Summary:

- I’ve been a Tesla shareholder for a long time (since 2013), and it’s also the No. 1 company that I’ve written about over the years (60th Tesla article).

- I like the company and its stock for many reasons, but a primary factor is that Tesla delivers remarkable results.

- The company’s recent deliveries report implies that Tesla should beat its Q1 revenues and earnings estimates.

- Therefore, we should look for a buying opportunity before Tesla reports earnings on April 19, later this month.

- If selling persists in the coming weeks, we could get the perfect opportunity to accumulate shares around the $160-140 range.

Spencer Platt

Tesla (NASDAQ:TSLA) recently released its Q1 production and deliveries report, and the numbers continue to expand. The company produced more than 440,000 cars in the first quarter, putting the company on track to deliver millions of vehicles in the coming years. Tesla’s revenues and profitability metrics should outperform the significantly lowered consensus estimates. Tesla remains a unique market-leading company, continuing to innovate, modernize, and optimize the technology-depleted conventional automotive industry. Therefore, Tesla should continue expanding revenues and optimizing profitability as the company advances in the coming years. Thus, despite near-term market gyrations, its share price should go much higher long term.

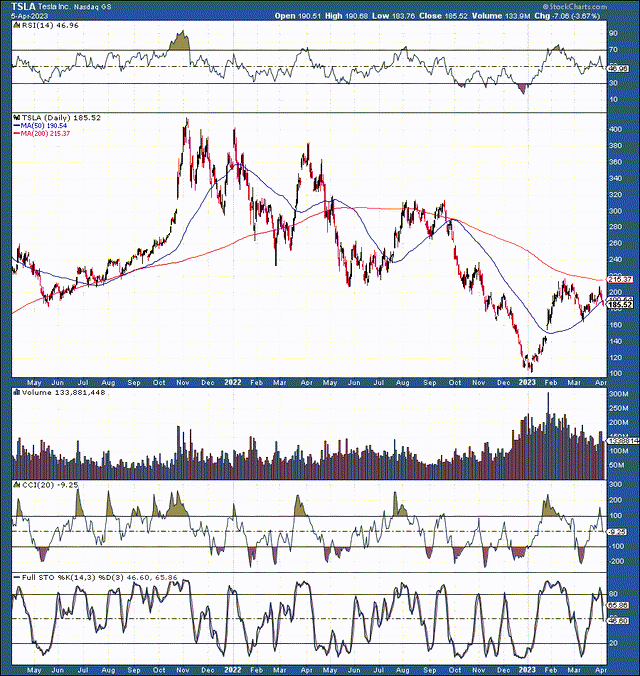

Technically Speaking – There’s a Buying Opportunity Ahead

Technically speaking, there’s probably an excellent buying opportunity ahead. Tesla’s stock has been everywhere since its top in November 2021. The blow-off top occurred close to $420 a share as the “epic drop” began dropping, and the recent bottom, I called Tesla a gift at the $100 point. From peak to trough, we witnessed a staggering decline of 75% in Tesla’s share price.

However, the stock likely bottomed around the $100 level, and we see a constructive reverse head and shoulders pattern forming here. Nevertheless, we should see more volatility ahead, as Tesla’s stock became near-term overbought recently. Therefore, we could see some deflating from here, especially if the broader market and tech sector continue to slide.

I’m long a partial (hedged) Tesla position here, but we could have an opportunity to dollar cost average in the $160-140 zone if general market sentiment worsens and the selling picks up in the coming months. Thus, I would be selective about an entry point here and view Tesla as a long-term investment.

Here’s Why You Want to Own Tesla

Production registered 440,808 vehicles, while Tesla delivered 422,875 cars in Q1. I remember the days Tesla had difficulties achieving 5K a week production. Last quarter, the company produced nearly 34K weekly vehicles.

Tesla sold 10,695 Model S/X cars (10% lease) and 412,180 (5% lease) Model 3/Y vehicles in the first quarter. If we adjust for lease accounting, Tesla sold roughly 9,626 Model S/X vehicles and approximately 391,571 Model 3/Y cars. Using an ASP of $125K for a Model S/X vehicle equates to roughly $1.2 billion in sales for Q1. Applying a $51K ASP to the Model 3/Y segment likely provided approximately $20 billion in revenues for Q1.

