Summary:

- Tesla, Inc.’s delivery trends show mixed results: cheaper lower-margin Model 3/Y variants are doing very well while sales of the pricier Model S/X are trending toward a decline.

- An aggressive price cut strategy, despite rising input costs, is creating mixed financial trends. Net income is trending low despite higher total revenue while Free Cash Flow continues to decline.

- Tesla faces challenges in the “premium EV” segment possibly due to brand fatigue. On the other hand, the new Cybertruck is priced close to its blockbuster models.

- All in all, it’s a turbulent moment in time for both company and stock. Investor caution is generally the norm for “high-conviction” stocks such as Tesla.

Justin Sullivan

On the 18th of October, Tesla, Inc. (NASDAQ:TSLA) released its 3rd quarter earnings for its Financial Year (FY) 2023. The trends and metrics in the results show the company is going through a rather complicated phase.

Delivery Trends: Mixed to Good

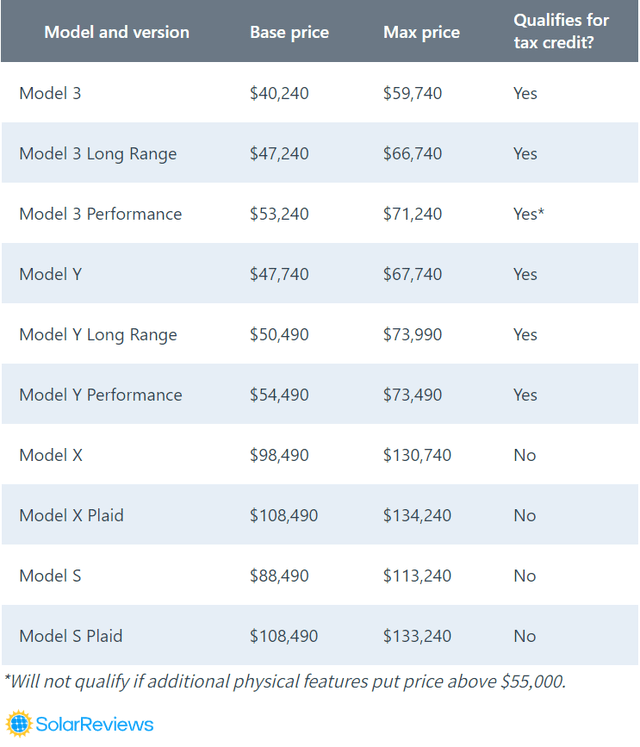

At current rates, the Model S/X is a higher-priced (and estimably higher-margin) products than the more diminutively-margined Model 3/Y.

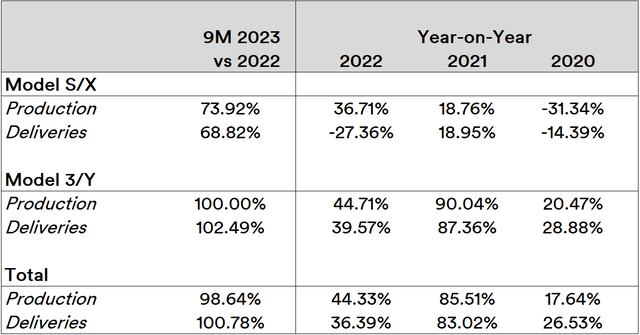

The company’s total production and delivery trends, across 9 months of the current FY, are well near par that of total numbers of the previous FY. Trends in the product mix, however, show the company’s brand appeal shifting in the addressable customer segments.

Source: Tesla Investor Relations

While production of the “pricier” models are more-or-less at par, sales have been dipping. In contrast, the cheaper Model 3/Y’s are selling like hot cakes, with current production and delivery trends likely to close out the year at volumes higher than the past FY.

The company has also announced that price cuts will continue into the next year. While the company has a pretty strong free cash flow for some time now, the battle to keep the delivery numbers aloft comes at a cost.

Financials: Mixed

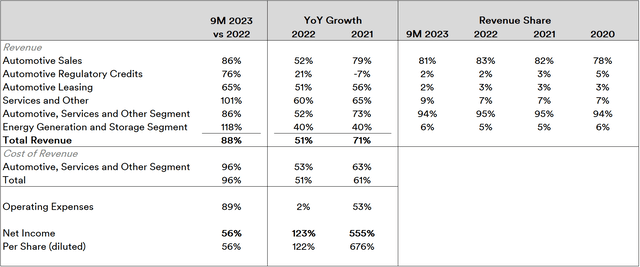

Among the trends in financial line items, one insight stands out: the company’s automotive business has consistently driven around 95% of revenues since 2020.

