Summary:

- My thesis is Tesla, Inc. stock is a hold, as it’s finally found a growth trajectory, but top and bottom-line growth is still far off for Robotaxi and Optimus.

- Automotive still represents 88% of total revenue as per the most recent 10Q.

- Tesla needs to grow the energy storage division to fill gaps in income reduction expected by analysts for the full year 2024.

- Stock-based comp and share dilution are expected to increase with CEO Elon Musk’s pay package on the horizon.

Hiroshi Watanabe

A bit of a mixed bag

This article is not intended to bash Tesla, Inc. (NASDAQ:TSLA) in any way, shape, or form. In fact, the delayed Robotaxi event that was originally to be held on 8-8 and finally conducted on 10-10, finally showed a growth direction for the company to diversify itself and have direction toward that next leg of growth. The worst part was that although we’ve seen progress with Optimus [which I didn’t expect would be as big a part of the event as the robotaxi], most of the scale-up to mass production for the robotaxi seems far off into the future.

My thesis for the stock is a hold, as it’s finally found a growth trajectory, but the investor is going to have to wait years before these new projects hit the top or bottom line. Meanwhile, an investor has to focus on the progress of other projects like energy storage.

What I learned about the robotaxi

X.com

I’ve watched several videos and analyses of the event posted by Tesla Bulls and social media influencers. By far, my favorite is Marques Brownlee, who does not pump stocks and gets access to all the best new technology for review before it hits the market. From his recent event analysis, I’ve learned:

- The Robotaxi is basically a model 3 with model X-esque butterfly doors.

- It is a two-seat configuration with no steering wheel or pedals, kind of like the Total Recall “Johnny Cab” minus Johnny.

- The prototype is gold with special rims and wheels.

- The rider enters their destination manually on a large touch screen.

- Tesla claims it will be in mass production for $30,000 before 2027.

Brownlee expressed skepticism over the 2027 mass production date, not due to the ability of Tesla to scale up and produce this vehicle, but the regulatory approvals needed to get this vehicle operational. I concur.

Google ((GOOGL)) (GOOG) with Waymo and General Motors (GM) with Cruise have been working on the regulatory matters for years and are just now scaling up in a select few cities with their autonomous taxi service. This is not an overnight rubber stamp process. Tesla has a great conceptual vehicle, but are way behind in the regulatory process.

Furthermore, Tesla uses cameras rather than Lidar for autonomous driving. There is still a significant debate as to if the camera systems could ever be as reliable as Lidar for the purpose of self-driving. I, personally, believe Tesla will one day give into using a combination of Lidar and vehicle cameras. Currently, Elon Musk is trying to prove a point, but when it comes to full autonomous, human safety requirements will leave no room for error.

The best part about the Lidar space is that the actual devices are not very proprietary at this point and can be retrofitted onto almost any vehicle, ICE, hybrid, or electric. All Musk has to do is make a deal with Velodyne, Luminar (LAZR), or Mobileye (MBLY), pair it with his Nvidia (NVDA) GPU hoard, and start integrating the system. I assume there will be no partnership with Google as they seem to now be locked in with Uber (UBER), but you never know.

Integrating Lidar could accelerate the approval process in my opinion, as Tesla could make the argument that they are basically using the same technology as existing licensed companies.

Optimus

X.com

The Optimus demonstrations might have stolen the show. Tesla demonstrated the robots being able to perform several human tasks such as serving drinks and playing charades, while also responding to questions. It was later revealed that there was some human assistance behind the scenes in making these robots move.

From Tech Crunch:

Bloomberg, The Verge, and other outlets have reported that the bots were being remotely operated by humans, a conclusion that is easy enough to arrive at considering that they all had different voices and their responses and hand gestures were immediate and synchronized.

Morgan Stanley analyst Adam Jonas also wrote in a report that the bots “relied on tele-ops (human intervention).”

Sources familiar with the matter told Bloomberg that while the Optimus prototypes were able to walk without external control using AI, employees stationed remotely oversaw many of the interactions between the bots and attendees during the “We, Robot” event.

At least one video from the event displayed an Optimus bartender acknowledging that it was being “assisted by a human.”

That being said, the articulation of the robots was capable of performing the tasks of the event, even if it was only representing an avatar of a human.

