Summary:

- Tesla, Inc.’s energy business, Tesla Energy, has fallen short of growth expectations in its energy generation segment, particularly in solar deployments.

- However, the energy storage segment has shown rapid growth, with deployments increasing by 222% in Q2 2023 compared to the previous year, with major improvement to gross margins.

- While the Q2 margin improvement is impressive, it remains to be seen if this can be sustained. Investors may learn a lot when Tesla reports Q3 earnings after the bell on Oct.18.

Brandon Bell/Getty Images News

Tesla, Inc. (NASDAQ:TSLA) has long portrayed itself as “more than a car company” by showcasing its various other business lines, especially its Energy Generation & Storage vertical, known as Tesla Energy. As I discussed last month, this perception helped create-and continues to sustain-Tesla’s eye-watering valuation.

CEO Elon Musk has for years promised big things from Tesla’s energy segment. In 2019, he claimed that Tesla Energy would soon be growing far more rapidly than its automotive business:

“The really crazy growth for as far into the future as I can imagine…It would be difficult to overstate the degree to which Tesla Energy is going to be a major part of Tesla’s activity in the future…I think both over time will grow faster than automotive. They’re starting from a smaller base. I think, especially, if you look at sort of – if you look at, like, year-over-year growth, it will be absolutely incredible…over the course of, say, a year, gigantic increase.”

Musk doubled down on this prediction less than a year later, claiming that Tesla Energy would eventually eclipse its automotive segment altogether:

“I think long term, Tesla Energy will be roughly the same size as Tesla Automotive. How big is the energy sector? Bigger than automotive.”

In the years since, the reality has proven far more prosaic. While Tesla’s energy business remains Tesla’s only non-EV business segment of any meaningful size, its growth has fallen far short of expectations. Even so, Tesla Energy showed remarkable margin improvement last quarter, even as Tesla’s automotive segment experienced considerable margin compression. That improvement, and whether it can be sustained, is worth examining ahead of the company’s next earnings announcement on Oct. 18.

Energy Generation: Stagnant Sales, Failed Tech

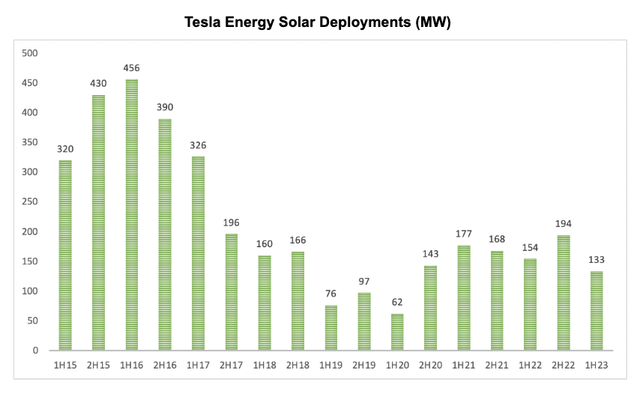

Almost since its inception, the energy generation side of Tesla’s Energy Generation & Storage business has been something of a problem child for the company. Tesla’s solar division started out as one of many largely undifferentiated players in a crowded solar panel installation market. The company launched the Tesla Energy brand in 2015; solar deployments that year totaled 750 megawatts (MW). However, it was not until the following year that the epic saga of Tesla’s foray into solar truly began.

In October 2016, Tesla announced plans to acquire SolarCity, a solar panel installer. As luck would have it, the chairman of SolarCity’s board at the time was none other than Elon Musk. The company, which was run by a pair of brothers who also happened to be Musk’s cousins, had found itself in a serious financial pickle. At the heart of SolarCity’s woes was an inability to service the massive debt load it had accumulated in its ultimately quixotic effort to sustain top-line growth. Tesla’s buyout offer was a lifeline for a company rapidly approaching insolvency. Musk touted the tie-up as a way for Tesla to leapfrog the competition to become the nation’s top solar energy player. He also claimed it would help Tesla roll out its Solar Roof, a brand new product that was, he said, already ready for commercial launch.

Tesla Inc.

As things turned out, the planned expansion of Tesla’s solar business never materialized. In fact, the company saw a steep decline in solar deployments. The 846 MW it deployed in 2016 was a new record, one which stands to this day. Deployments fell 38.3% in 2017 and another 37.6% in 2018. 2019 marked the nadir, with solar deployments of just 173 MW during the entire year, a 47% drop from the year before and down fully 80% from 2016.

