Summary:

- Tesla, Inc. is in a strange position of a $500 billion empire finding itself in the growing pain phase.

- Tesla stock has fallen about 14% since my last review, but then, estimates have fallen almost the same.

- The appointment of a new CEO for Twitter is the biggest news for Tesla in the last 3 months.

- However, I retain my hold rating on Tesla stock while lowering my entry point to add to my position.

jetcityimage/iStock Editorial via Getty Images

I wrote an article on Tesla, Inc. (NASDAQ:TSLA) three months ago, rating the stock a hold due to a variety of business, stock fundamental, technical, and macro reasons. Since then, the stock has lost nearly 14% compared to the market, being flat in the same time period. Meanwhile, the company reported its Q1 earnings as Seeking Alpha has covered here.

Three months is a short time in most of our lives, but it is a long time for a company and stock like Tesla with their ever-changing dynamics (thanks to the man at the helm, CEO Elon Musk, primarily). Hence, it is time to revisit my hold rating using the same 13 reasons from the original article. Let us get into the details.

Four Business Reasons

- Margin Erosion: I had stated in the original article that Tesla was sending mixed signals to the market about being a margin player vs. a volume-based discount player. In the last three months, Tesla has managed to increase prices a couple of times:

Overall, I am still concerned with margin erosion given that prices are still not back to where they were in Q1 2022.

- Demand Erosion: The fact that Tesla has both slashed and increased prices more times than I care to count in the last few months suggests there is still a huge demand at the right price. Tesla and Musk ate crow in a way when the company admitted it is willing to sacrifice profit margin to expand its demand/market share shortly after promising it can do both. But it comforts me as a long that the company and market are both willing to give in and take to keep the relationship moving. If only all couples can figure out the same! This one gets a pass for the time being, but I’d like to note that Tesla is finding itself in a unique situation here as a $500 billion empire that is still feeling what is referred as “Growing Pains” in the business world.

- Market Share: While there is no doubt Tesla faces increasing competition from both new companies and established auto players, a couple of reports since my last review should comfort investors: Tesla’s share (of overall auto) in the U.S./Canada reached a record 4% in Q1 2023 and 2.5% in Europe. In addition, a vast majority of fans will likely continue backing the company and what its vision represents, irrespective of what Elon Musk does.

- The Elon Musk Problem: I should have moved this to the top of this section due to its significance and recent development, but chose to retain here for ease of comparison with the previous review. Elon Musk appears to have solved (or least progressed meaningfully towards solving) the “Twitter problem” in more ways than one. Must recently reported that Twitter is now operating at breakeven and could even be profitable shortly before announcing he has finally found a full-time CEO for the company. As much as one may speculate over how much real power Musk may conceded to the new CEO, Linda Yaccarino, this is a welcome relief for Tesla shareholders given the numerous hats Musk wears.

Four Stock Fundamental Reasons

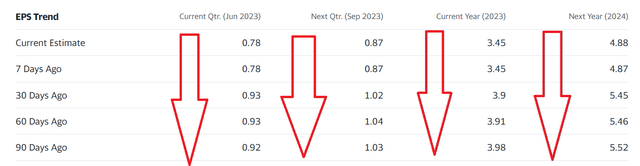

- Forward Multiple: Despite the ~14% fall in stock price since my last review, Tesla stock’s forward multiple remains close to 50. That only means estimates have fallen in the meantime, as covered below.

- PEG: Growth at Reasonable Price (“GARP”) investors like myself tend to look at the Price-Earnings/Growth (“PEG”) multiple as it tells us how fairly valued a stock is relative to its growth prospects. Tesla stock has gotten considerably worse on this metric since my last review, as the current estimated growth rate of 10%/yr gives the stock a forward PEG of nearly 5, while it was 2 during my February review.

- Price Target: At the current price per share of $168, the stock is just a good 10% away from its median price target. This looks better than the last time when the stock was just 2% away from its then median target of $190 but from a medium-perspective, 10% is still not much of a margin for error given the current macro environment.

- Falling Estimates: Both 2023’s and 2024’s estimates have fallen by about 13% since my last review. Just like in the last review, estimates have been falling all across the board as shown below. This makes the 14% fall in stock price seem justified.