If these can be trained and really built and sold for $25,000, I can imagine some really affluent techies taking the plunge in a couple of years and having Optimus pick up their Amazon packages. The vision is there, the hardware seems decent, and the training will simply take more time to get a capable product to market. Optimus might be easier to get into the hands of consumers than the robotaxi due to what I would assume would be a non-issue around regulations of owning one of these things.

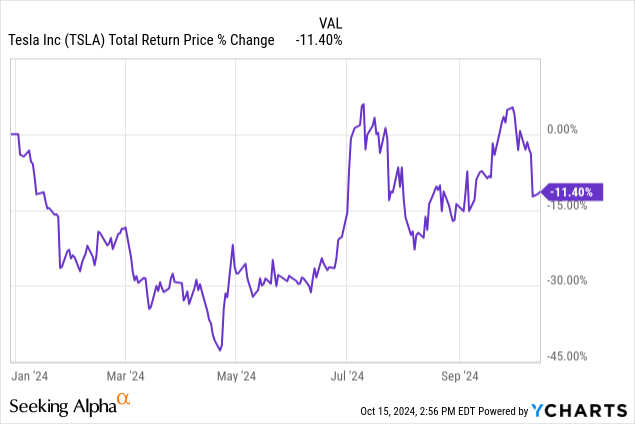

Year to date performance

Now back to the stock:

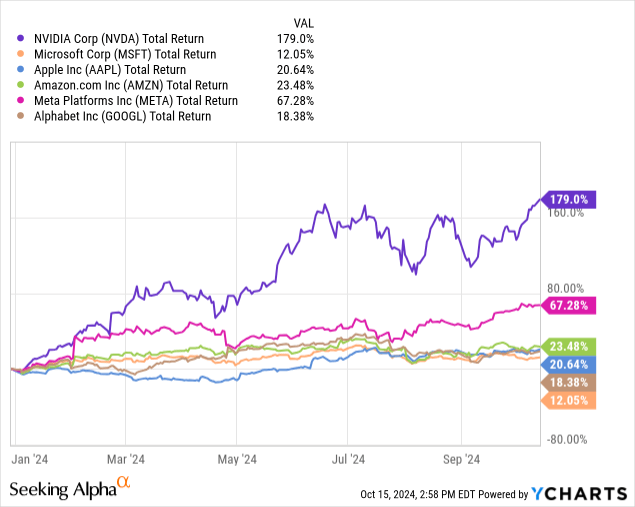

The stock is down -11.4% year to date, let’s see how that stacks up against the rest of the Mag 7:

As we can see, all are in the positive, with another outstanding year being booked by Nvidia.

I recently did an article checking in on the prices of the Mag 7 on an EV/EBITDA basis, here were the results:

| STOCK | EV/EBITDA FWD |

| (AAPL) | 25.13 X |

| (MSFT) | 22.03 X |

| (GOOGL) | 13.11 X |

| (TSLA) | 51.57 X |

| (NVDA) | 34.86 X |

| (META) | 14.75 X |

| (AMZN) | 15.43 X |

Tesla is by far the most expensive of the group on a trailing basis, with the least amount of near term growth prospects. Again, I can see the growth plan now, but I can’t imagine numbers improving just based on vehicle sales alone if energy storage does not pick up the slack.

Current revenue exposure according to the most recent 10Q

All numbers in millions courtesy of Tesla MR10Q:

| SEGMENT -MRQ | AMOUNT | PERCENTAGE |

| Automotive sales | 18,530 | 72.60% |

| Automotive regulatory credits | 890 | 3.50% |

| Automotive leasing | 458 | 1.80% |

| Energy generation and storage | 3014 | 11.80% |

| Services and other | 2608 | 10.20% |

| total | 25,500 |

Automotive-related business revenue is 88.1% of total revenue MRQ. I include the “services and other” category in this as I assume those services are Tesla vehicle repair and maintenance with a bit of energy generation and storage work mixed in. With Lithium prices at some of the lowest levels since the EV boom started, I’m still a bit perplexed as to why this business isn’t being pushed harder, as costs must have come down due to battery price reduction.

That leads me to believe that it is more of a demand issue than supply regarding the mega packs. These can back up electrical grid systems and smooth out energy generation demand for factories that might operate on an independent power plant system. The demand for this product would be seemingly overwhelmingly useful in a place like China, which has massive amounts of factories off the grid. However, it appears that there is a lot of competition in the industrial battery space in China with Contemporary Amprex and BYD.

