Summary:

- Tesla, Inc.’s current stock price reflects very optimistic targets for Full Self-Drive and Optimus, making it riskier when compared to earlier this year.

- FSD, while impressive, is far from achieving full autonomy, and its revenue potential may not justify Tesla’s high valuation.

- Tesla’s automotive business, despite growth, doesn’t support the current market price; even optimistic scenarios value it below $250/share.

- Given the high valuation and ambitious growth expectations, Tesla is downgraded to HOLD.

felixmizioznikov/iStock Editorial via Getty Images

It has been over six months since I last covered Tesla, Inc. (NASDAQ:TSLA) and nearly 10 years since my first article on the stock. Earlier this year, I noted that around $150/share the valuation had become difficult to ignore, and in a separate article, I detailed how full self-driving (“FSD”) presented a major upside catalyst and upgraded to strong buy. Since, Tesla has tripled off its lows and investors in the stock are very aware of FSD. In fact, I will argue that very aspirational targets for the software are required to support the present valuation of the company. The Optimus robot is another potential catalyst, but sales remain far away, even though the company’s charismatic CEO Elon Musk predicts that Optimus will contribute to sales sooner.

Tesla’s stock has priced in very optimistic targets for both these emerging technologies, anticipating their arrivals. As such, buying Tesla today presents far more risk than buying the stock early this year did. FSD, while a transformational technology, may not be material enough to power the substantial revenue and EPS growth that analysts are anticipating in coming years. As a Tesla owner, I have used FSD for several months and been impressed by it, while declining to pay for it. This is largely due to my current residence (Pittsburgh), which is not a friendly location for FSD. Perhaps this gives me a more realistic outlook on the technology.

In my opinion, FSD is a useful driver assistance tool, but remains far from achieving autonomous driving in all locations. As such, I expect there are future bumps in the road as Tesla as investors become aware that FSD is not quite as transformational as they are pricing in, at least in the short term. Therefore, I am downgrading Tesla to HOLD.

Tesla’s Value as a Car Company

CEO Elon Musk has stated that Tesla is “not a car company,” instead proposing that the company should be considered “an AI and robotics company.” Personally, I prefer to view Tesla as multiple companies: a car and energy company, an AI company with its FSD, and a robotics company (Optimus). We can break these segments down to determine how optimistic the market is overall on Tesla.

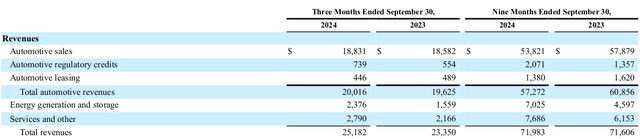

In the most recent quarterly report, $20.0 billion (79%) of revenues were automotive, with the remainder in energy generation and storage ($2.38 billion, 9%) as well as services (11%). Since the company’s services relate mostly to servicing its automotive fleet, the current revenues of Tesla are dominated by its automotive business.

Tesla: Revenues by Segment (Tesla Q3 2024 10-Q Report)

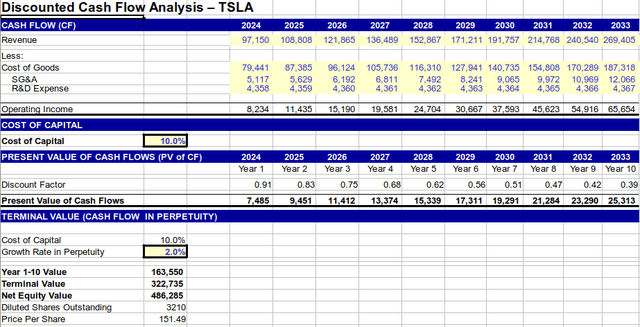

Putting a value on the automotive business is relatively straightforward. This segment is no longer in a hyper-growth phase. Expecting revenues to grow by 12% per year for the next 10 years, while margins expand (costs increasing by 10% a year) nets a present value of approximately $151/share.

Tesla: Legacy Automotive Business DCF (Author’s Analysis)

In other words, fairly rosy assumptions of 12% revenue growth, expanding margins and low costs only reach a value greatly lower than the current market price for Tesla. Perhaps I can entertain that as a premium car company, Tesla should enjoy a premium valuation.