TSLA Estimates (Yahoo Finance)

Three Macro Reasons

- Market Complacency: The market – S&P 500 (SP500) – has remained almost flat since my February article. That does not mean the market has not gotten more complacent. Since February, the popular volatility and fear index, S&P VIX Index (VIX), has dropped 12%, suggesting calm waters or complacency depending on the way you look at things. I personally believe this is complacency, and a bad report here or there on employment or inflation in general may send overvalued stocks like Tesla sharply lower.

- Recession or Fears of One: This was the toughest of the 13 sections to write about. Because there is little information, I nor anyone have to say with 100% confidence whether a recession will hit us and, if so, when. However, I still hold the opinion that Tesla will be one of the hardest-hit growth stocks in case the economy tanks. This is especially true given the typical price range and the layoffs in high-paying jobs.

- China: China and Tesla in the same context is like having two headline makers (for both good and bad reasons) in the same household. Hence, I am covering only a couple of China-related items here.

- First, a recent recall caught the headlines and Musk’s ire (rightly so). “Recalls” in the traditional manufacturing sense is a time and cost consuming activity and hence that word usually has negative ramifications. Tesla’s reported recall is just a software update. While this did not adversely affect the stock, categorizing this as a recall is like saying Microsoft Corporation (MSFT) recalled Windows every time it releases an update for new features or bugs.

- Second, Tesla increased the price of a few models in China a couple of times since my last review, as reported here and here. This should calm down demand concerns in the short to medium terms at least.

Two Technical Reasons

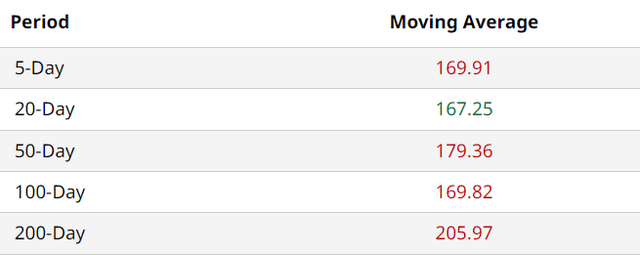

- Moving Average: Just like in February, Tesla’s stock is currently trading a good 22% away from its current 200-Day moving average. The key thing to note here is that while the stock is down 14% since my February review, the gap between the current trading prices and respective 200-Day moving averages remained the same. Clearly, this suggests a shifting base, to the downside. However, the rest of the moving averages appear fairly close to the stock’s current price. I am inclined to believe the stock is now in a holding pattern technically and is waiting for catalysts to either blast up or crater down.

TSLA Moving Avg (Barchart.com)

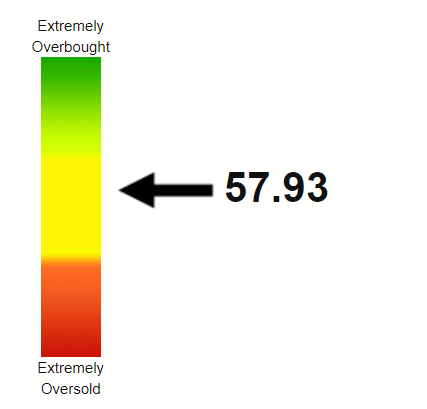

- RSI: Tesla stock’s Relative Strength Index (“RSI”) of 58 right now appears a lot better than the 83 during February’s review. This also confirms my thesis above that the stock is in a holding pattern as the RSI indicator is bang in the middle of the chart as shown below.

TSLA RSI (Stockrsi.com)

Conclusion

So, there you have the 13-point comparison with my February article. I still am long Tesla, Inc., but did trim in the early $200s after my previous review. Given that none of these 13 reasons have improved significantly, bar the news about Twitter’s new CEO, I feel comfortable enough only to retain my “Hold” rating on Tesla stock. The recent ~15% fall saves Tesla, Inc. stock from a sell rating; however, the fact that estimates are falling at a quicker pace concerns me. Hence, I am lowering my entry point to add more to Tesla stock to the $130s from the $150 I had in my February review. Given that Tesla’s stock has a beta of 2, this price may be here quicker than you think if the market gets jittery and Tesla/Musk hit the wrong buttons.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.