During the next couple of years, Tesla’s diminished solar business showed some signs of bouncing back from the bottom. In 2020, solar deployments actually rose, albeit only modestly, with full-year deployments rising 18.5% to 205 MW. While growth accelerated in 2021, seeing a 68% jump in deployments to 345 MW, the positive momentum soon began to dissipate. Tesla managed 348 MW in solar deployments, eking out a year-over-year increase of less than 1%.

This year, solar deployments are once again treading water. Tesla deployed 133 MW in the first half of 2023, 13.6% less than it managed during the same period last year, putting Tesla on track for yet another down year. In its Q2 earnings report, Tesla stated that it was only able to deploy only 66 MW during the quarter “predominantly due to a high interest rate environment that is causing postponement of solar purchasing industry-wide.”

Stagnant deployment numbers are not the only sour note for Tesla’s solar business. Its bet on the Solar Roof has also largely failed to pay off. Tesla had promised 1,000 installations per week in 2019. As of March 2023, Tesla had managed just 3,000 Solar Roof installations in total.

Energy Storage: Rapid Growth Raises Eyebrows

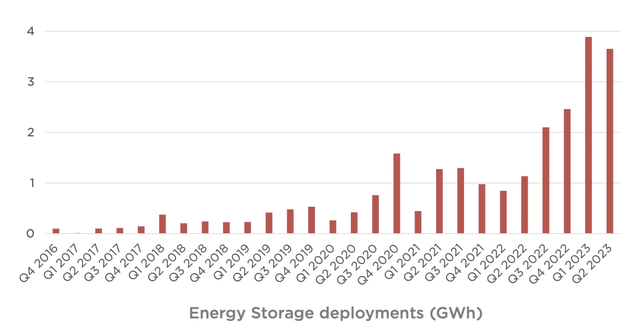

The storage side of the “Energy Generation & Storage story” is somewhat happier, at least by comparison. Tesla first announced plans to use its battery technology to develop a battery home storage system in 2015. This evolved into the Powerwall, which entered mass production in 2017. Tesla introduced a utility-scale product, the Megapack, in 2019.

In stark contrast to its stagnant solar deployment figures, Tesla’s storage deployments have been growing at a strong clip. While dipping slightly on a sequential basis, the 40 gigawatt-hours (GWH) of energy storage deployments Tesla reported in Q2 represented a 222% increase from the same period last year. Tesla attributed the increase to “the ongoing ramp of our first dedicated Megapack factory (Megafactory) in Lathrop, CA,” which the company has promised is just “the first of many” such facilities.

Tesla’s energy storage segment is growing fast thanks in no small part to rising demand for utility-scale energy storage solutions that can support industrial activities and power grids that are currently reliant principally on fossil fuel power sources. There is undoubted demand for this type of product. However, its real-world viability as a true replacement for existing systems remains far from proven. The extreme energy density of lithium-ion batteries makes their use at utility scale inherently dangerous. The past few years have seen serious fires and explosions occur at battery storage facilities from Arizona to Australia. While industry leaders are constantly seeking to improve designs in order to prevent recurrence of such incidents, they are limited by the simple fact that the technology is so new that there has been little opportunity for large-scale testing. That can be a problem, as Wired reported last month:

“In the absence of extensive tests on large grid batteries, the “foundation” of safety design in the grid battery industry is making tweaks in response to real-world incidents, [professor of fire science Guillermo] Rein says. They include a system in Surprise, Arizona, that in 2019 caught fire and later exploded, after fire suppressants mixed with the burning batteries, turning the warehouse in which they were installed into a pressure cooker. Nine first responders were injured. Two years later, near Geelong, Australia, a fire broke out during testing at what was then the world’s largest battery installation, a collection of Tesla Megapacks, the EV maker’s grid storage product. High winds spread the flames from one Megapack to a neighboring device, and the blaze took four days to put out…

Strategies for how to halt growing fires-including systems to quench or corral blazes within the containers, vary between manufacturers. “I think there’s still a lot of engineering that is believed to be best-practice but is not completely proven,” says Steve Kerber, executive director of the Fire Safety Research Institute, an affiliate of the Underwriters Institute, or UL, a nonprofit that creates the most widely used fire safety standards.”