Source: Tesla Financial Statements

FY 2021 was a stalwart year where the company’s net income grew 555% over the past year while total revenue had grown by only 71%. In the past nine months of the current FY, net income is a little over half of what the company had over the past FY despite total revenue comfortably running above par relative to past year.

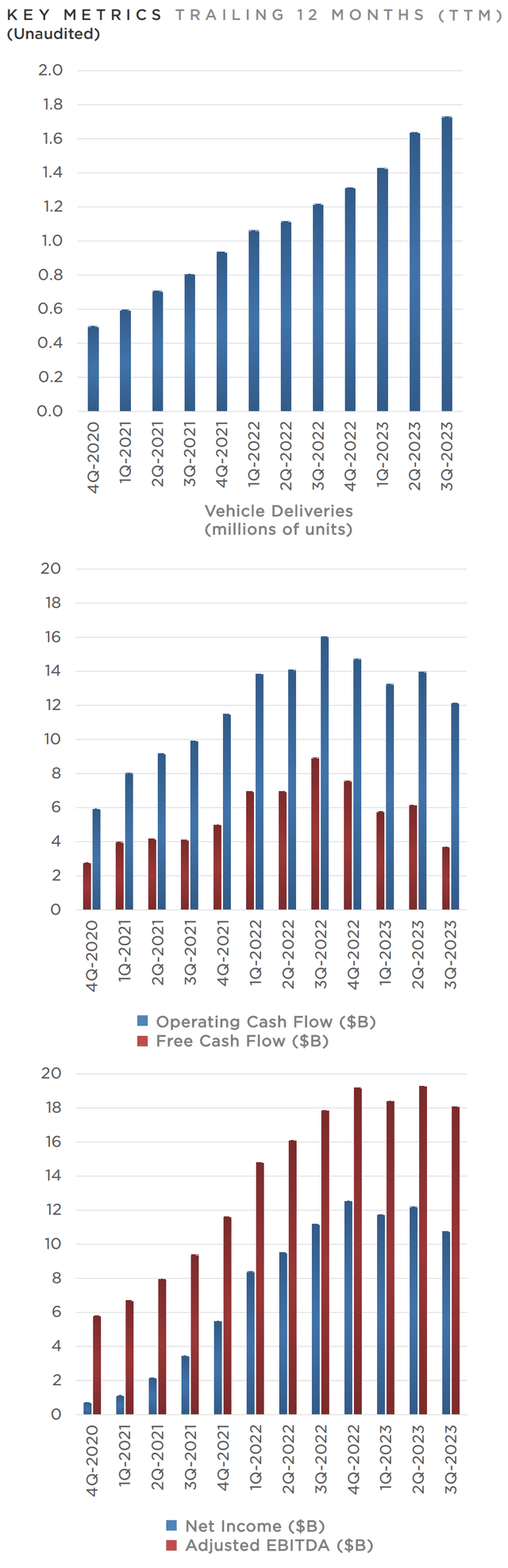

The reasons for these are in the cost elements: cost of revenue for the current FY is already at par with the past year while operating expenses aren’t far behind either. This could be attributable to two factors: firstly, the battle to continue pushing up delivery volumes via aggressive discounting while input costs are rising is straining the bottom line. The company’s own quarterly earnings deck highlights this strain in graphical terms: while total vehicle deliveries are consistently rising, free cash flow has been in decline over the past four quarters, which is essentially a reversal of long-term trends.

Source: Tesla 2023 Q3 Quarterly Update Deck

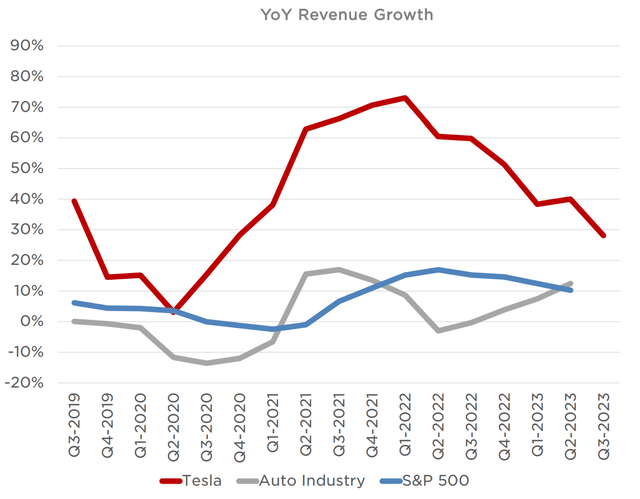

Over the past four quarters, net income has also been declining while the trend of consistently rising EBITDA is also broken. The company also indicates that its Year-on-Year (YoY) revenue growth is diving relative to that of the auto industry, which has been rising for six straight quarters now.

