Summary:

- My investing experience has taught me that the more a stock is dominated by market sentiment, the more I should bet against such sentiment.

- Tesla, Inc. is an excellent example.

- Tesla stock price suffered significant corrections after its 2023 Q3 earnings report, for issues that are largely temporary in my view.

- As a result, Tesla stock now offers favorable odds for both near- and long-term returns.

wildpixel

Time to be a contrarian again

Readers familiar with my writing know that I am in general bullish on Tesla, Inc. (NASDAQ:TSLA). However, its stock prices are so volatile – and for good reasons in my view. First, it is a reflection that it is a disruptive company in a rapidly growing industry. As a result, developments that are temporary in nature (which happens all the time for any sizable organization tend to create either a lot of excitement or skepticism. Second and more relevant to the thesis of this article, such large volatilities only create opportunities for calm and patient investors. In my investing experience, the more sensitive a stock responds to market sentiment, the better my odds are to bet against such sentiment.

A recent example is shown in the chart below. It happened only about ~4 months ago. The overall sentiment at that time was so positive that its stock prices rose by about ~70% (from ~$160 in May to about $270 when I downgraded it). I believe a large driver for the price rally at that time was the announcements involving TSLA’s supercharging stations, which the market interpreted as a sign of further consolidation of TSLA’s dominance in the EV space. However, a careful check (or routine check like that Peter Lynch uses) would have shown that the optimism is overdone and has pushed the valuation multiples too high.

Against this backdrop, the thesis of this article is to explain why its Q3 earnings report has created a very similar contrarian opportunity – in the opposite direction this time. In the section immediately below, I will detail why the market has overacted, and the correction is overdone. Thus, TSLA stock now offers a very asymmetric return/risk ratio both near- and long-term.

Why you should bet against the Street now?

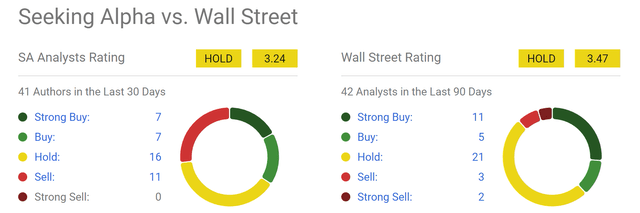

First, let’s take the pulse of the current sentiment on TSLA’s stock. As seen, the sentiment is now a lot less bullish than it was 3~4 months ago. Wall Street’s current rating is 3.47, a lukewarm HOLD. And the main Street opinion (approximated by SA authors’ ratings) is even a bit lower at 3.24.

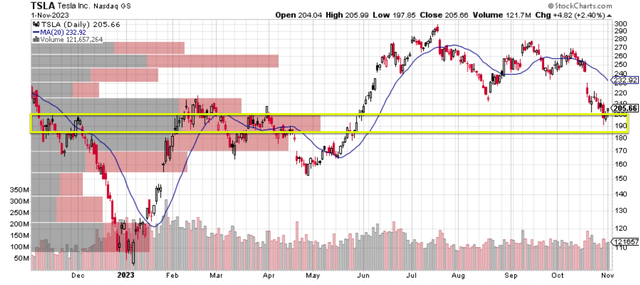

So, why is it a good time to bet against such overall sentiment? My arguments largely fall into three categories. The first one is near-term oriented. I think the stock is oversold at this point. The current price is near a strong support level and I don’t expect too many downside risks at this level. As seen from the chart below, its price fell from a peak of ~$270 before Q3 earnings to the current level of ~$205 (a drop of about 25%), close to the level where the largest trading volume occurred in the past year (highlighted by the yellow box).

The next two of my arguments are more long-term oriented. As elaborated next, I will explain: A) why the issues mentioned in its Q3 ER are only temporary in my view; and B) why the large corrections have created a reasonable valuation for TSLA shares.

Cybertruck and margin pressure in perspective

The way I read its Q3 earning report, I do not see anything structural has changed at the company. If I have to speculate a bit, the market’s overreactions are largely caused by the comments made about its Cybertruck (see the quote below) and margin pressure.

Elon Musk: “I mean, we dug our own grave with Cybertruck. Cybertruck’s one of those special products that comes along only once in a long while. And special products that come along once in a long while are just incredibly difficult to bring to market, to reach volume, to be prosperous.”

I may not agree with him that Cybertruck is a “special” product (if he convinced you that it is a special product, jump to the last sentence of this paragraph and see my comment there). But from my high-tech R&D experiences, I agree that for any reasonably complicated products, delays and setbacks are the norm. On the contrary, I would be highly suspicious if a company kept reporting that it was hitting the preset R&D milestones. In my mind, this usually means it is either cooking the data or just using rhetoric for expectation management. And by this time, I hope TSLA investors have better understood Musk’s colorful personality and stop overacting to what he says.