The above is what the megapack setup should look like. If CATL ever enters the US market for industrial batteries, it could put a lot of pressure on the Tesla energy storage division. Luckily, for now, the US government and EU instituted tariffs on lithium batteries and EVs coming from China [which is maybe why China is experimenting with sodium batteries to get around tariffs]. These tariffs won’t last forever, Tesla needs to attack and increase their book of future business in this area as factory re-shoring continues across North America. The new factories and data centers should be the target.

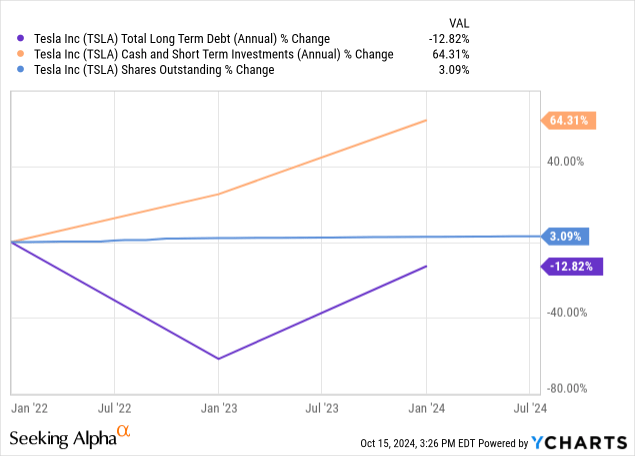

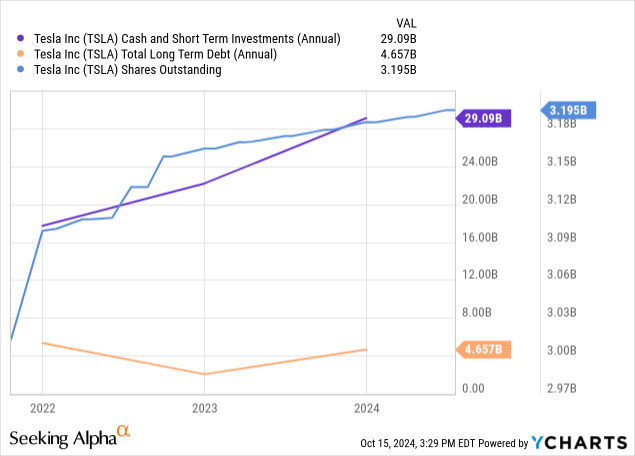

How is the balance sheet holding up?

Here I would like to look at both nominal and percentage change over a 3-year period for 3 important balance sheet items, long-term debt, cash and short-term investments, and shares outstanding. Cash has been about flat in this period and has increased more than long-term debt, which has actually been reduced in this period, a plus. The glaring negative is the shares outstanding, which have increased by 64.3% over the last 3 years.

So on the positive, Tesla has ample liquidity, they are probably in a better spot from a balance sheet perspective than any other automotive company. On the negative side, the company continues to use investors like their personal piggy bank to compensate employees and help fund the business. Every time I write these articles, I point out that no other auto company could get away with this. This is because Tesla is not an auto company but a self-proclaimed AI and robotics company. They better turn into one fast, or they may have to begin borrowing more money if investors finally balk at the dilution.

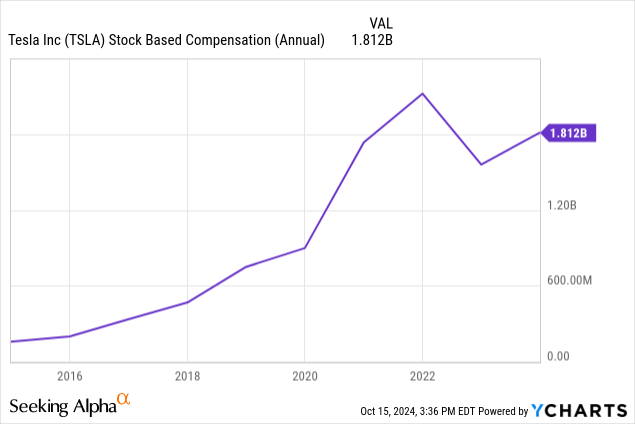

Dilution from the Musk pay package and ongoing stock-based comp

Musk’s 10-year pay plan, which would equate to about $4.4 Billion in stock-based compensation per year [details of the $44.9 Billion plan], will continue adding fuel to the fire of dilutive headwinds. Let’s take a look at the current stock-based comp trends:

Currently sitting at $1.812 Billion on an annual basis, the extra $4.4 Billion would pump this up to $6.2 Billion a year if none of the package is paid directly in cash. With a current market cap of $700 Billion, this would make Tesla 8.8% pricier per year in a 10-year vacuum where income does not increase, and the market cap stays the same. Of course, that is an illogical model, but this is a case of negative compounding if there is not an exponential growth moment in the future.

