Summary:

- Company falls well short of guidance for the year.

- Production again outpaces deliveries by sizable amount.

- Demand questions not likely to subside anytime soon.

Justin Sullivan

One of the worst performing stocks in recent months has been Tesla (NASDAQ:TSLA). While shares of the electric vehicle maker have mostly fallen thanks to the drama surrounding CEO Elon Musk’s purchase of Twitter, there have also been worries about slowing demand for the company’s vehicles. On Monday, Tesla announced its Q4 production and delivery figures, and the numbers aren’t likely to ease those sales worries in the near term.

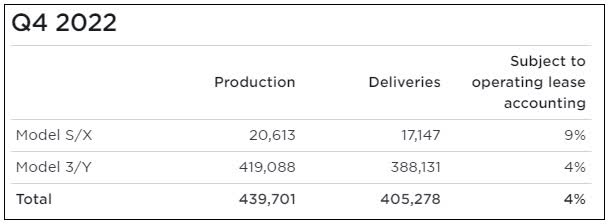

As Tesla continues to ramp its new factories in Germany and Texas, along with increasing output at Fremont and Shanghai, new records are expected to be announced each quarter now. Early in 2022, some of the company’s biggest supporters were hoping for the name to deliver more than half a million vehicles in the last quarter of the year. Due to COVID issues in China and some slower production ramps than expected, those expectations gradually came down. Tesla did announce new records for both production and deliveries as seen below.

Tesla Q4 Vehicle Figures (Company IR)

The first thing that one will notice is that production significantly outpaced deliveries for the second quarter in a row. Management attributed this to a “continued transition towards a more even regional mix of vehicle builds,” leading to more in-transit vehicles at the end of the period. Musk said back in early 2019 that Tesla would soon fix the delivery surge that results in a lot of deliveries late in the quarter. That still really hasn’t happened over the last three years, despite plenty of opportunities to reorganize the timing of vehicle builds in the production facilities. As a result, the company produced more than 56,500 vehicles more than it delivered in the back half of 2022. That will only help to fuel the concerns about sluggish demand.

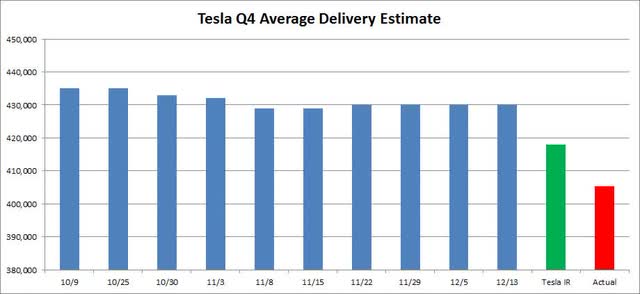

This was the second straight quarter where Tesla’s reported delivery figure fell quite a bit short of estimates. In the graphic below, you can see how street estimates basically hung around the 430,000 level for most of the fourth quarter. In late December, Tesla investor relations sent out its usual company compiled estimates figure, which was just a little below 418,000 vehicles. Despite that number being a bit below where the street was just a few weeks earlier, the actual figure fell almost 13,000 units short.

Q4 2022 Deliveries vs. Estimates (Troy Teslike Twitter, Tesla IR)

The delivery result is even more disappointing when you consider a few important items. First, the company’s CFO guided to “just under 50% growth” for the full year back at the Q3 earnings report, which itself was a guidance cut, and Tesla only came in a little above 40% for 2022. The second thing is that there were numerous promotions throughout Q4 to drive demand. In the US, Tesla pushed a late in quarter $3,750 credit, which was eventually doubled, along with the giveaway of 10,000 free supercharging miles. In China, multiple promotions were detailed throughout the quarter, and these even came after prices were cut early in the quarter. Some other promotions were even enacted in lower volume sales countries to help, but apparently, they were not enough. Tesla has started 2023 by offering another set of incentives in China to offset the elimination of that country’s EV subsidy.

I will be very curious to see Tesla’s automotive revenues per vehicle delivered when we get Q4 results in about three weeks (including leases and credits), especially given all the discounts out there. A lower sales mix of Model S and X vehicles will also provide a small headwind to this average price figure, as well an increase in the leased vehicle percentage over Q3 2022. On the flip side, the company will likely recognize a bit of its deferred full self-driving revenue that’s been held back for years, which should offset some of these sequential average revenue per vehicle losses.

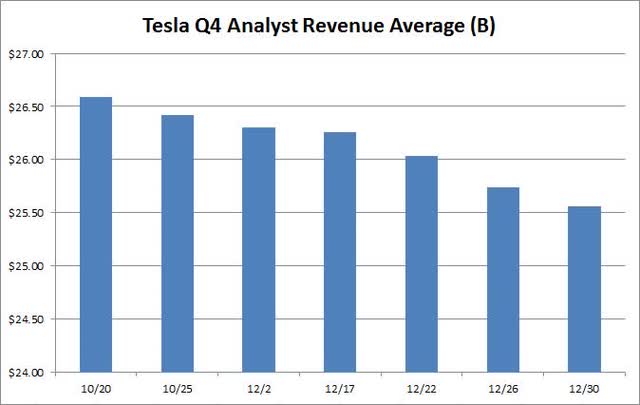

The key number analysts will likely focus on for Q4 will be gross margins. Tesla management has cited inflationary pressures in past conference calls, and discounts certainly won’t help. The ongoing production ramps of the Berlin and Austin factories should improve margins from those facilities, although more production out of Europe that takes away sales of China made vehicles and the closing down of the Shanghai plant for a week or so in December could be a small drag. Going into Monday’s release, analysts were expecting $1.24 in non-GAAP EPS for Q4, as compared to $1.05 seen in Q3. I’ll be watching to see how much more revenue estimates decline, given they were down over a billion dollars since late October already as seen below.

Tesla Q4 2022 Analyst Revenue Estimate Average (Seeking Alpha)

As for Tesla shares, this news was certainly not welcome for those looking for a short-term rebound. Tesla finished last week around $123, just $15 above its recent multi-year low, after being at more than $300 in late September. A great report could have sent shares back toward the 50-day moving average, currently just under $180 but declining by the day, but upside in the near term now appears limited. The average price target on the street was $248 as of Monday, down from $336 about eight months earlier, but we might see some more target cuts on the delivery miss.

In the end, Tesla missed delivery estimates by a wide margin for the second straight quarter. Management will talk about regional builds, but it has been talking about eliminating the end of quarter delivery surge for years and still hasn’t done much about it. With production heavily outpacing deliveries in the back half of 2022, bears will talk about weak sales alongside a bunch of promotional activities. We’re now likely to see analyst estimates and price targets cuts come, and I don’t expect shares to massively rebound before earnings unless the overall market starts the new year with a decent rally.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.