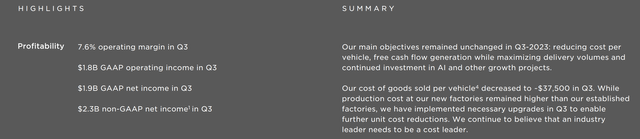

Now, onto the margins. It is true that Tesla has been cutting prices on its vehicles in an effort to boost sales. This is at the cost of its margins. To wit, it reported an operating margin of 7.6% in Q3 (see the next chart below). It is indeed a far cry from its peak level of ~18% not that long ago.

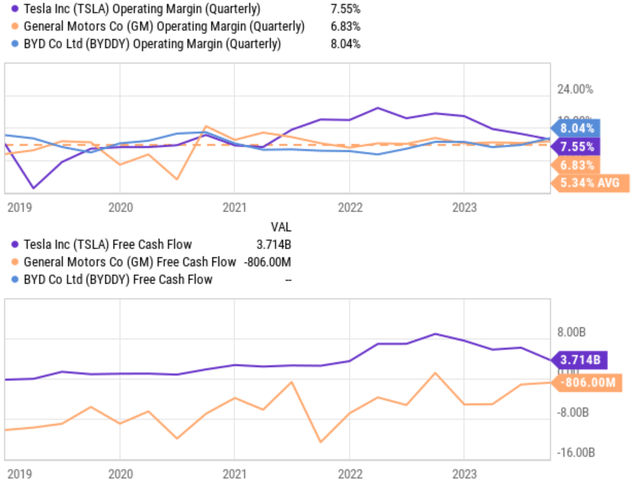

However, if we broaden our horizons a bit and contextualize the numbers, I think the picture is much less bleak. The chart below (top panel) shows TSLA’s operating margin in comparison to BYD Company Limited (OTCPK:BYDDF) and General Motors Company (GM) in the past 5 years. As seen, Tesla’s current margin of ~7.6% is indeed far below its peak levels. However, the peak levels are just too high to start with and not sustainable in my view. The average operating margin for both traditional carmakers like GM and pure EV players like BYD is in the neighborhood of ~5%.

Moreover, it is important to note that operating margin is just one measure of profitability. Two other important factors to consider include free cash flow and brand recognition. Its Model Y crossover is still the top-selling vehicle in the world and enjoys a premium brand image. Also, Tesla largely follows a model of building its cars on demand. In combination with the efficiency and capacity of its gigafactories, this leads to better control and inventories and cost control. As a result, despite similar operating margins, TSLA kept generating far better free cash flows than most of its peers (see the bottom panel of the chart below).

Other risks and final thoughts

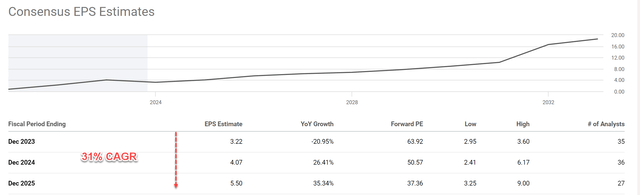

In the meantime, the large corrections have brought the stock to a much more reasonable valuation. Admittedly, a P/E of ~64x can still be off-putting as seen from the chart below. However, consensus estimates project an average EPS growth rate of 31% in the next two years. I think such a growth rate is feasible given TSLA’s production and delivery projections. In its Q3 report, TSLA reaffirmed full-year 2023 deliveries of 1.8M vehicles. In the meantime, the company plans to double production capability at its gigafactory in Germany. Given such growth, its PEG (P/E growth ratio) is ~2x for 2023 and would further shrink to ~1.2x in 2025. It is not the ideal 1x PEG that can get GARP (growth at a reasonable price) investors really excited. But I think a premium in PEG is well justified, given TSLA’s leading position and the secular support the EV sector enjoys.

In terms of downside risks, Tesla faces the same set of macroeconomic risks as other car companies. These risks include inflation, labor costs, raw material costs, et al. These issues are part of the reasons for TSLA’s margin pressure in recent quarters. But ultimately, I view these issues as external and temporary. Although, I see a few risks that are more specific to TSLA.

As aforementioned, TSLA largely relies on a model for building its cars on demand. This means it has to be more vertically integrated than other car companies. For example, it manufactures more of its own components in-house (and batteries are a good example). This can give Tesla a competitive advantage in terms of cost and efficiency as mentioned earlier. However, it increases the company’s exposure to certain risks. For example, it makes TSLA more vulnerable to supply chain disruptions or geopolitical conflicts in certain regions.

Overall, I see more upside risks than downside risks for Tesla under current conditions. To recap, the key considerations for my upgraded rating are threefold. First, I think the stock is oversold in the near term and the current price is near a strong support level. Second, I see the key issues mentioned in its Q3 reports are only temporary. Finally, the recent corrections have brought Tesla, Inc.’s stock valuation to a range reasonable for long-term holding.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.