Source: Tesla 2023 Q3 Quarterly Update Deck

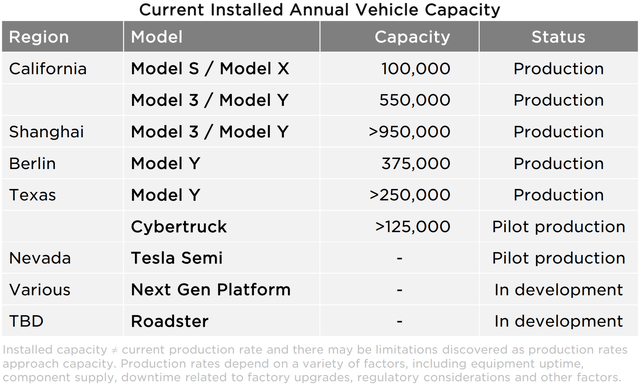

The second factor could be that the company is gearing up to finally enter into the market a new model using the current-generation platforms: the Cybertruck.

Source: Tesla 2023 Q3 Quarterly Update Deck

A production line that would produce roughly about 500 Cybertrucks a day likely isn’t cheap and, considering the trends, a rather bold proposition.

Conclusion and Challenges

As per news reports from September, the pricing of the Cybertruck is proximate to that of the Model 3. This is likely a welcome development for the company’s sales teams: present delivery breakdowns seem to indicate that the consumer segments with a preference for the price point still find value in the company’s branding. This is likely not the case with its “pricier” models: as highlighted in past articles, Tesla has seen an erosion of market share in “premium EV” segment due to the measured yet aggressive entry of high-end legacy carmakers into the segment.

Tesla isn’t unique in that it’s a challenge to have a “basic” and “premium” model under the same marque: nearly every major carmaker tends to build out (or at least try to) a separate marque for the “premium” buyer segment. It isn’t presently clear if the company will do so. If it does, this means a deepening commitment to being in the “premium” space. A separate marque could bring out collaboration opportunities with other carmakers, upstart or not.

Overall, Tesla misses the analysts’ benchmarks for success since the positive trends in overall delivery growth didn’t translate into a commensurate growth in net income. Continuing with the “discounting” strategy would likely lead to further declines in free cash flows and, with it, the flexibility to plough cash into fueling growth of production capacities and new models for the market. It won’t be surprising if the company issues a significant amount of new “paper” (i.e. corporate bonds) over the next quarter or so.

The Federal Reserve’s latest “Beige Book”, released on the 18th of October, reveals that consumer spending is mostly mixed for a variety of factors. Foreign central banks are beginning to highlight significant risks with U.S. tech stocks, amongst which the likes of Tesla is included. The Bank of England’s Financial Policy Committee (FPC) meetings on September 26 and October 5 noted thus in its summary released on October 10, “Given the impact of higher interest rates, and uncertainties associated with inflation and growth, some risky asset valuations appeared stretched”. In particular, the FPC noted that a deterioration in the global economic outlook, further increases in risk-free interest rates, or further interest rate volatility could lead to sharp reductions in asset prices – with U.S. dollar-denominated corporate bonds and U.S. technology equities being specifically vulnerable – and further tightening in financial conditions for households and businesses.

Past coverage of the company by the author indicated that while Tesla does fine as a company which has a favourable position in a growing market, an unassailable (and historical) fact is that it won’t have a commanding position in said market forever; EVs are no longer a curiosity in the automotive space.

There’s a certain element of uncertainty in Tesla, Inc.’s forward prospects so a “Buy” isn’t being recommended. But then again, neither is the company’s financial standing dire: a net positive is a net positive but it doesn’t justify the stock’s historical overvaluation; this will likely be tested in both the short and long runs, depending on the company’s market share changes over the next 12 months.

All things considered, it’s a “Hold” for those already with the stock in their portfolio.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I lead research at an ETP issuer that offers daily-rebalanced products in leveraged/unleveraged/inverse/inverse leveraged factors with various stocks, including some mentioned in this article, underlying them. As an issuer, we don't care how the market moves; our AUM is mostly driven by investor interest in our products.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.