $1.5 billion in 2024, or around $2 billion annualized. For a company that is valued at around $700 billion, that’s not much, as this pencils out to a free cash flow yield in the 0.3% range.

Liquidity is not a concern, however, as Tesla has a pretty strong balance sheet with a $34 billion cash position. Tesla thus has ample reserves to invest in its robotaxi efforts, its energy business, and so on.

Is Tesla A Good Investment?

Tesla’s Q3 report was better than expected and showed several positives: Profits improved, margins recovered to some degree, and Tesla’s cash flow performance also was a lot better than the pretty bad numbers from the first half of the year.

That being said, Tesla also continues to have problems: Average selling prices continue to shrink, despite the growth from the high-priced Cybertruck, and Tesla’s automobile business is not faring well, with no real (inflation-adjusted) revenue growth and with growing inventory levels.

Tesla has potential in the future robotaxi market, but it does not have any product on the road yet, unlike peers such as Waymo (GOOG) (GOOGL). It is hard to say whether Tesla will be able to catch up with the current market leaders.

Tesla’s annualized free cash flow yield currently stands at just 0.3%. With shares being valued at around 100x earnings while many competitors trade at a fraction of that, Tesla is too expensive for me and I continue to see shares as quite risky. Even if Tesla’s shares were to fall by 20% or 30%, for example, they would be far from cheap, after all. Tesla is showing relatively weak auto growth right now, thus in a recession or economic downturn it could suffer meaningfully. Overall, I thus remain bearish on Tesla, mainly due to its valuation and massive competition in both the EV and the robotaxi market.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!