Summary:

- Tesla, Inc.’s profit margin fell alarmingly in Q3, justifying the stock’s fall.

- Price cuts have ensured high demand for Tesla and the company can withstand a price war longer than new entrants could.

- 6/13 factors have gotten worse since my previous review while 5 have gotten better and 2 have remained the same.

- I retain my Hold rating on Tesla stock and expect technical weakness to push the stock below $200 at least.

jetcityimage

I am a little early in my quarterly review of Tesla, Inc. (NASDAQ:TSLA) but I believe it is justified given the tanking the stock has seen recently. In my last review almost three months ago, I had rated the stock a “Hold” while evaluating the stock on 13 different parameters. Since then, the stock has lost more than 15% compared to the market’s 6.50% drop. Does that change my rating on the stock? How have these 13 factors changed meanwhile? Let us find out below while I also assign a rating to each of these 13 factors based on whether they’ve gotten better or gotten worse or stayed the same.

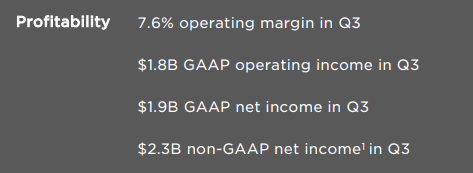

Four Business Reasons

- Margin Erosion: The hammering the stock has recently taken primarily has to do with margin concerns. In the recently reported Q3, Tesla’s profit margin fell alarmingly as shown below, despite total revenue being up 9% YoY. GAAP net income fell from $3.3 billion in Q3 2022 to $1.9 billion in Q3 2023 as operating margin fell from 17.2% to 7.6% YoY. The company acknowledged (page 5) that it had multiple-whammies including an increase in operating expenses and pressure in Average Selling Price [ASP]. There is no doubt in my mind that this has gotten worse since my last review. (Gotten Worse: #1)

TSLA Q3 2023 Operating Margin (ir.tesla.com) TSLA Q3 2022 Operating Margin (ir.tesla.com)

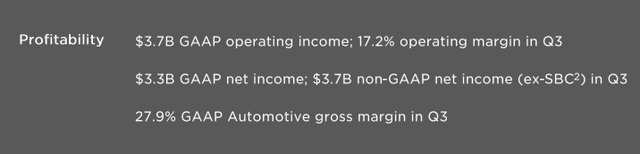

- Demand Erosion: The only solace in Tesla’s recent Q3 report was that revenue went up, propelled by higher demand/deliveries. The 14% YoY decline in Model S/X was easily compensated by the 29% increase in Model 3/Y to push overall deliveries up by 27% YoY to 435,059 in Q3 2023. (Gotten Better: #1)

TSLA Deliveries (digitalassets.tesla.com)

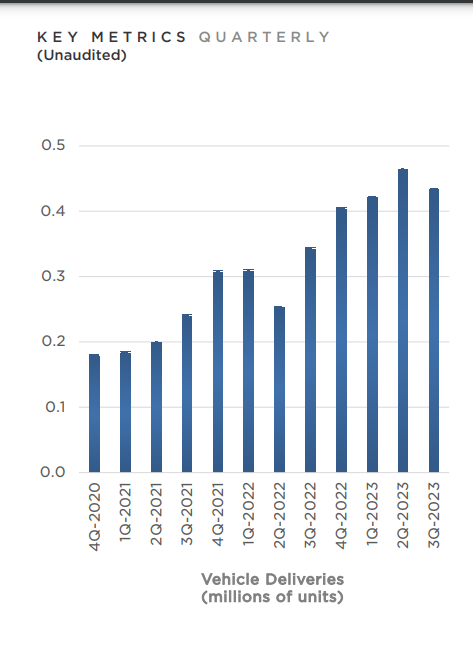

- Market Share: Tesla’s market share in Q3 slipped to 50% from the 59% share it had in Q2, which was down from the 62% in Q1. While total electric vehicle (“EV”) sales in the U.S. surpassed 300,000 in Q3, setting a record as the number jumped almost 50% YoY, Tesla’s share of the pie is getting concerningly smaller. In other words, the playing field is getting bigger but more players are making their presence known. Audi, BMW, and Mercedes continue posting impressive numbers with the latter two posting a 300% increase in sales in Q3 while Audi posted a nearly 100% increase. Another indication of the rapidly changing competitive space is the fact that 14 new EV models hit the market in Q3. (Gotten Worse:#2).

US EV Market Share (Cox Automotive)

- The Elon Musk Problem: At least based on headlines, Musk’s distraction with X (formerly, Twitter) and thankfully, the cage fight with Mark Zuckerberg, have reduced. The fact that Q3 turned out to be disappointing for the company and stock may be a blessing in disguise for Tesla investors as it appears like Musk is focused on the problems at hand. A few examples below:

- “We dug our own grave with the Cybertruck,” Elon Musk said when the company released its Q3 report. To me, an angry Musk who admits mistakes and feels like he is cornered is a much safer bet than one who is happy but distracted in many directions.

- Musk acknowledged there will be enormous problems with scaling productivity and reaching profitability with Cybertruck. I don’t know many who can focus on solving this problem than Musk could.

- Another example of Musk appearing to be focused on the issue at hand with Tesla: “I don’t want to be going top-speed into uncertainty,” Musk said. “I’m not saying things will be bad. I’m saying they might be.” when talking about the economic uncertainties.

Overall, I’d rate this section as “Gotten Better.” (Gotten Better: #2).