In the table below, Tesla is compared with several other companies that make cars or premium cars. The most highly valued peer is Ferrari (NYSE:RACE) with Tesla far surpassing the valuation of any standard car manufacturer.

| Company | Symbol | P/E (FWD) | Market Cap. (billions) | Price/Sales | EV/EBITDA |

| Tesla | TSLA | 175.6 | $1,400 | 14.3 | 104.2 |

| Ferrari | RACE | 53.0 | $81.4 | 11.4 | 35.6 |

| Toyota | TM | 7.70 | $230.0 | 0.73 | 8.66 |

| Ford | F | 5.77 | $41.3 | 0.23 | 18.48 |

| GM | GM | 5.12 | $57.8 | 0.34 | 8.88 |

The most optimistic comparison from this table is that Tesla would trade around $347/share to achieve the same price/sales ratio as Ferrari. However, as a business segment, it is difficult to value the automotive legacy business of Tesla above $200/share or certainly $250/share. As seen from the market capitalization, Ferrari enjoys a very specific niche.

Thus, the question for current buyers of the stock remains. Can FSD and Optimus support a valuation of at least $200/share?

Valuing the Intangible: How Much is FSD Worth?

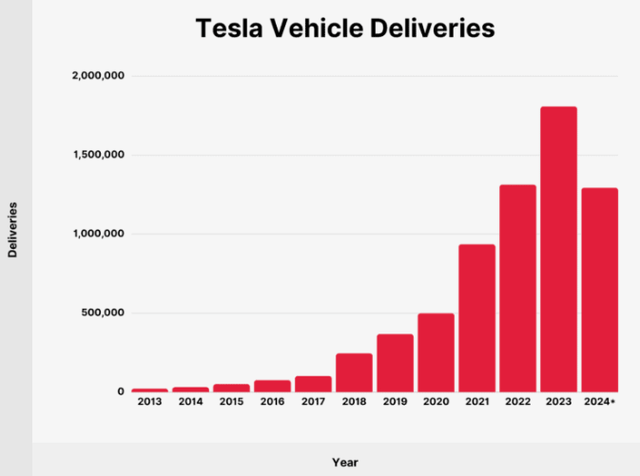

Since Tesla began selling cars, there have been approximately 6.7 million deliveries from 2013 until the first half of 2024. With FSD typically costing $8000 per license, the most optimistic math would put the value at $53.6 billion ($16.70/share) with a 100% penetration rate. Obviously, this is unrealistic and Tesla has reduced the price of FSD to $4500 on new cars in an attempt to increase penetration.

However, it must be repeated for emphasis: if every Tesla driver paid $8000 per car, this would represent a one-time profit of $16.70/share (6.7 million cars * $8000/3210 million shares outstanding). The difficult aspect is that Tesla has become so huge that even major advances in sales move the needle only modestly.

Tesla Deliveries by Year (backlinko.com/tesla-stats)

However, Tesla intends to introduce an entirely separate robotaxi business could create even greater value for FSD. In this case, we have some idea of the value of such a network because ride-sharing is a mature business with Uber (NASDAQ:UBER) and Lyft (NASDAQ:LYFT) representing market capitalization of $126 billion and $5.9 billion respectively.

In this case, if Tesla dominated to completely upend and capture Uber and Lyft’s business, it would be worth $131.9 billion or $41.09/share. Of course, Tesla is not without competition, Google’s (NASDAQ:GOOGL) Waymo is rapidly expanding as well. While Tesla is a fearsome competitor, it is difficult to imagine it capturing the entire business.

However, the simplistic analysis above shows that even with perfect penetration, it is difficult to see how FSD alone can achieve the minimum $200/share valuation premium that exists today for Tesla. What the market seems to expect moving forward is not simply rosy growth, but rather a complete upending of the entire automotive model. While I can entertain that this could happen, I find it very unlikely that it will occur fast enough to justify the current rally.