Regardless of these issues, Tesla is obviously gaining some traction. Thus far, Tesla has been able to find sufficient demand for its rising production, and there is little indication that this will change in the near term.

Reality Check: The Economics of Tesla Energy

Now that we have a solid picture of each component of Tesla Energy’s business, what can it tell us about Tesla the company and Tesla the stock?

Fortunately, Tesla breaks out revenue and cost of revenue attributable to Tesla Energy. Unfortunately, Tesla does not separate energy generation revenue from energy storage revenue within the segment:

| 2Q23 | 1Q23 | 2Q22 | |

| Revenue (millions) | 1509 | 1529 | 866 |

| Cost of Revenue (millions) | 1231 | 1361 | 769 |

| Gross Margin | 18.4% | 11.0% | 11.2% |

Source: Tesla Inc., Author’s calculations.

In terms of Tesla’s solar operations, the fundamental economics have always been iffy, to say the least. When Tesla’s automotive business was turning the corner into profitability, its solar margins remained persistently negative. Things have hardly improved since, as the company has failed to capture any of the hoped-for economies of scale that were supposed to come with increased production and deployment. The Solar Roof has largely been a bust, while its solar panel installation business competes in a commodity-priced market in which even the biggest players can struggle to break even. However, the profitability of Tesla’s solar operations is almost a non-issue at this point, as the deployment counts are negligible compared to storage.

Turning to the storage side of the business, we already know that Tesla is selling its battery storage system in ever-increasing volume. In Q2 this year, Tesla deployed 3.7 GWh of storage, 2.27 times the 1.133 GWh deployed in the same period the previous year. However, revenue has failed to grow at the same rate:

| 2Q23 | 1Q23 | 2Q22 | |

| Solar Deployments (MW) | 66 | 67 | 106 |

| Storage Deployments (GWH) | 3.7 | 3.9 | 1.133 |

| Revenue (millions) | $1,509.00 | $1,529.00 | $866.00 |

| Revenue/GWh | $407.84 | $392.05 | $764.34 |

Source: Tesla Inc., Author’s calculations.

Even so, Tesla reported a major improvement in gross margins for Energy Generation & Storage last quarter. That is rather perplexing. Increased utilization and efficiency of its battery storage production operations can offer some explanation of the improvement, especially in year-over-year terms. The sequential step-change from Q1, however, is less easy to explain. Despite a dip in deployments and revenue, cost of revenue reportedly fell considerably further to result in a nearly 80% improvement in gross margin. That is impressive on its face, but it may prove difficult to sustain. Tesla’s Q3 results will hopefully be able to shed greater light on the matter, namely whether the sequential improvement in Q2 was the result of one-off factors in Q2, or an actual durable improvement in operating efficiency.

Conclusion: Watch Those Energy Margins

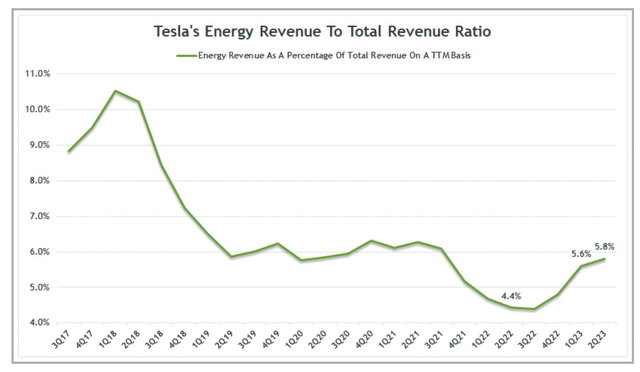

Tesla Energy has become more interesting than ever following its Q2 earnings report. While its automotive business continued to experience significant margin compression as a result of price cuts, its energy segment saw massive margin improvement. While Tesla Energy is still just a very small piece of Tesla’s overall business, accounting for less than 6% of total revenue, it is critical to the narrative of Tesla being “more than just an automaker” on which its rich valuation partly hangs.

Stock Dividends Screener; Tesla Inc.

Investors should pay very close attention to Tesla Energy’s numbers when Tesla reports Q3 earnings after the bell on Oct. 18.

If Tesla, Inc. Q3 earnings can show sustained margin improvement in its energy segment, it could help shift investors’ focus from its ever-deteriorating automotive margins. That may be enough to sustain the stock in the face of flagging automotive profitability-at least for a time.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.