Four Stock Fundamental Reasons

- Forward Multiple: Almost directly as a result of the stock’s 15% fall since my last review, Tesla stock’s forward multiple has fallen down a bit to reach 65. The stock is still overvalued by this metric. (Stayed Same #1)

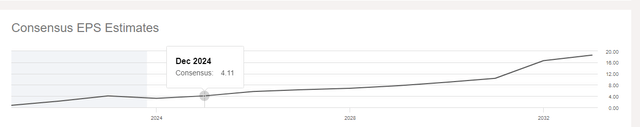

- PEG: Growth at Reasonable Price (“GARP”) investors like me tend to look at the Price-Earnings/Growth (“PEG”) multiple as it tells us how fairly valued a stock is relative to its growth prospects. Tesla stock has gotten considerably worse on this metric since my last review, as the current estimated growth rate of 3.60%/yr gives the stock a forward PEG of nearly 18, while it was 7.5 during my August review. This clearly belongs to the “gotten worse” category, with the expected earnings growth rate being especially concerning. (Gotten Worse: #3)

- Price Target: At the current price per share of $260, the stock is nearly 25% away from its median price target, which is far more attractive than the 7% upside in this regard during my August review. (Gotten Better #3).

- Estimates: 2024’s estimates have fallen from $4.72 during my last review to $4.01 now, a 15% reduction using Yahoo Finance’s estimates and by 13% using Seeking Alpha’s estimates. Either way, this section has worsened considerably. (Gotten Worse: #4)

TSLA 2024 Estimate (Yahoo Finance) TSLA Estimates (Yahoo Finance) TSLA 2024 SA (Seekingalpha.com)

Three Macro Reasons

- Market Complacency: Being a contrarian, I tend to favor stocks of good companies during bad times for the stock. Tesla’s stock is still up almost 100% YTD despite recent weakness but it is undeniable that there is more fear now as Tesla was up 134% during my August review. The general market has been very shaky in the 2nd half of the year and Tesla’s own estimates have been slashed as covered above. So, with some signs of fear palpable, this section has actually gotten better for Tesla stock. (Gotten Better:#4).

- Recession or Fears of One: “I don’t want to be going top-speed into uncertainty,” Musk said. “I’m not saying things will be bad. I’m saying they might be.” – Elon Musk.

I quoted this above in “The Elon Musk Problem” section but this is powerful enough to be quoted again to convey the economic uncertainties we are facing. When the most confident and optimistic person in the business world sounds cautious, others take note. (Stayed Same: #2).

- China: The recent news that China is about to curb Graphite export came when Tesla was already hurting from the report that the company’s China-made EV sales fell nearly 11% YoY in September. The report that the U.S. is considering curbing China’s cloud access does not appear to soothe things either. Overall, this section has gotten worse. (Gotten Worse: #5).

Two Technical Reasons

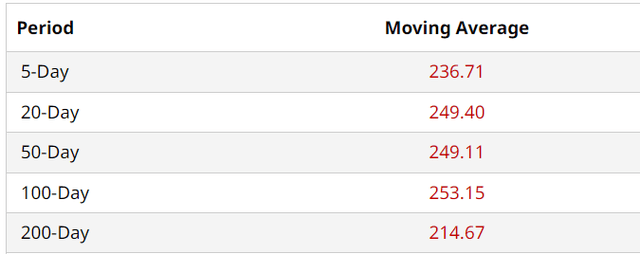

- Moving Average: While the fact that the stock’s current price is below all the commonly used moving averages is not encouraging, Tesla’s 200-Day moving average has now risen to ~$215 from $195 in August. That is positive in two ways: a higher-base has been formed and the stock is currently pretty close to the 200-Day moving average and could find support here. (Gotten Better: #5).

TSLA Moving Avgs (Barchart.com)

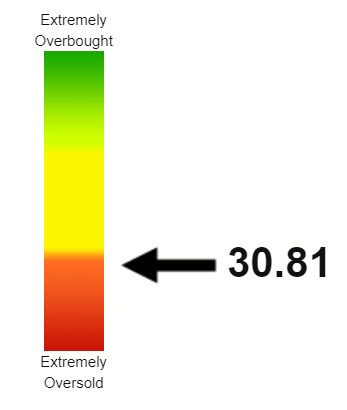

- RSI: Tesla stock’s Relative Strength Index (“RSI”) of 30.81 right now appears a bit lower than the 38.74 during August’s review. This is not a surprise given the stock’s weakness over the last month where it has lost about 20%. From a purely technical basis, this falls under the “gotten worse” category as weakened stocks don’t suddenly stop and turnaround. (Gotten Worse: #6).

TSLA RSI (stockrsi.com)

Conclusion

For those curious about scores, this is how the 13 factors stack up now compared to August:

- Stayed Same: 2

- Gotten Better: 5

- Gotten Worse: 6.

I especially like the fact that the stock has taken a beating of late and that has brought a much-needed pullback. Musk’s statements recently make me believe he is more attuned to Tesla’s operations and problems, which in turn makes me believe he knows how to fix them. I agree with this Seeking Alpha analysis that the company’s margin pressure is transitionary, as I believe the Cybertruck situation will be sorted out sooner rather than later. In addition, Tesla has the power to afford a long pricing war, which the new aspirants may not be able to afford. That said, technically, the stock is at a critical juncture as it is trading very close to its 200-Day moving average.

With no further company-specific catalyst expected at least for a few more weeks, it will be up to the market in general and the geopolitical conditions to determine the stock’s direction from here. I retain my “Hold” rating on Tesla, Inc. stock, but believe there will be some opportunities before the end of the year to buy the stock below $200.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.