Tesla: Analyst Expectations for Growth

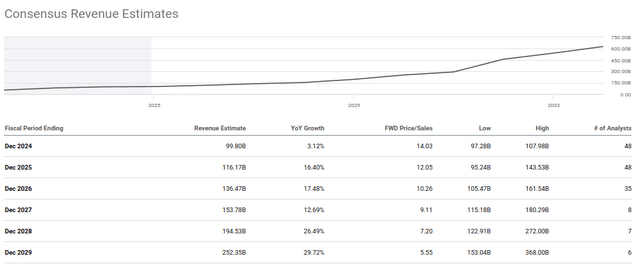

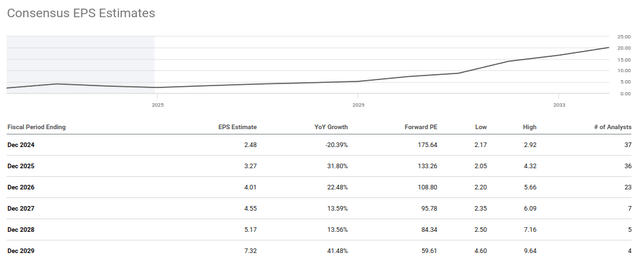

A stock can move higher, but over the long term, it is growth of revenues and earnings per share (EPS) that must ground it in reality. The difficulty for Tesla is that the company is already so large that the greater than double-digit growth in sales expected by analysts begins to seem very aspirational.

To justify increasing price targets, analysts must increase their projections for revenues and EPS. The share price has now run up so substantially that modest year-over-year growth of 3.1% this year is expected to reach double-digits and nearly 30% annualized by 2029. This level of sales growth from a company as large as Tesla would be nearly unprecedented.

Tesla: Consensus Revenue Estimate (Seeking Alpha)

Even achieving this level of growth over 5 years with expanding margins amounts to a P/E of 59.6x on 2029 earnings. It is simply becoming impossible to value Tesla by any standard metric of valuation. This is even true bearing in mind that analyst’s expectations for growth are ambitious.

Tesla: Consensus EPS Estimates (Seeking Alpha)

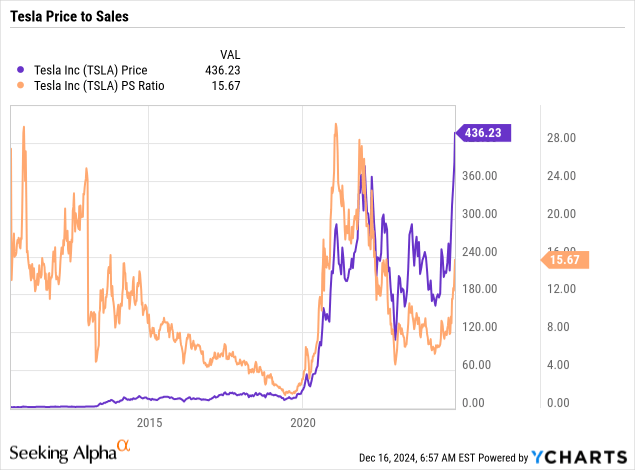

At this stage, perhaps the best way to predict where the current rally could end is based on Tesla’s own history. In 2021, the stock eventually peaked with a price to sales multiple of approximately 28x. Revisiting this stratospheric level would require a price target of $780/share.

To be clear: I am not predicting that Tesla will reach this level. Among the spectrum of possible outcomes for the stock, this is the level that seems the most optimistic based on the company’s historical valuation. Next year, analysts expect 16.4% revenue growth, if Tesla can continue to outperform expectations, the stock could approach these levels, but eventually, a drop will occur because no company this large can maintain such aggressive growth.

Perhaps I am too pessimistic about the prospects of Tesla’s Optimus robot. Clearly, much of the later sales growth is assuming a successful launch in this field. While the implications of Optimus maybe massive, I expect the humanoid robot to be a very niche product to begin. Optimus is projected to sell for $30,000, but how many individuals will be willing to pay for such a product? Since there is not yet a working prototype it is difficult to say, but in this case, I prefer not to assign value as yet.

Conclusions

Tesla is a wonderfully innovative company, but the price to invest has become very high. As such, I am downgrading Tesla, Inc. stock to HOLD based on valuation concerns. While this piece is not investment advice, I think investors looking to allocate new capital to the concept of FSD should consider Google as an alternative. Personally, I consider it to have been a great opportunity to invest in a wonderful company like Tesla at a fair price earlier this year. However, today seems like a much better time to take chips off the table, hoping that a fair price will reemerge some day.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

All investment opportunities carry inherent risk, including potential loss of principle. Carefully consider your investment objectives, level of experience and risk appetite before making any investment. The above discussion is a framework for investors (both long and short), to understand the factors that will move the underlying security’s price. It is not a prediction and should not be considered investment advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.