Here’s how Tesla’s revenues could look like for Q1

- Model 3/Y: $20 billion

- Model S/X: $1.2 billion

- Regulatory credits: $300 million

- Total automotive sales: $21.9 billion

- Automotive leasing: $700 million

- Energy generation & storage: $1.2 billion

- Services & other: $1.6 billion

- Total Q1 Revenue: $25 billion

The Takeaway

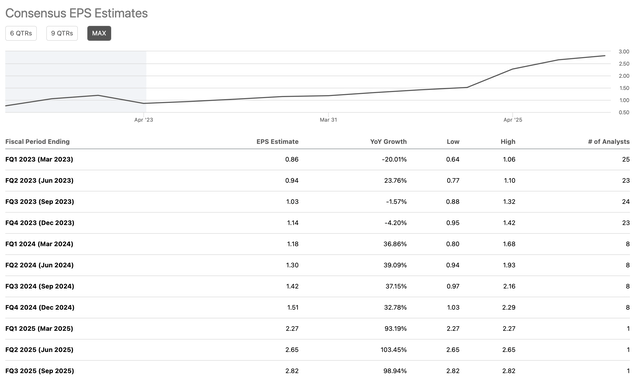

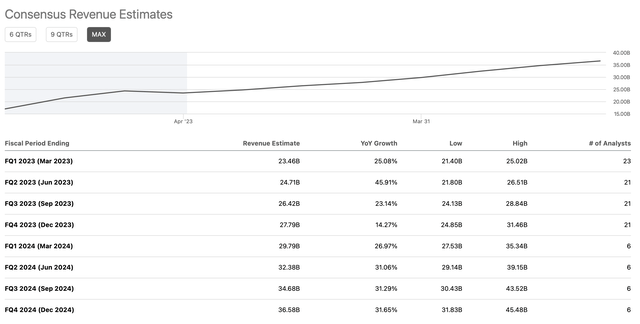

Tesla’s revenues should register toward the higher end of analysts’ estimates, as the current consensus estimate is only $23.46 billion. I suspect Tesla can surpass this lowballed figure. Moreover, Tesla should do better than expected on the EPS, providing better than expected EPS in Q1 and the coming quarters as we advance.

Revenue Estimates – Extremely Strong

Tesla revenues (SeekingAlpha.com )

Next year’s Q1 revenues should be around $30-35 billion, representing a substantial 30% revenue growth rate over this year’s estimates. Furthermore, in addition to Tesla’s robust revenue growth, the company should become increasingly profitable in the coming years.

EPS Projections Point to Higher Profits

Tesla’s EPS could rise rapidly around 2025 as the company should have its Semi Truck segment and other units providing significant profits. Tesla’s automotive sales growth margin is ridiculously high. Even excluding regulatory credits, Tesla’s automotive sales gross margin was around 26.35% last quarter. Therefore, Tesla is not your typical Ford (F), General Motors (GM), or Toyota (TM). Tesla is a highly profitable industry leader, continuing to expand, innovate, and lead forward in the continuous shift toward a 100% EV future.

Therefore, Tesla’s financials could look like this in future years:

| The year | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $110 | $160 | $215 | $300 | $400 | $510 | $640 | $780 |

| Revenue growth | 35% | 45% | 34% | 40% | 33% | 27% | 25% | 22% |

| EPS | $5 | $9 | $13 | $18 | $23 | $30 | $35 | $40 |

| EPS growth | 25% | 80% | 44% | 38% | 32% | 28% | 19% | 18% |

| Forward P/E | 22 | 23 | 25 | 27 | 25 | 24 | 23 | 22 |

| Stock price | $200 | $299 | $450 | $621 | $750 | $840 | $920 | $1,000 |

Source: The Financial Prophet

I’m using a relatively modest forward P/E valuation, capping off at about 27. Tesla’s stock could appreciate more quickly if the market awards a higher multiple to the company. However, the company must execute flawlessly, providing robust revenue growth and increasing profitability. Nevertheless, Tesla has the potential to become a highly profitable company, which makes this stock a strong buy around current levels. Furthermore, we can hedge our position via covered call options or collar plays, and I will buy more Tesla around the $150 level if the market provides such an opportunity in the coming weeks and months.

Not So Fast – Some Risks To Consider

A slowdown in demand, increased competition, supply issues, decreased growth, issues with regulators and foreign governments, and other variables are all risks we should consider before betting on Tesla to move higher. Serious concerns could cause Tesla’s valuation to lose altitude, and the company’s share price could even head in reverse if any serious issues should arise. Therefore, one should consider these and other risks before committing any capital to a Tesla investment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2022 17% return), and achieve optimal results in any market.

- Our Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement our Covered Call Dividend Plan and earn an extra 40-60% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Own Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now, and start beating the market for less than $1 a day!