Valuation, at what price would this be “growth at a reasonable price”?

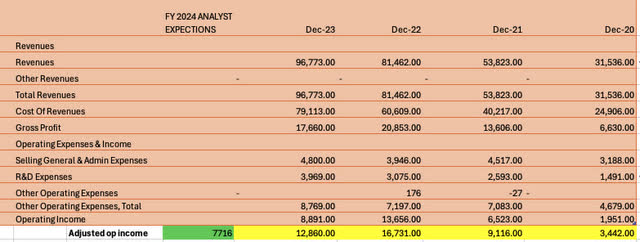

I still give Tesla the benefit of the doubt. I evaluate them as I do the other tech monopolies in the Mag 7, adding back in research and development expense, which is more of a growth catalyst than it is a true expense. Similar to what Bill Miller and others did around the time of Amazon’s first ascension, I added back in the R&D expense and tried to extrapolate the value of the company based on growth into the future.

Here I will be using the trailing 4 years combined with next year’s expectations to define an average growth rate over those years. In this case, I am defining fair value as a PEG ratio of 1 or less based on this modified PEG model. I also incorporate Peter Lynch’s advice to set an upper limit on growth expectations at 25%.

My own excel, data from Seeking Alpha

In this instance, I am considering analysts’ average growth estimates for Tesla GAAP earnings. The company earned $3.89 on a TTM basis and is expected to finish the year at a mere $2.3 a share. This is a reduction of 40% for FY 2024 versus current TTM. I am using a reduction in adjusted op income by 40% versus reducing it by the negative growth rate from FY 2023 to compensate for expected additions to R&D. If I just used 2023 numbers, the expected reduction for 2024 vs. 2023 would be closer to 50% than 40%.

Looking at the compound annual growth rate over this period from FY 2020 to FY 2024 would result in a CAGR of 17.48% per year [$3.4 Billion 2020 to $7.7 Billion FY 2024]. Again, The PEG ratio is simply the P/E ratio divided by the growth rate, dropping the percent sign. Thus, we can get a fair value if we use the growth rate [17.48] as the multiple and the earnings metric per share to represent the multiplicand. This is all assuming a value of 1 or less is a good deal.

With 3,194 million shares outstanding, the adjusted op income per share projected for 2024 would be $7,716 million / 3,194 million shares = $2.45 a share adj op income.

Using $2.45 a share times 17.48 to get our fair value of 1 gets us to $42.82 a share. This is where Tesla would equal a PEG ratio of 1 based on this modified metric that actually stretches the scope of Tesla’s profitability. This is the biggest reduction in share value assumption I’ve encountered while doing write-ups on the company. Share dilution and shrinkage in earnings expectations are a true near-term headwind.

Catalysts

Investors are not often swayed by logical GARP analysis on Tesla. I don’t blame them, as I believe Tesla is still one of the most innovative and daring companies in the world. Actual product demonstration typically means more to Tesla investors than the numbers do. If Elon Musk can keep showing improvements in his robotics division [including robotaxi], I can imagine a world where the share price is still materially higher by 2027 even though the fundamentals are probably in an even worse position than they are today.

Summary and risks

We live in a market of buyers and sellers, and what the buyer will pay is all that really matters. If you really believe that Tesla will be at the center of replacing humans in factories with robots and having everyone rolling around in an autonomous “Johnny Cab” like Total Recall, then not holding on to Tesla and waiting is a bigger risk than selling due to a truly horrific breakdown in fundamentals. That is up to you. As I function on fundamentals, I’m waiting for a much better price.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, AMZN, META, MSFT, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information provided in this article is for general informational purposes only and should not be considered as financial advice. The author is not a licensed financial advisor, Certified Public Accountant (CPA), or any other financial professional. The content presented in this article is based on the author's personal opinions, research, and experiences, and it may not be suitable for your specific financial situation or needs.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.